Spark Credit improves credit insight, helps you manage risks and enhances over all financial efficiency

Are you worried about your credit-facing challenges? Our company offers open and honest advice from professionals; we at Spark Credit make it a point to carefully examine each case and the goals of individuals who engage us.

We provide the following services together with advice and assistance:

- Remove Negative items

- Credit Score

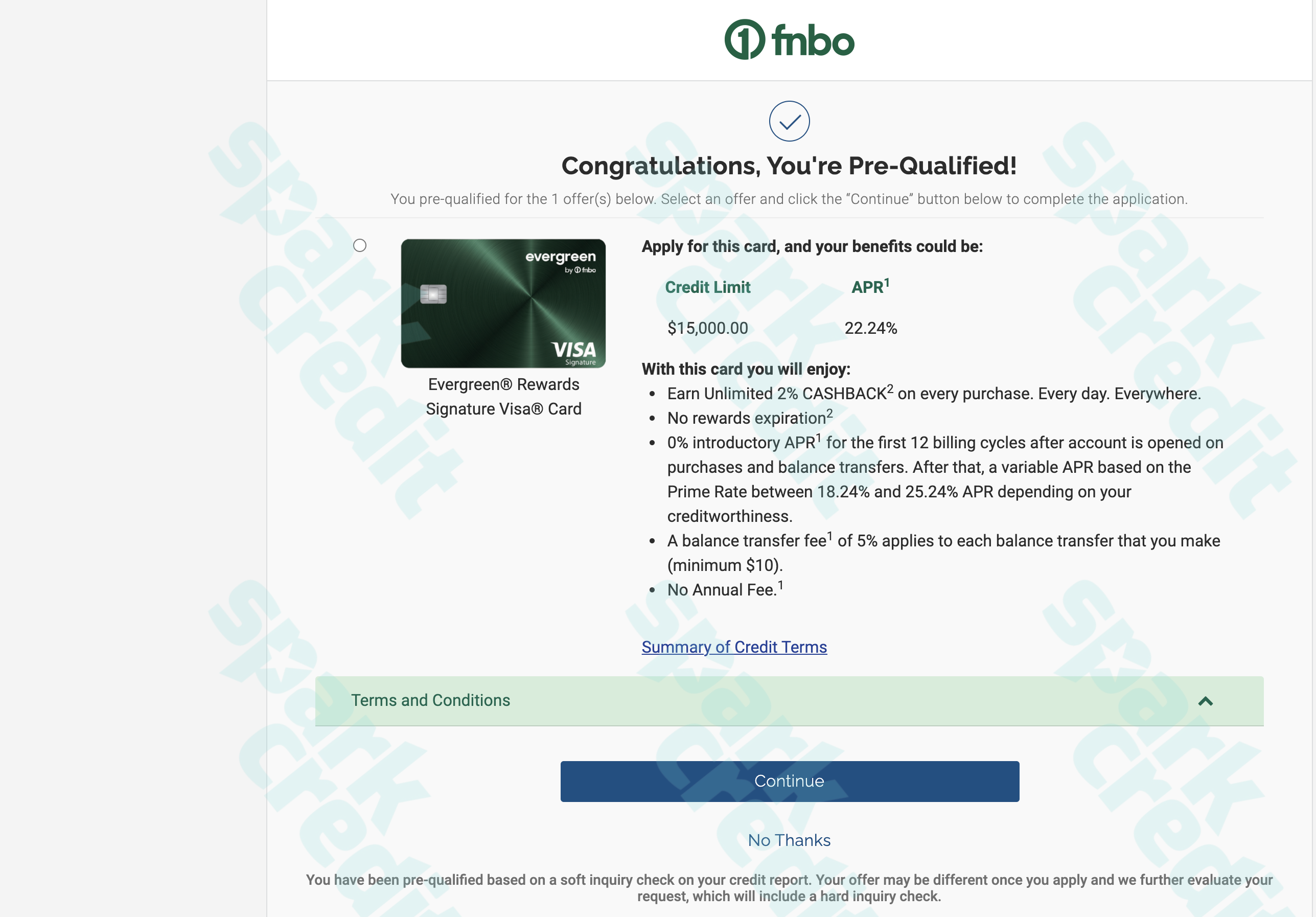

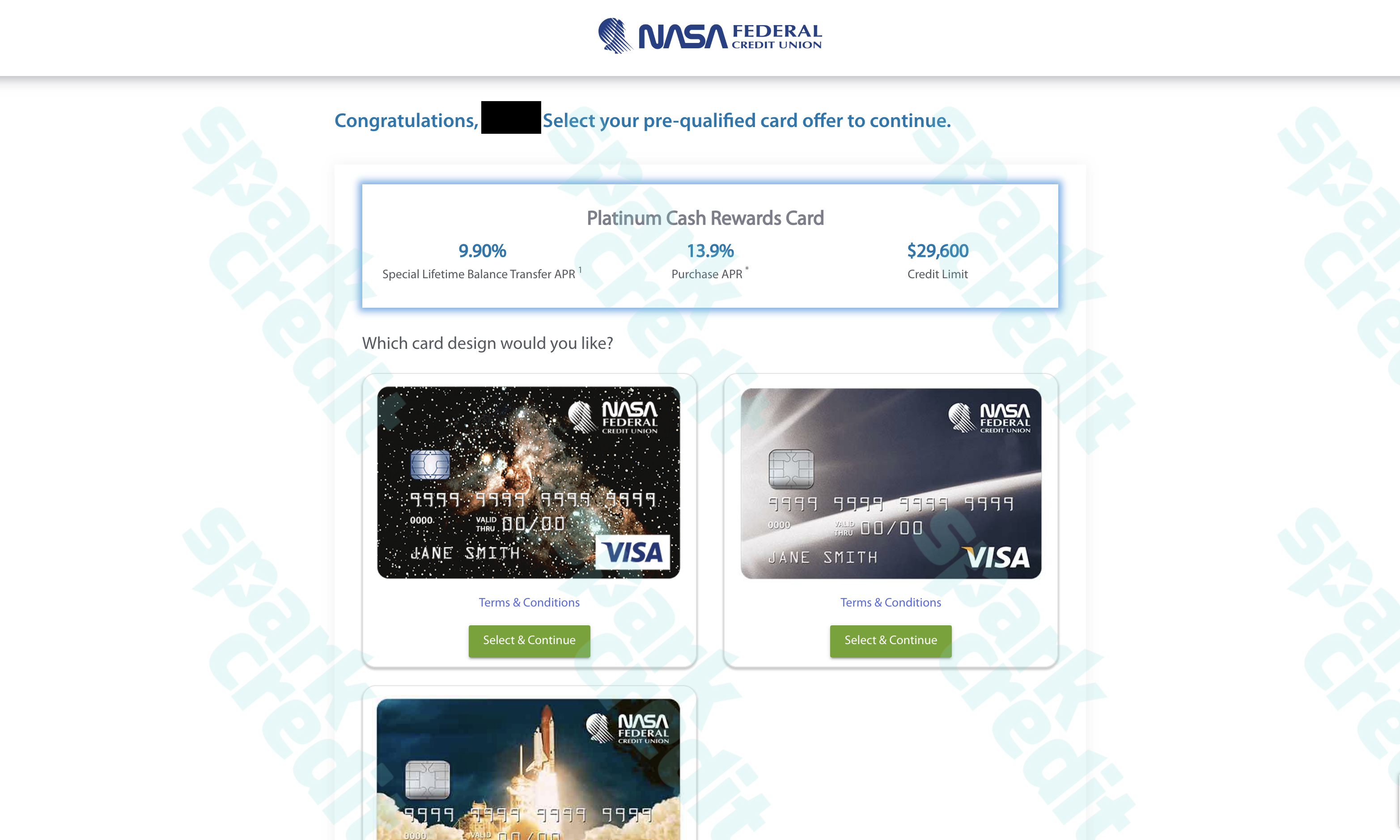

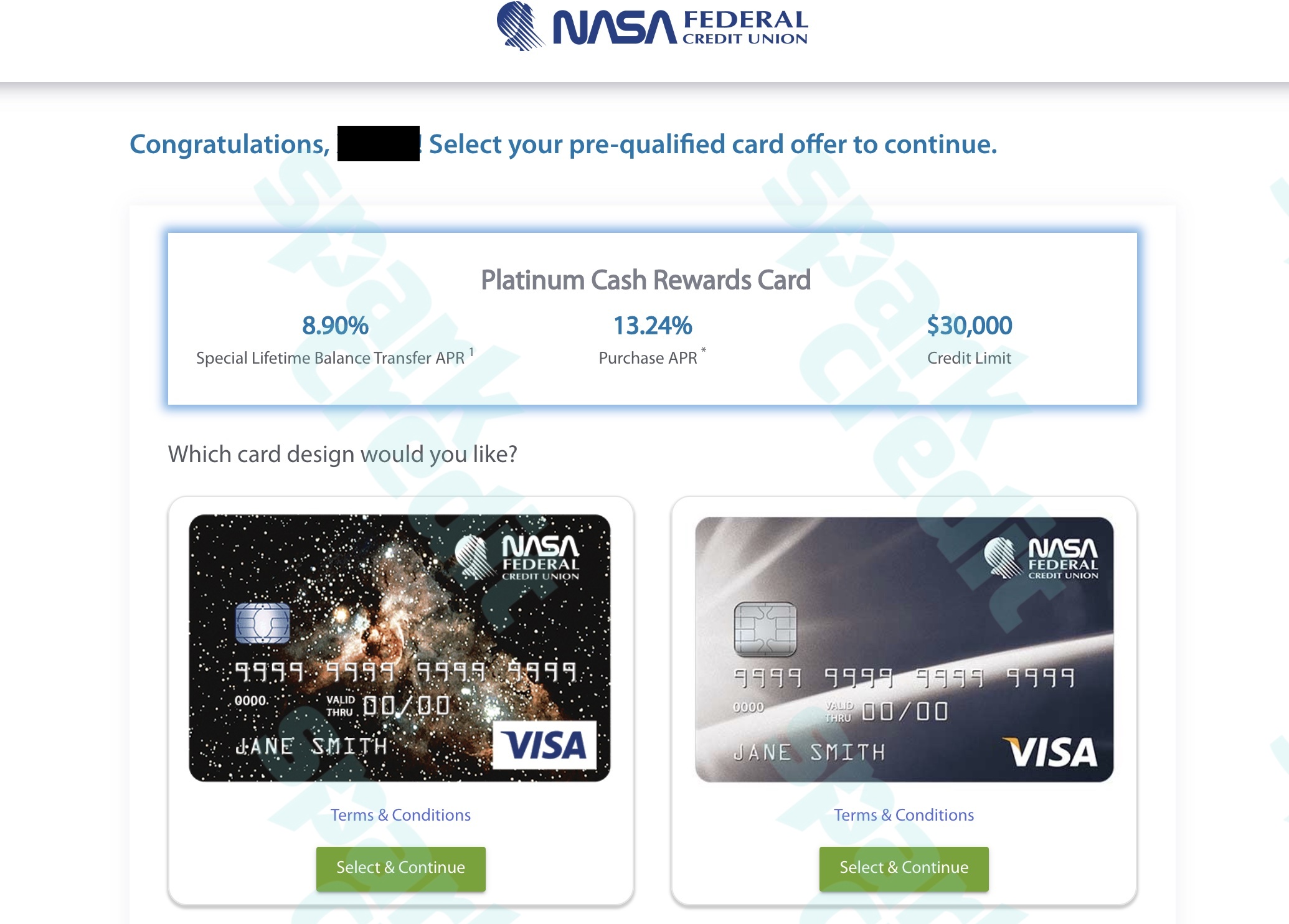

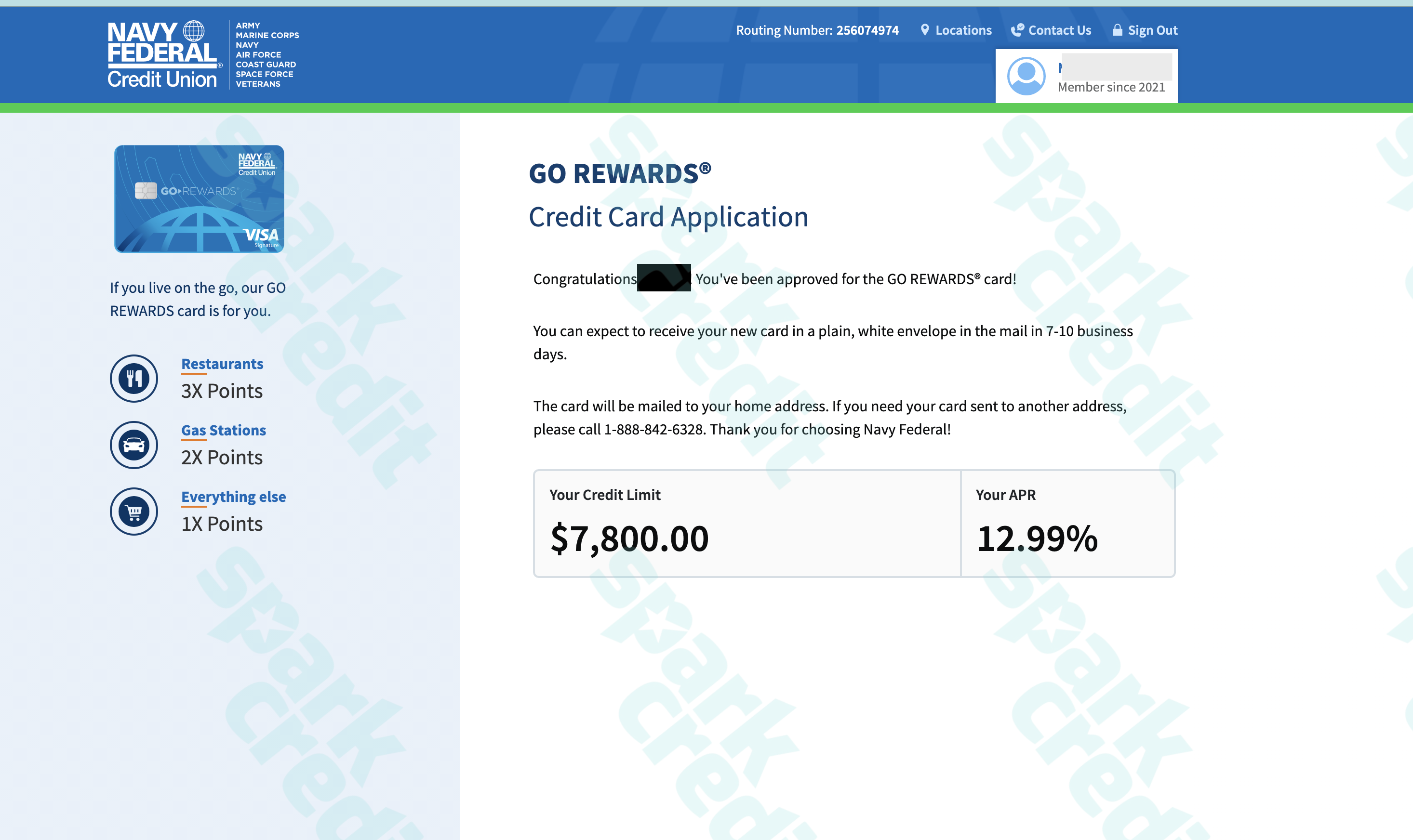

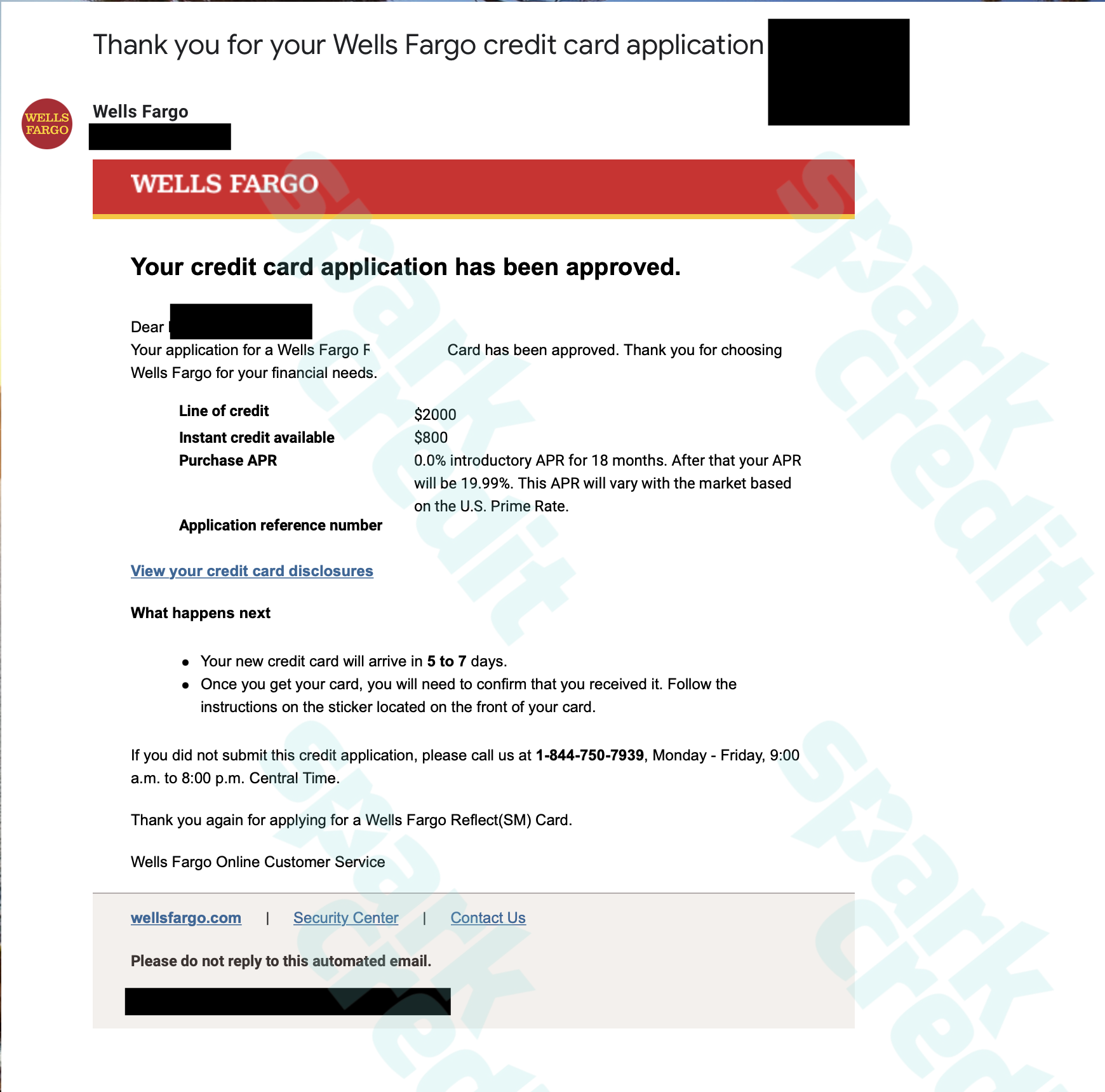

- Credit Approvals

- Increase Credit Limit

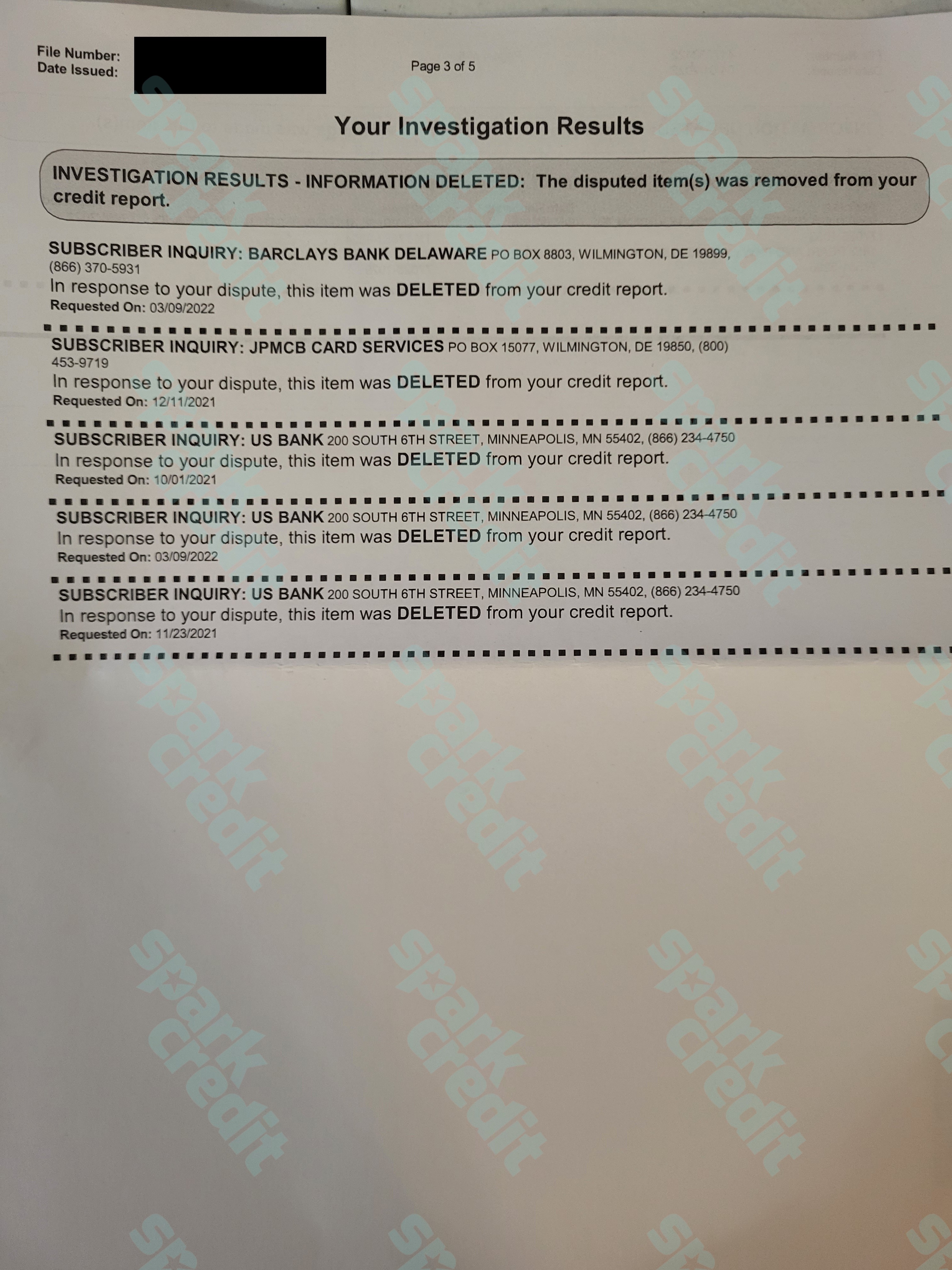

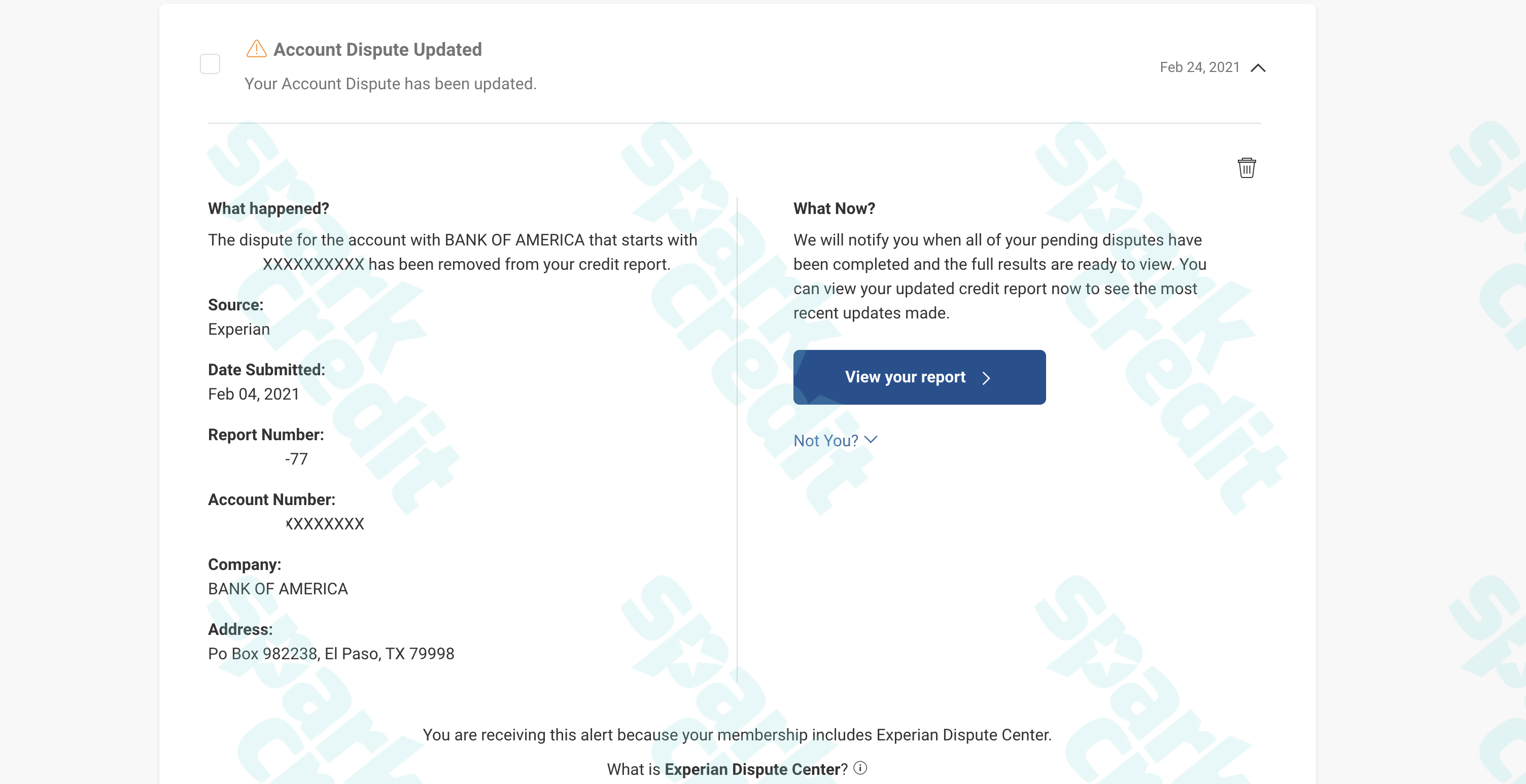

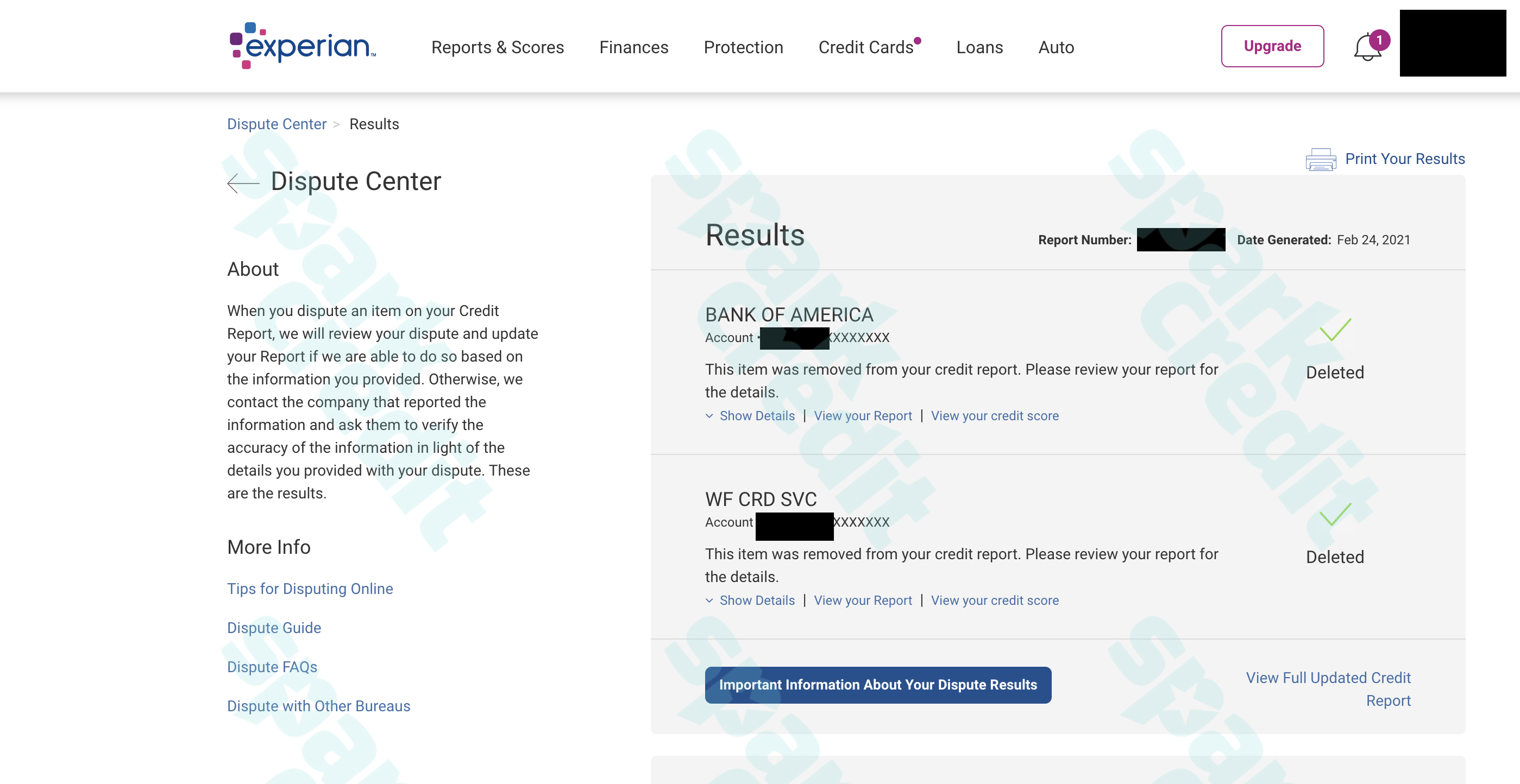

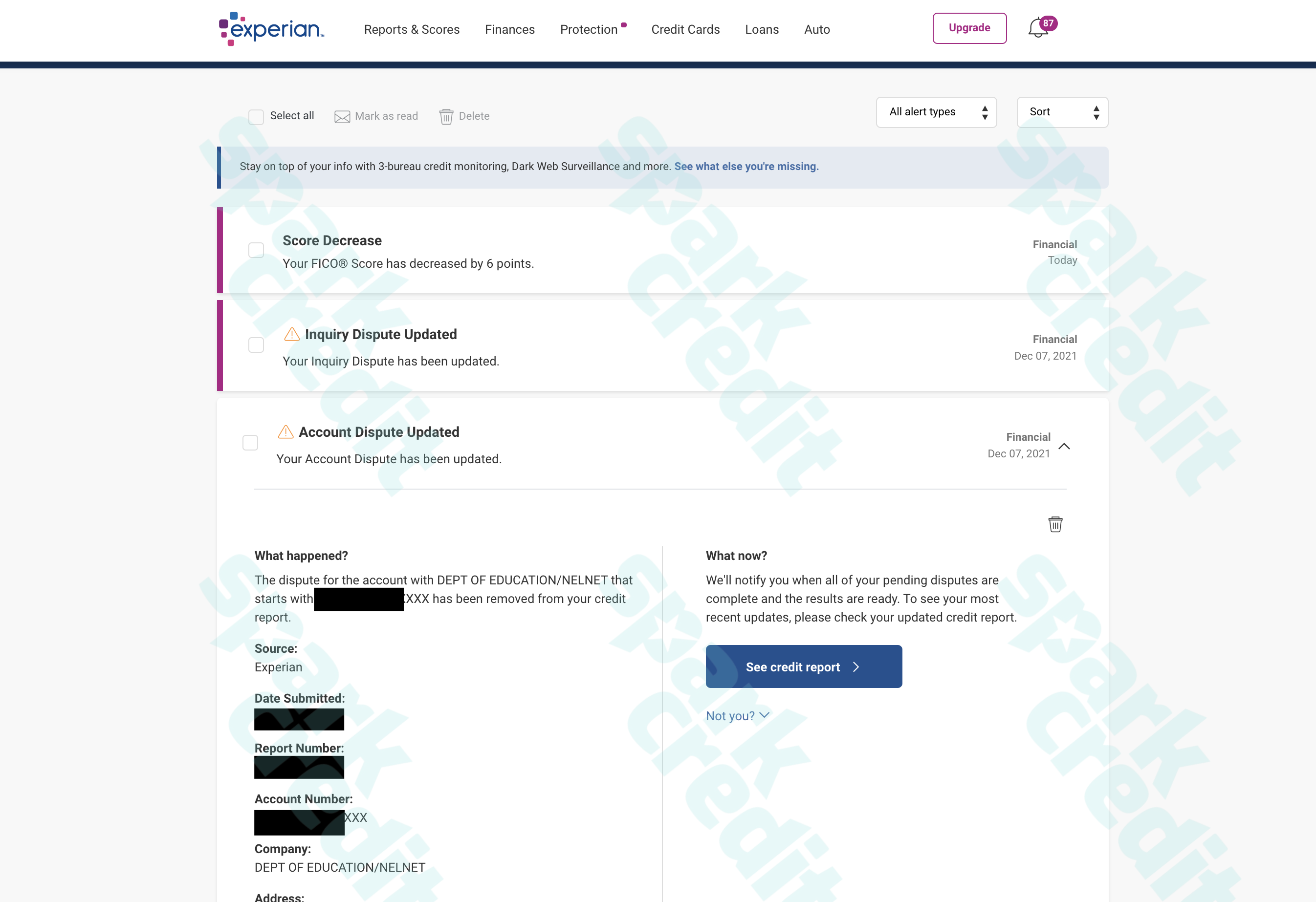

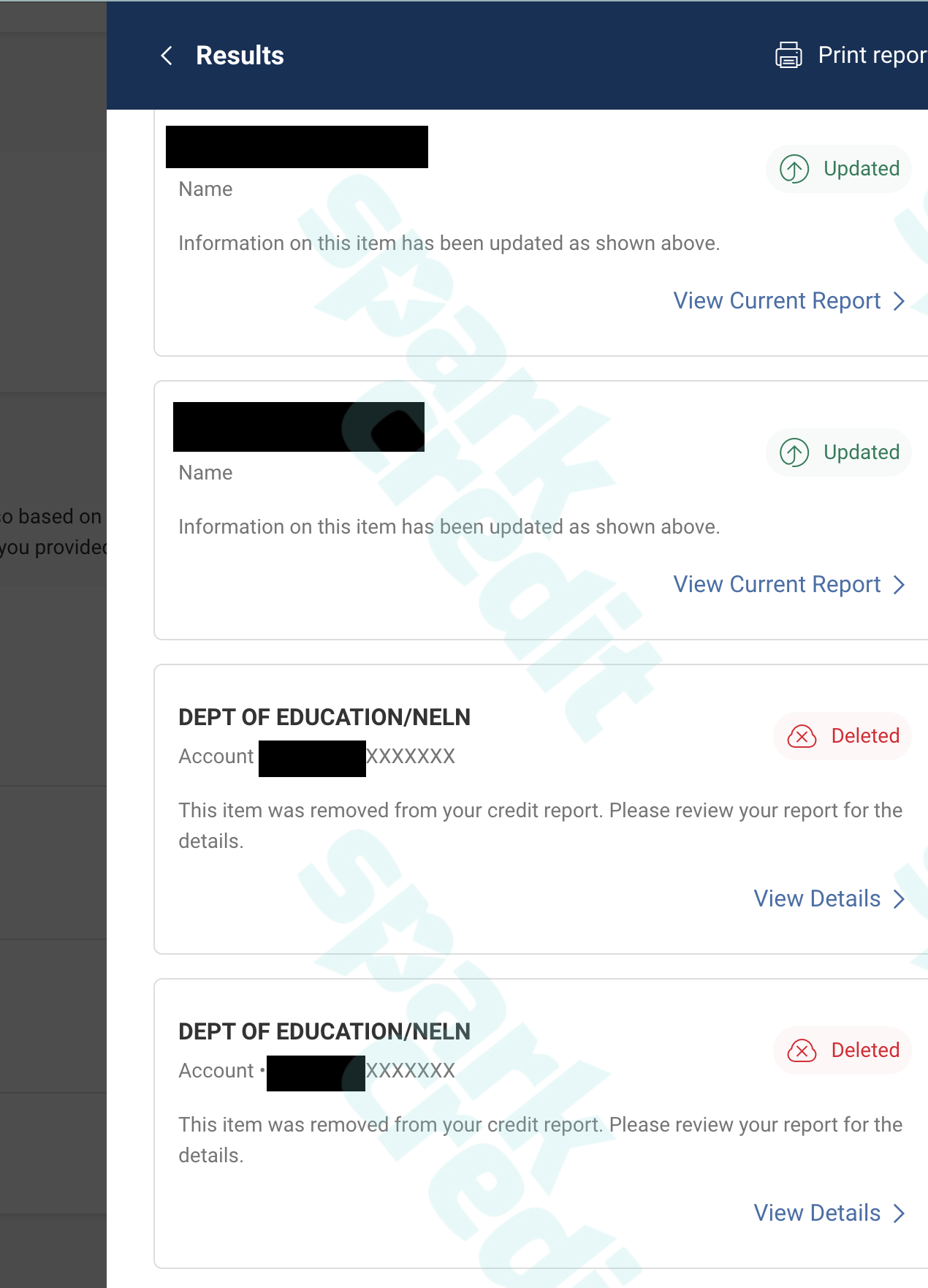

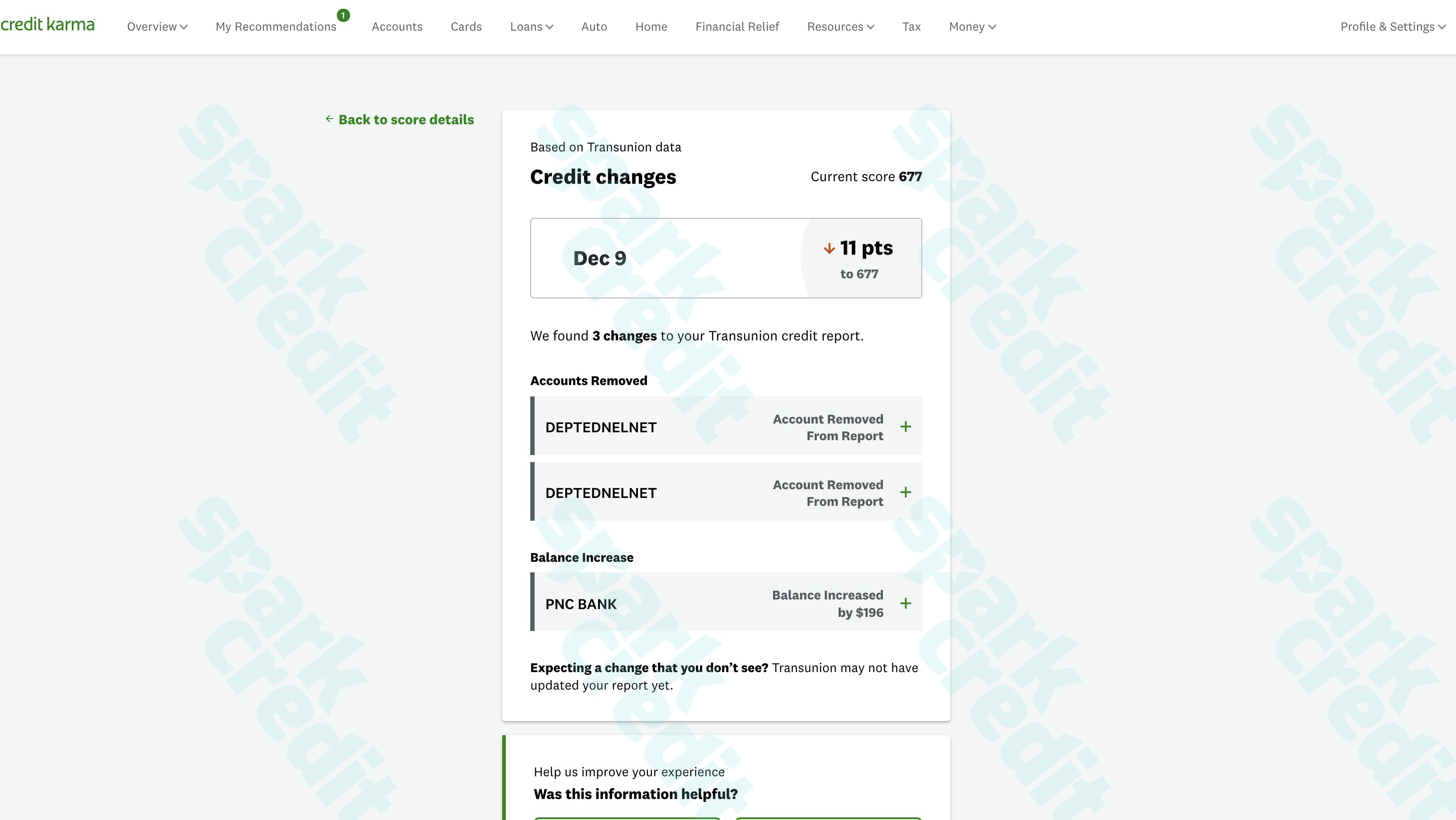

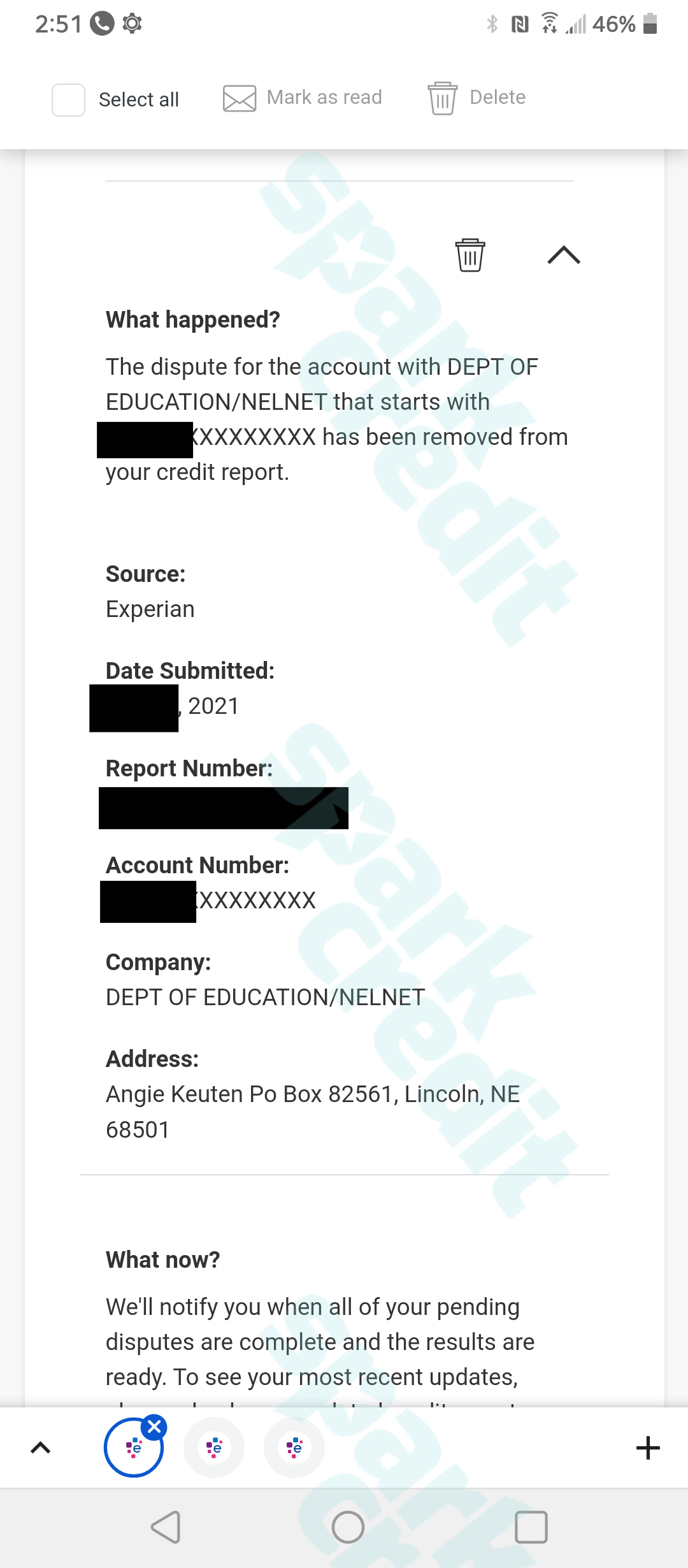

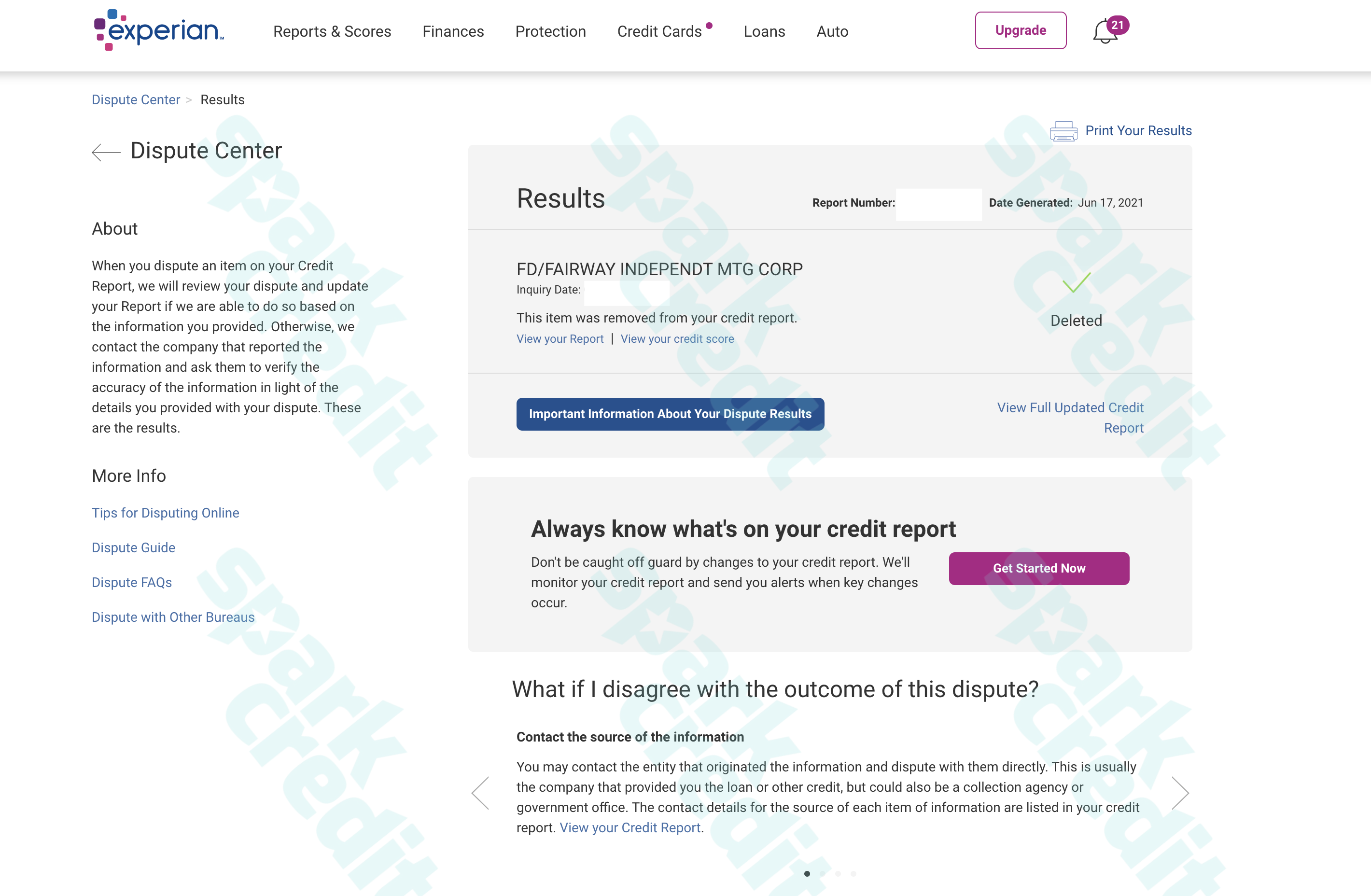

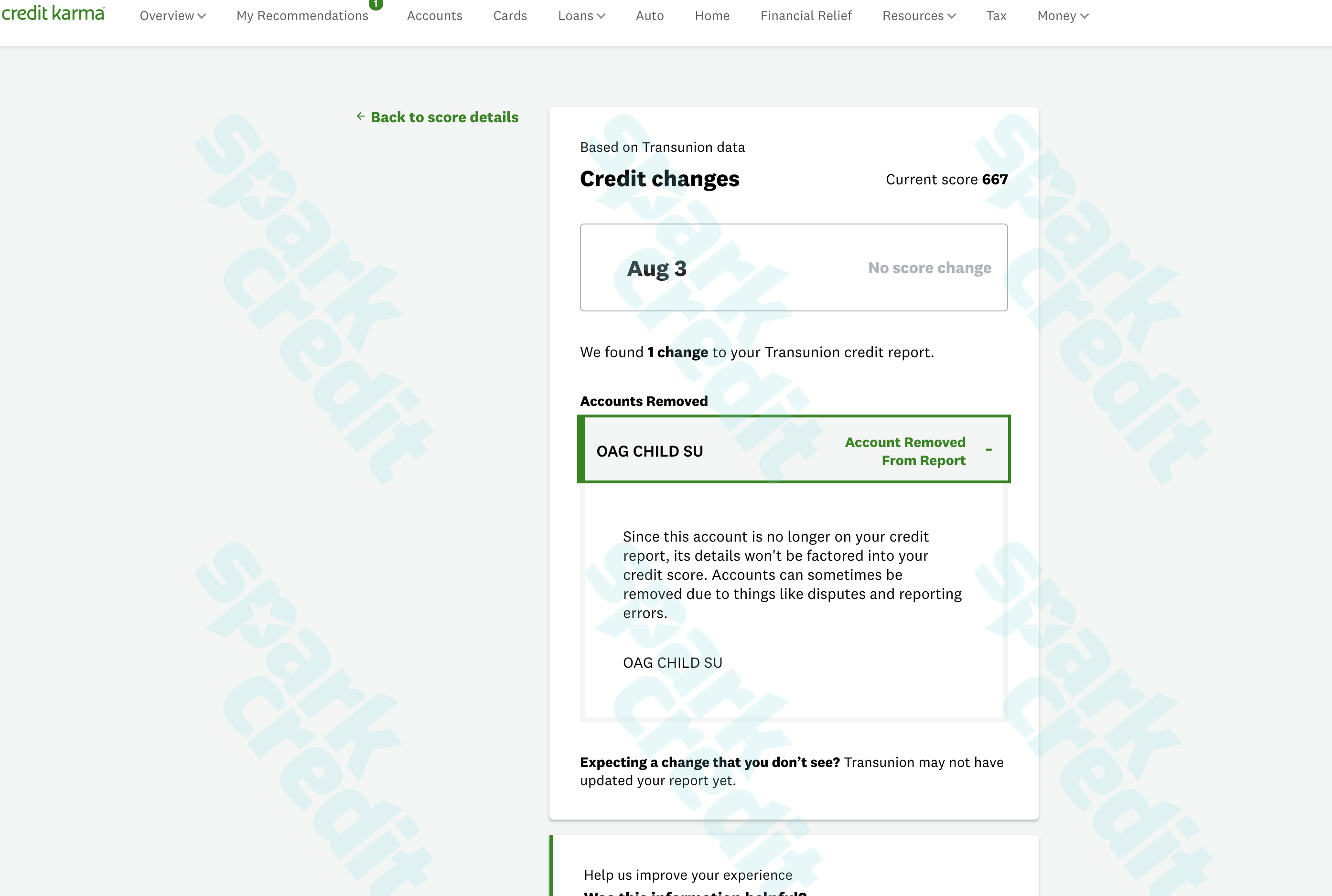

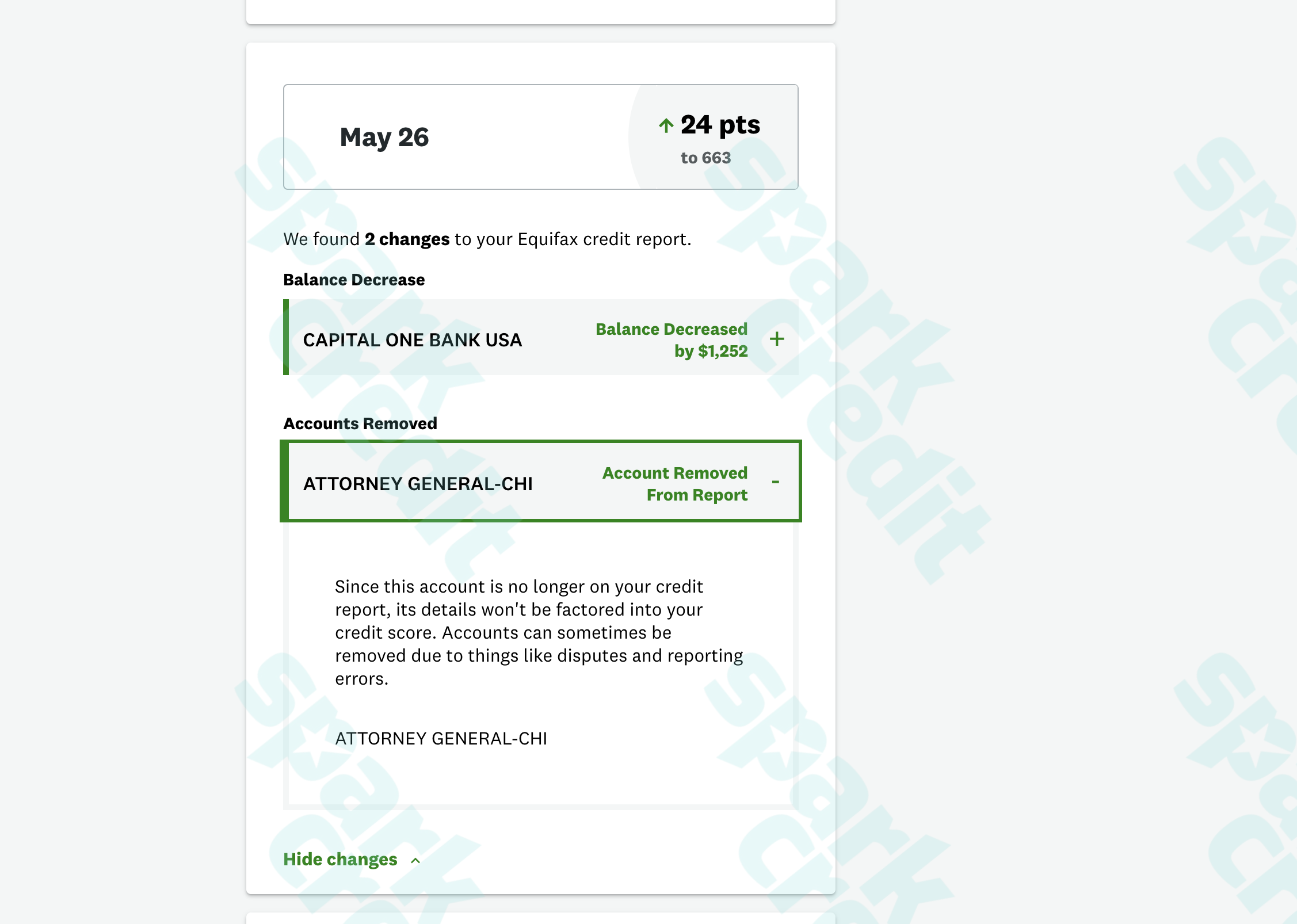

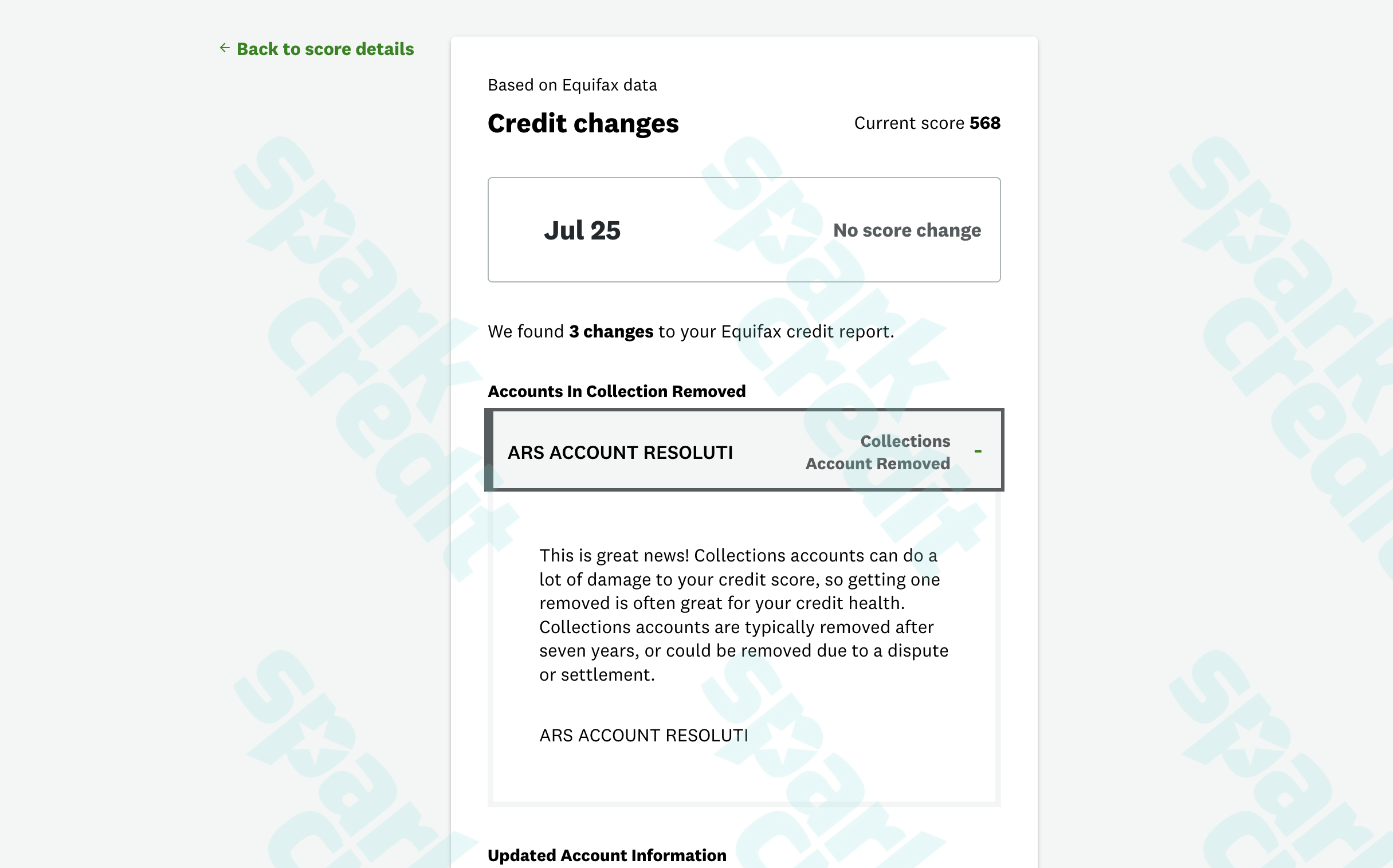

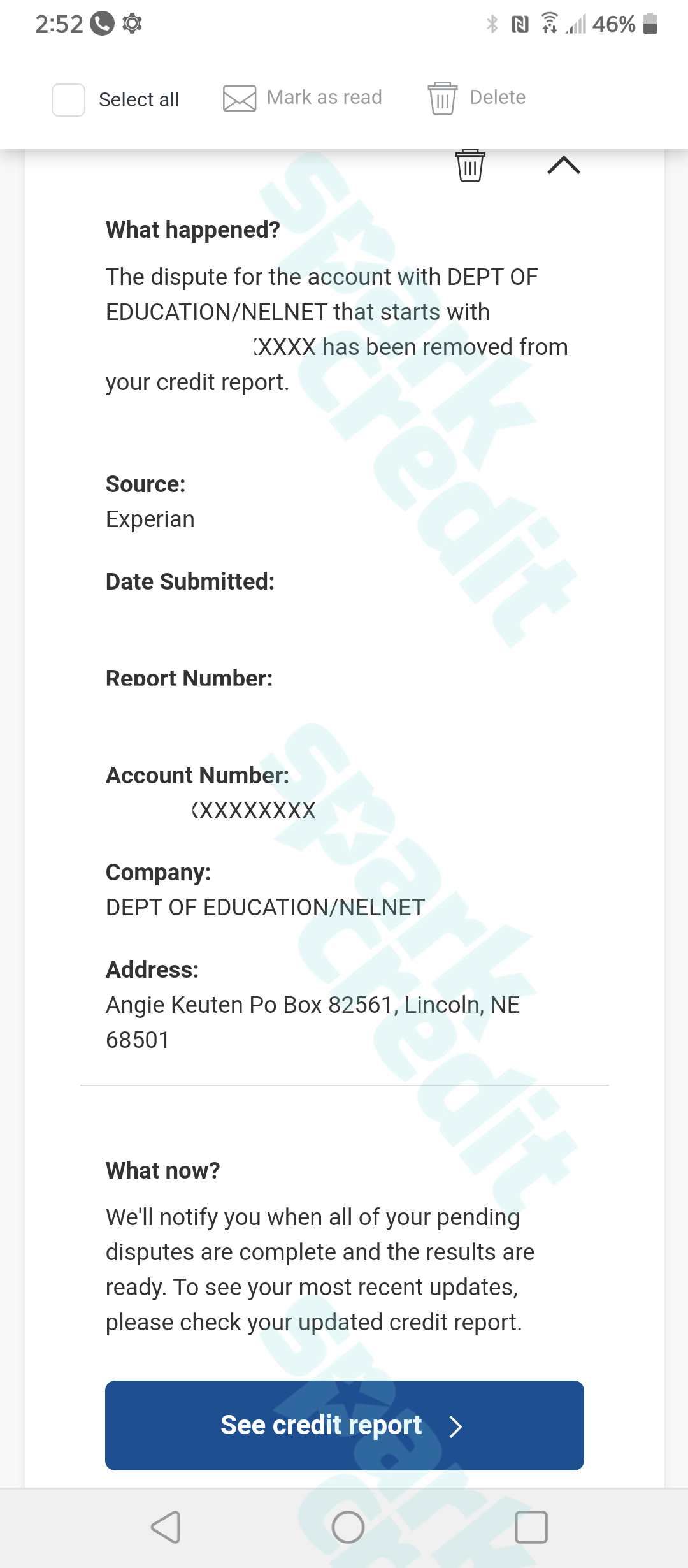

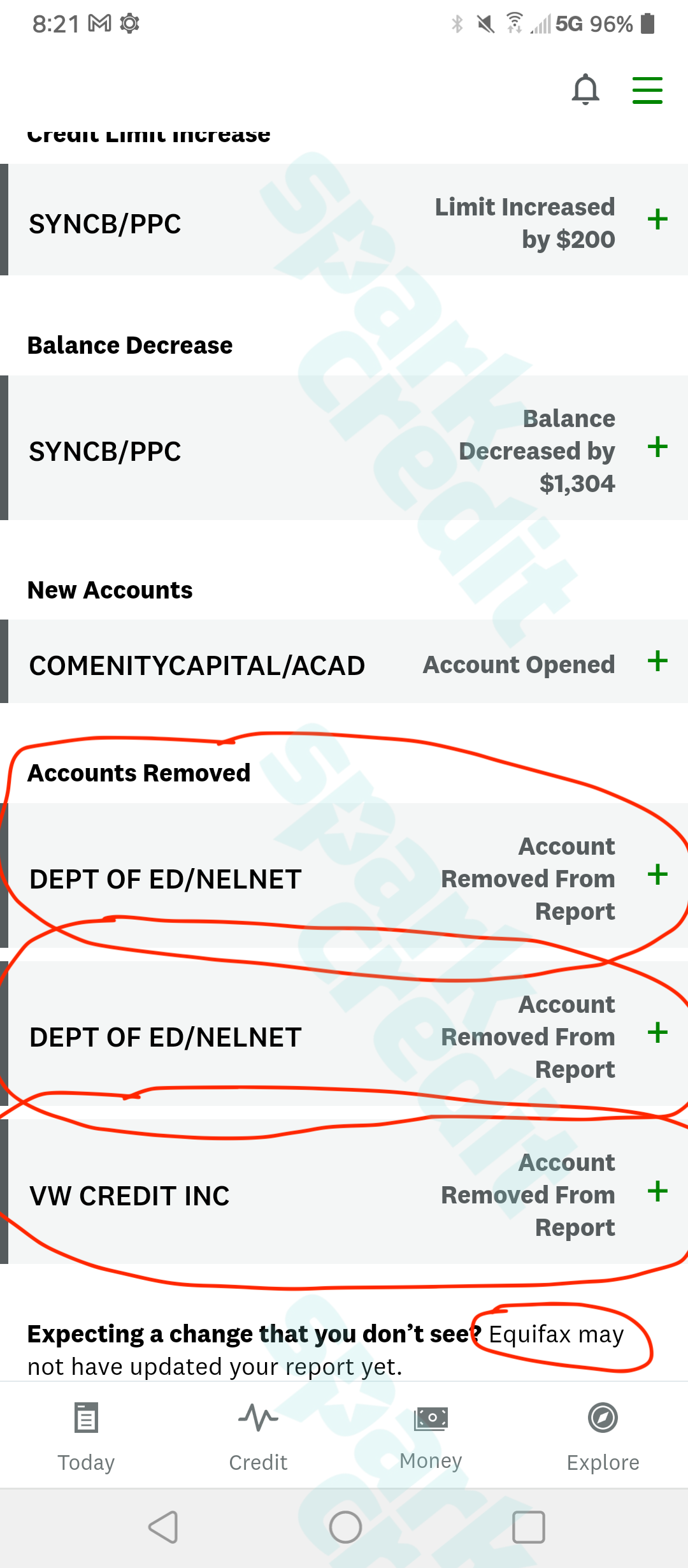

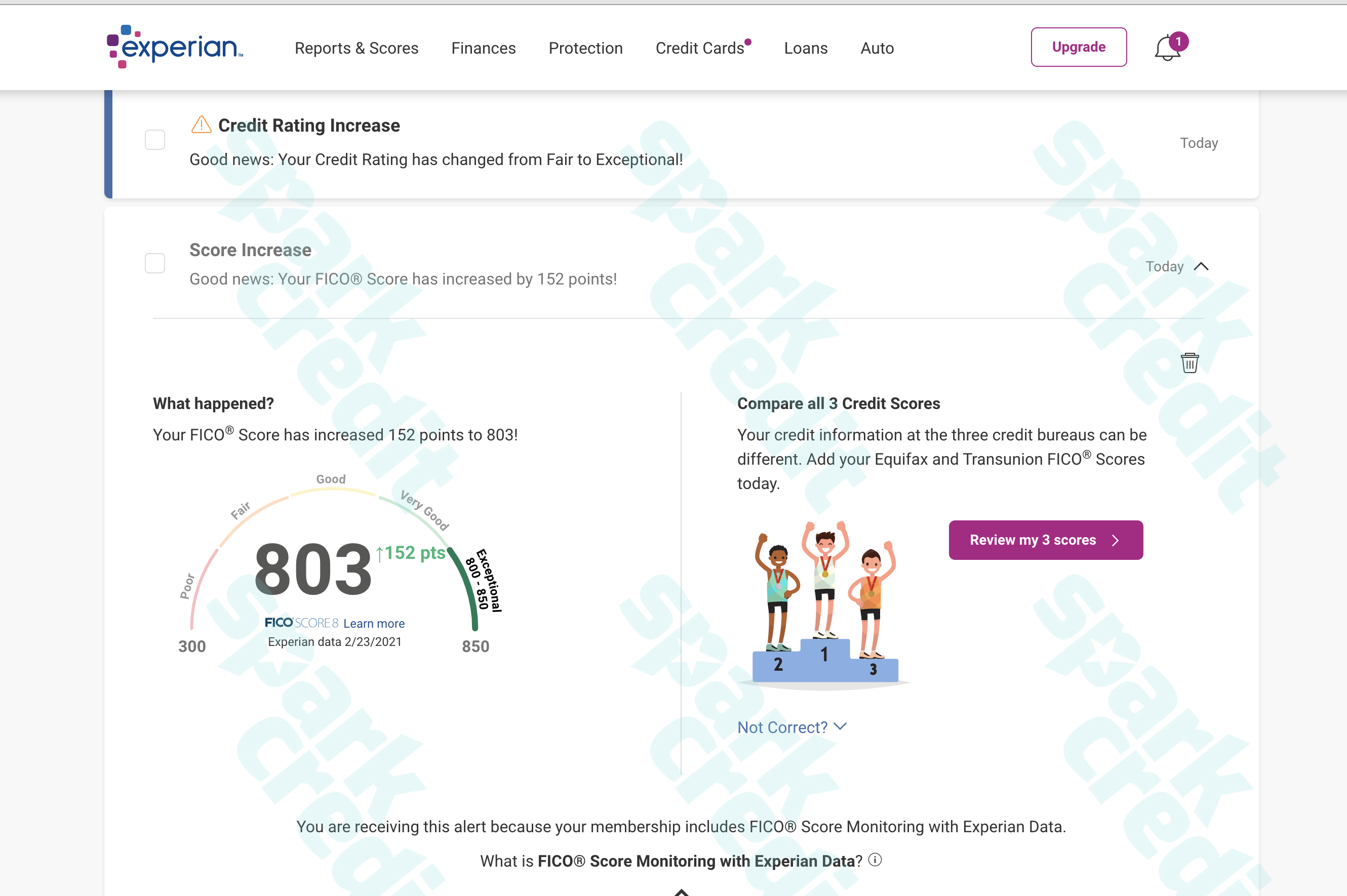

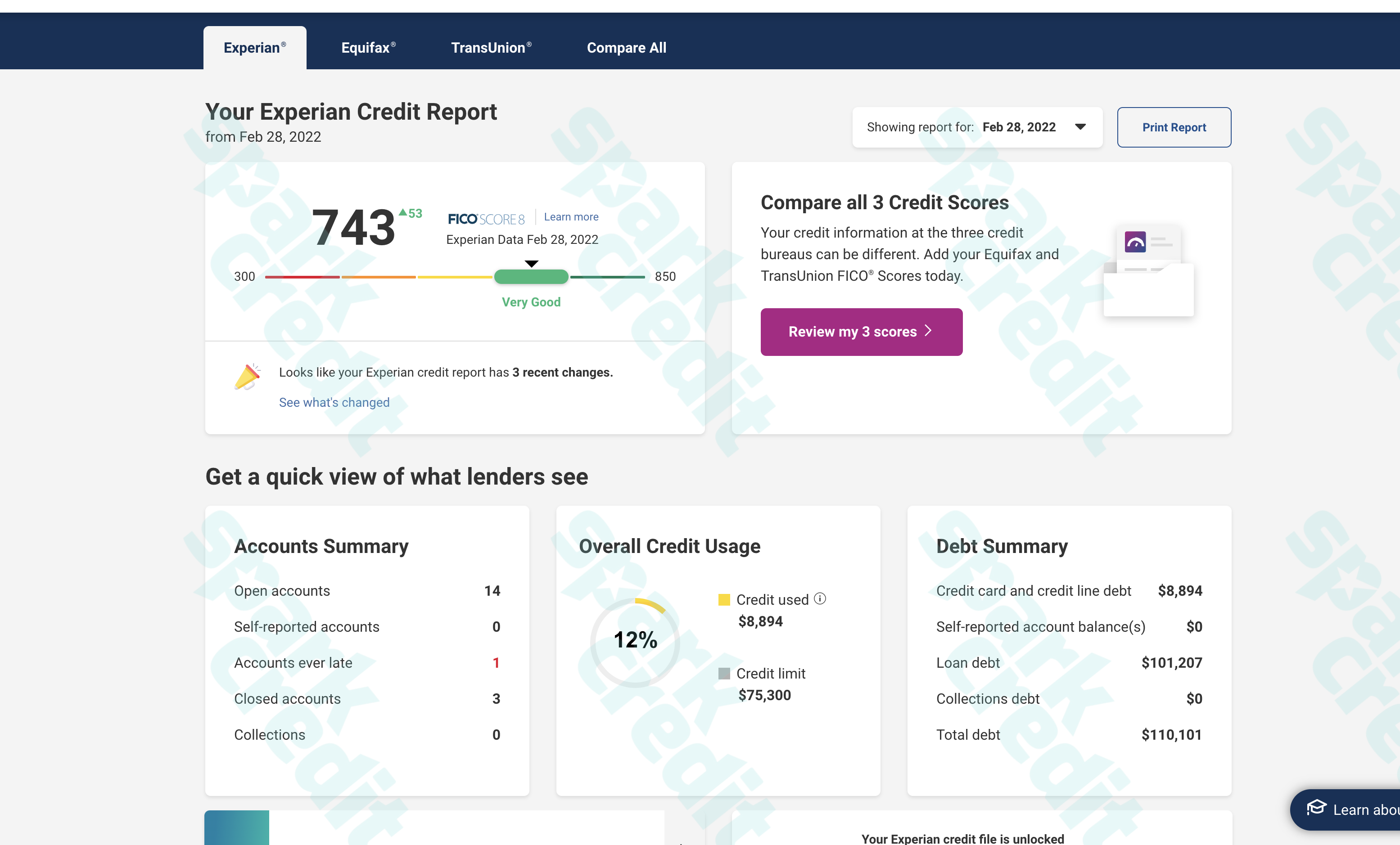

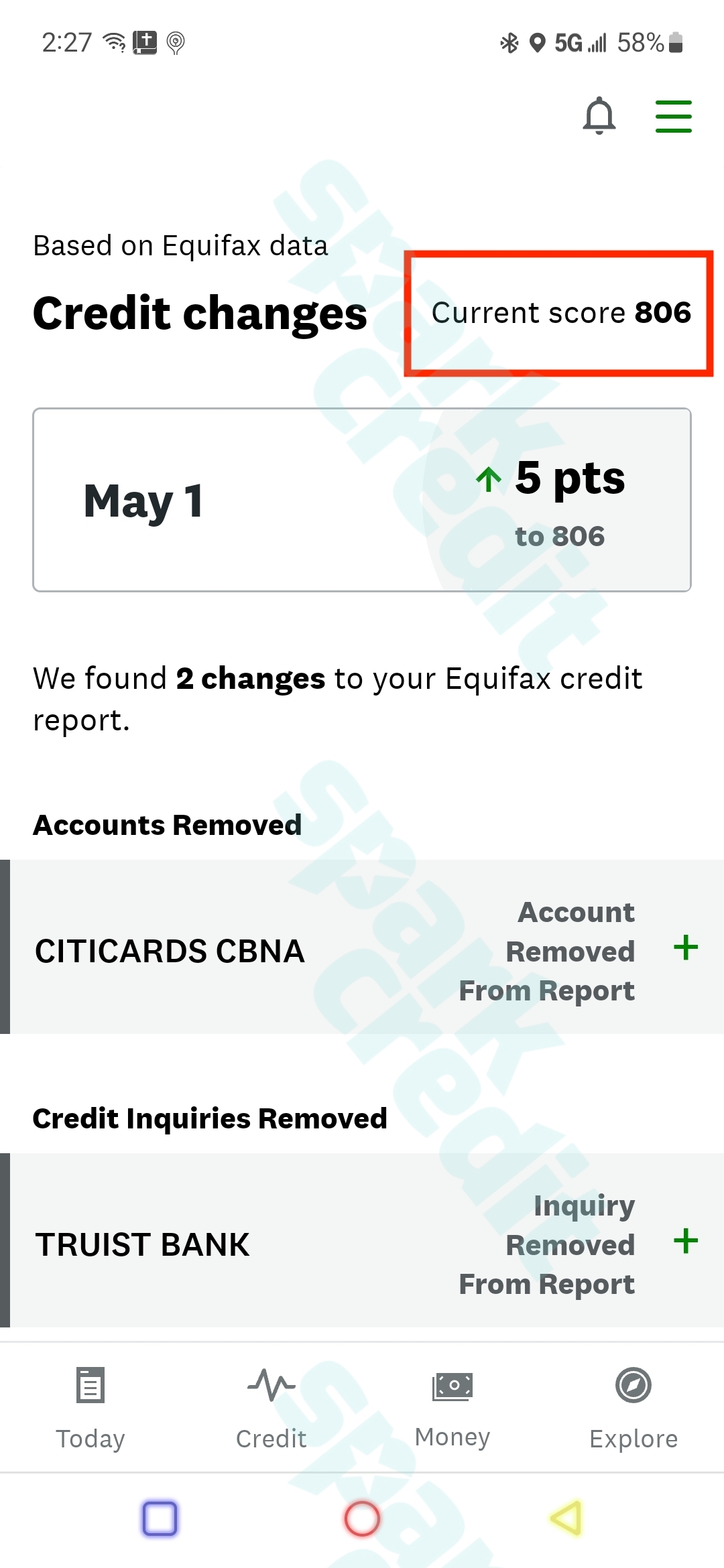

Remove Negative items

Don’t know how to delete negative items from a credit report?

Spark Credit provides you with the resources and one-on-one assistance necessary to repair your credit, negotiate with your creditors and credit bureaus to manage your obligations permanently, and boost your credit score. We have the information and skills to achieve your monetary objectives for the rest of your life.

There are methods available to make improvements to your credit that are long-lasting. Your credit reports serve as a kind of finance statement record; they are a beneficial record that allows creditors in assessing the level of risk associated with providing you with a loan of money.

The credit history includes bill payments and the current record condition in your credit accounts. The data includes time payments for your loans or credit cards, the total amount of available credit, utilization of present credit, and records of outstanding debts. The debt may be auctioned or transferred to a collection agency, depending on the circumstances, if loan payments are not on time.

How can we help you to remove negative items?

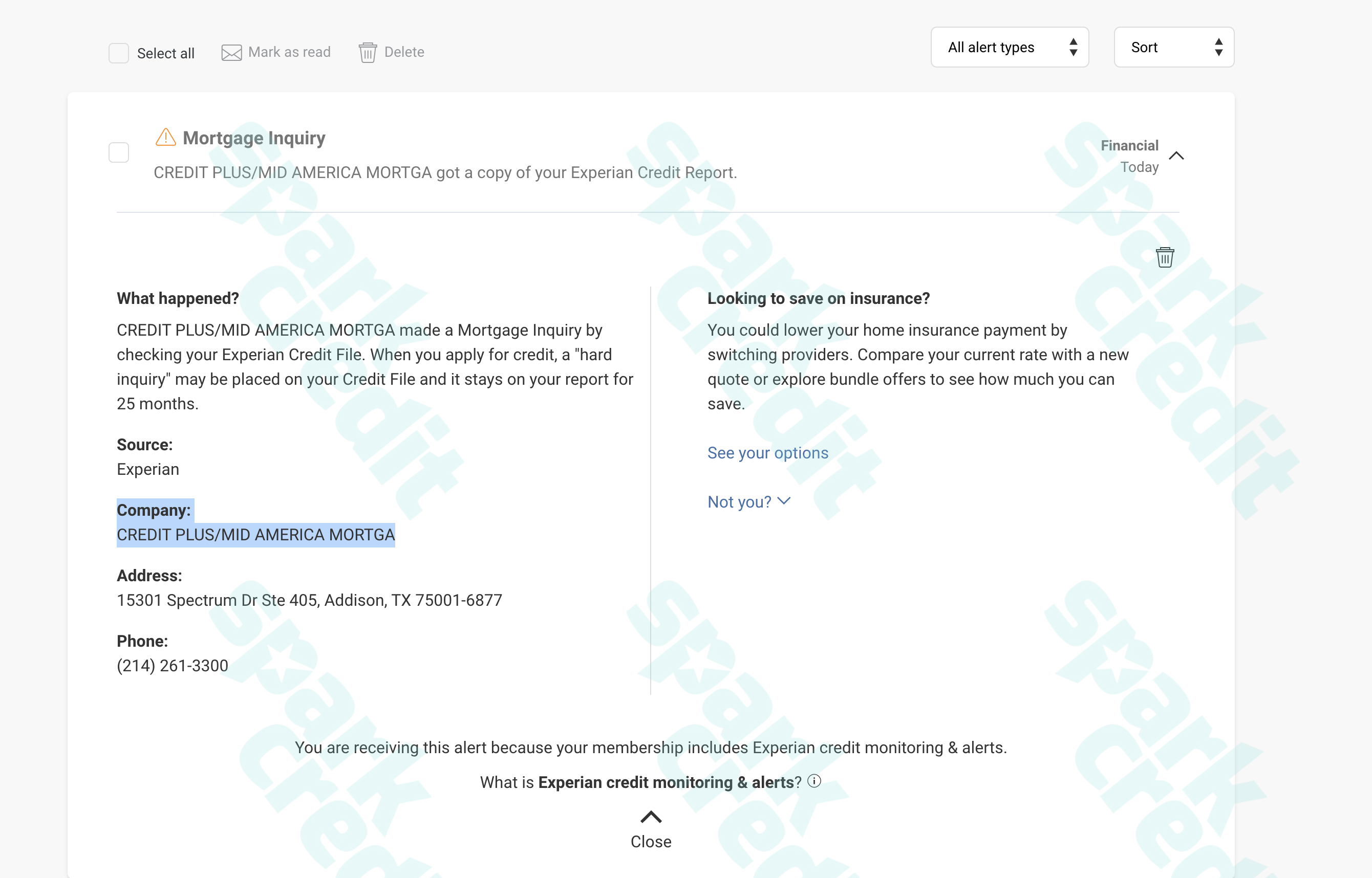

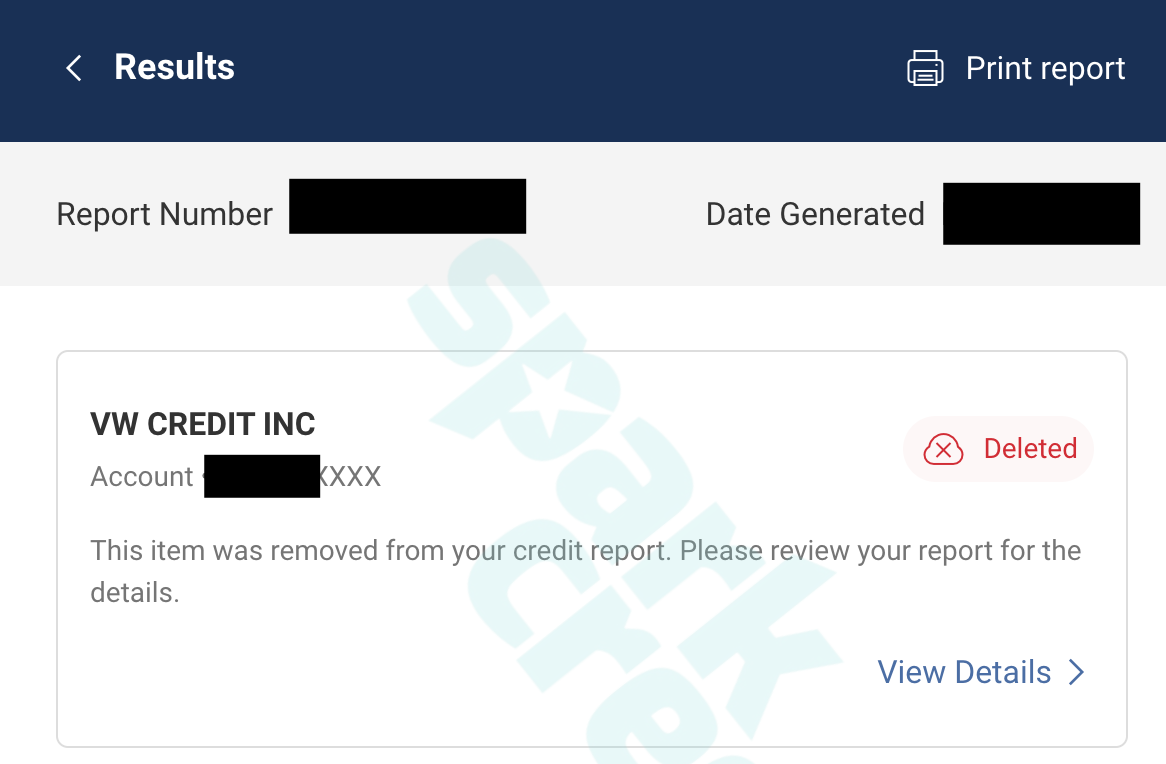

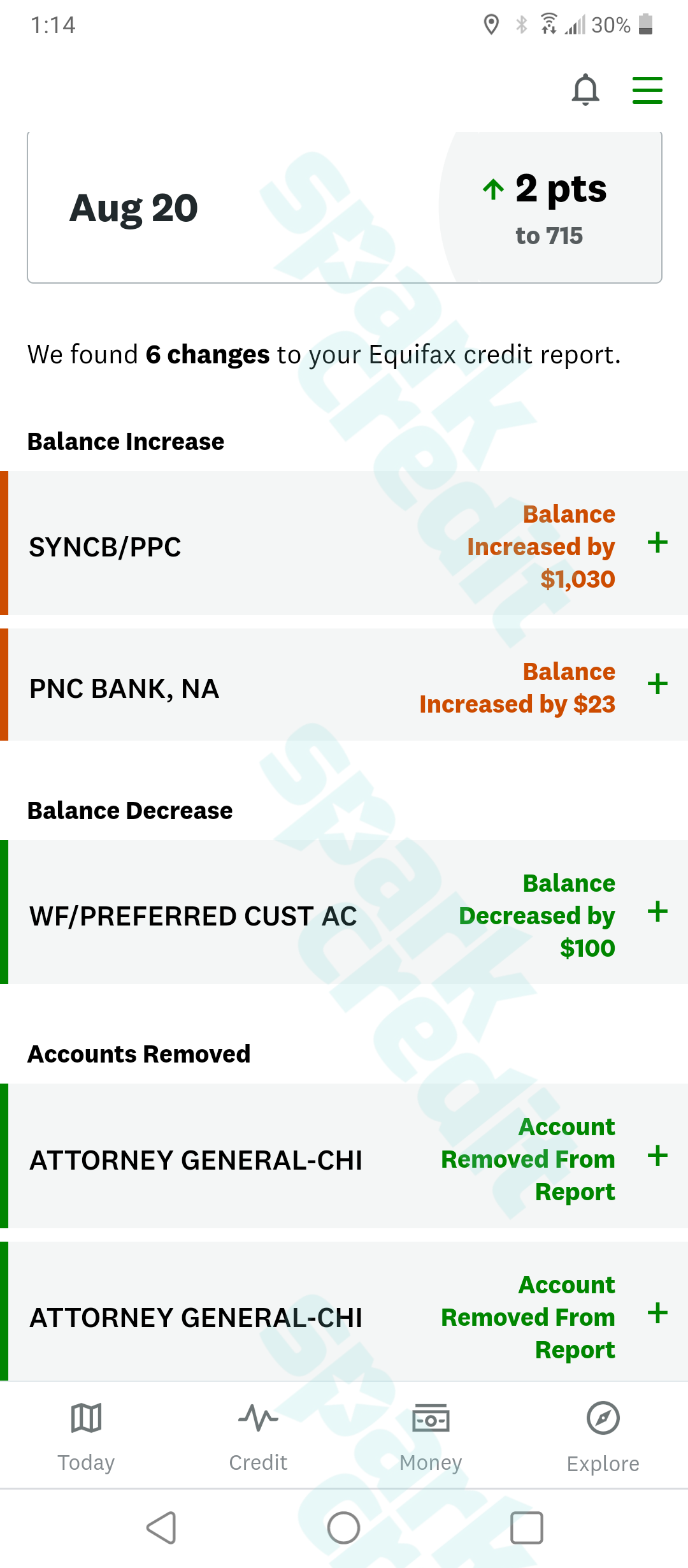

We remove negative information from credit reports which in turn increase your credit scores. Spark credit has helped thousands of clients boost their credit history and financial standing. We have given assistance to our customers to remove:

- Public Records

- Collections

- Late Payments

- Charge-offs

- Inquiries

- Judgments

- Tax Liens

- Bankruptcy

- Repossessions

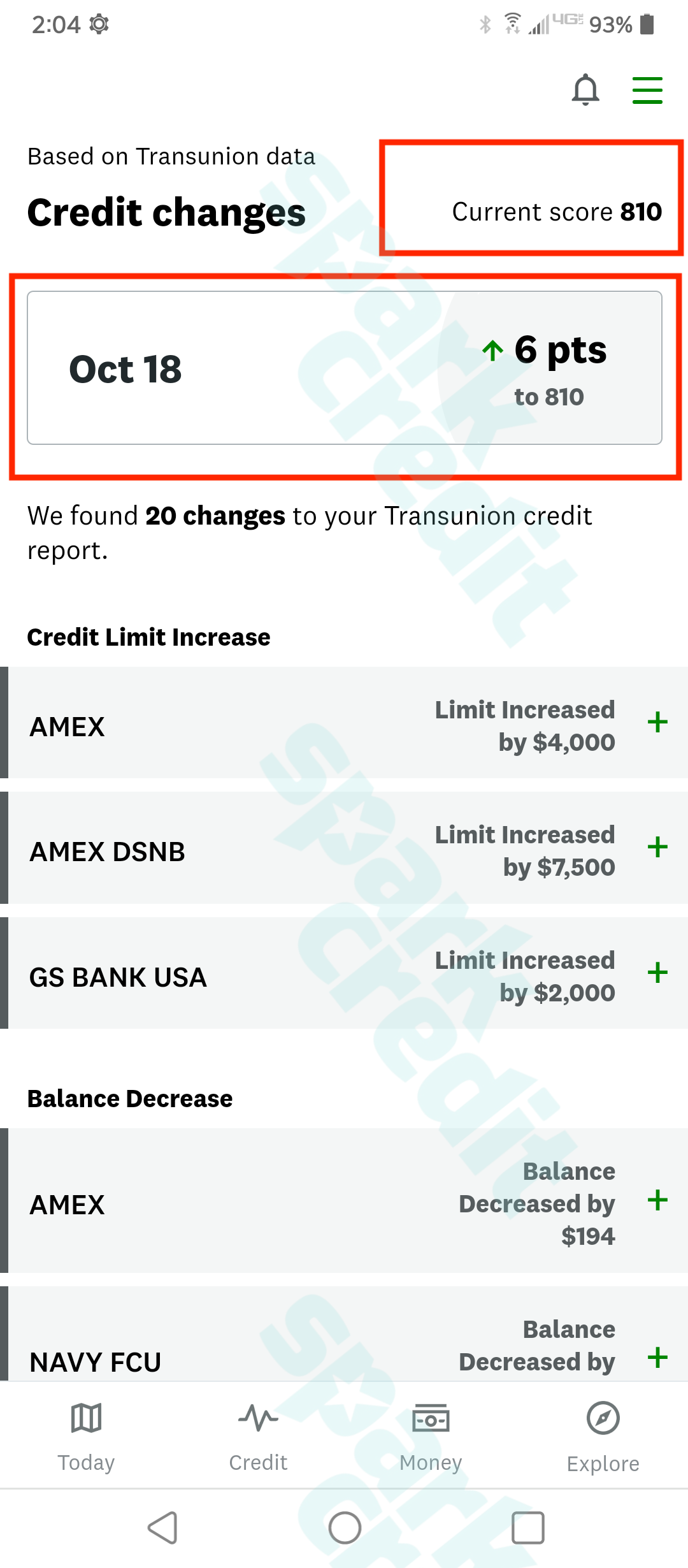

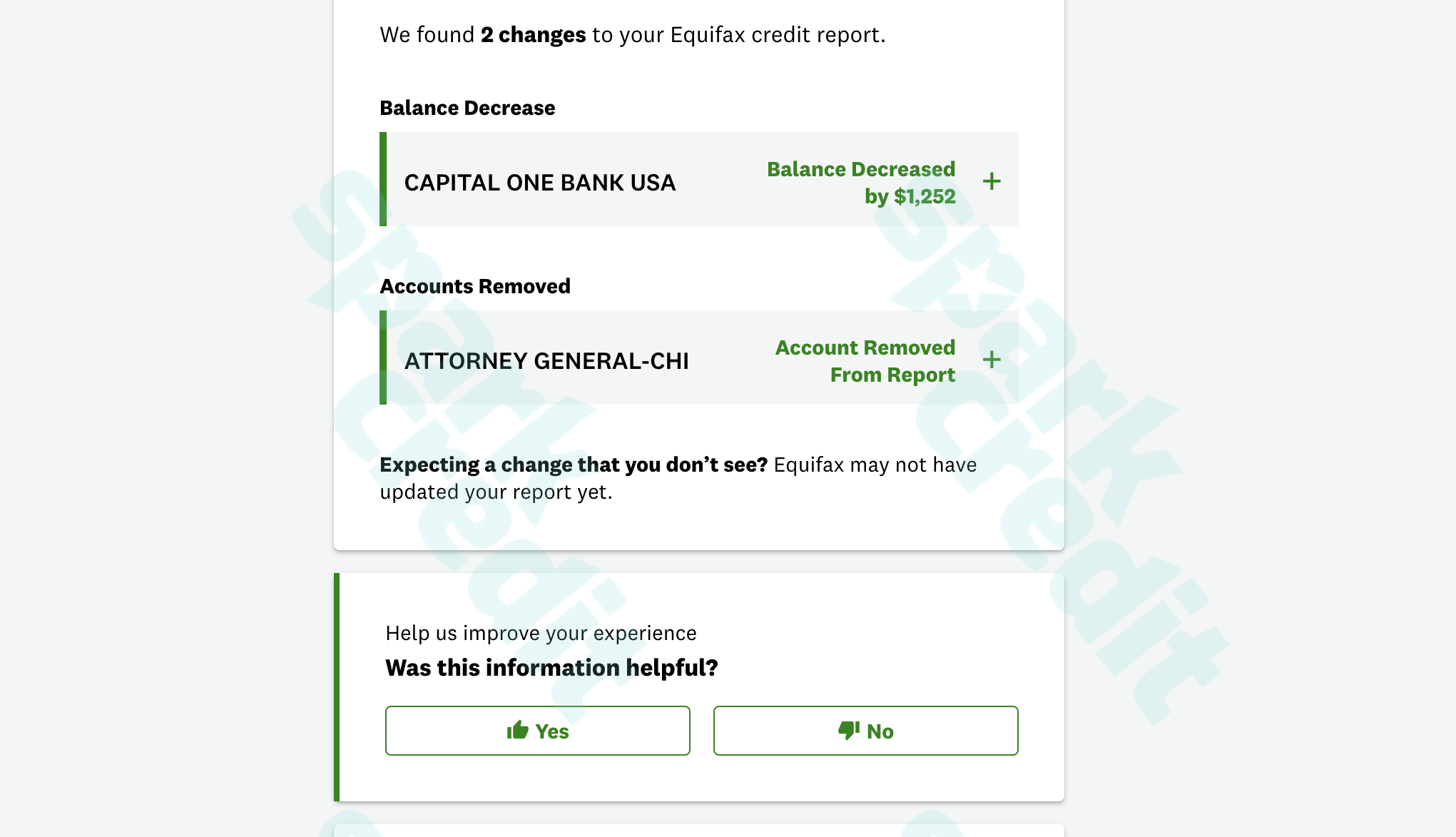

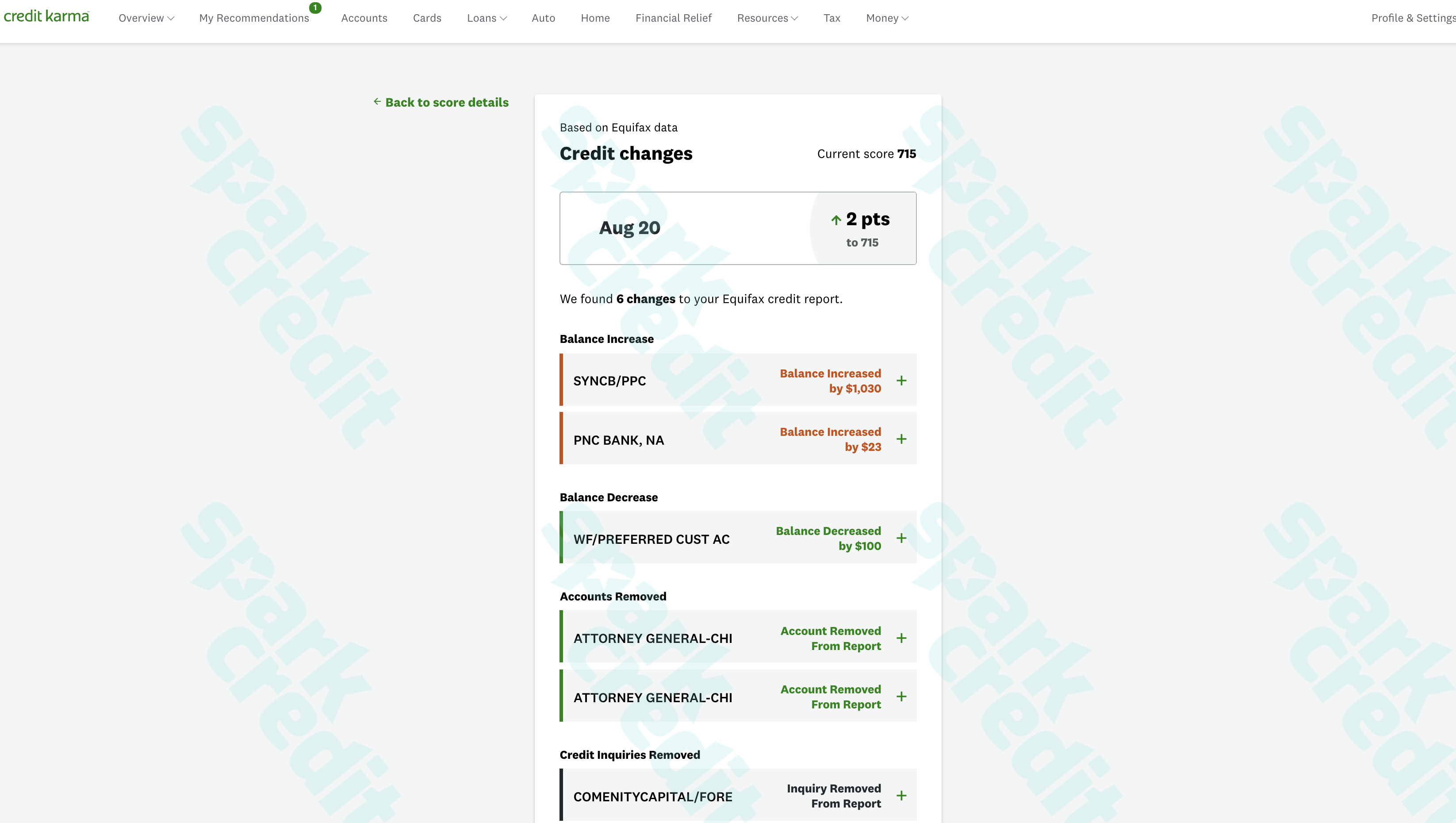

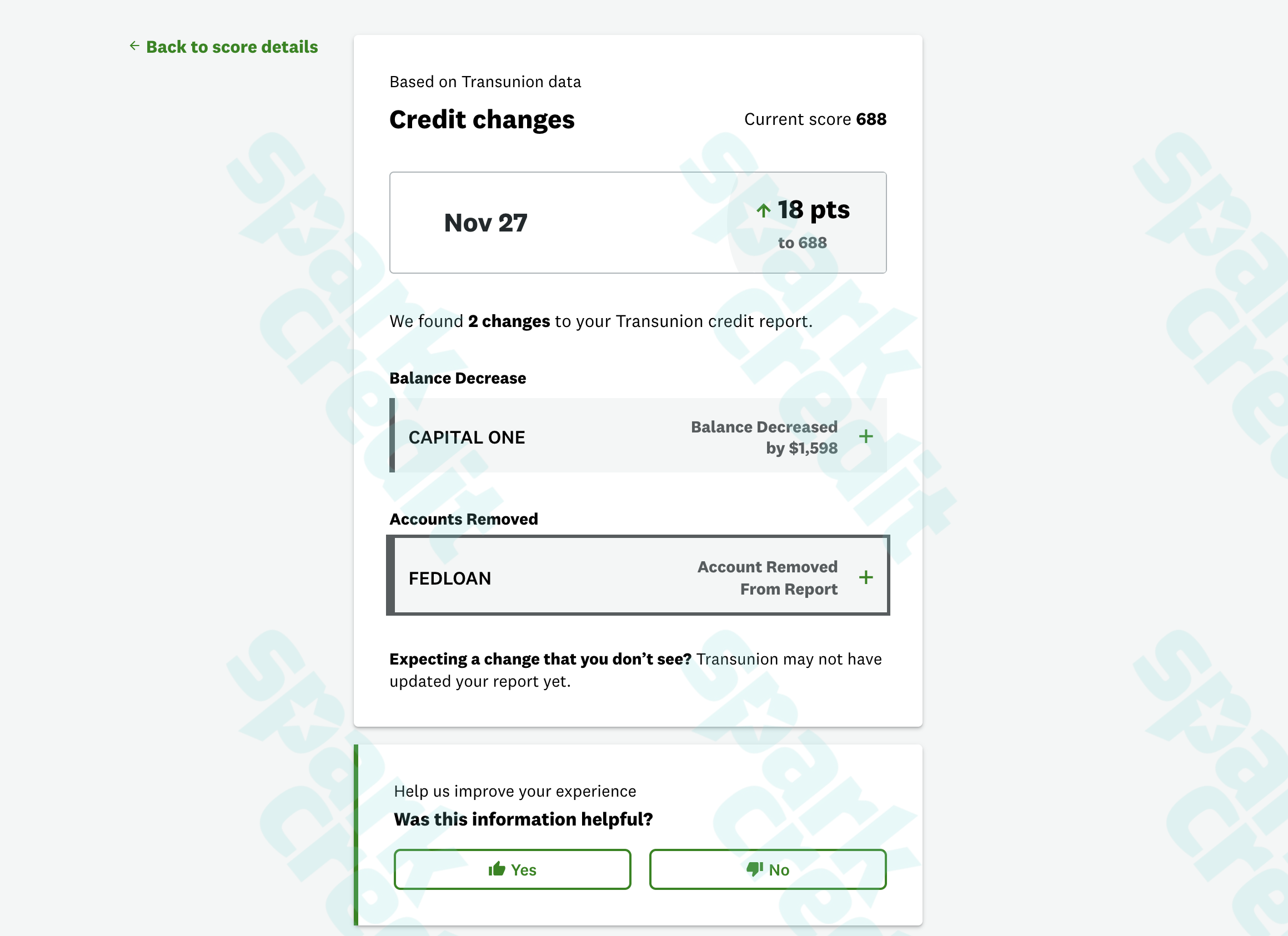

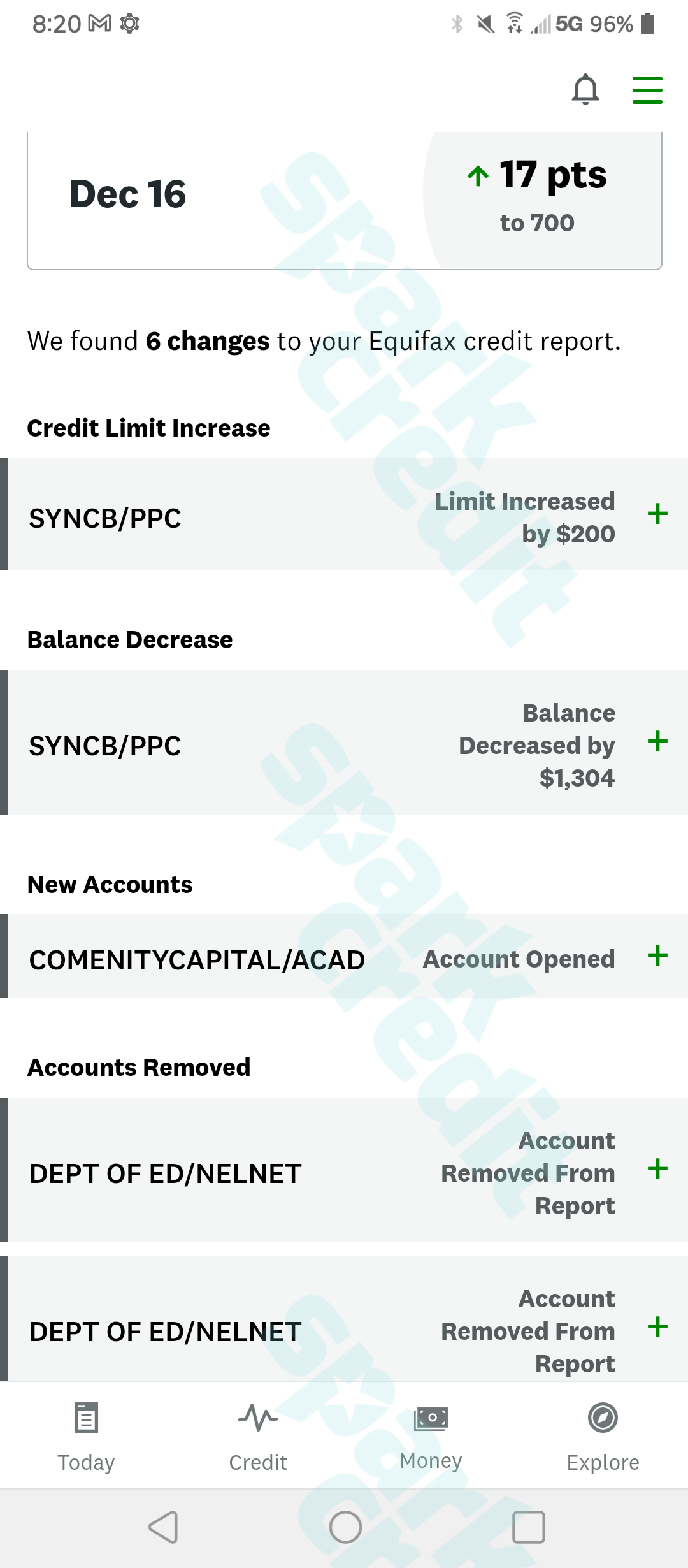

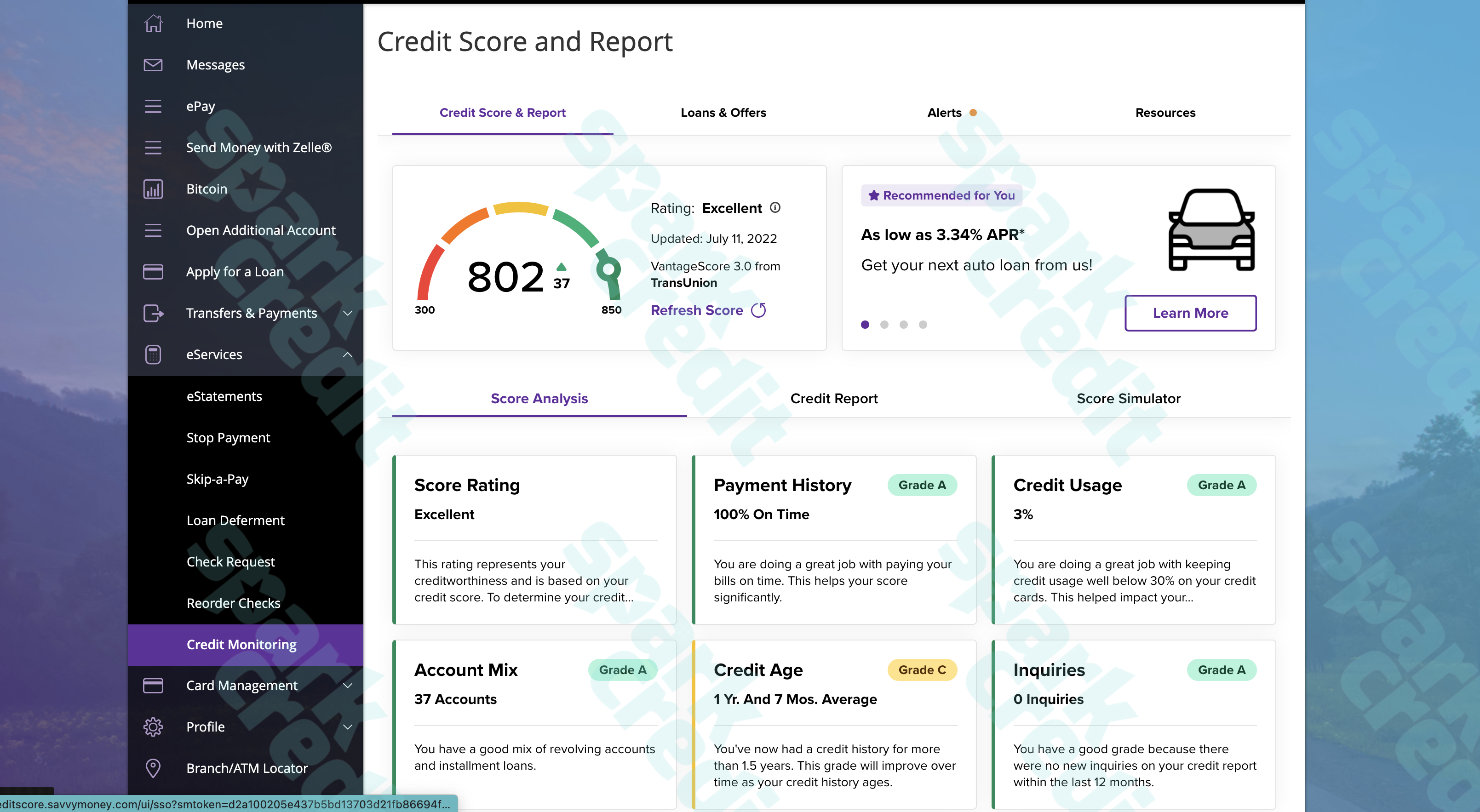

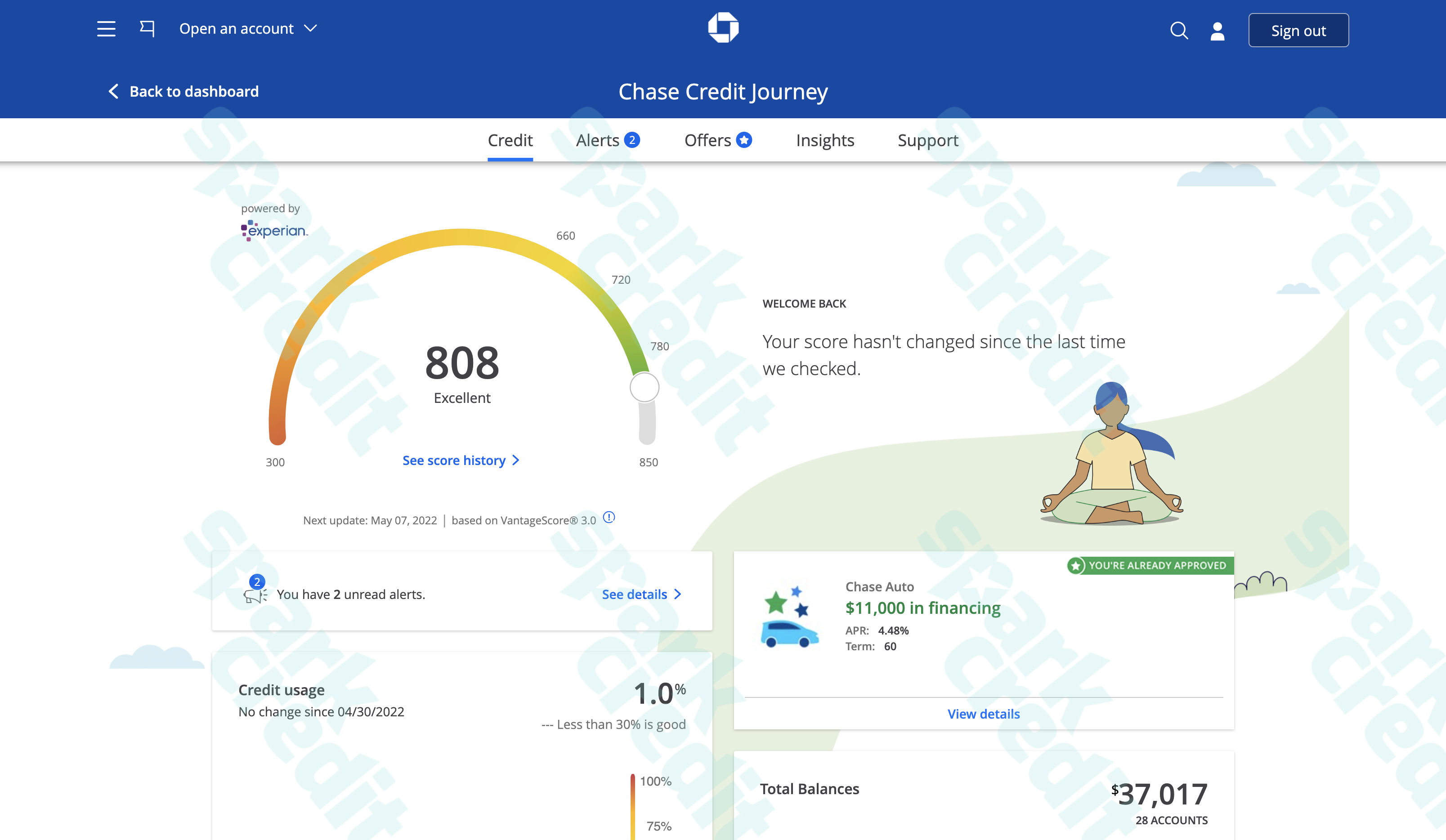

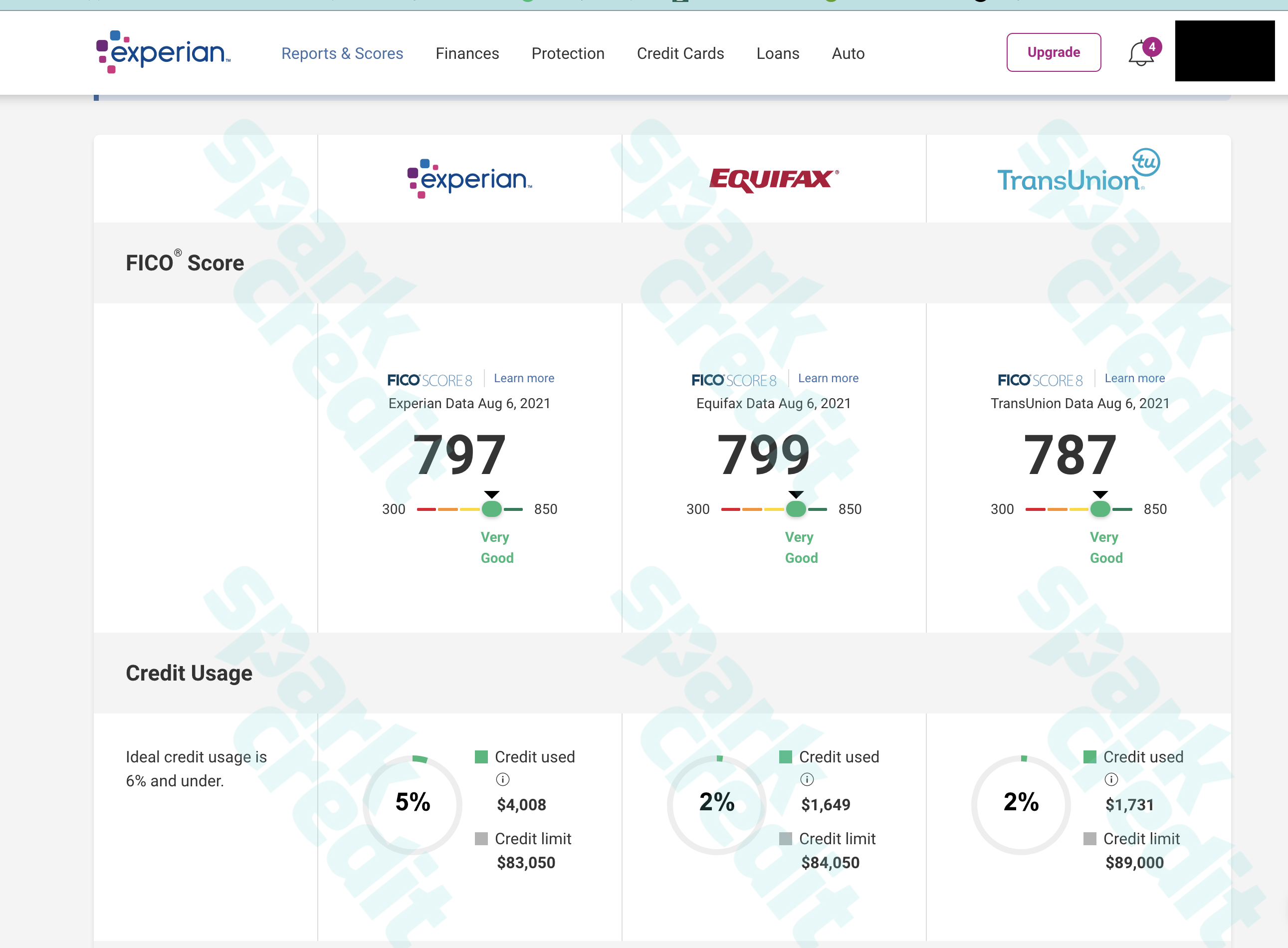

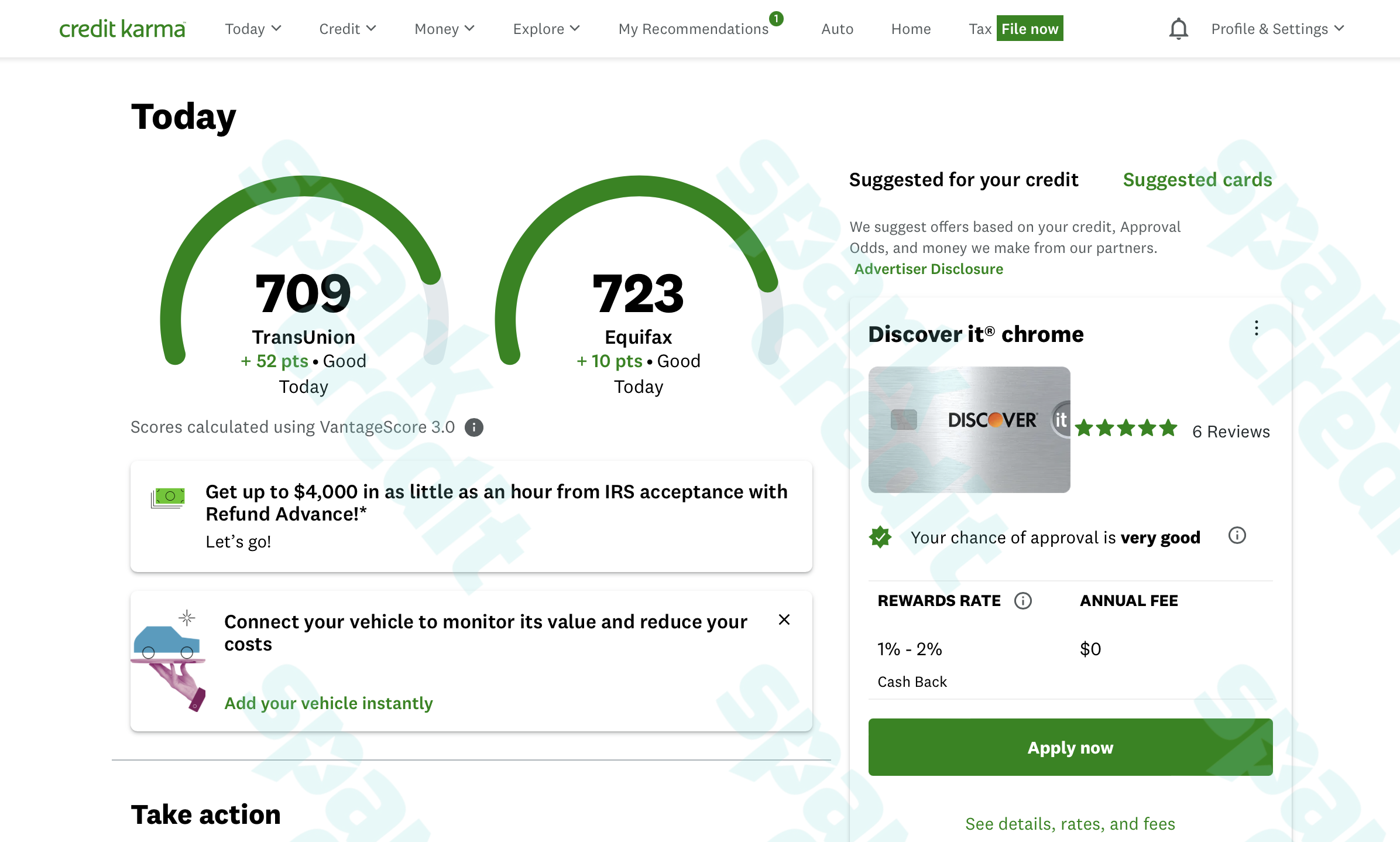

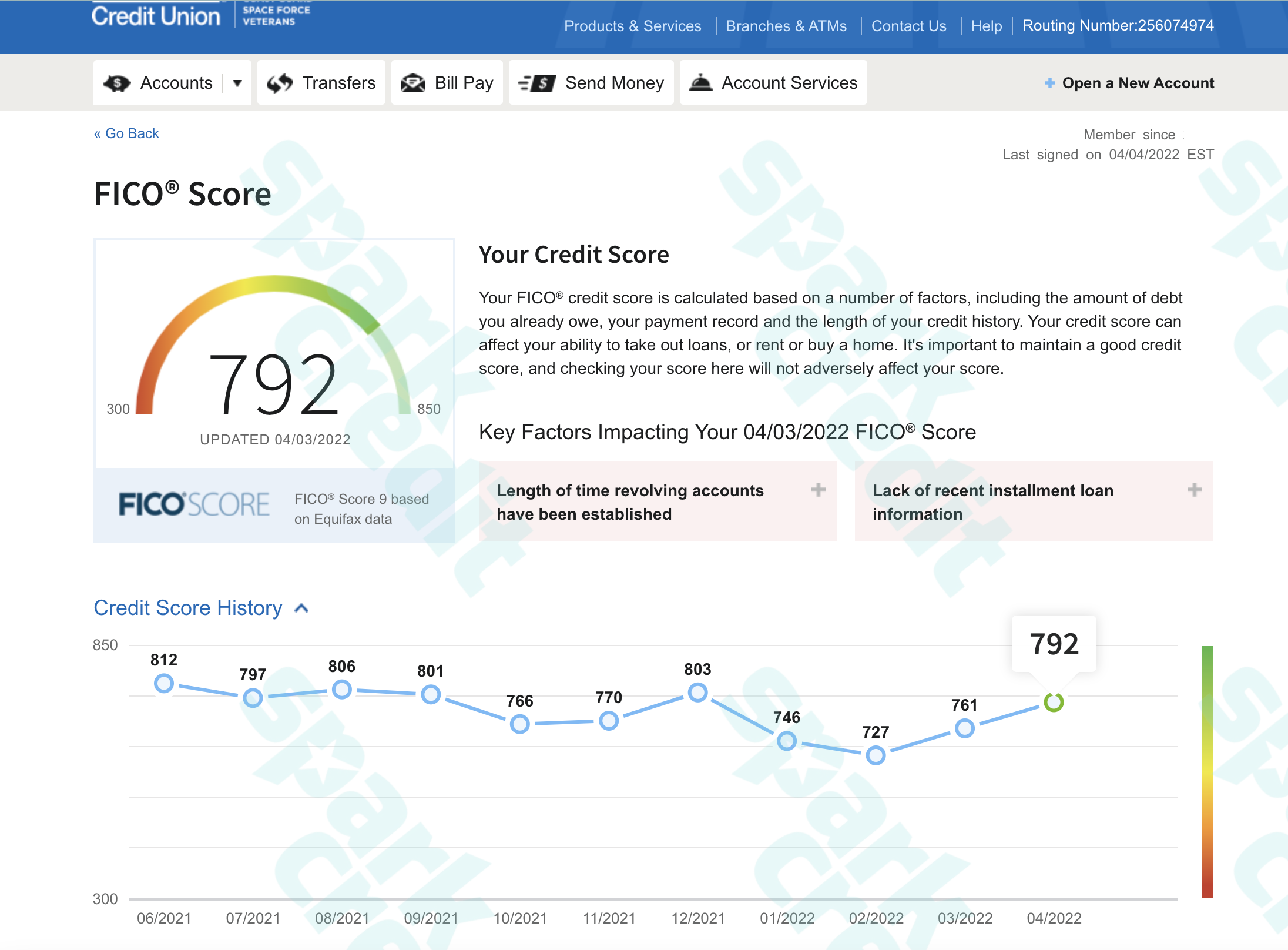

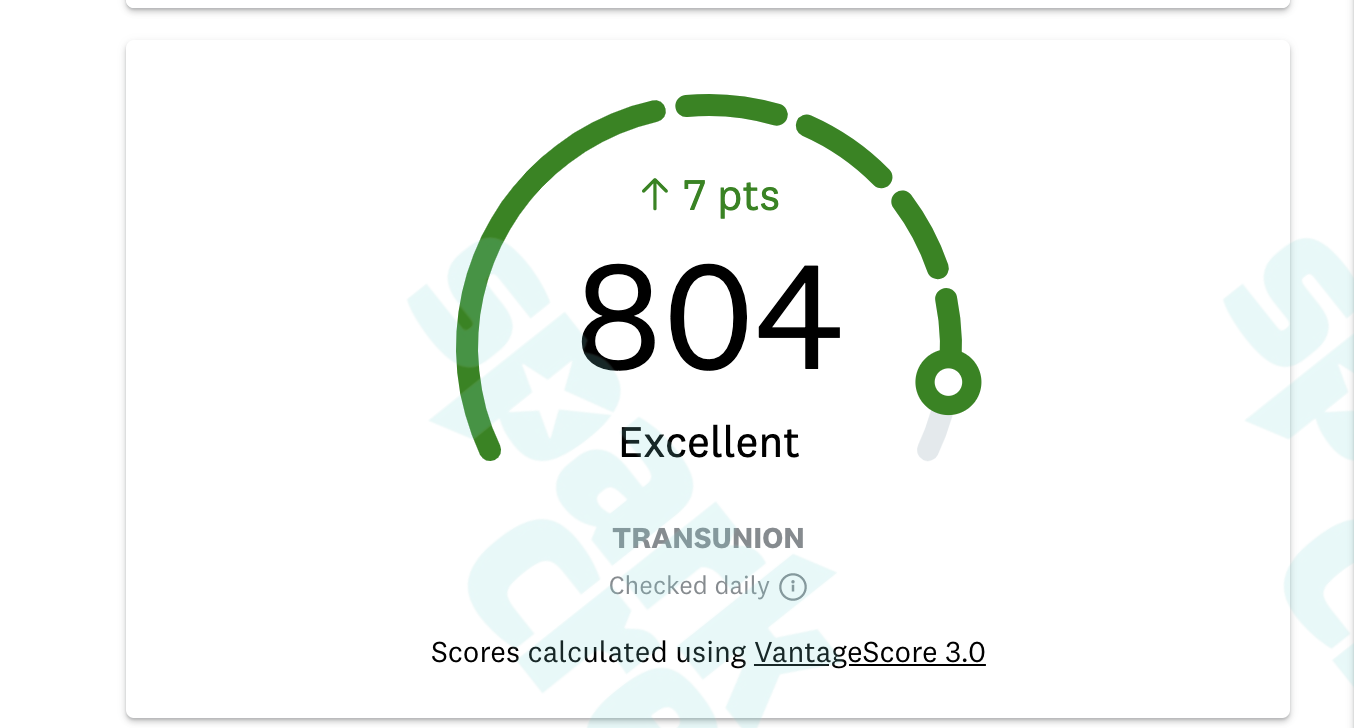

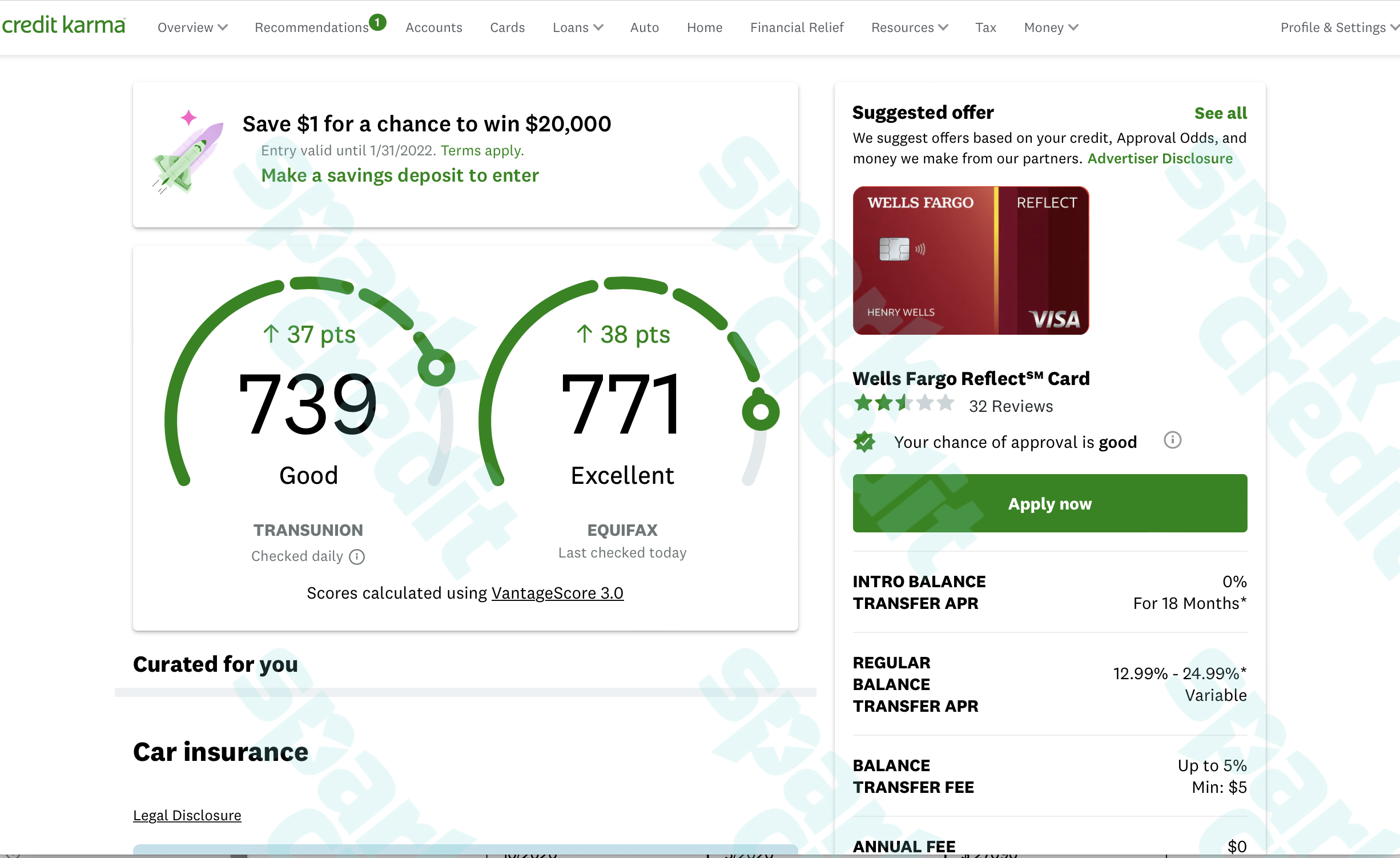

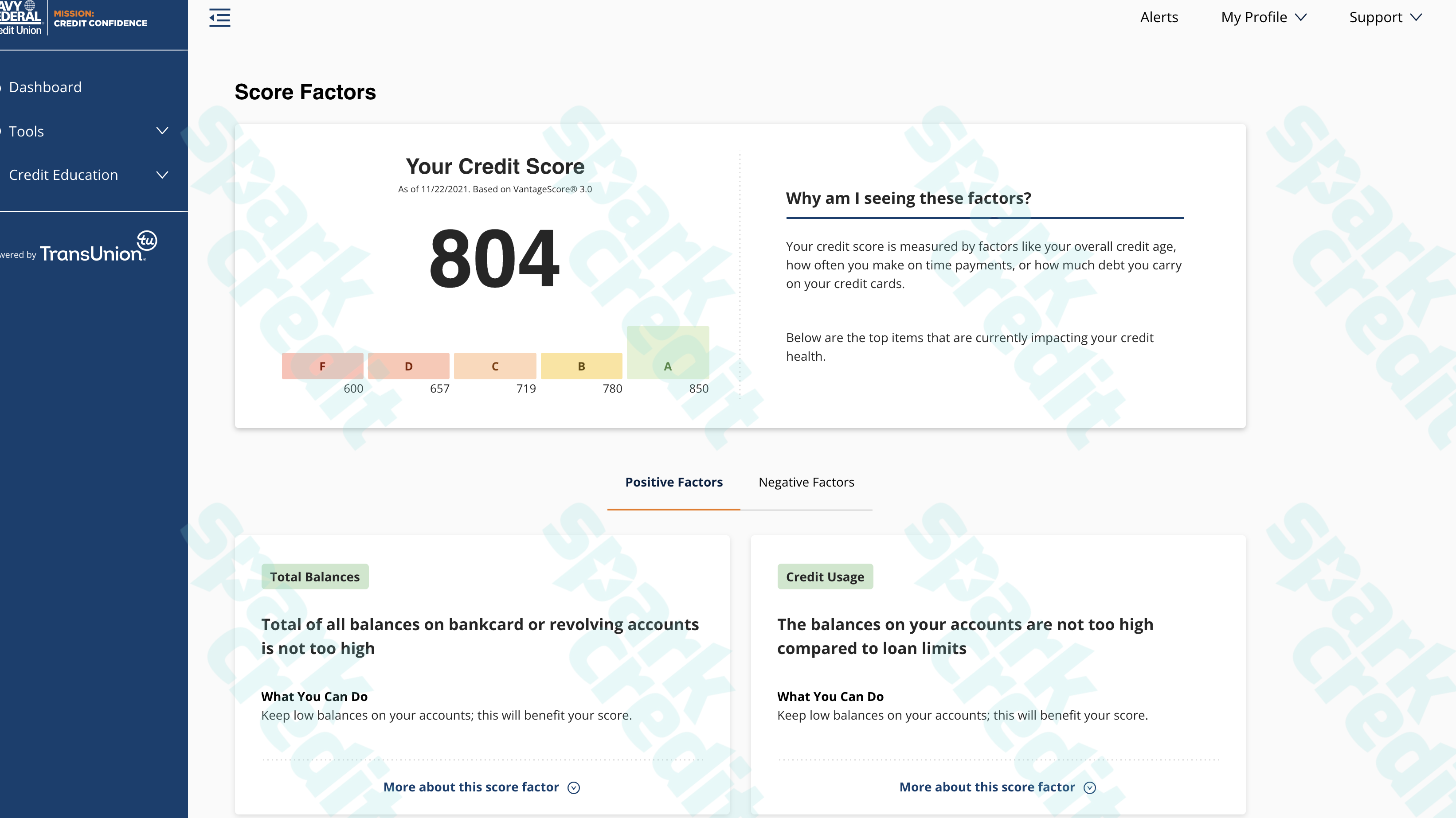

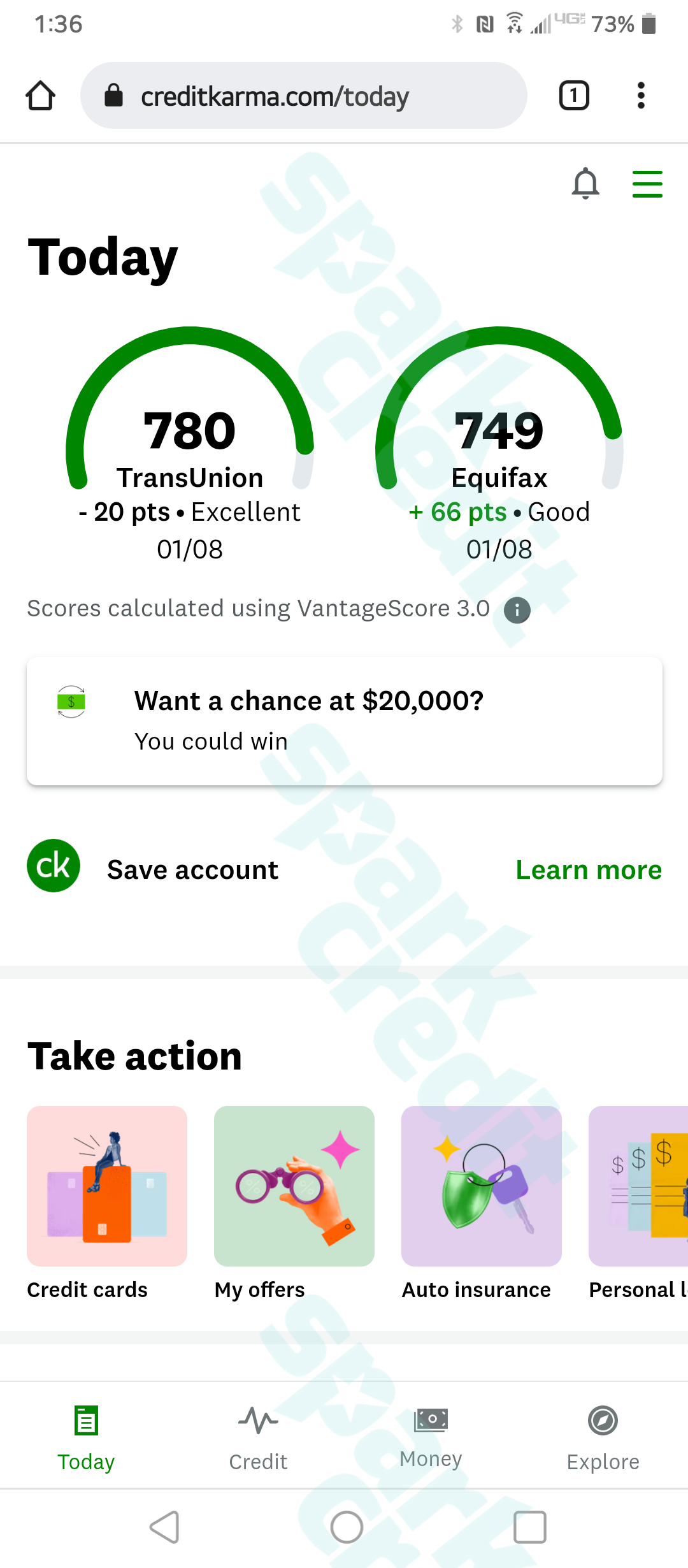

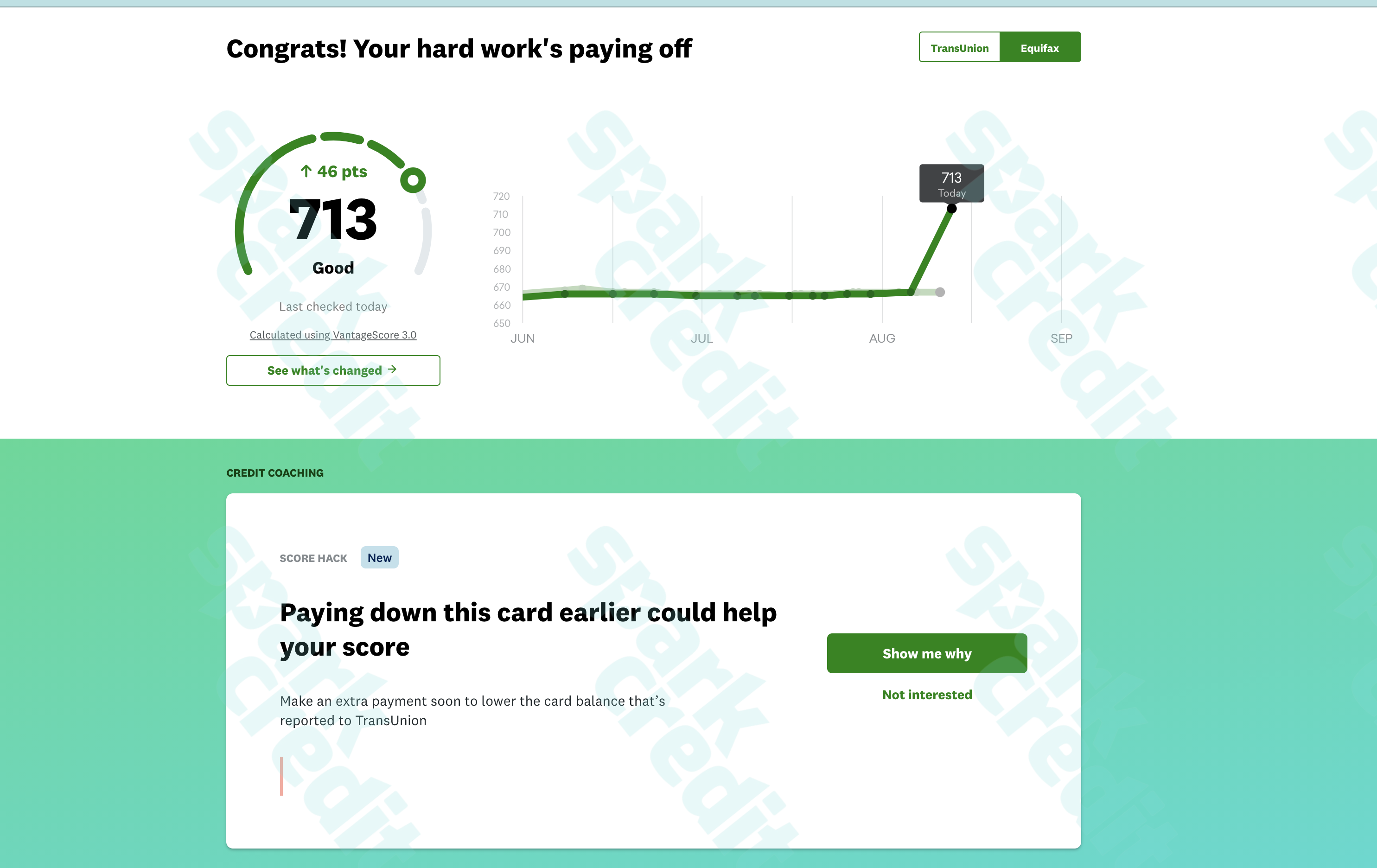

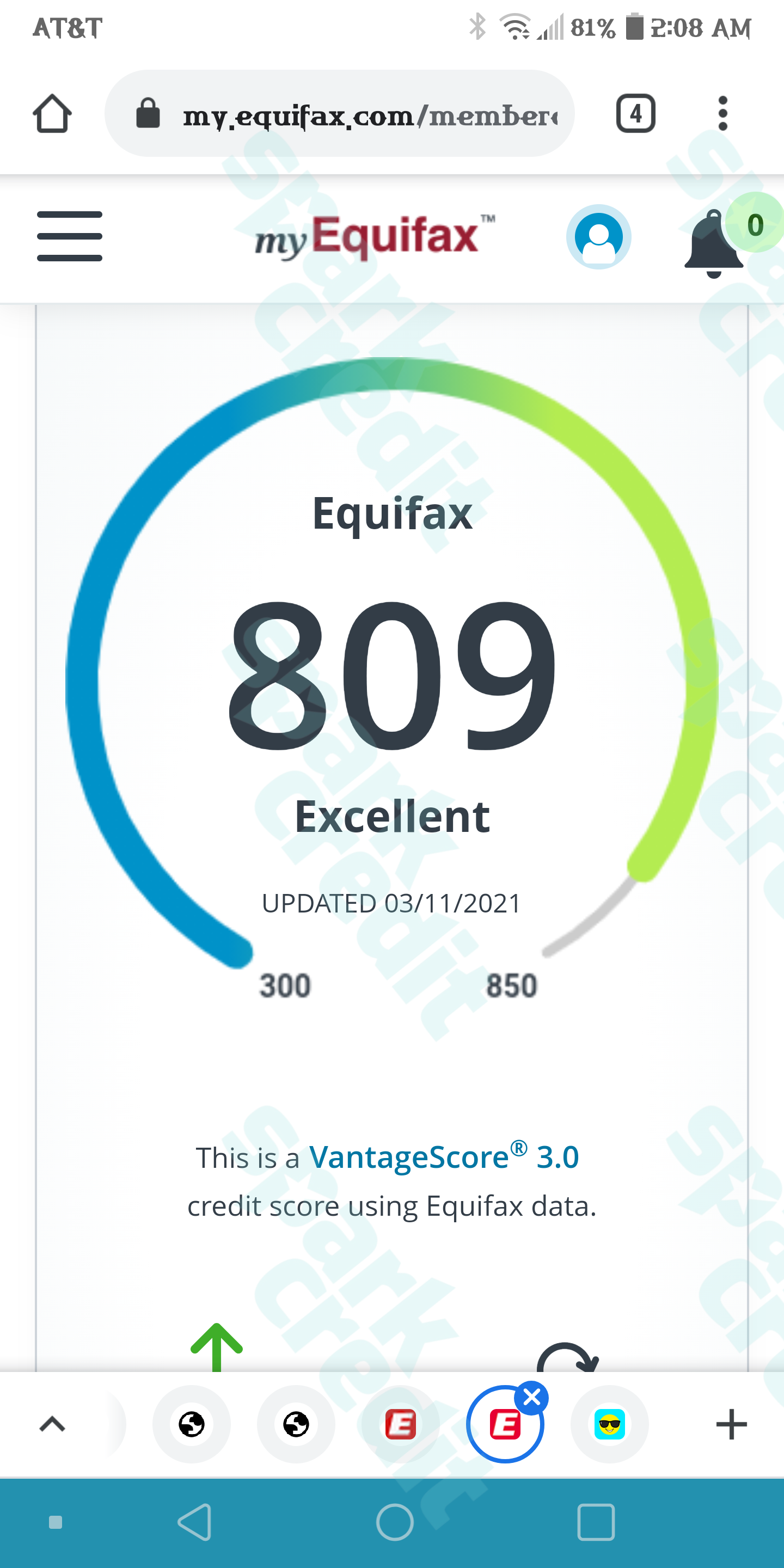

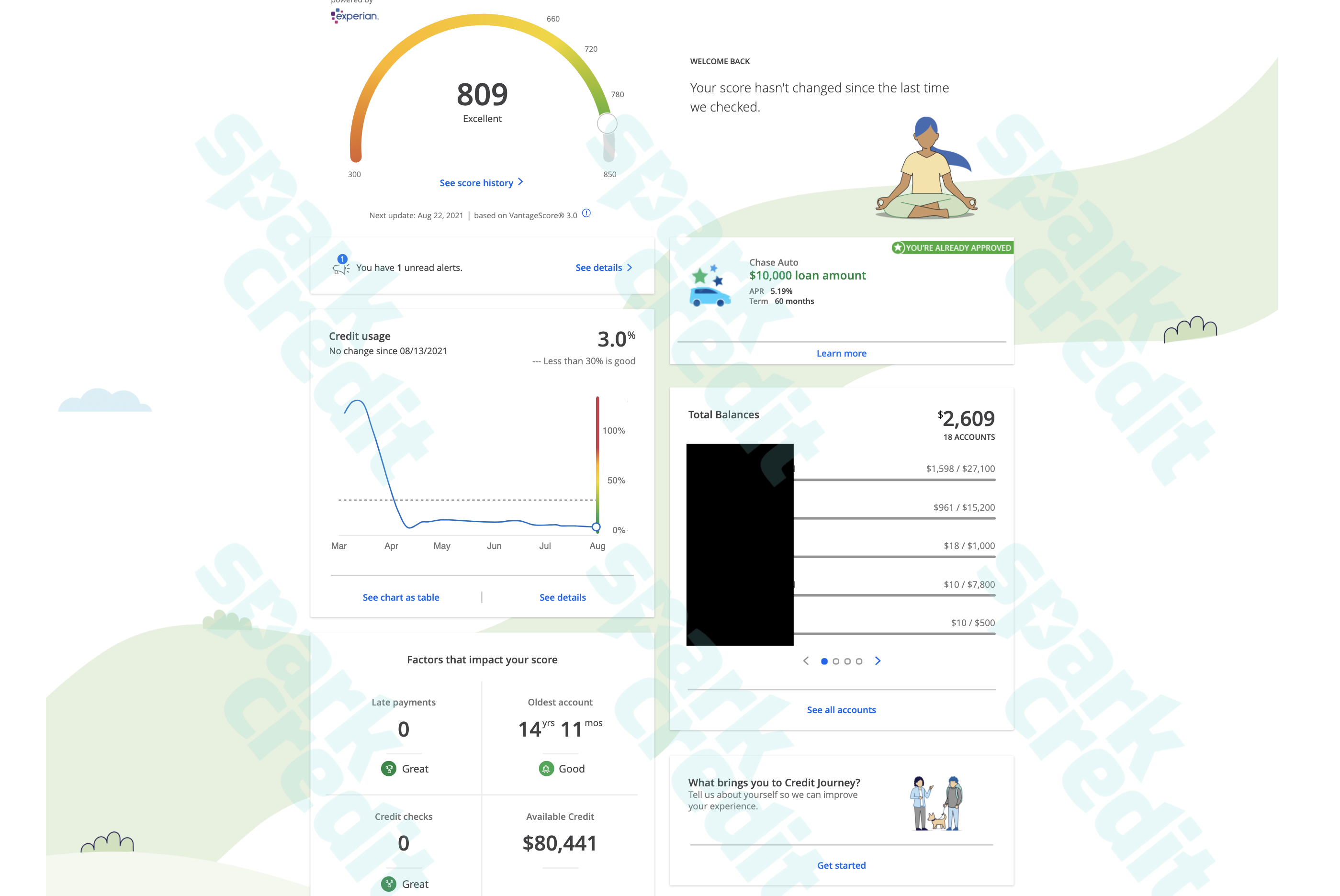

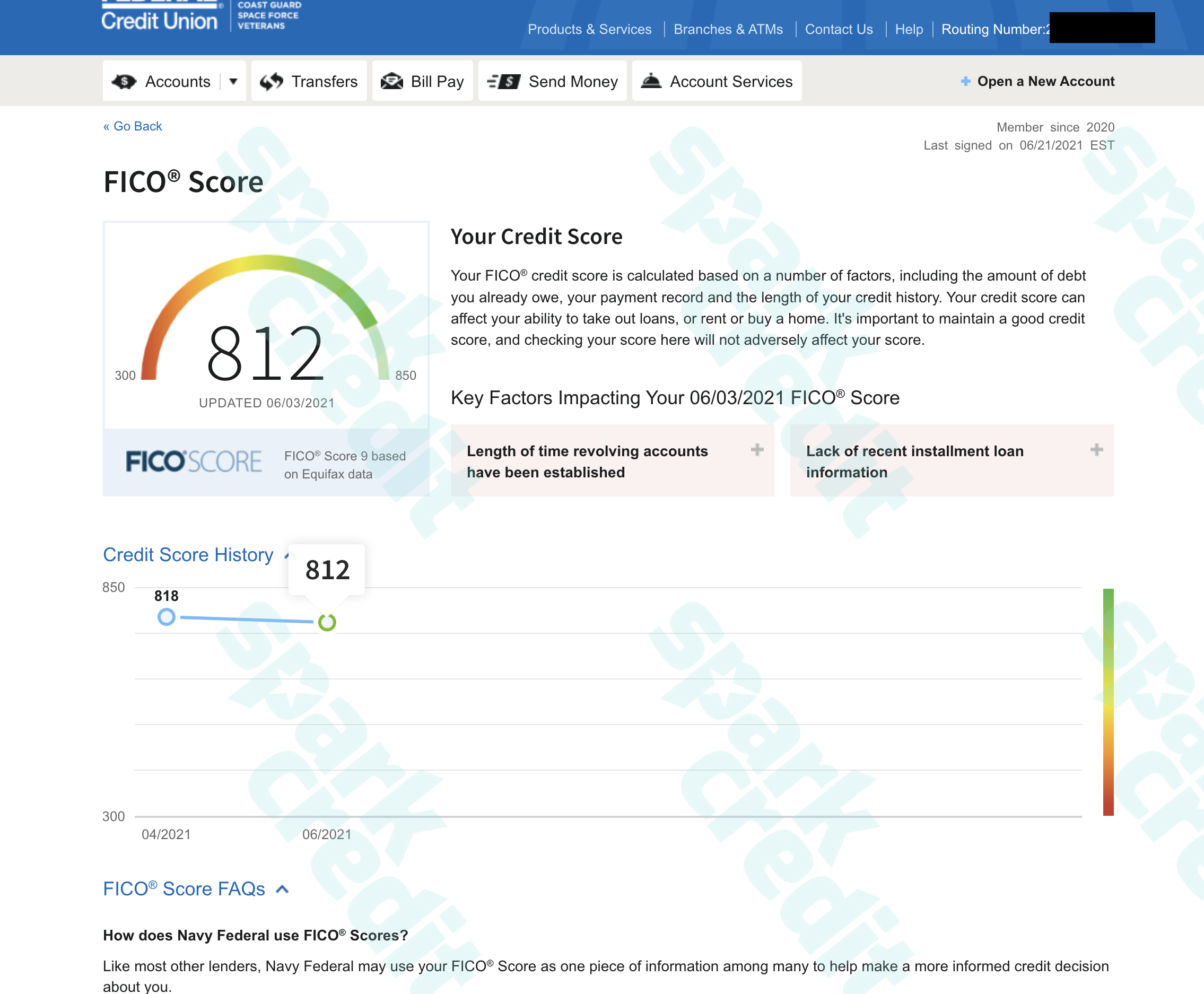

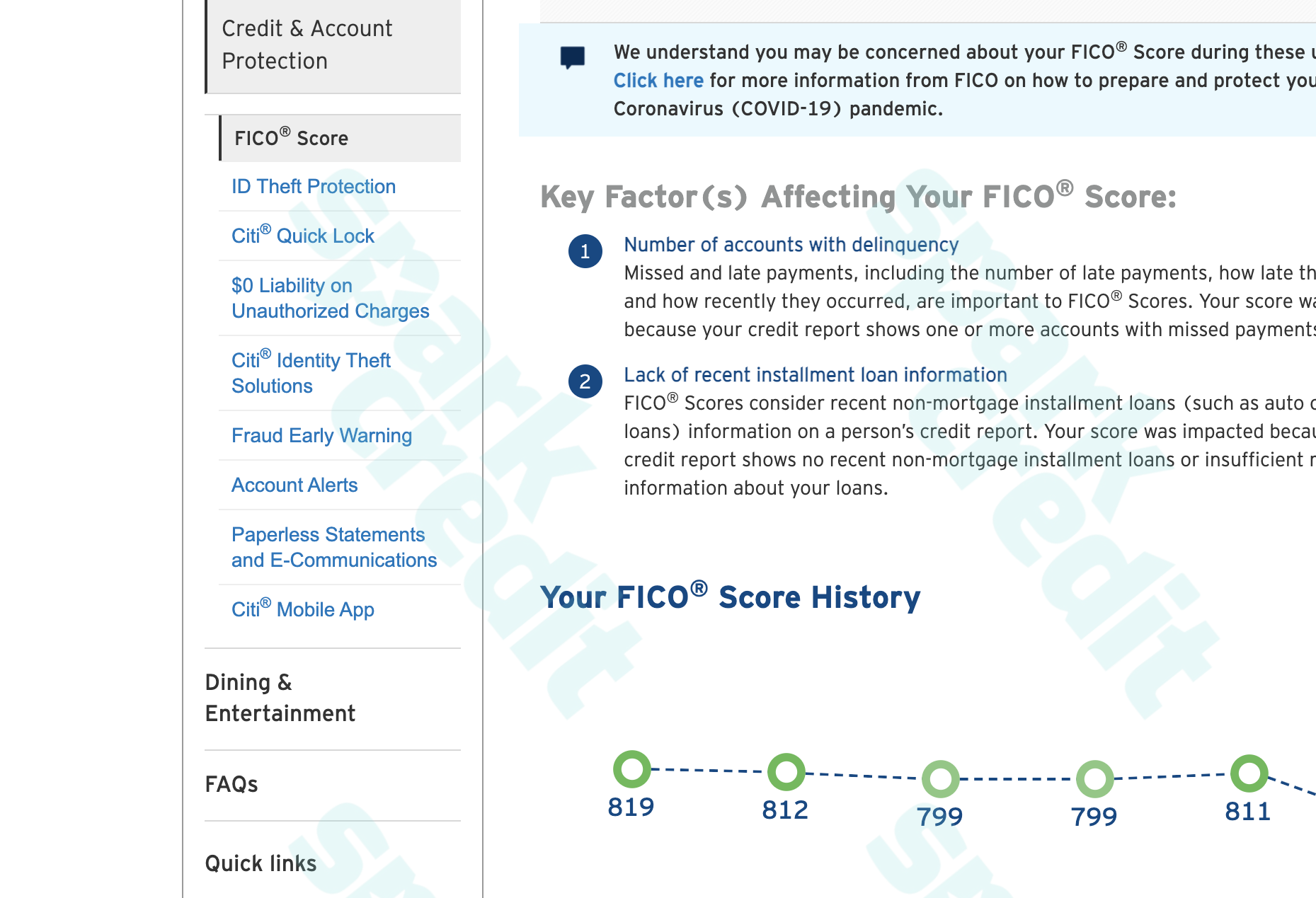

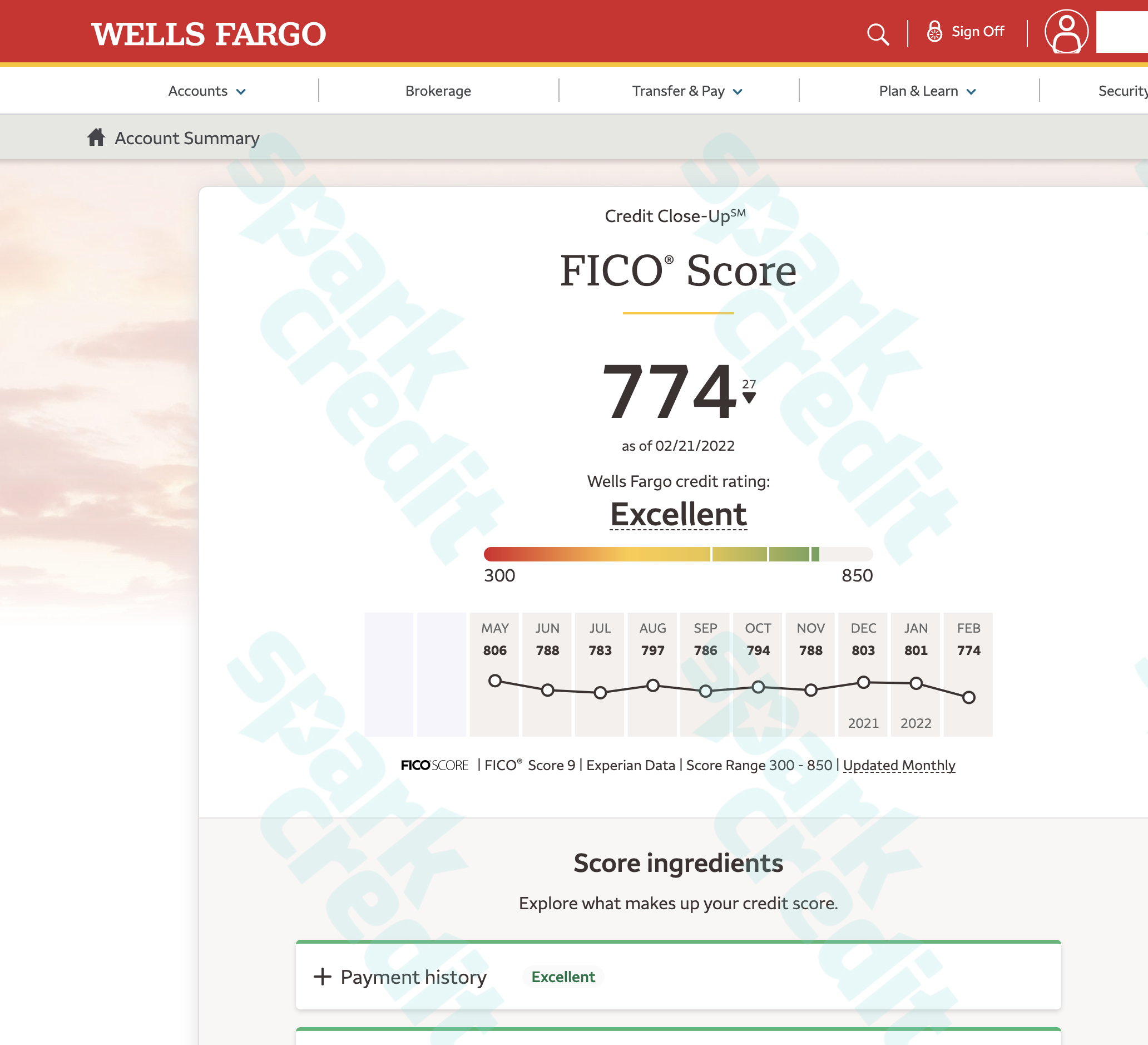

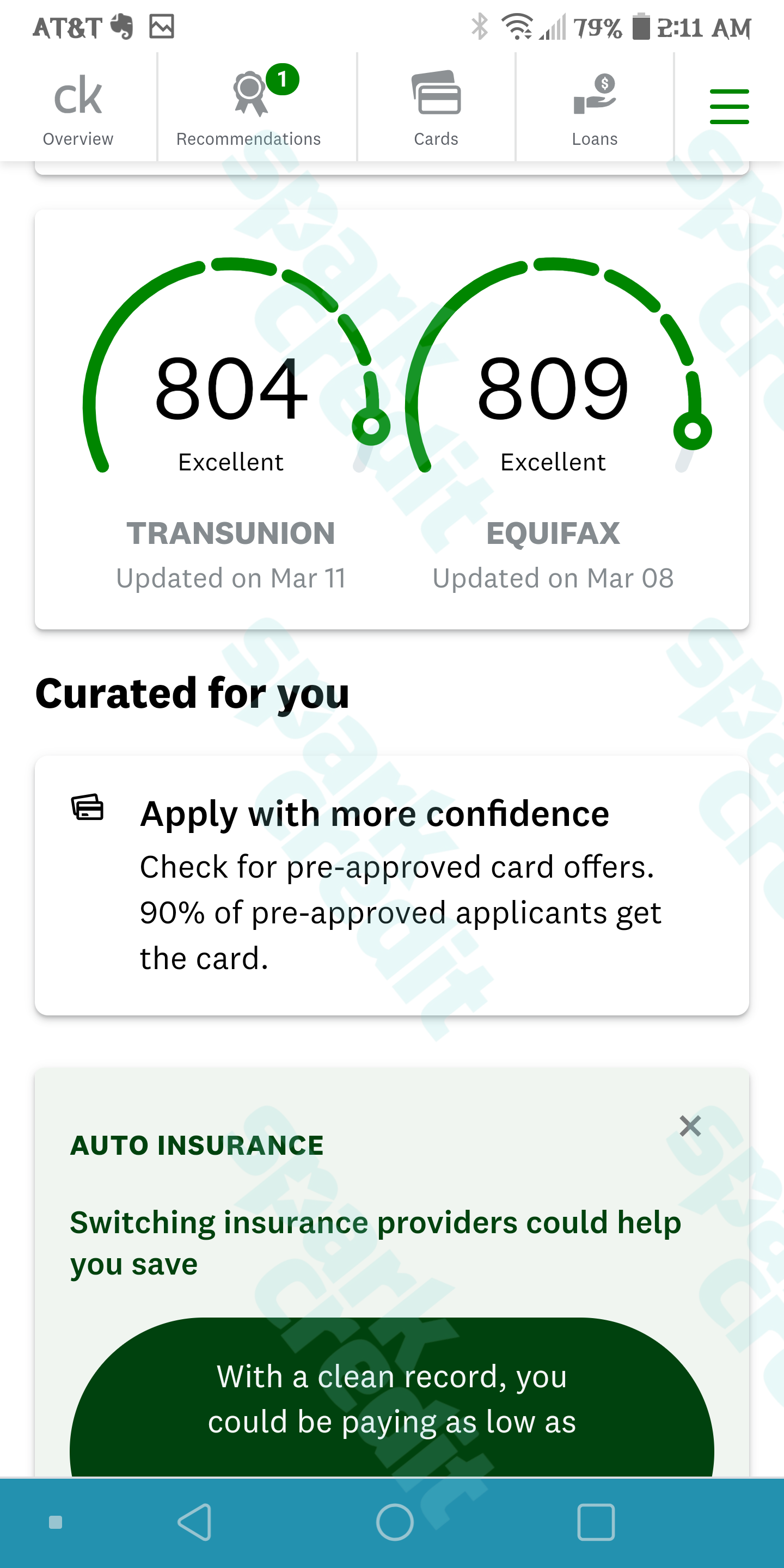

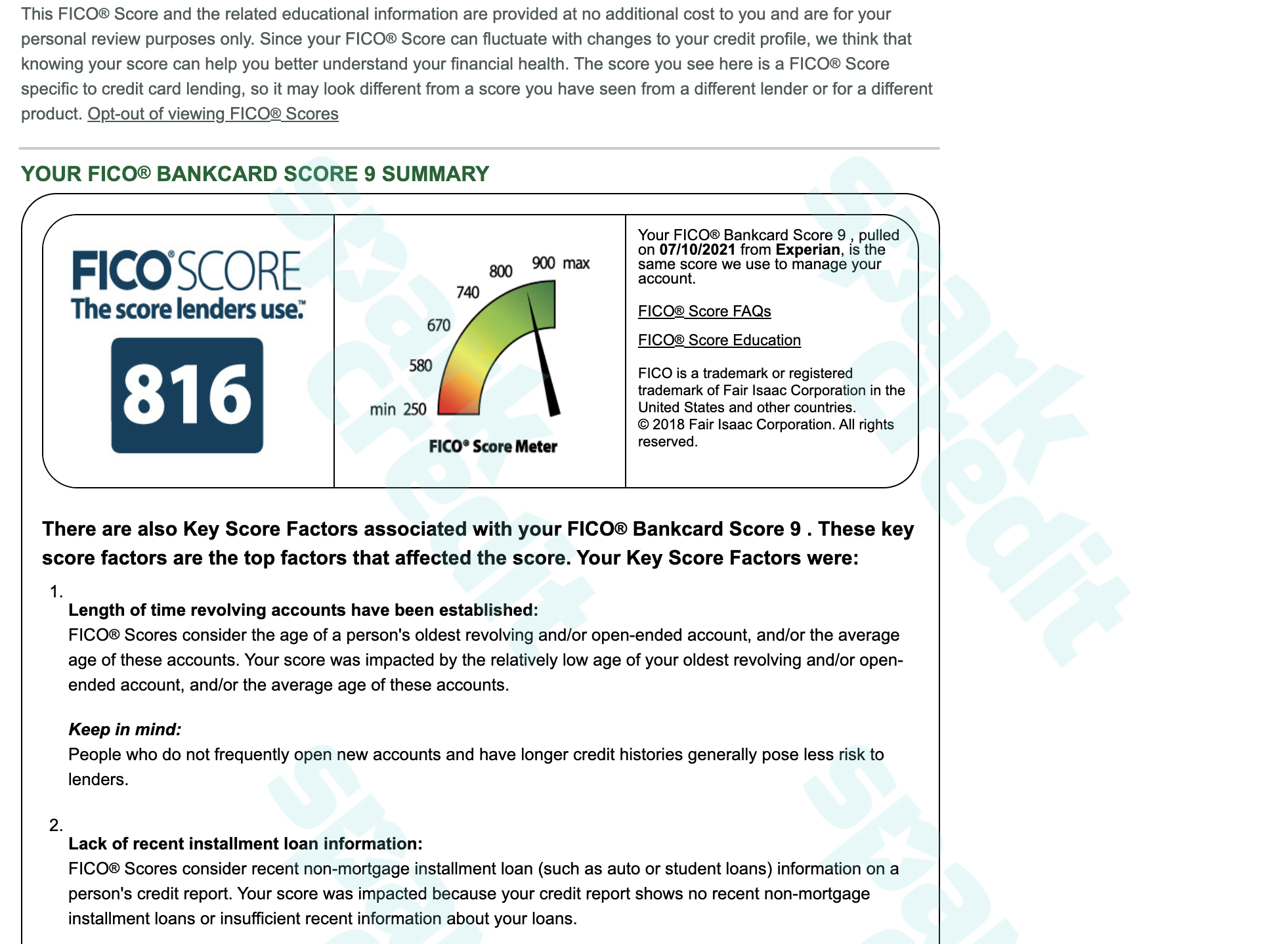

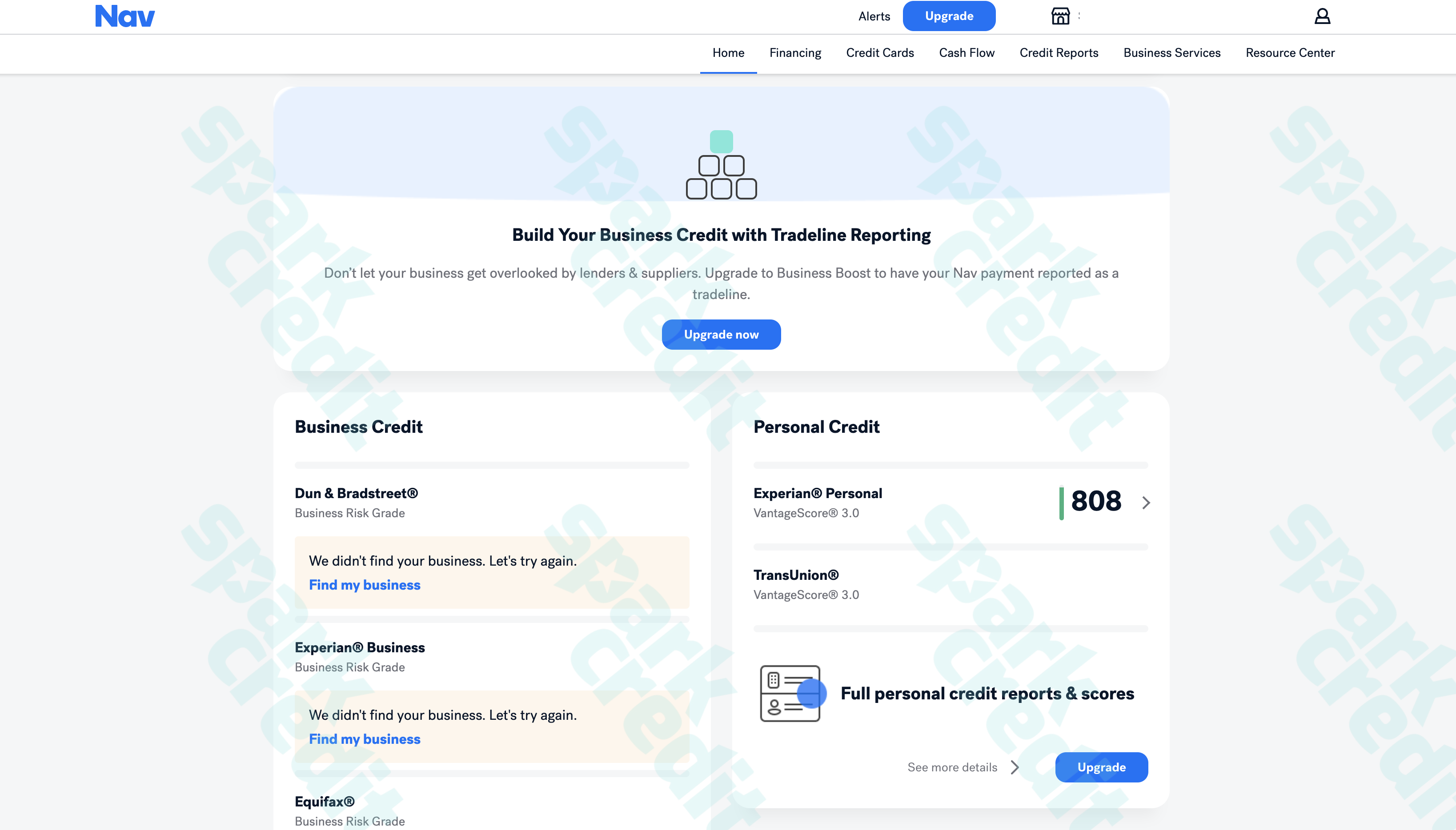

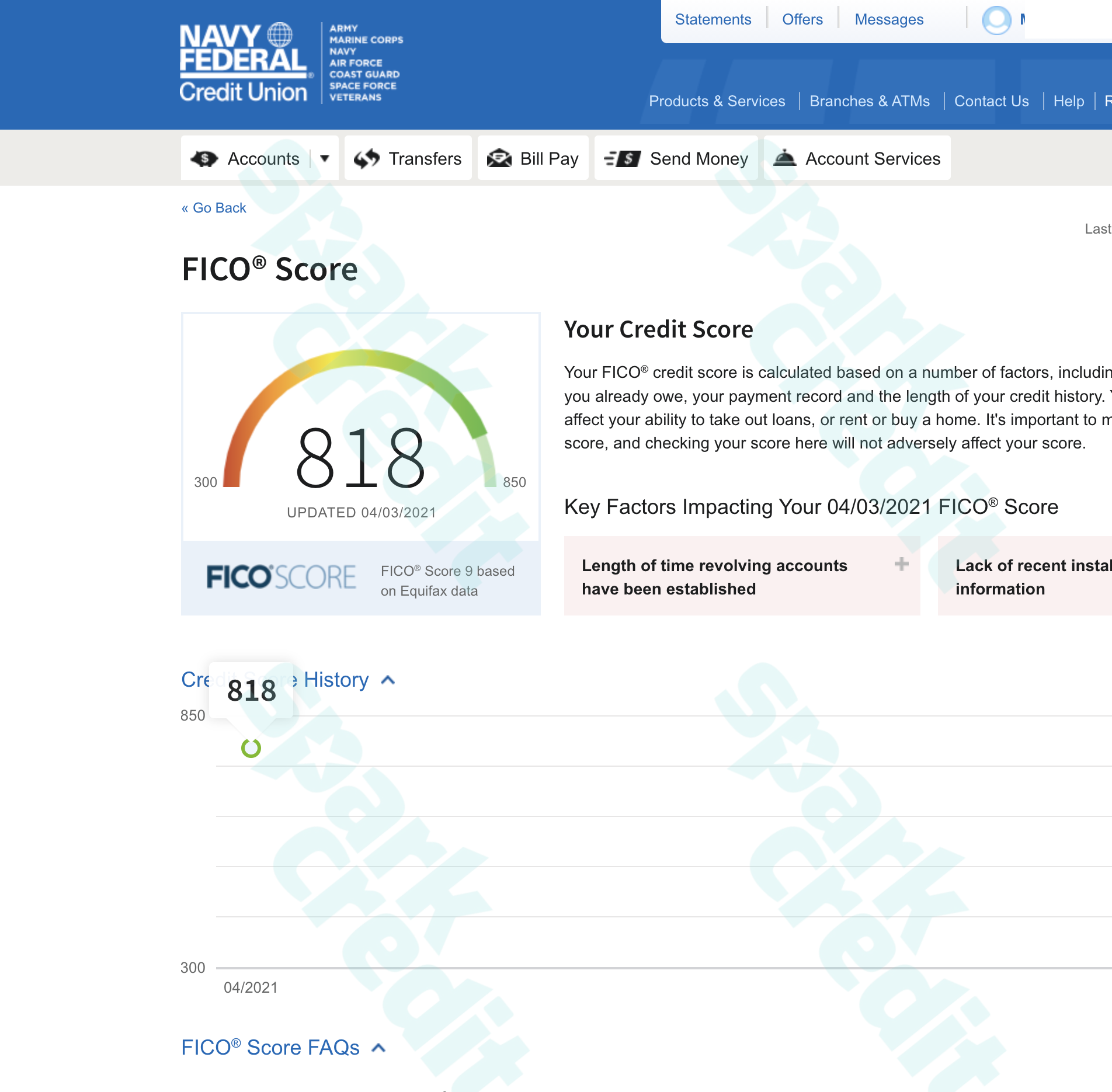

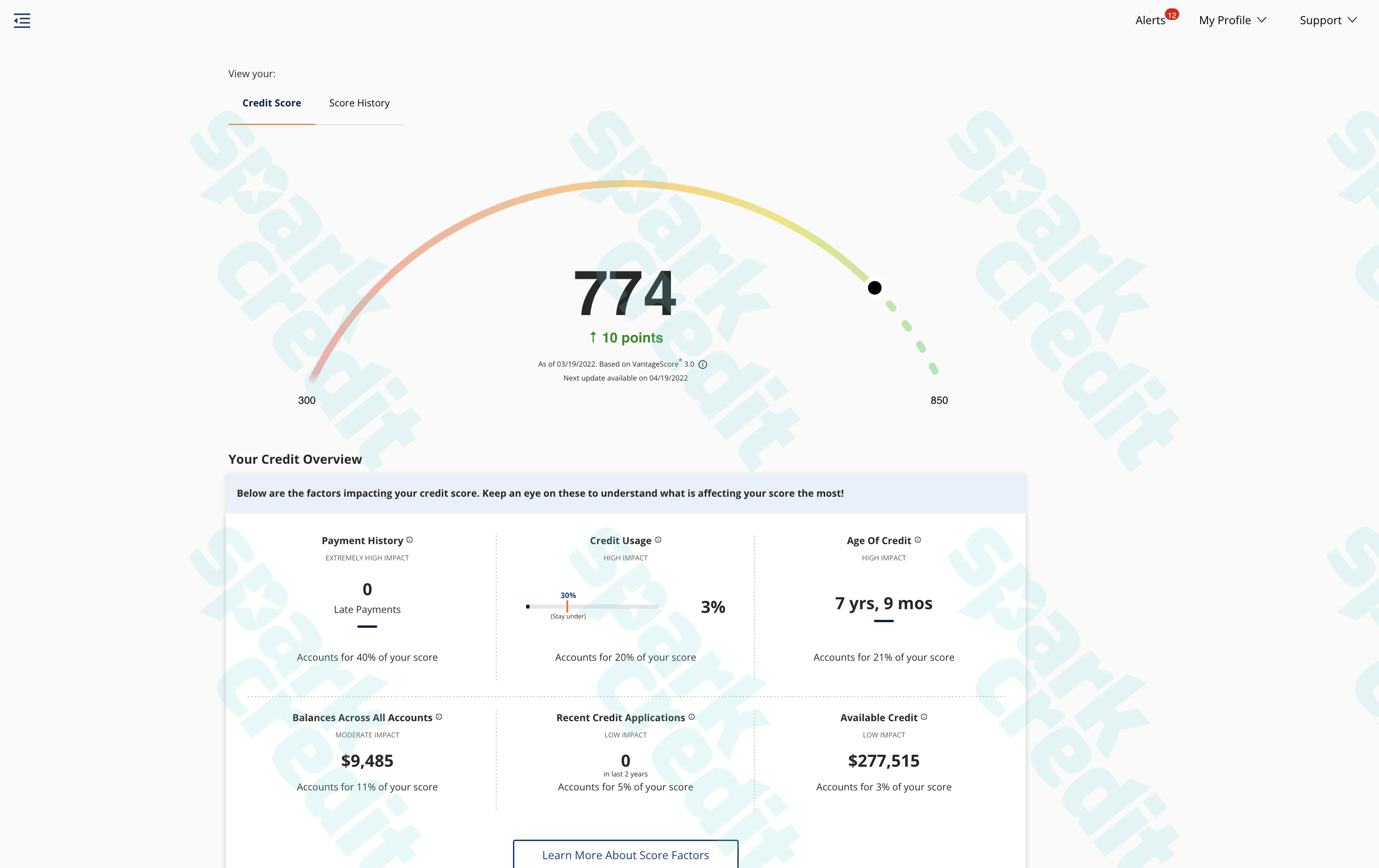

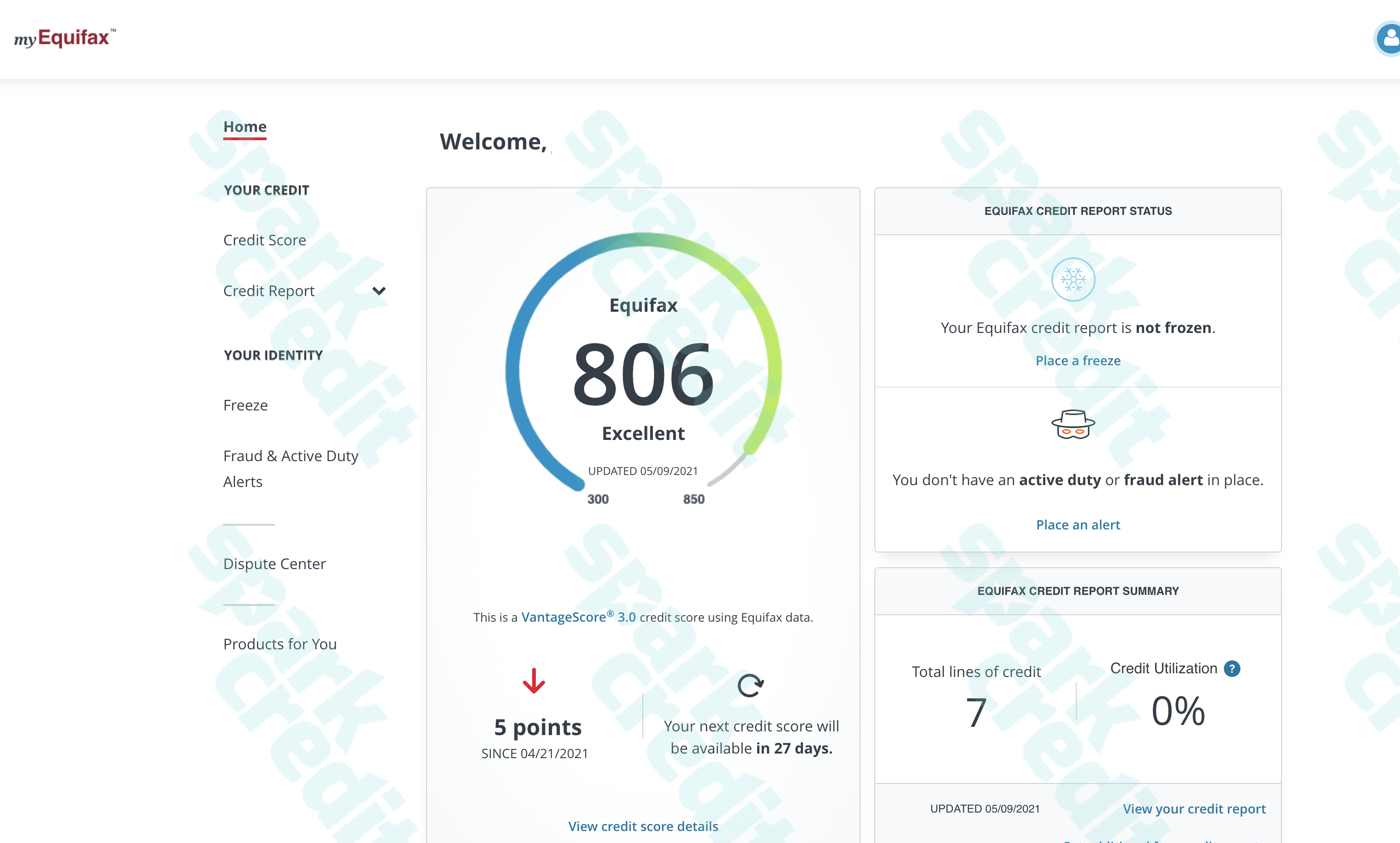

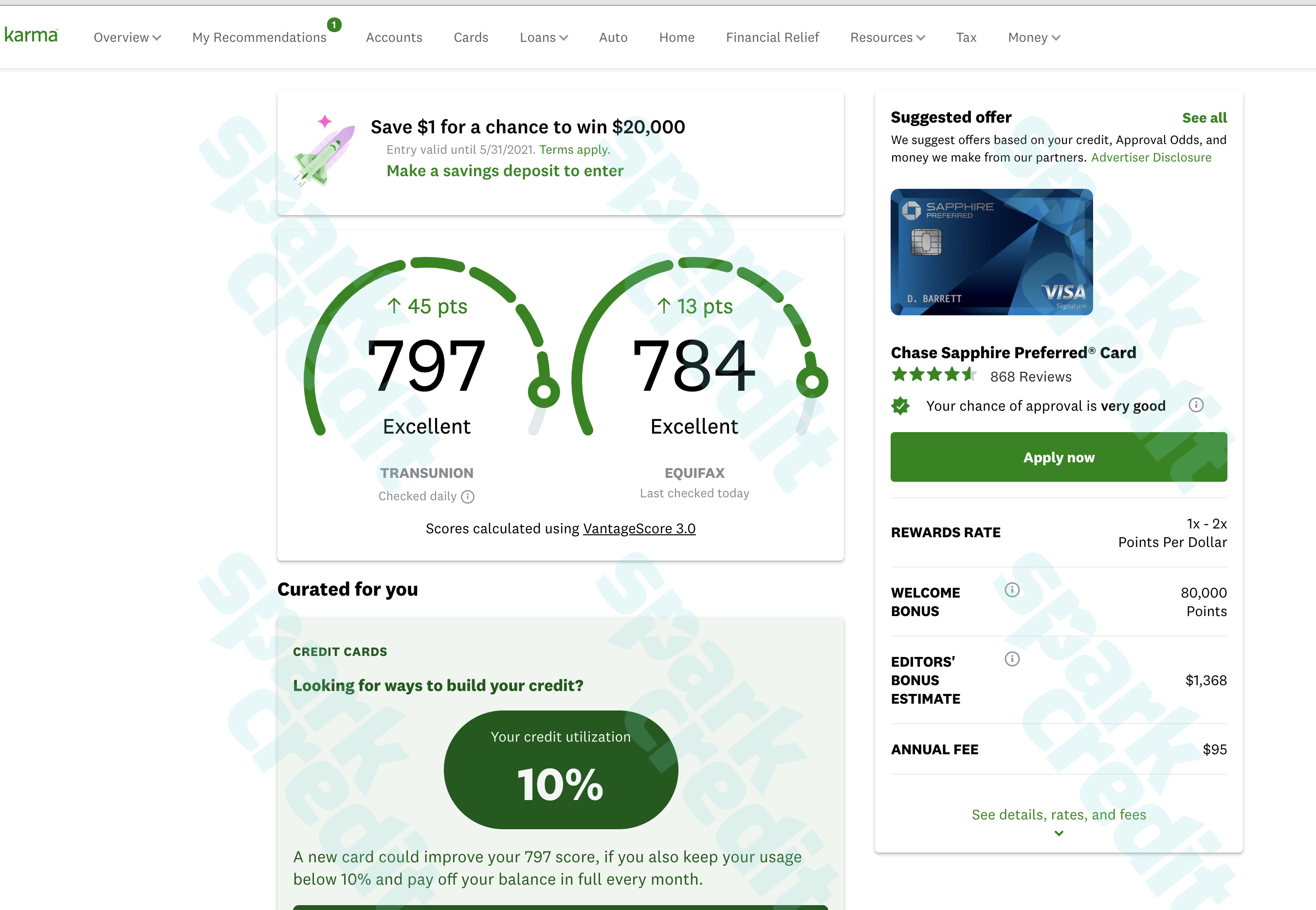

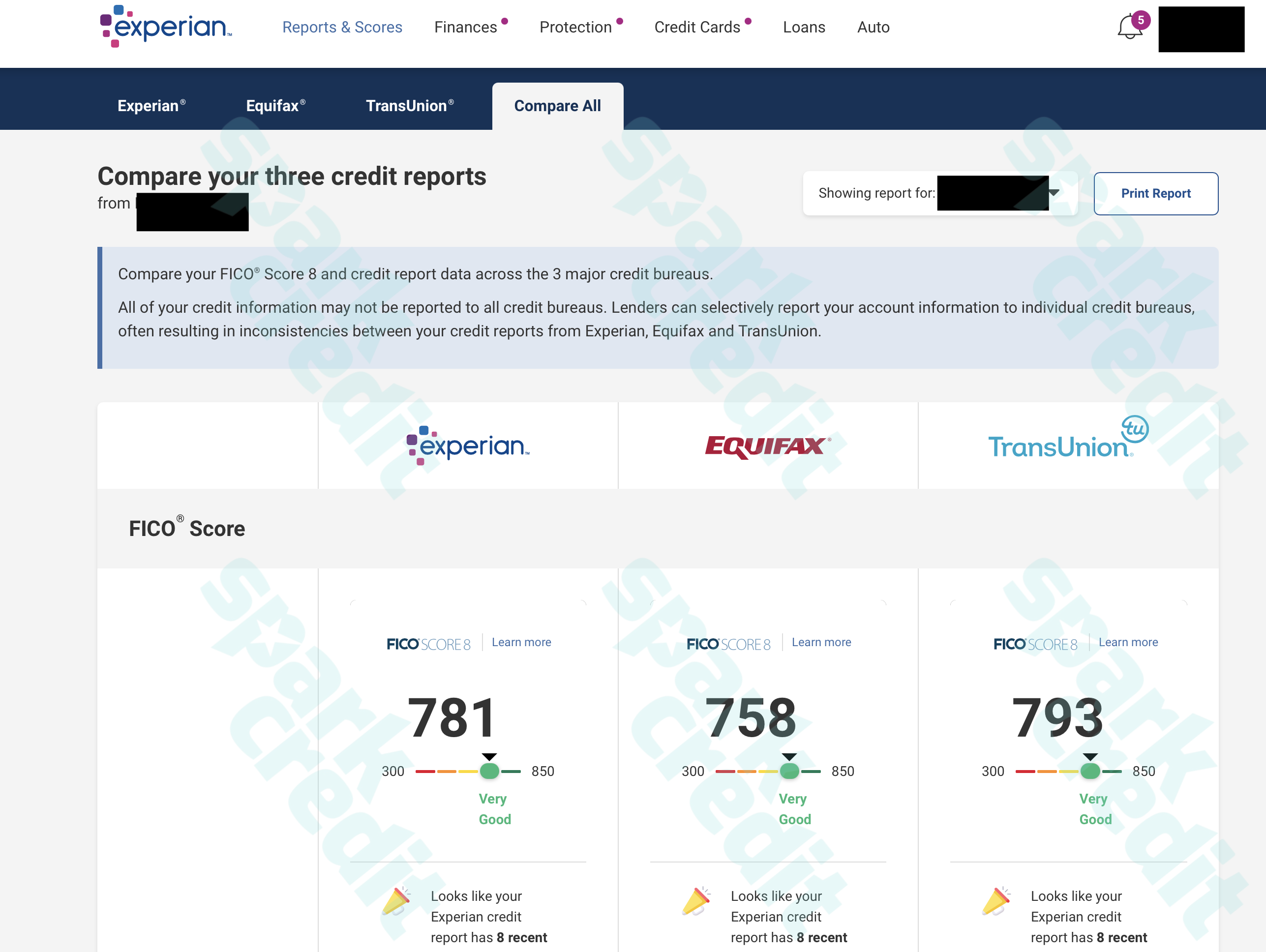

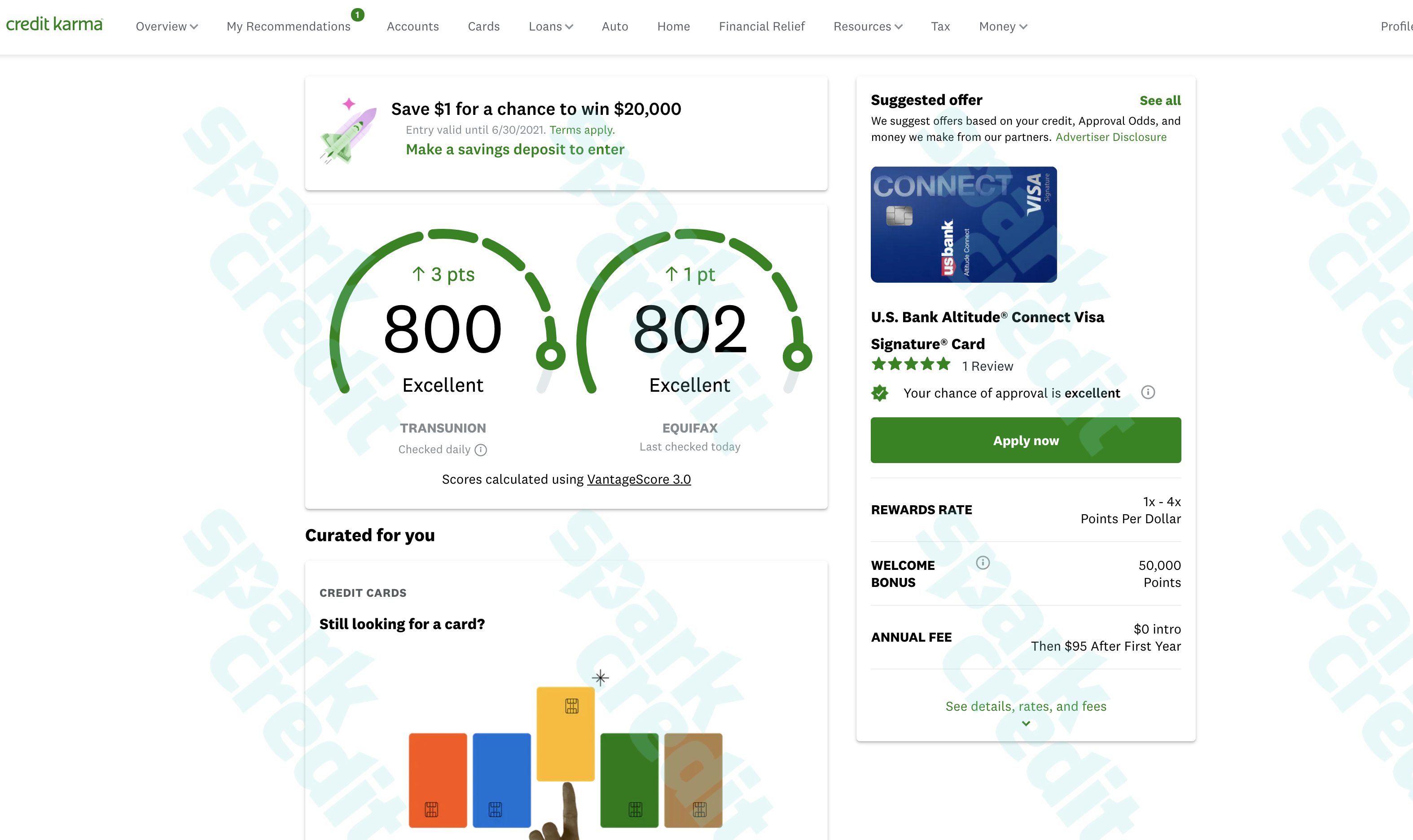

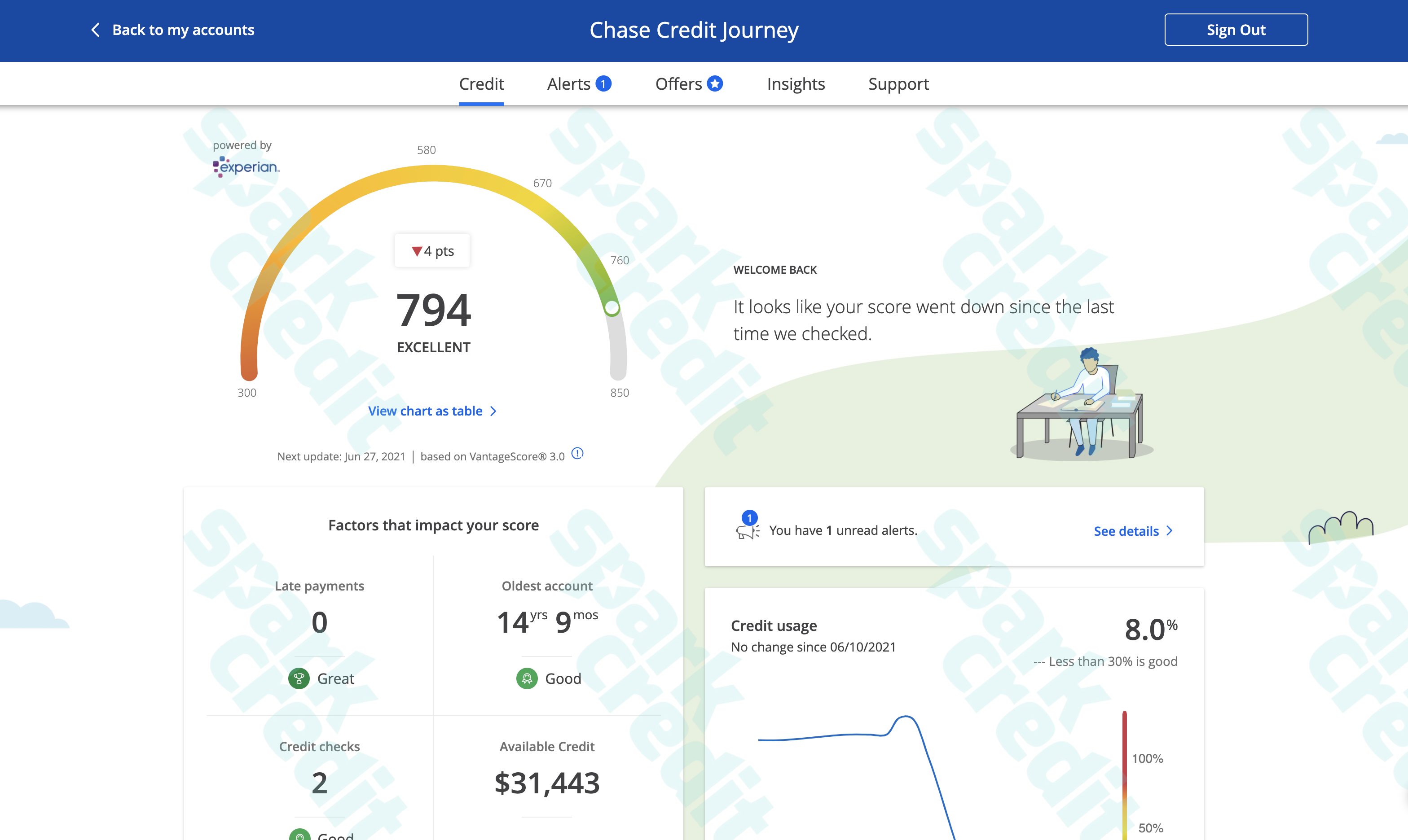

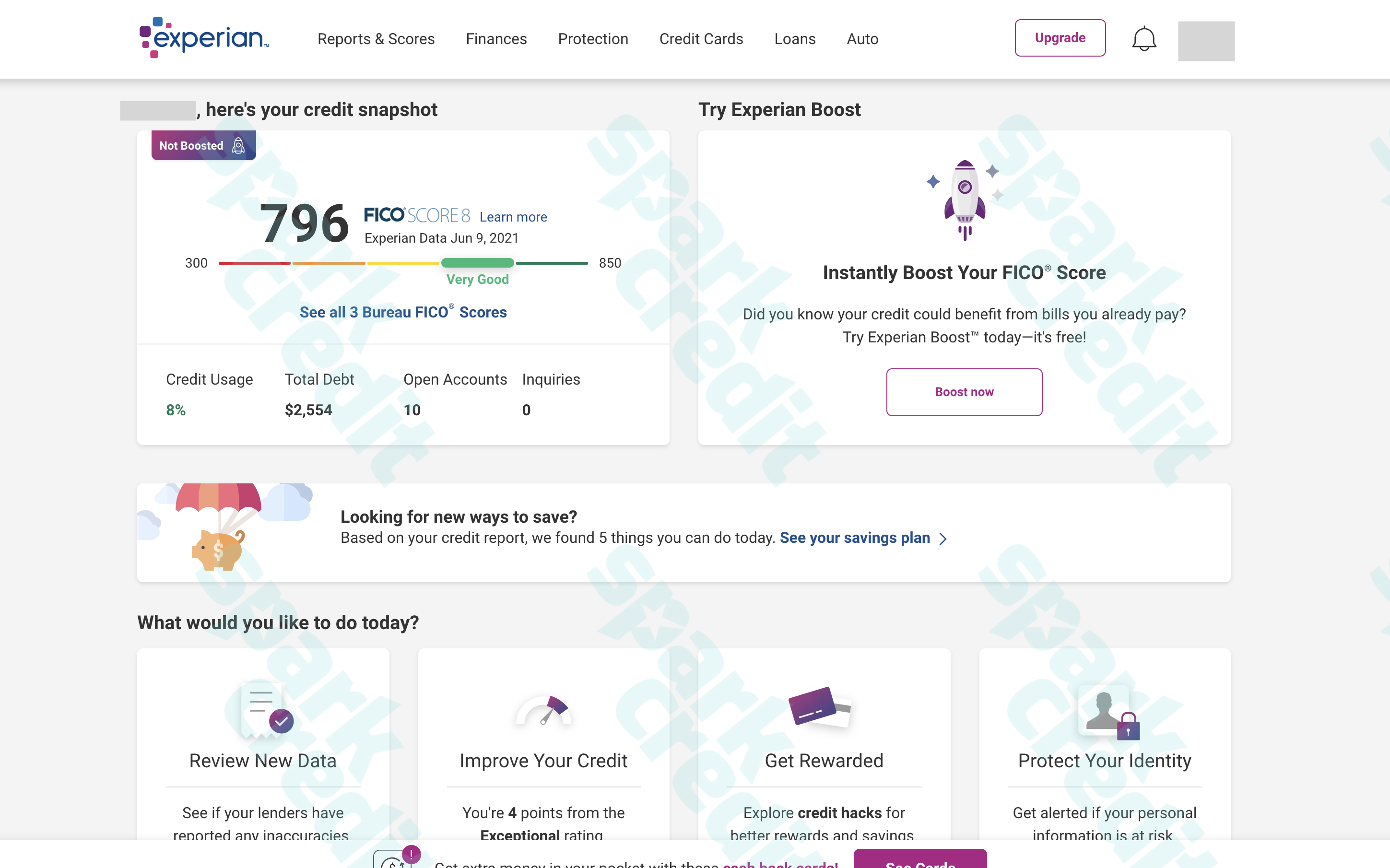

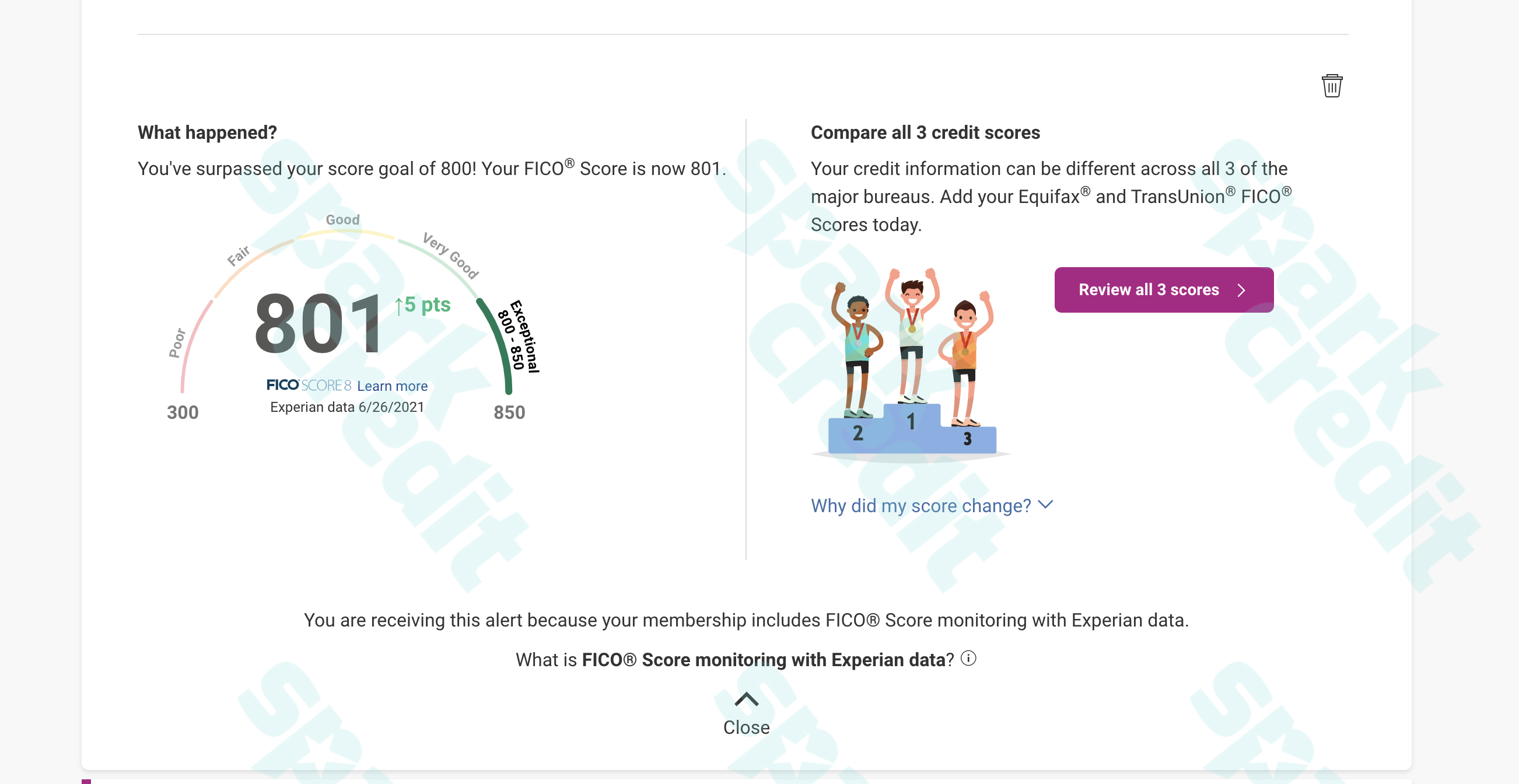

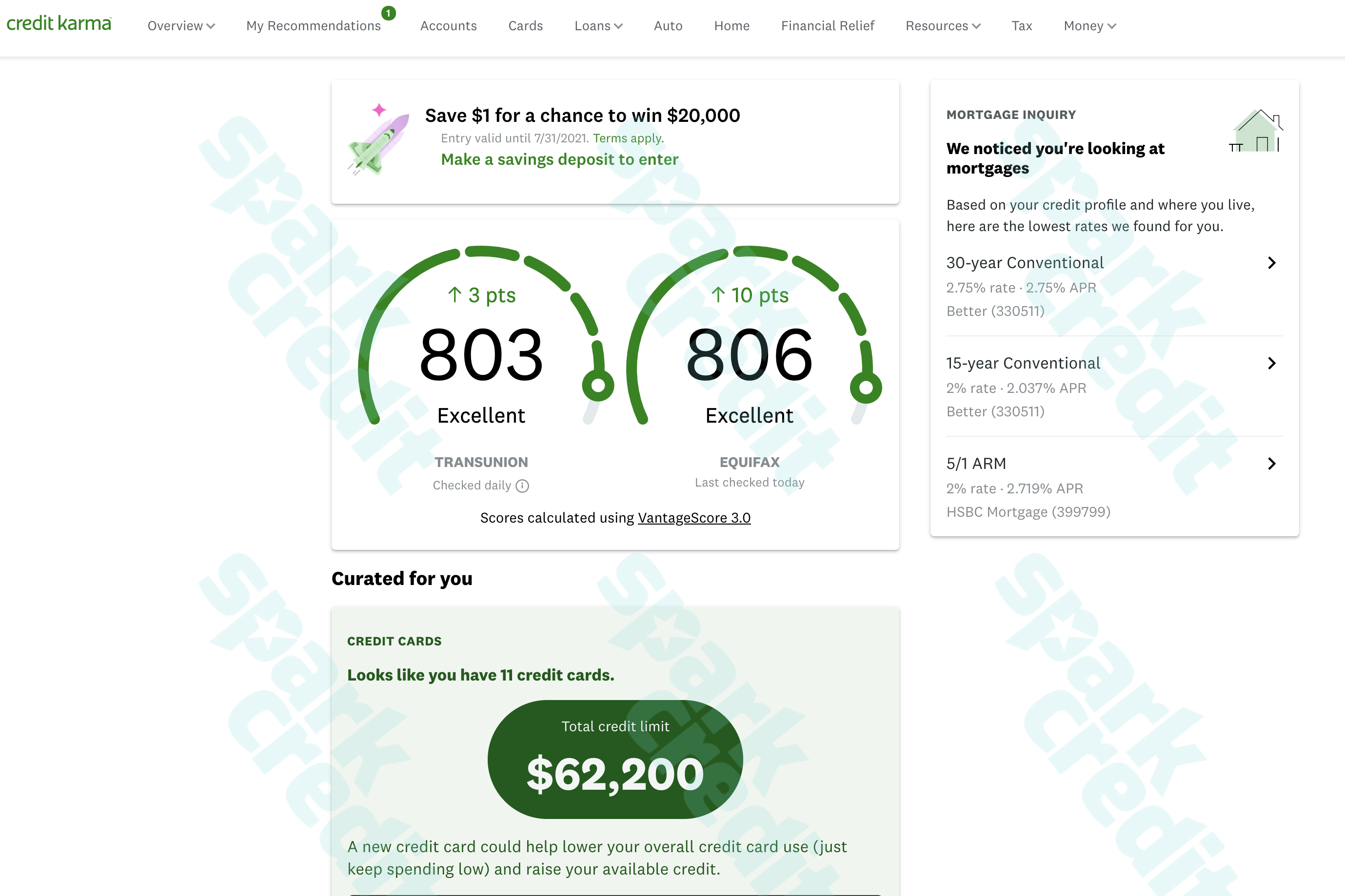

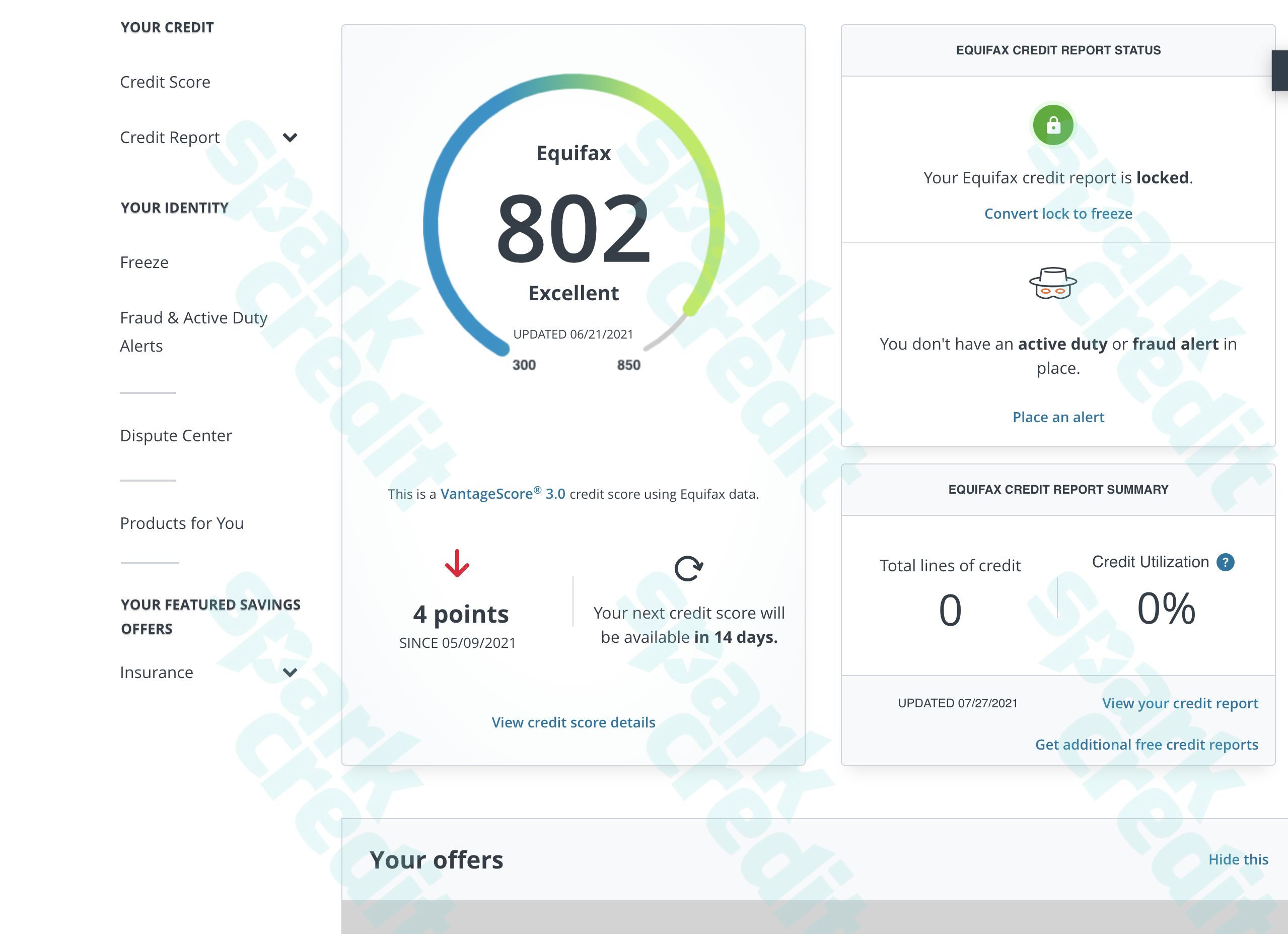

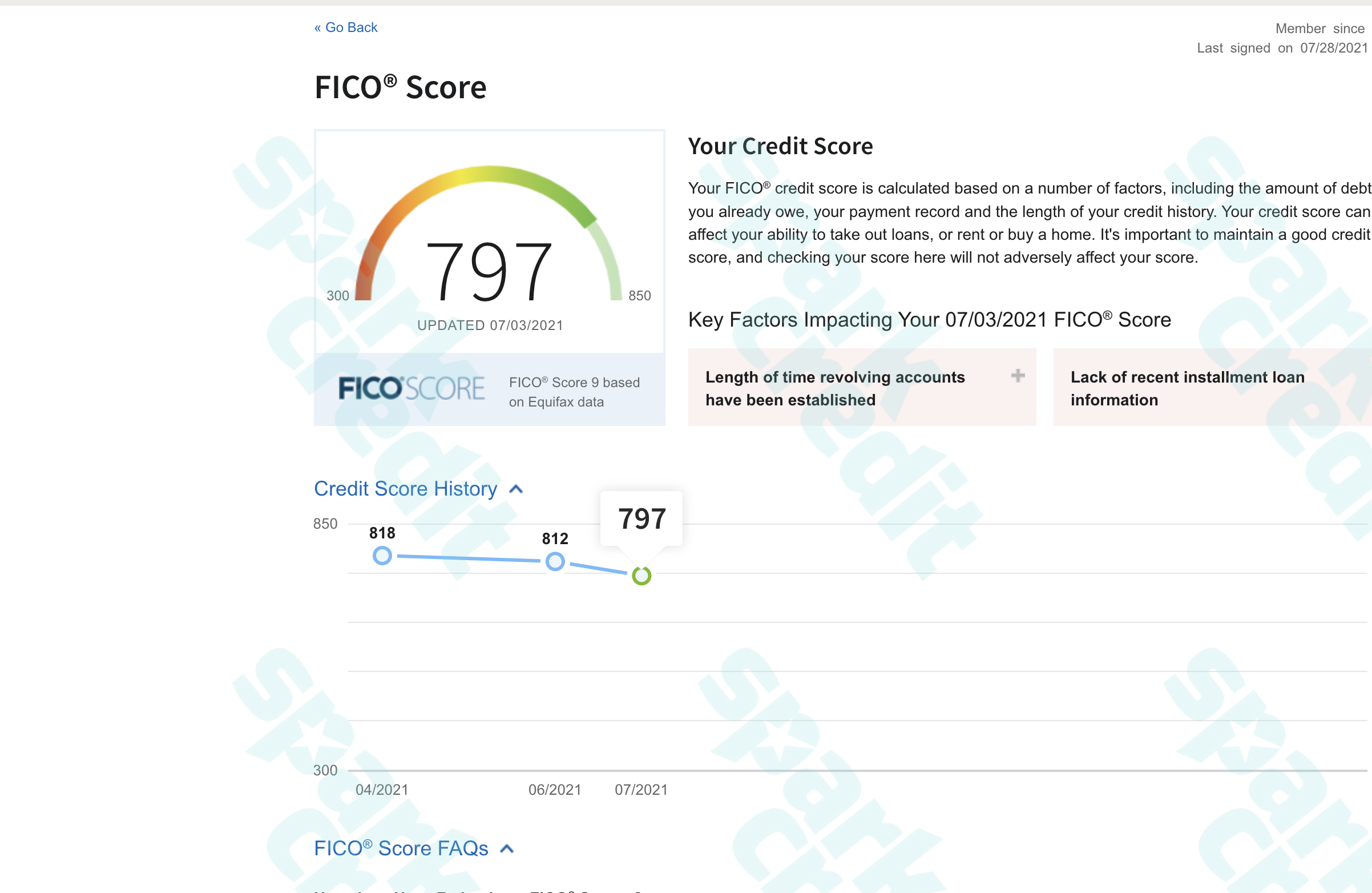

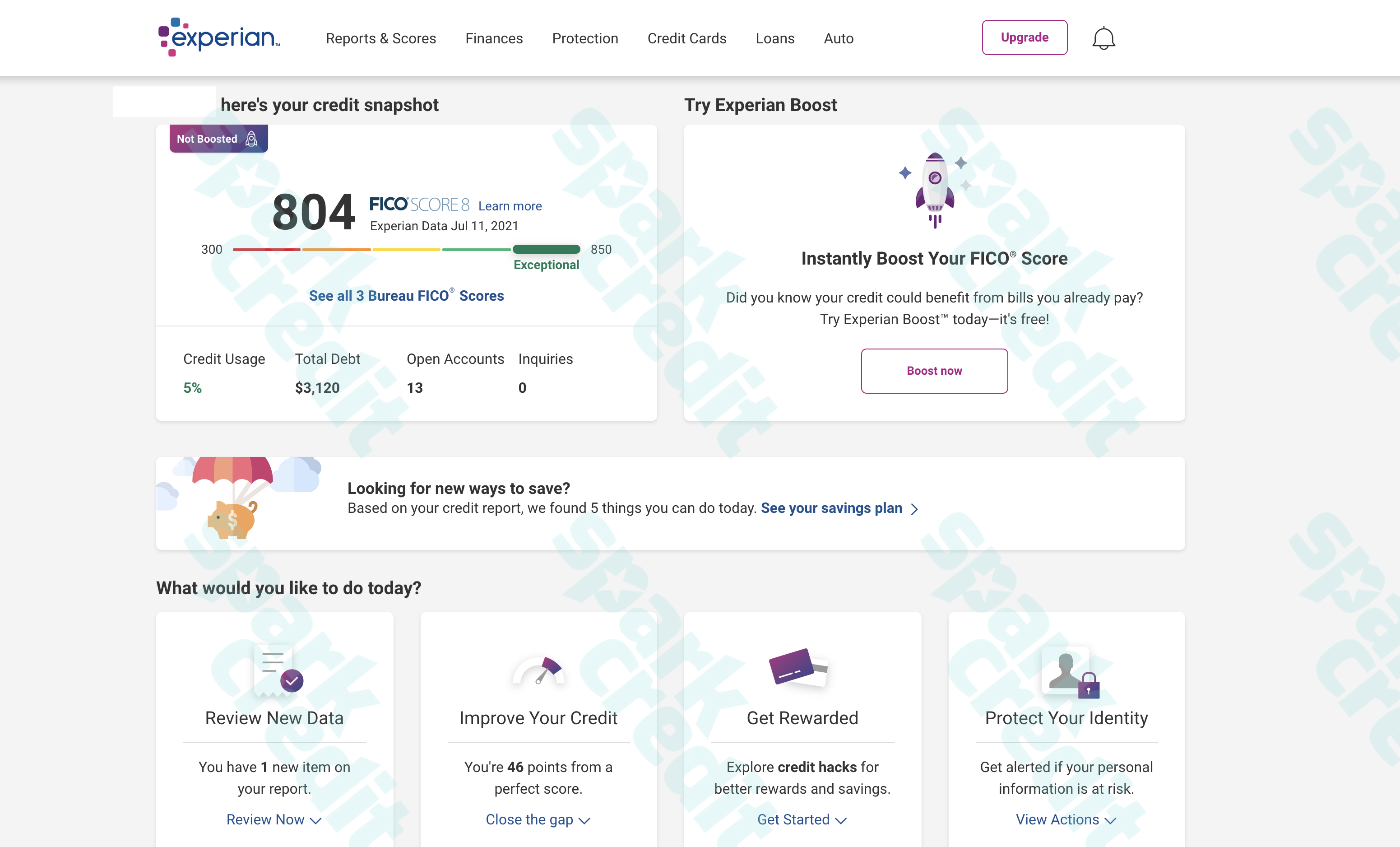

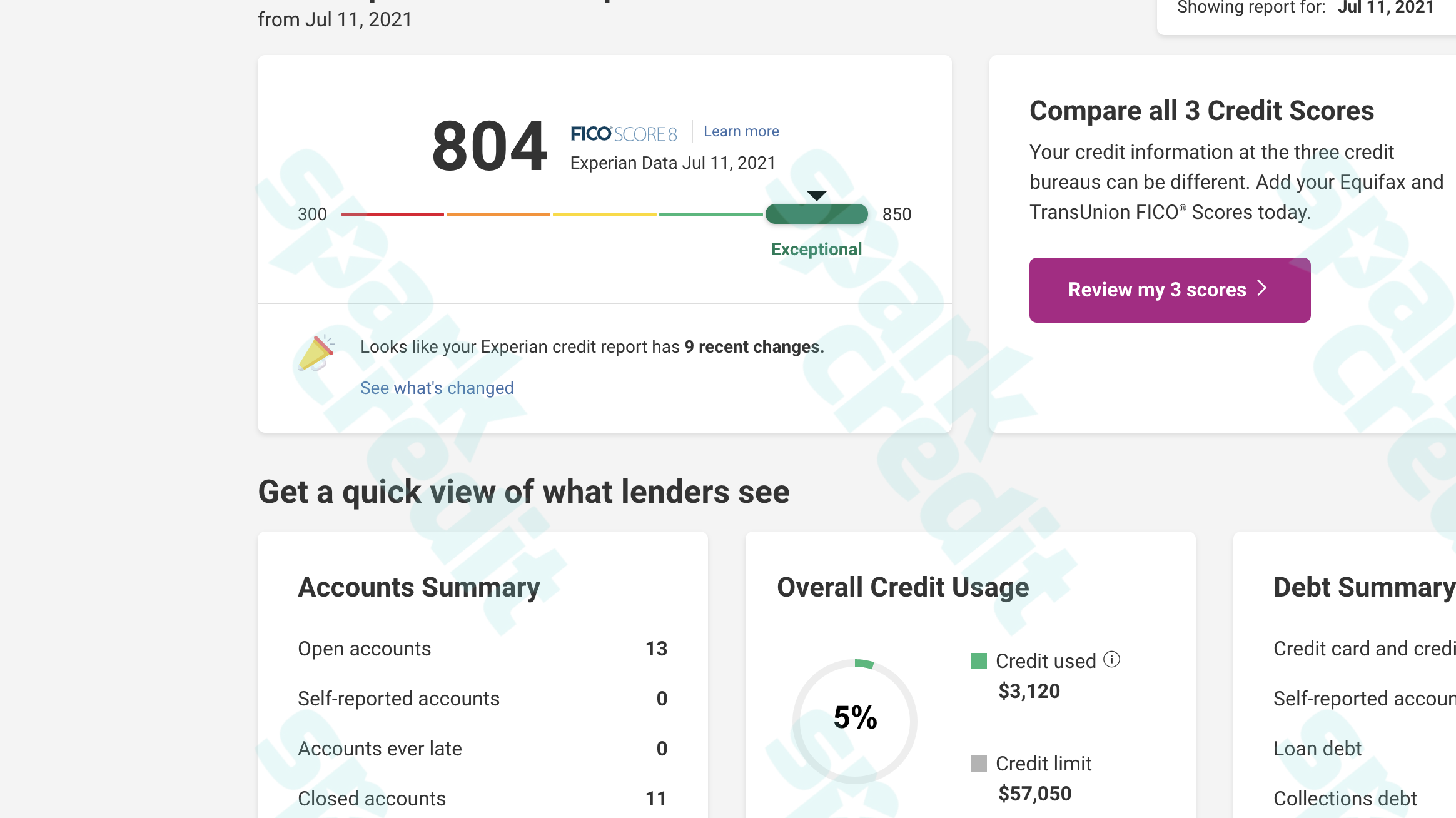

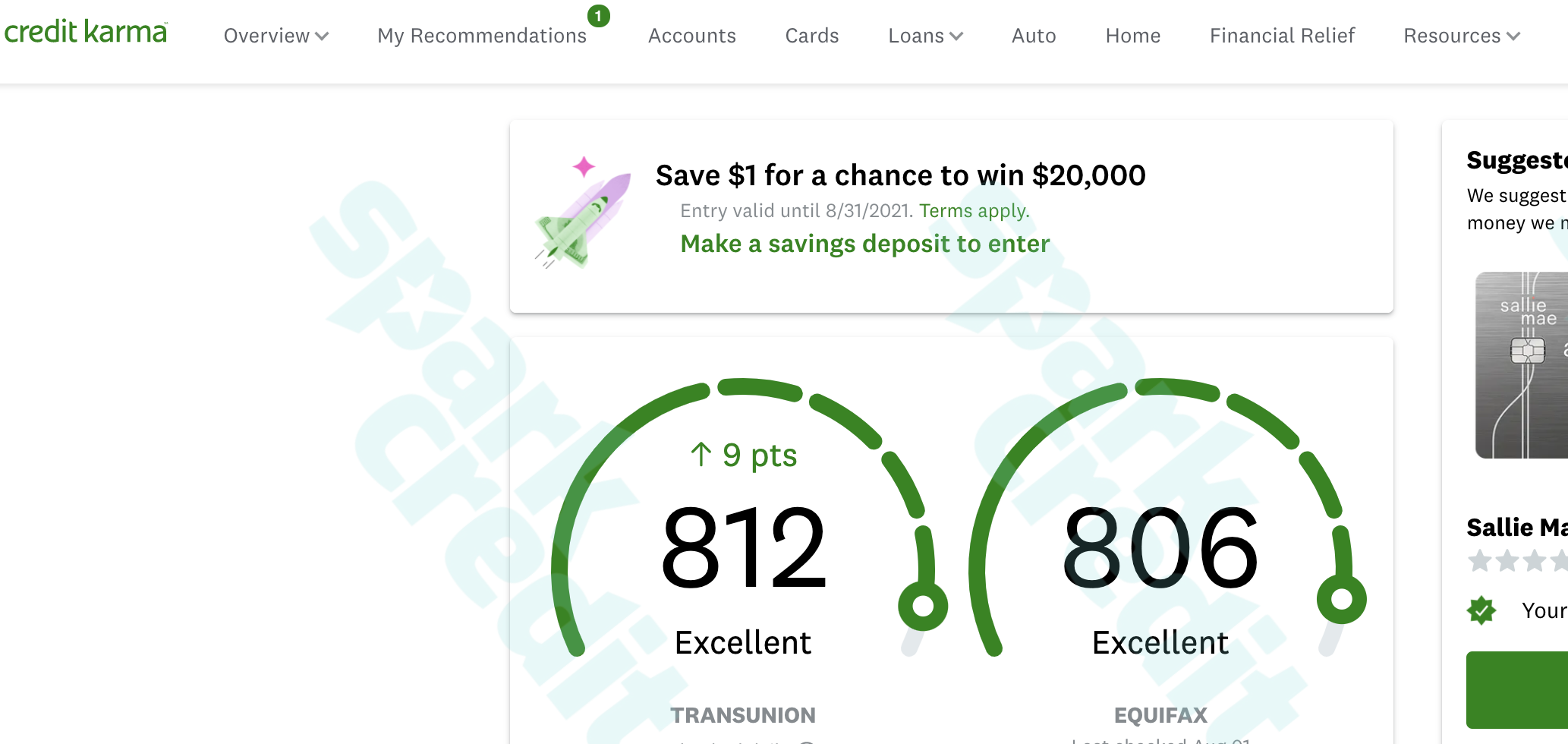

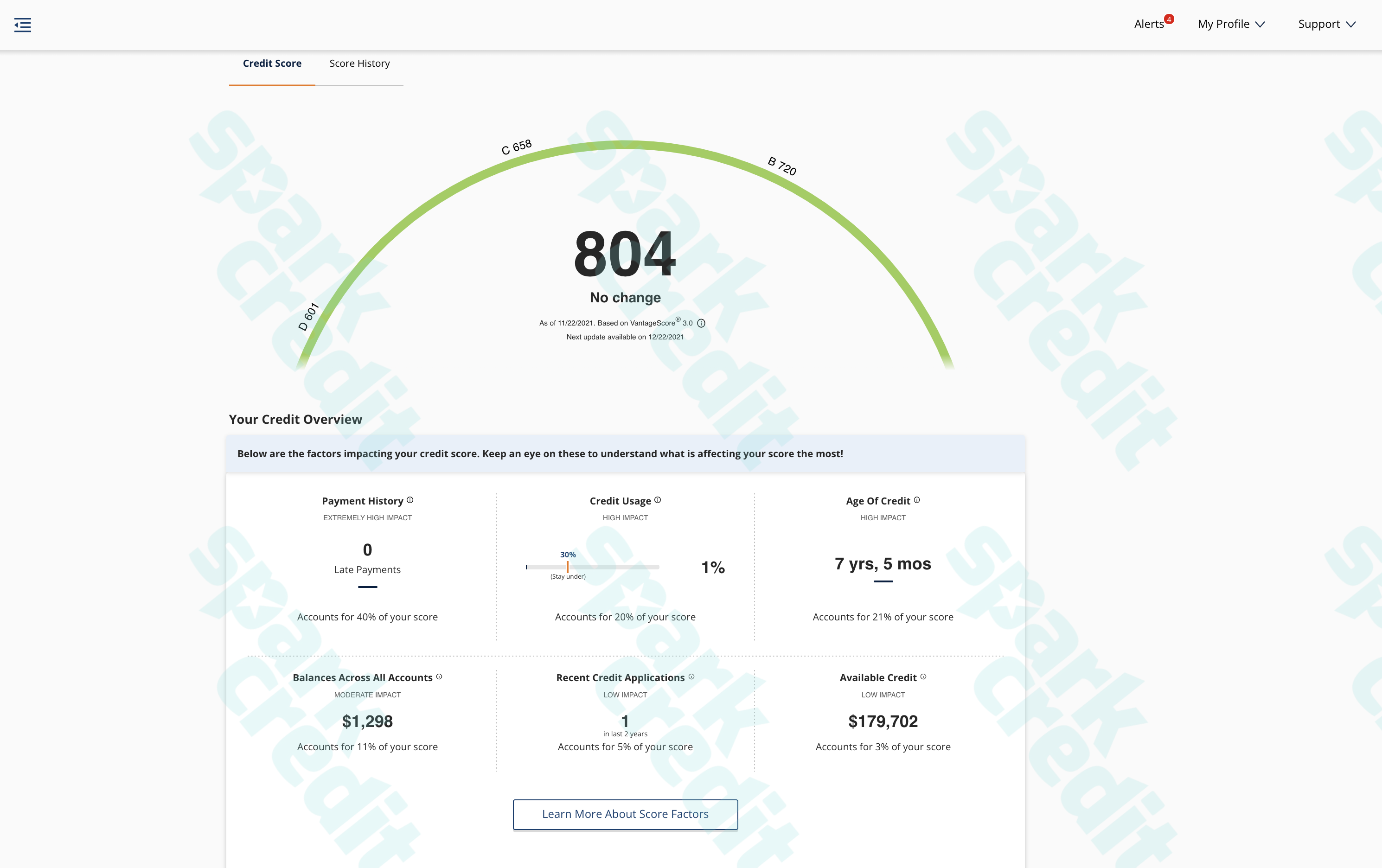

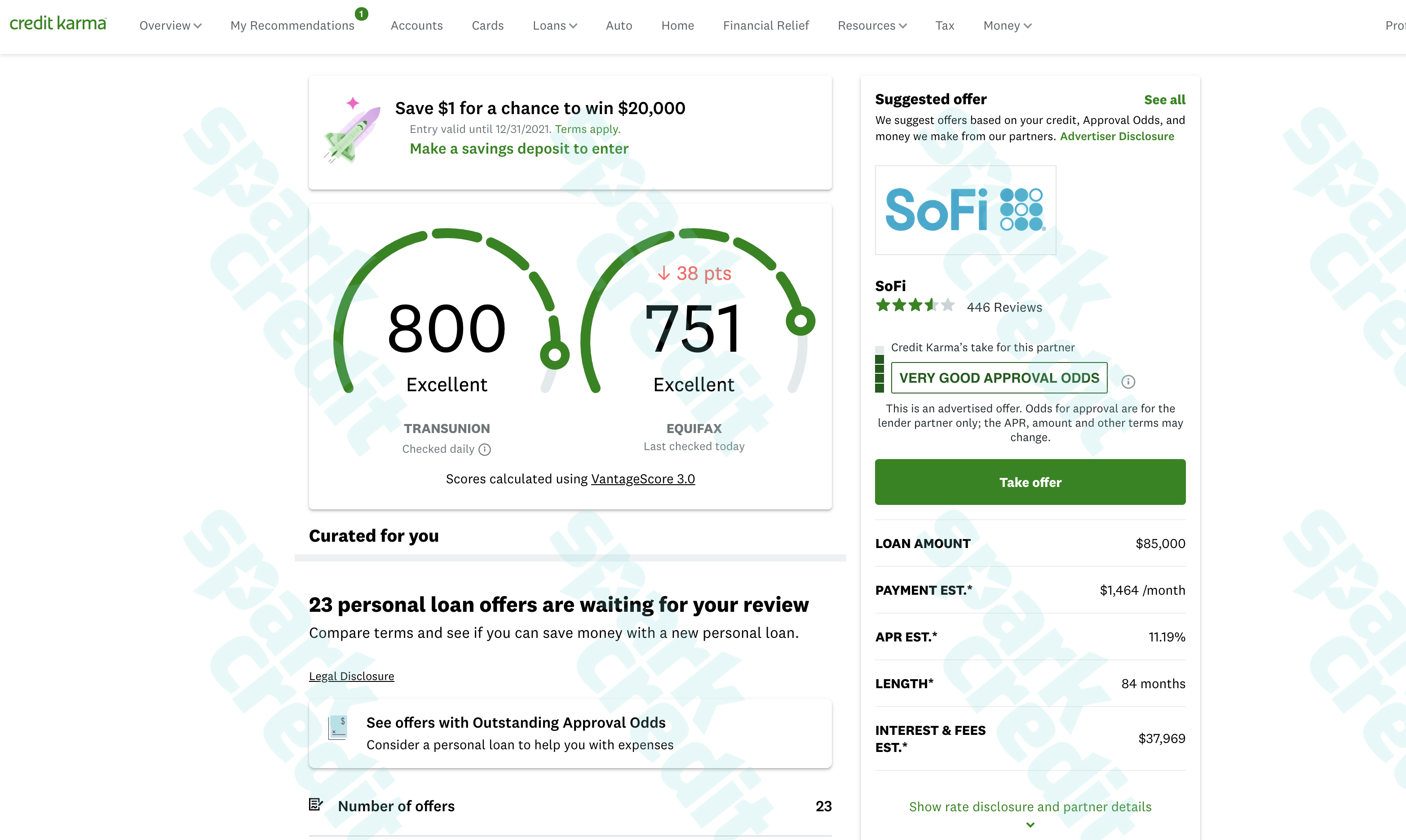

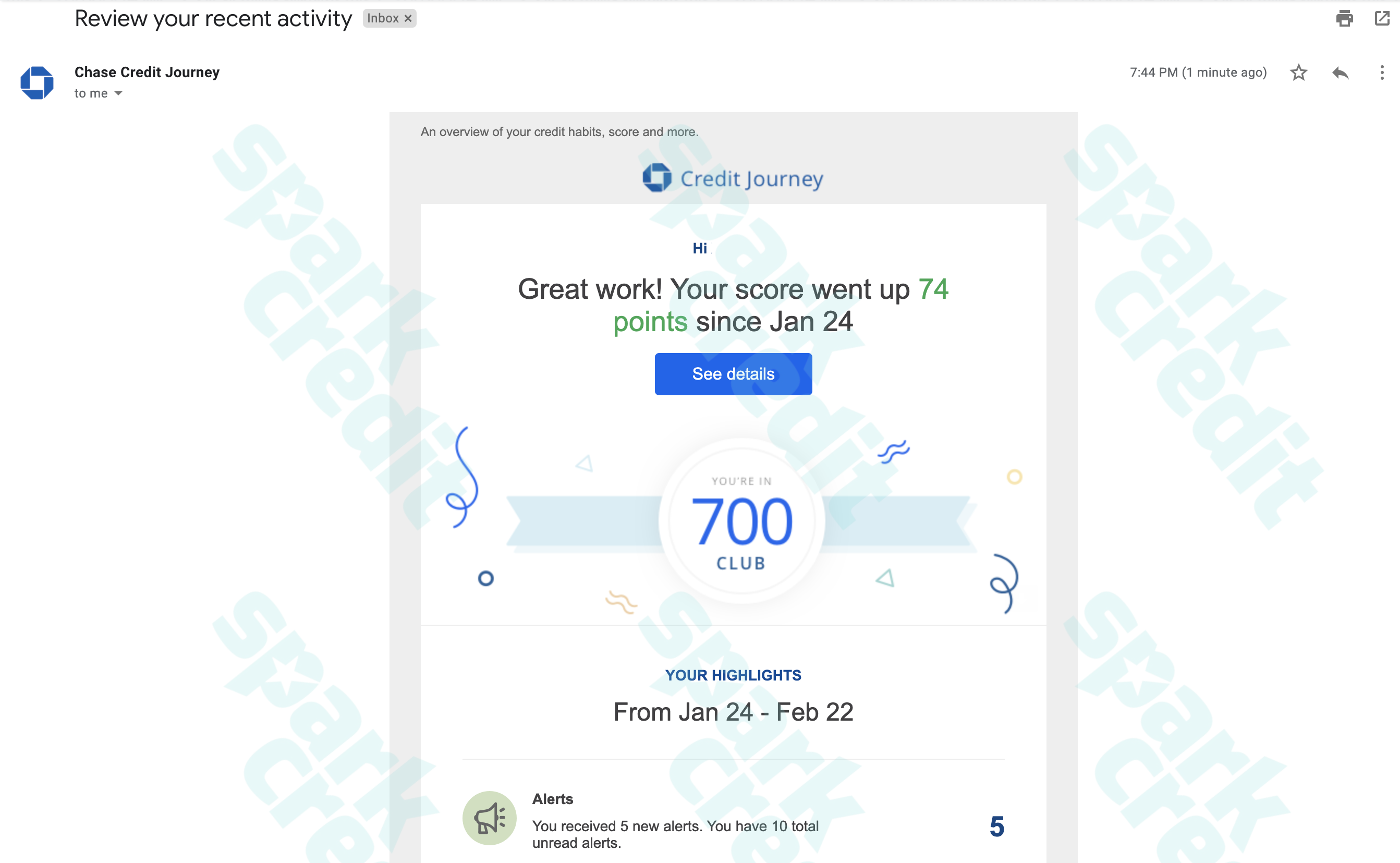

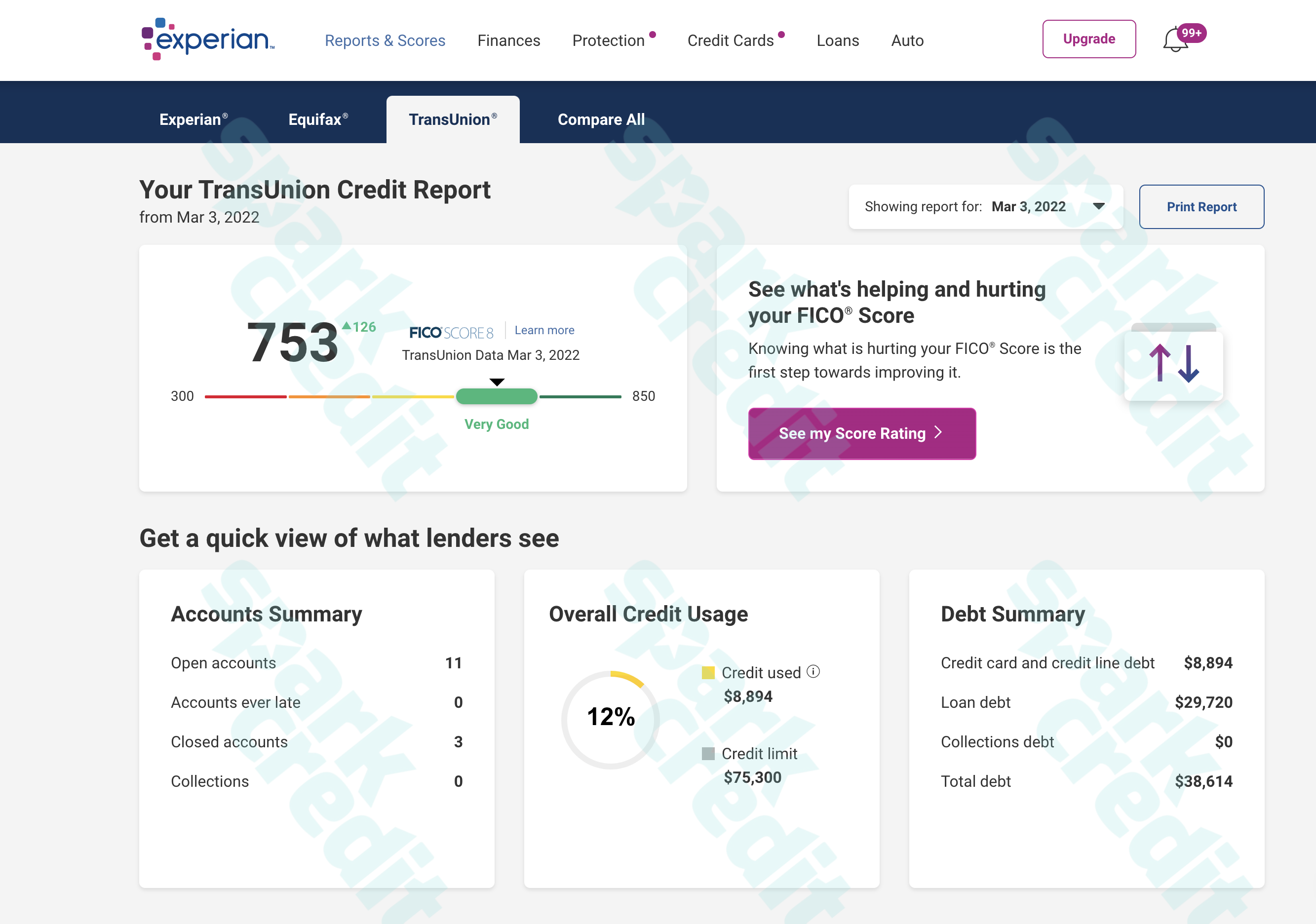

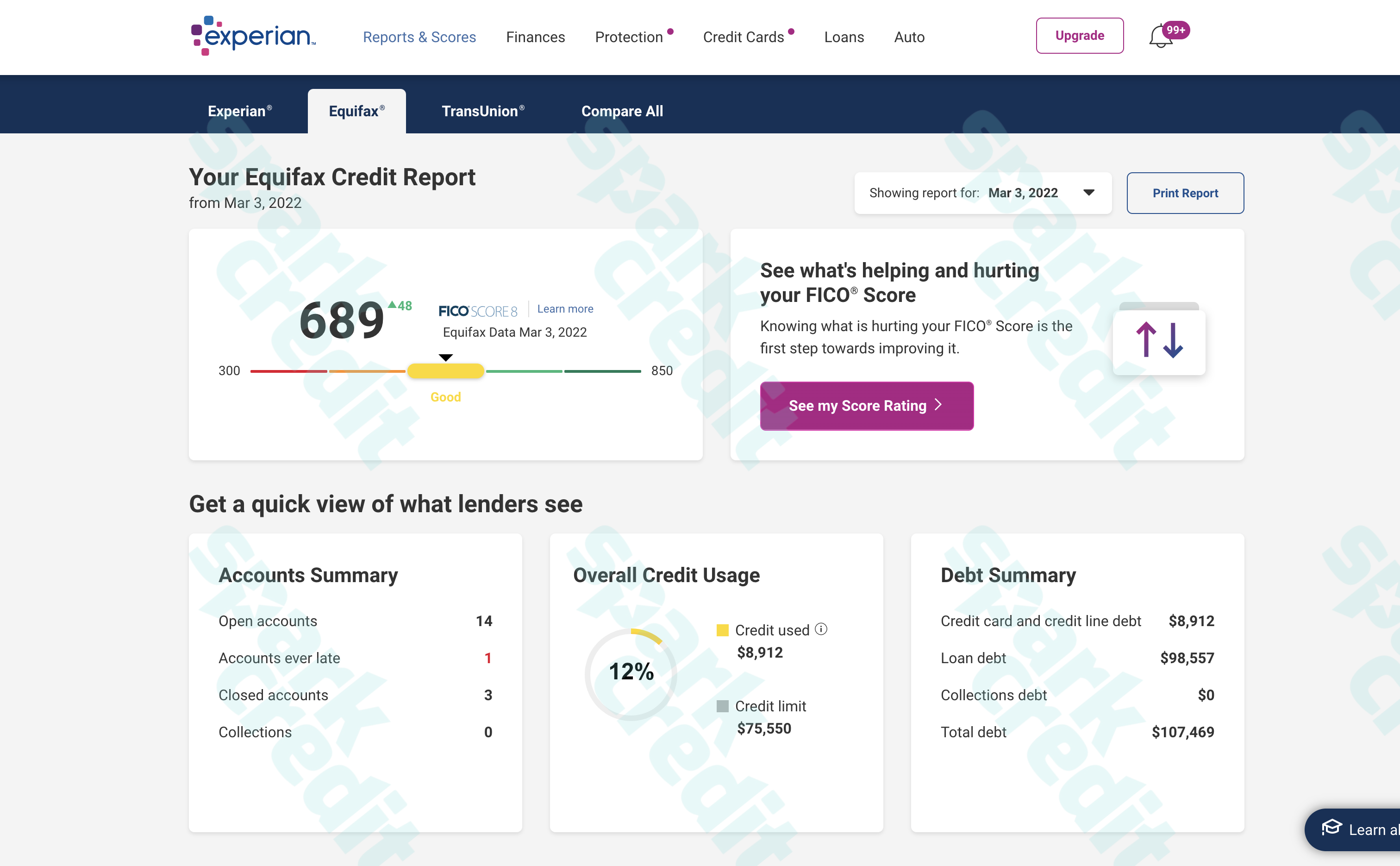

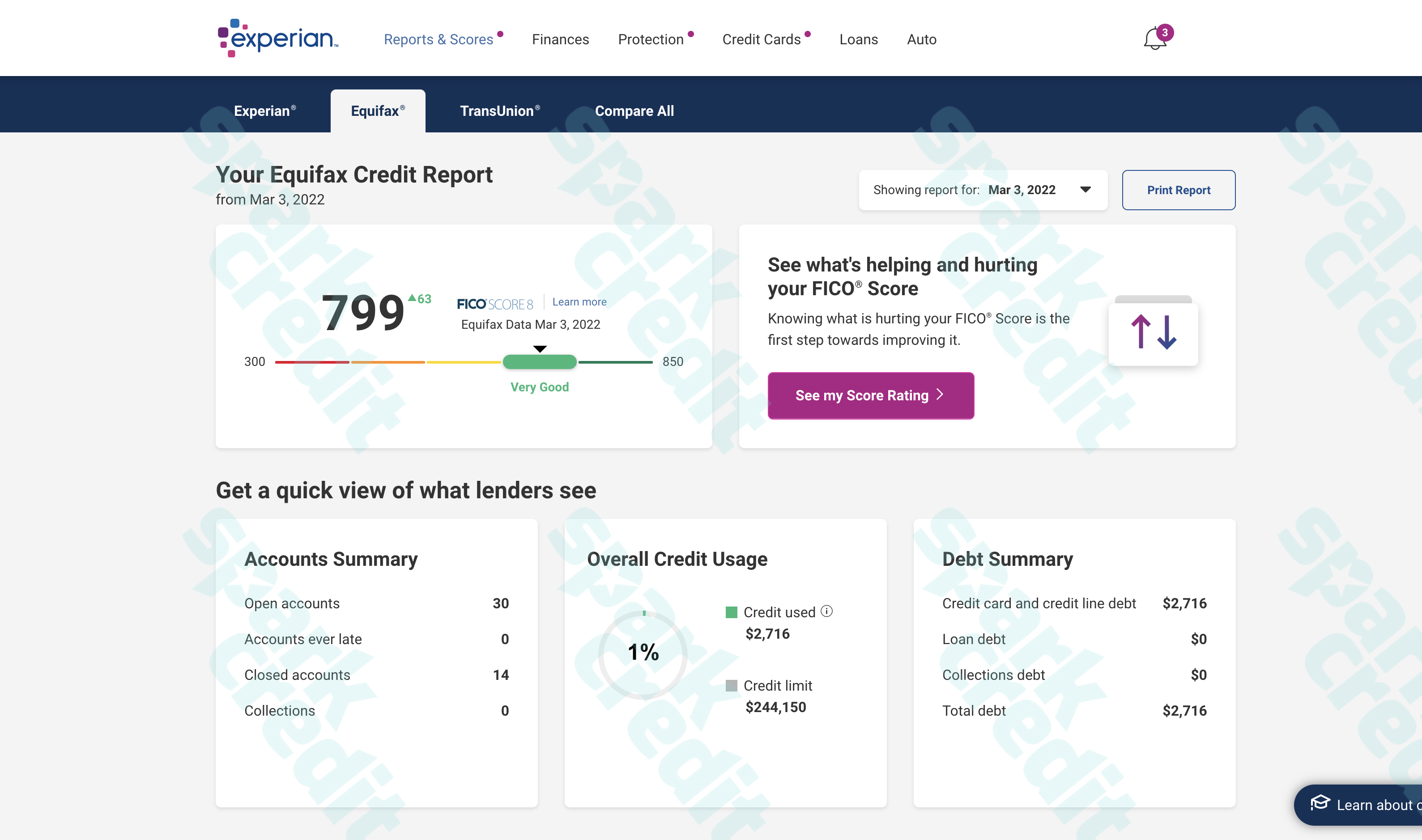

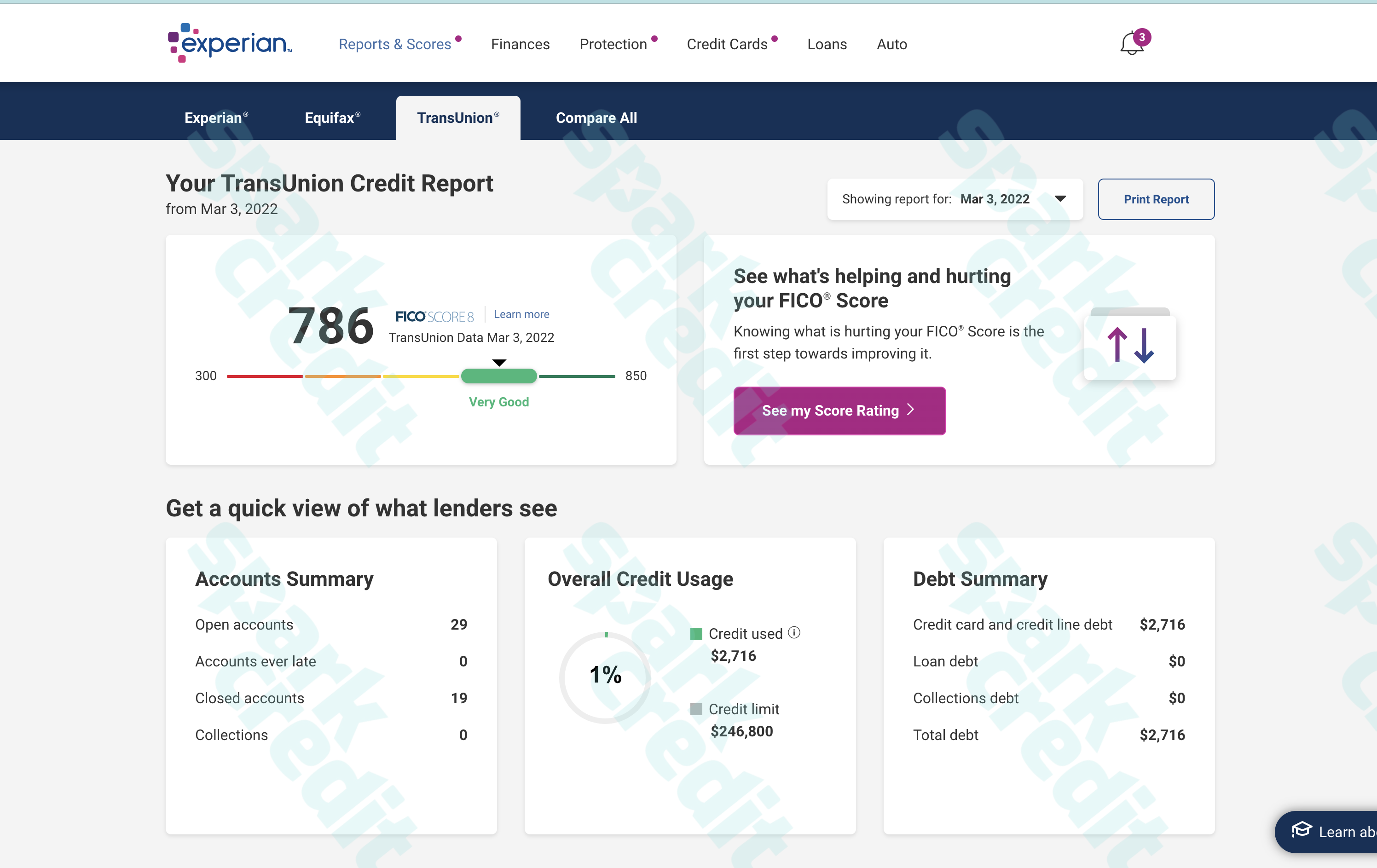

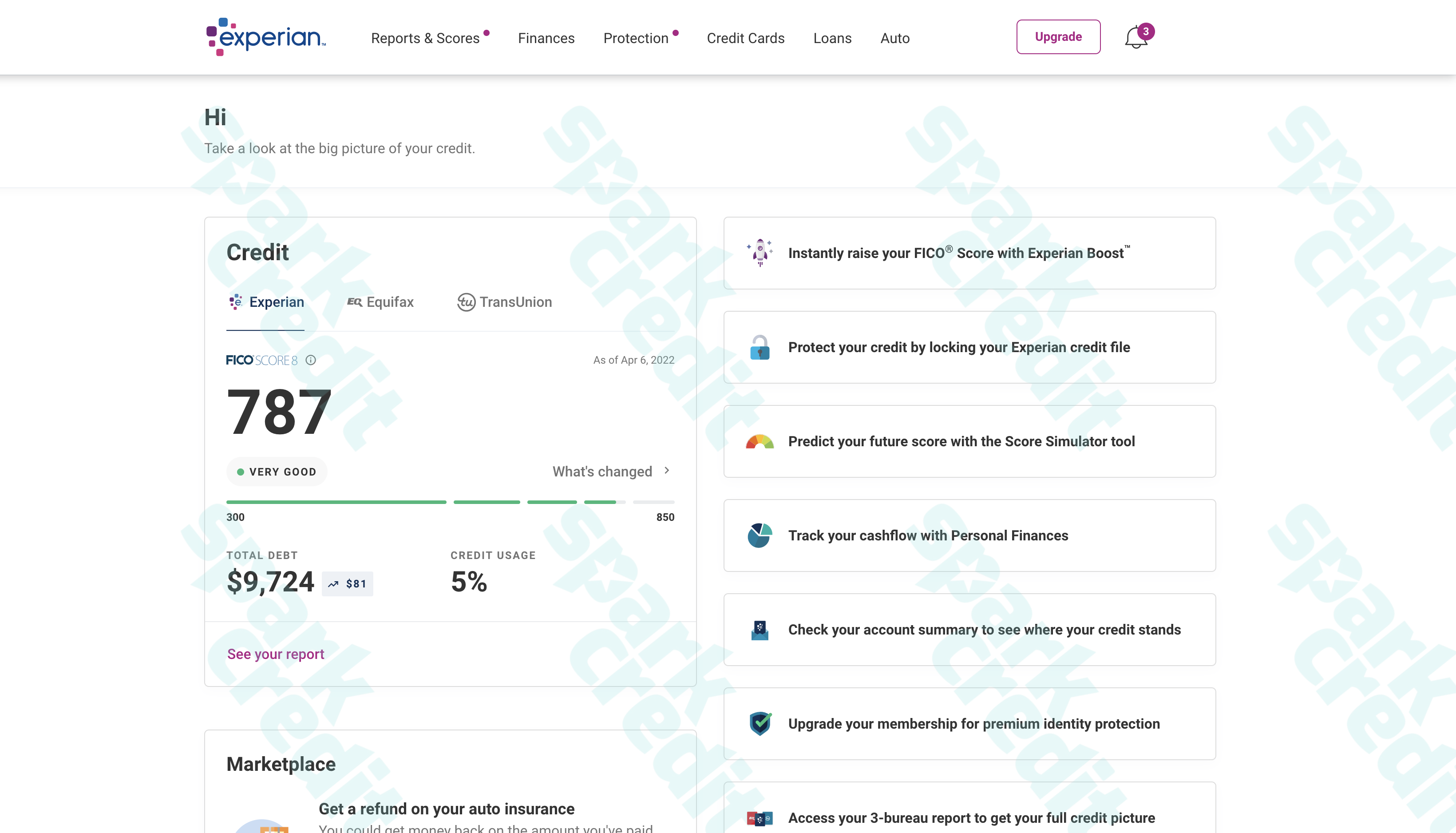

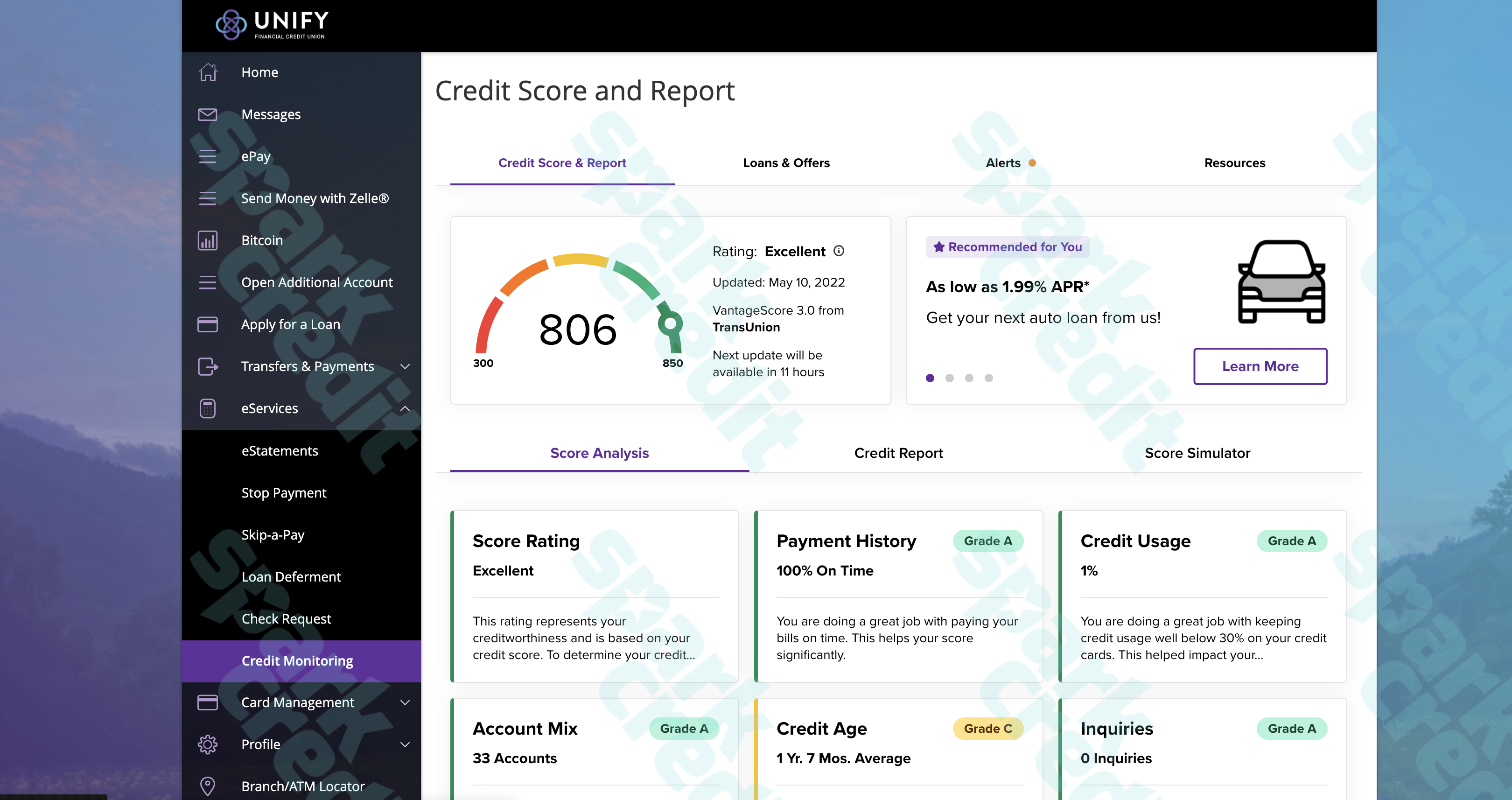

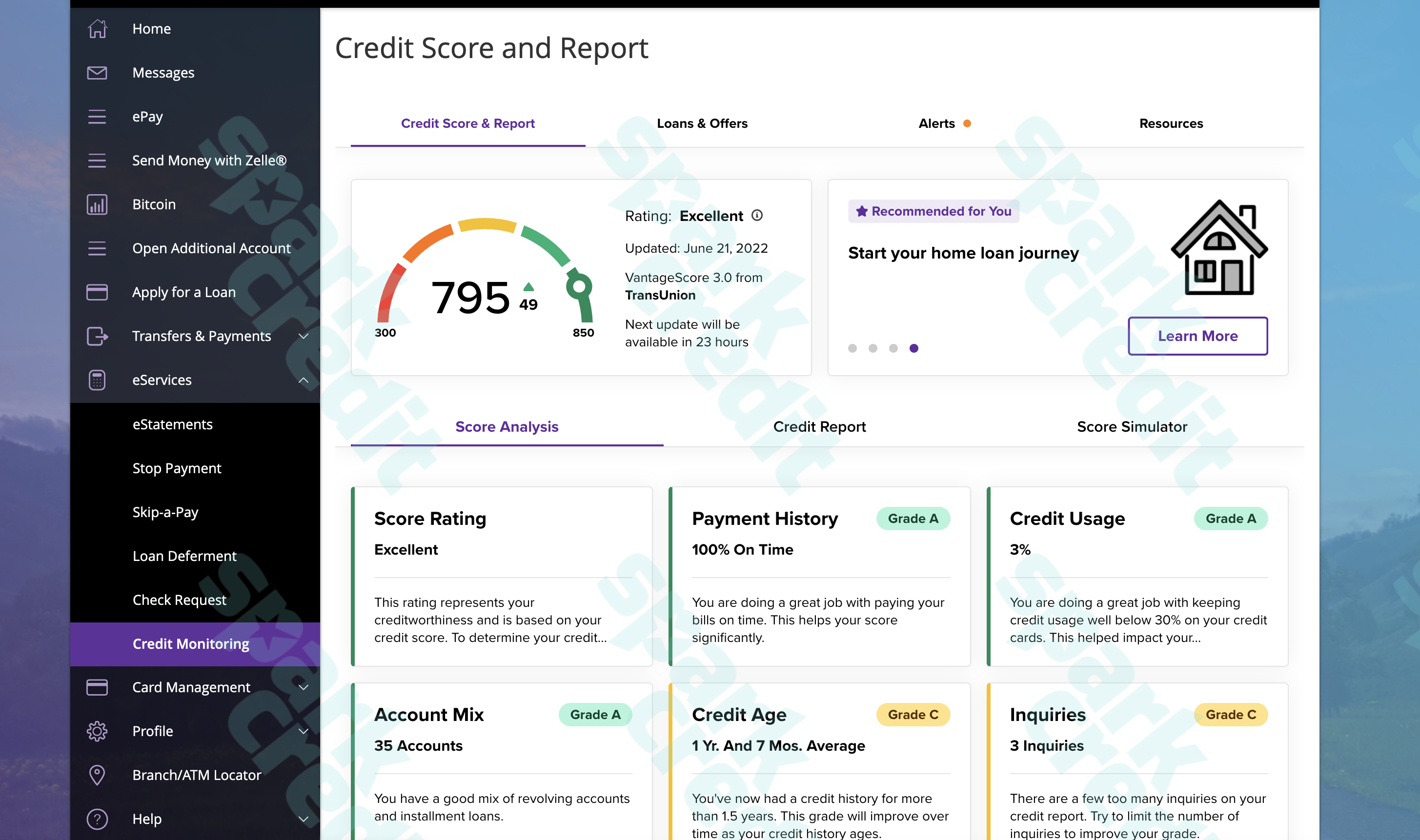

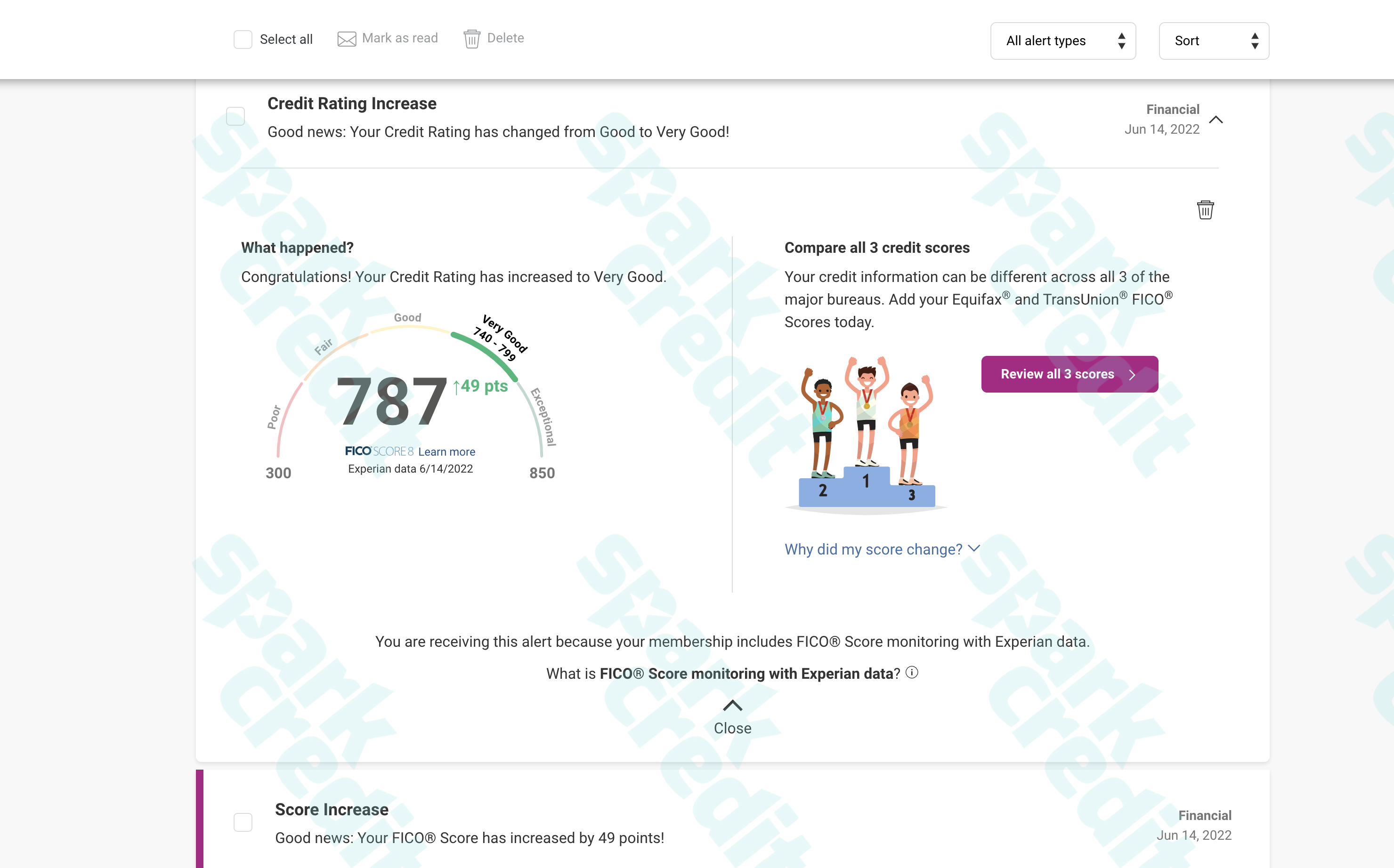

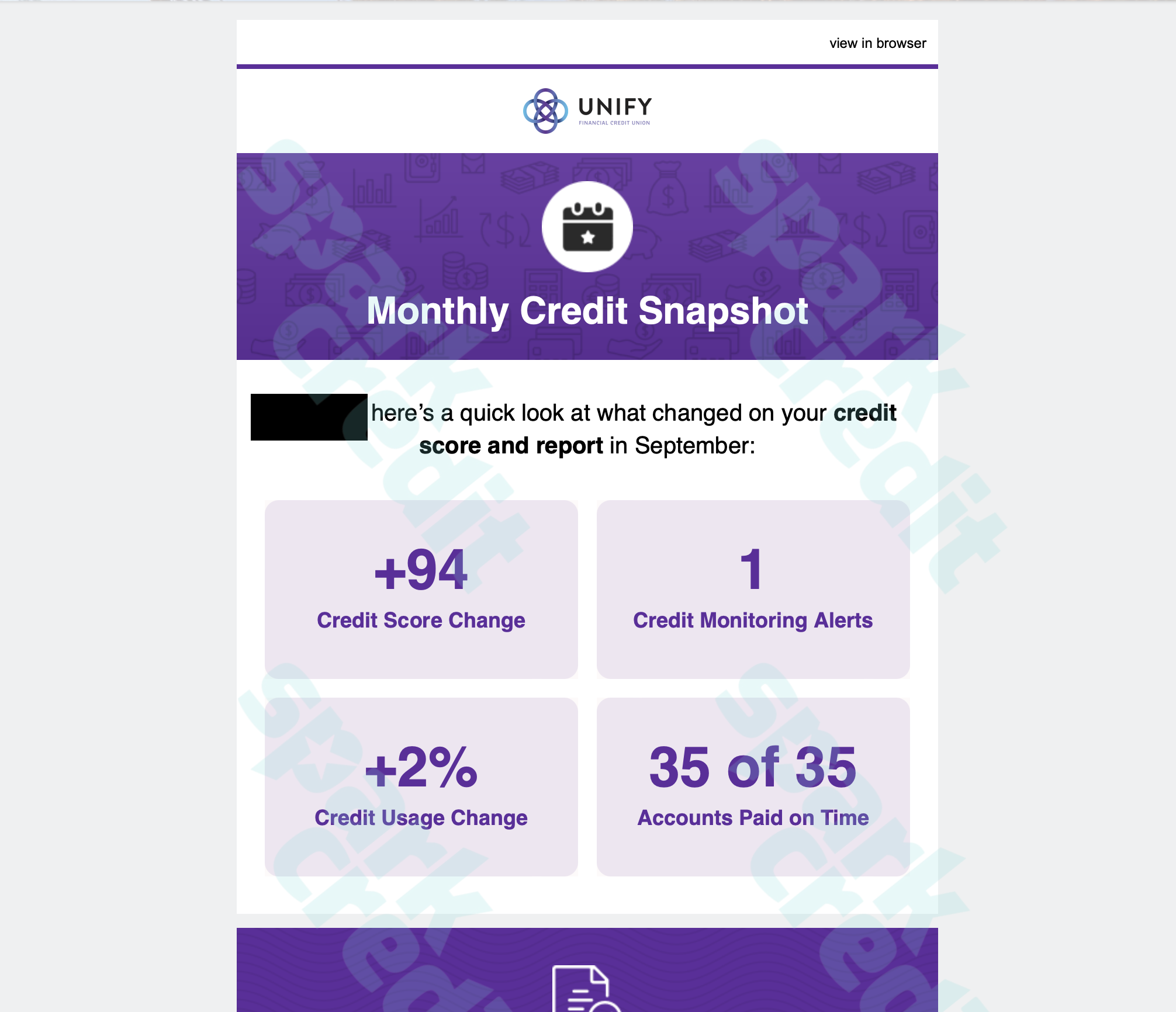

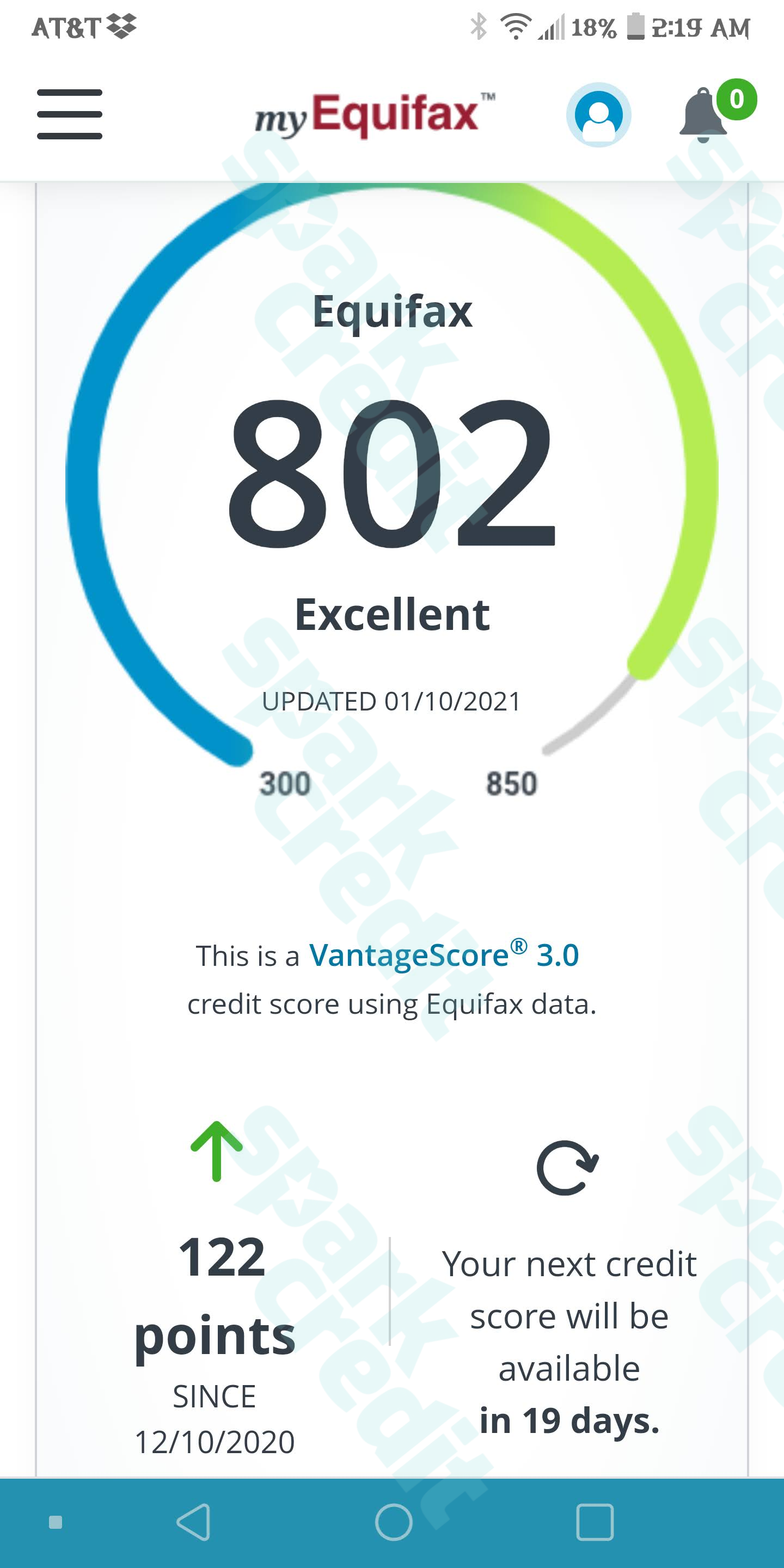

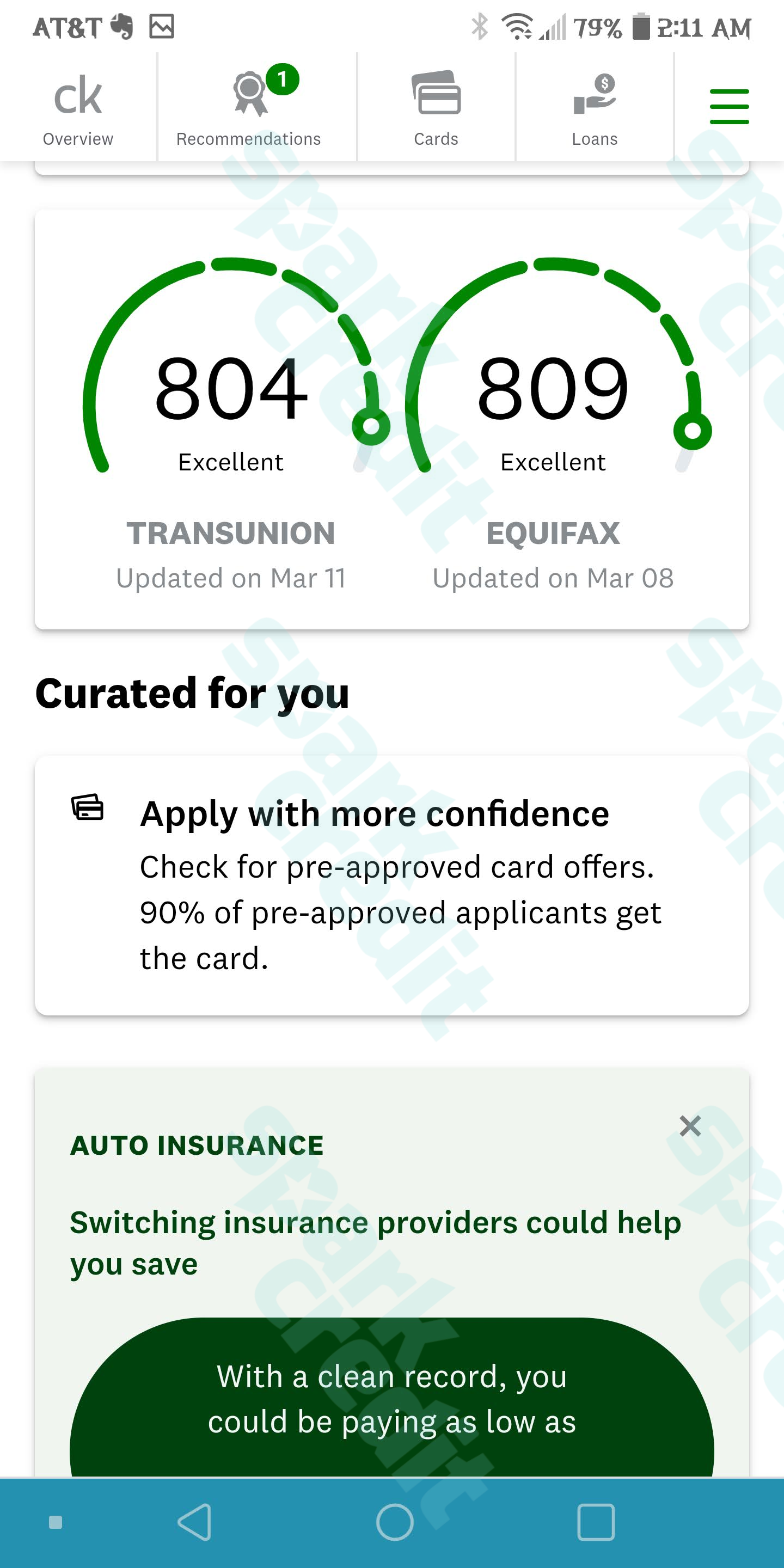

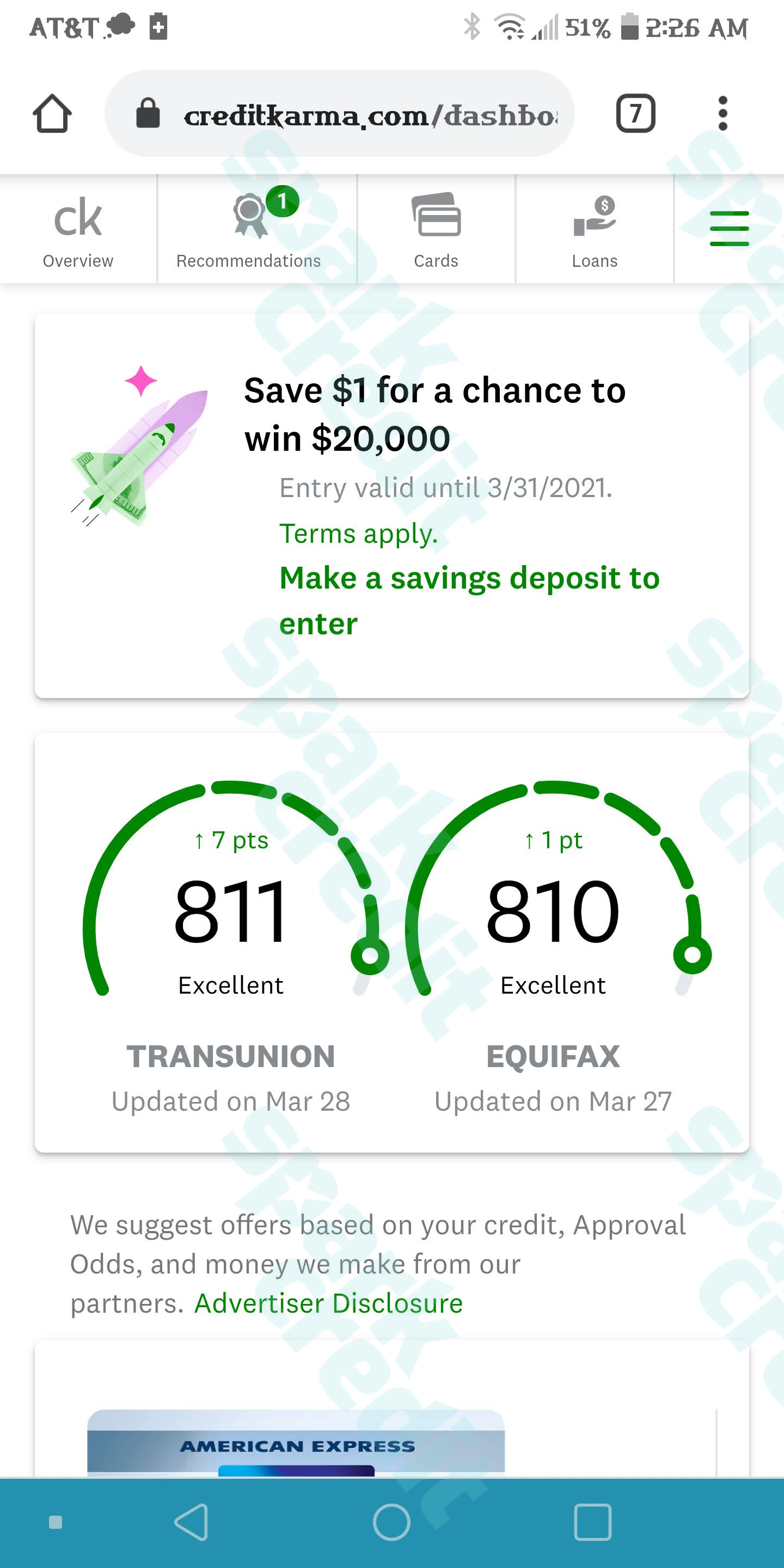

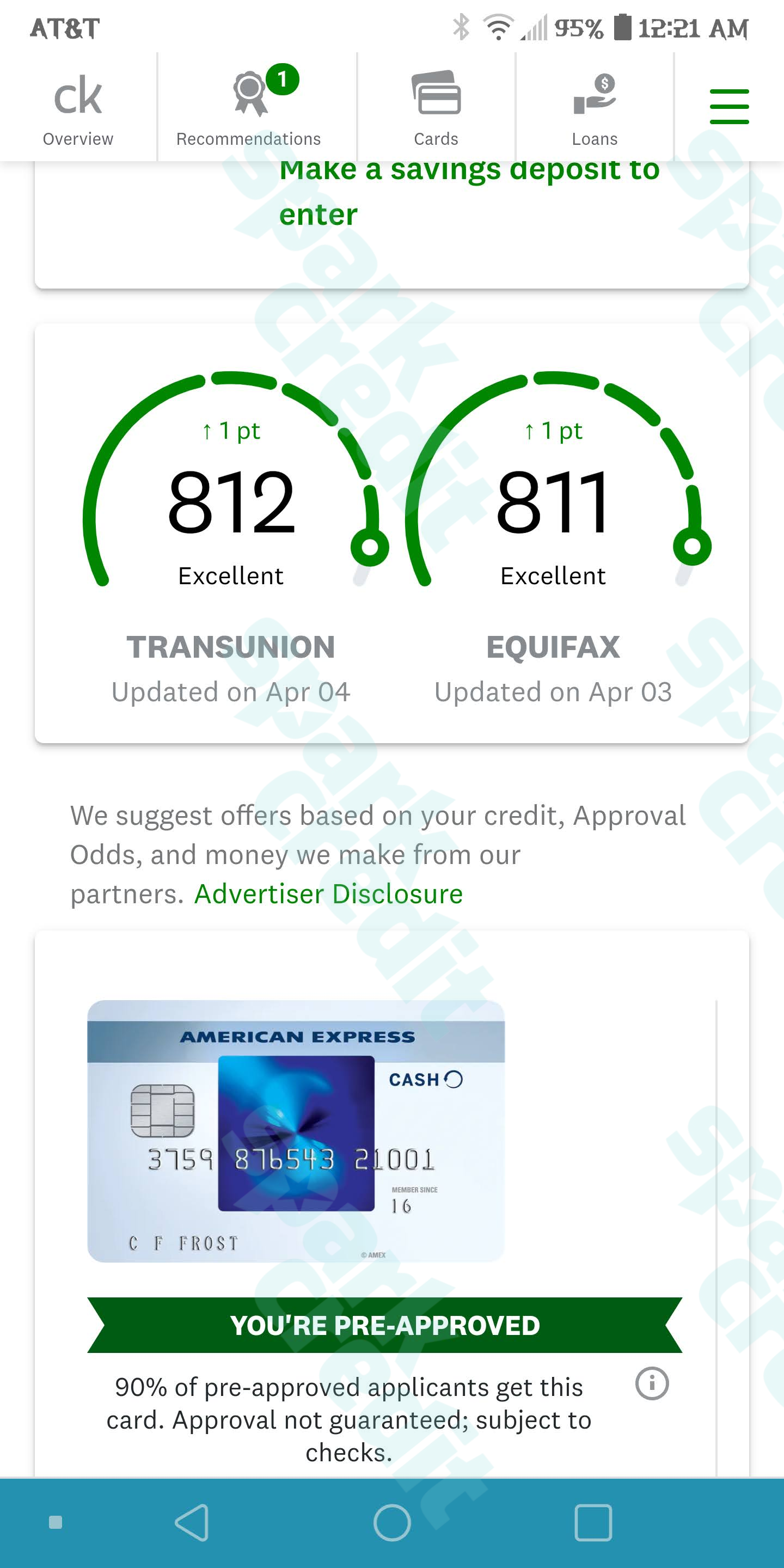

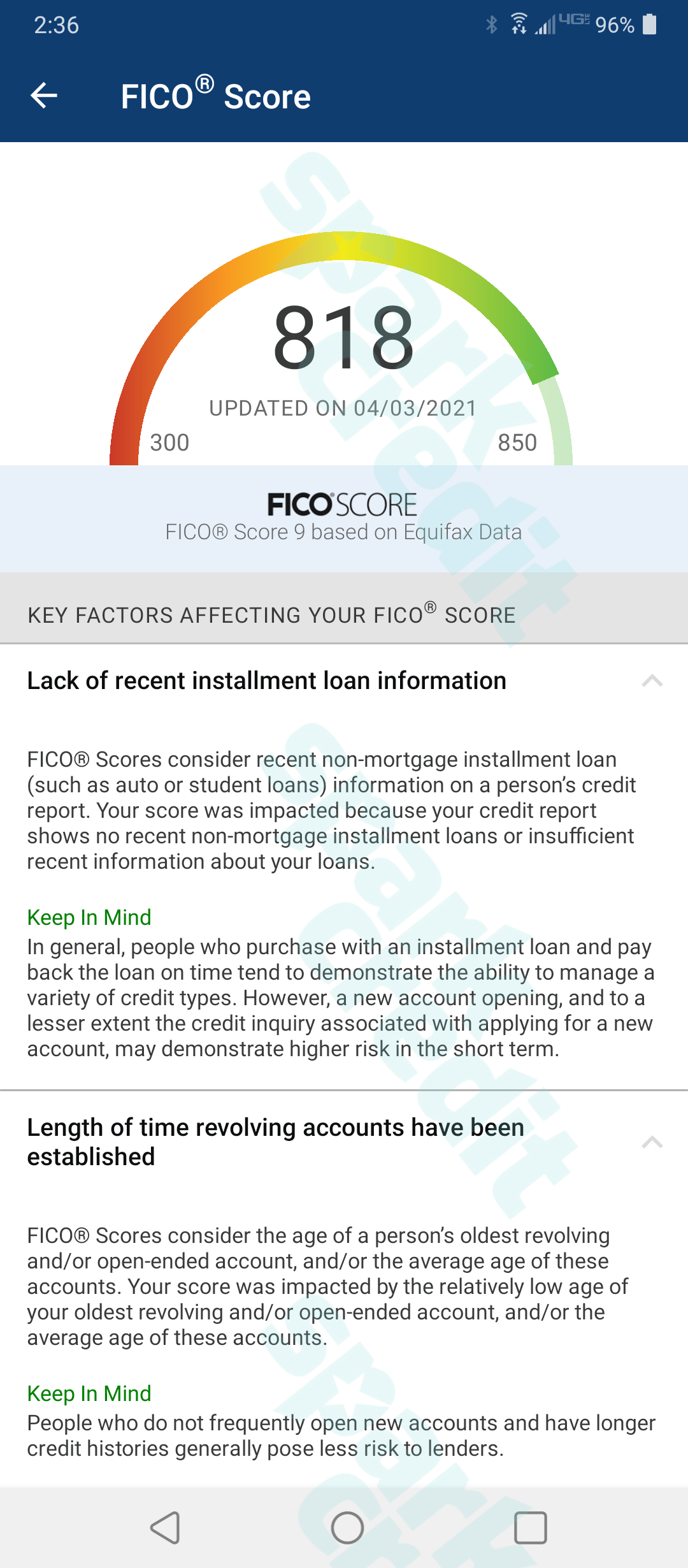

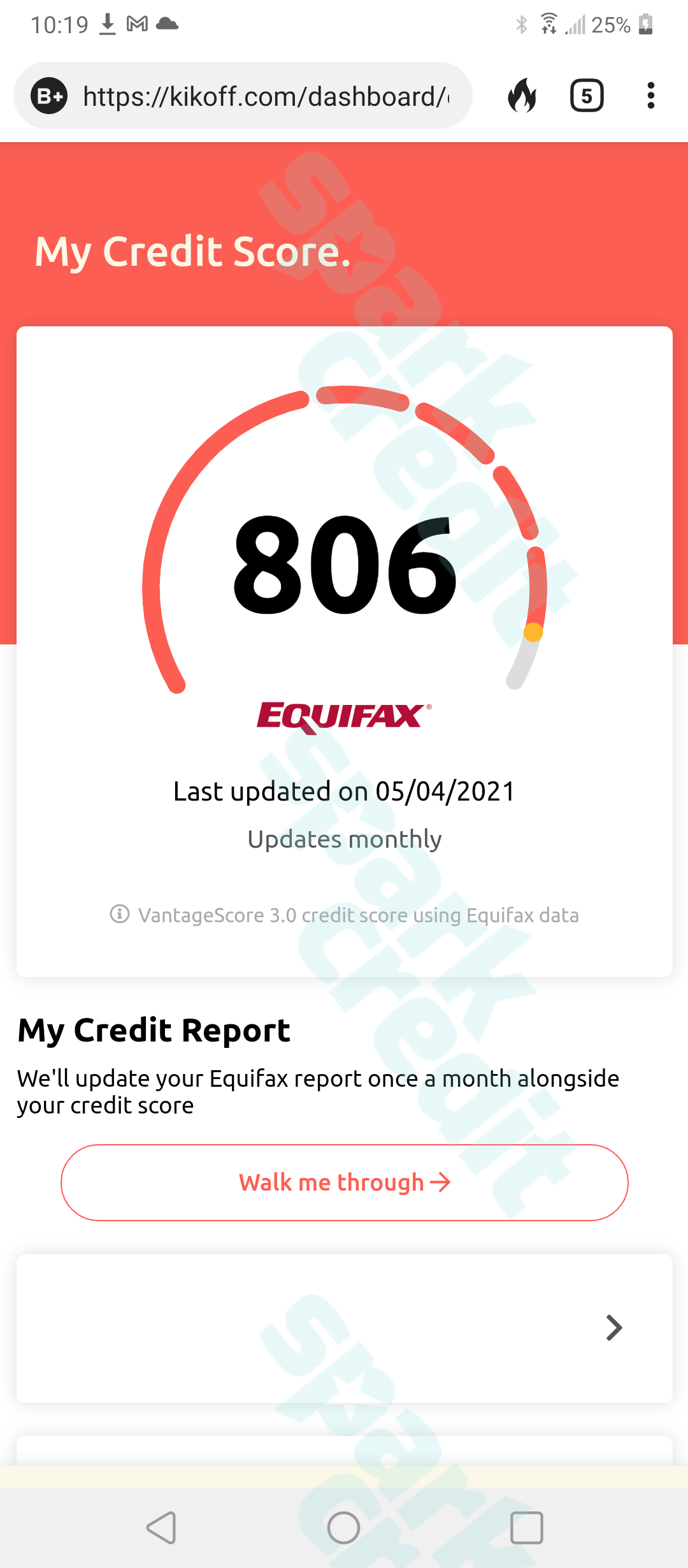

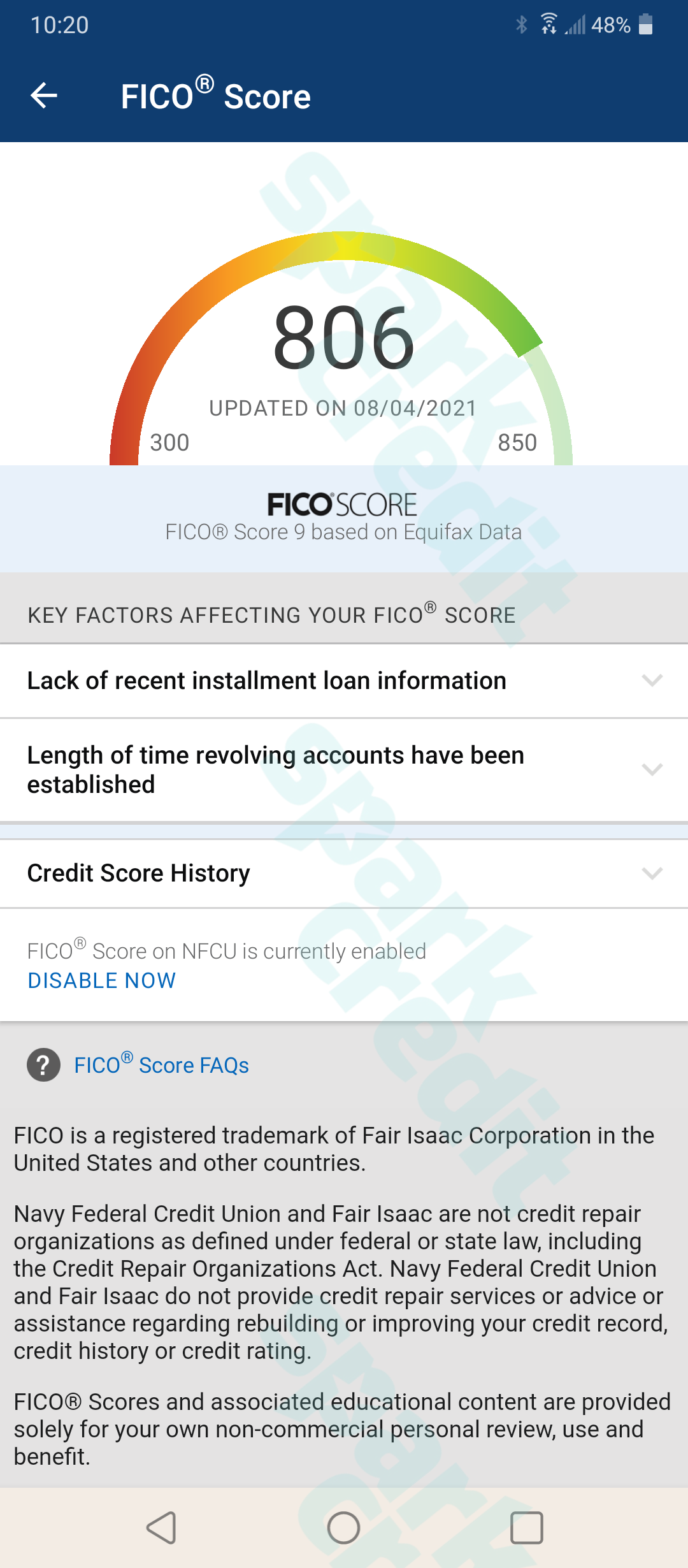

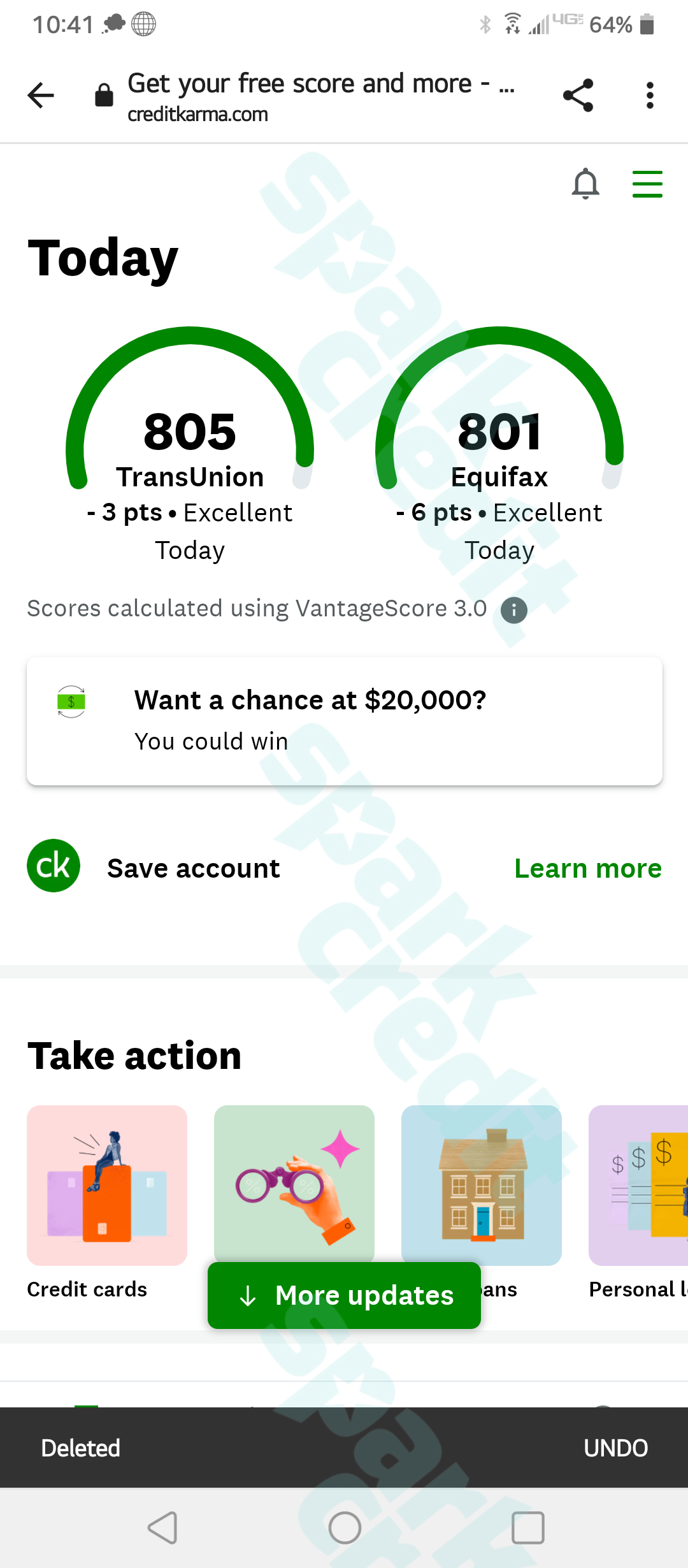

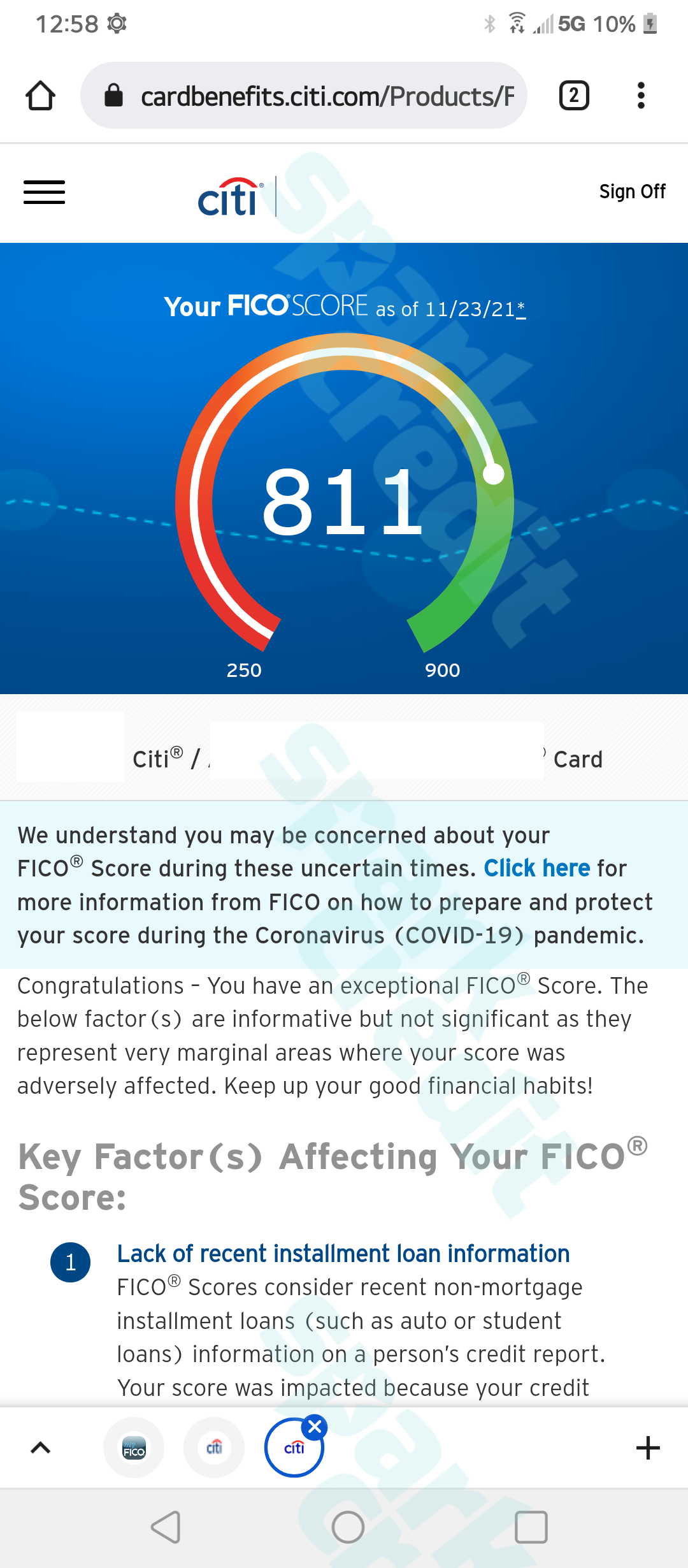

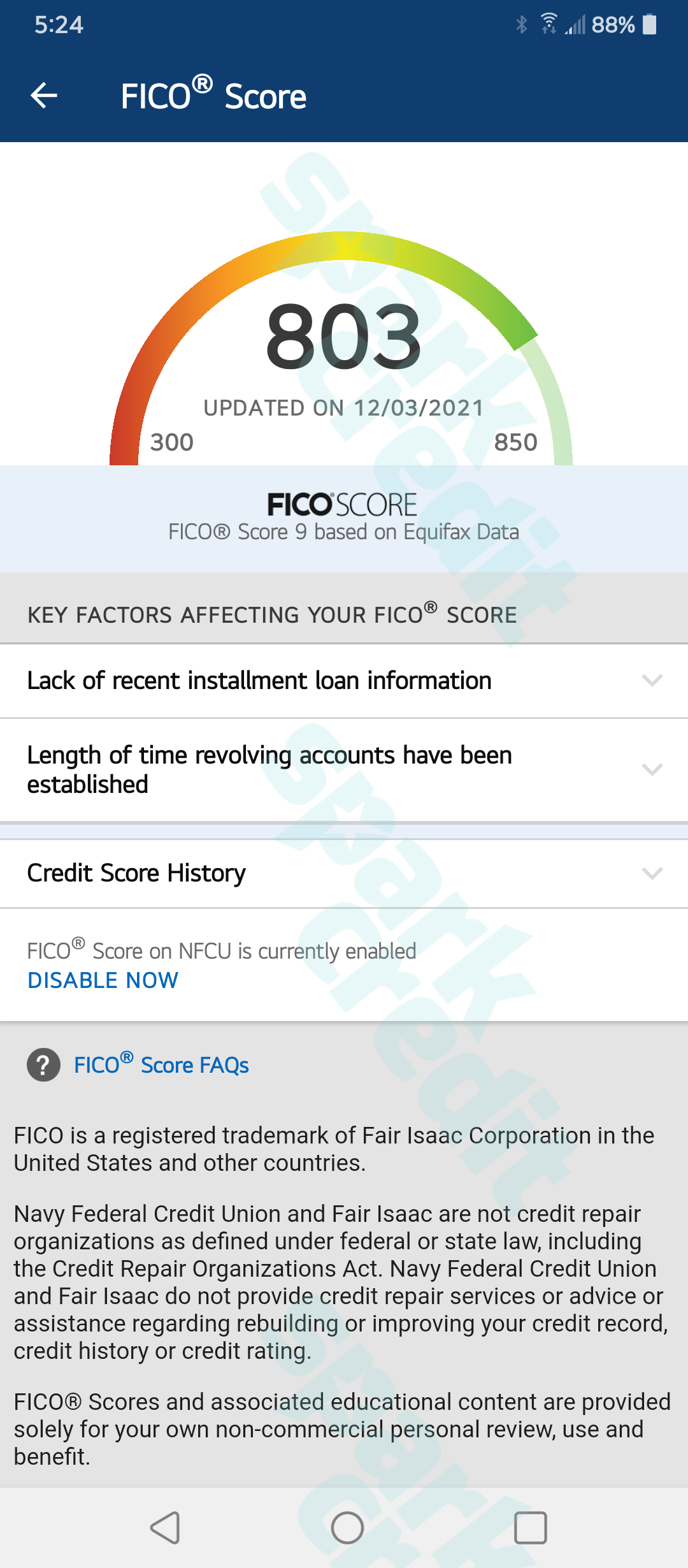

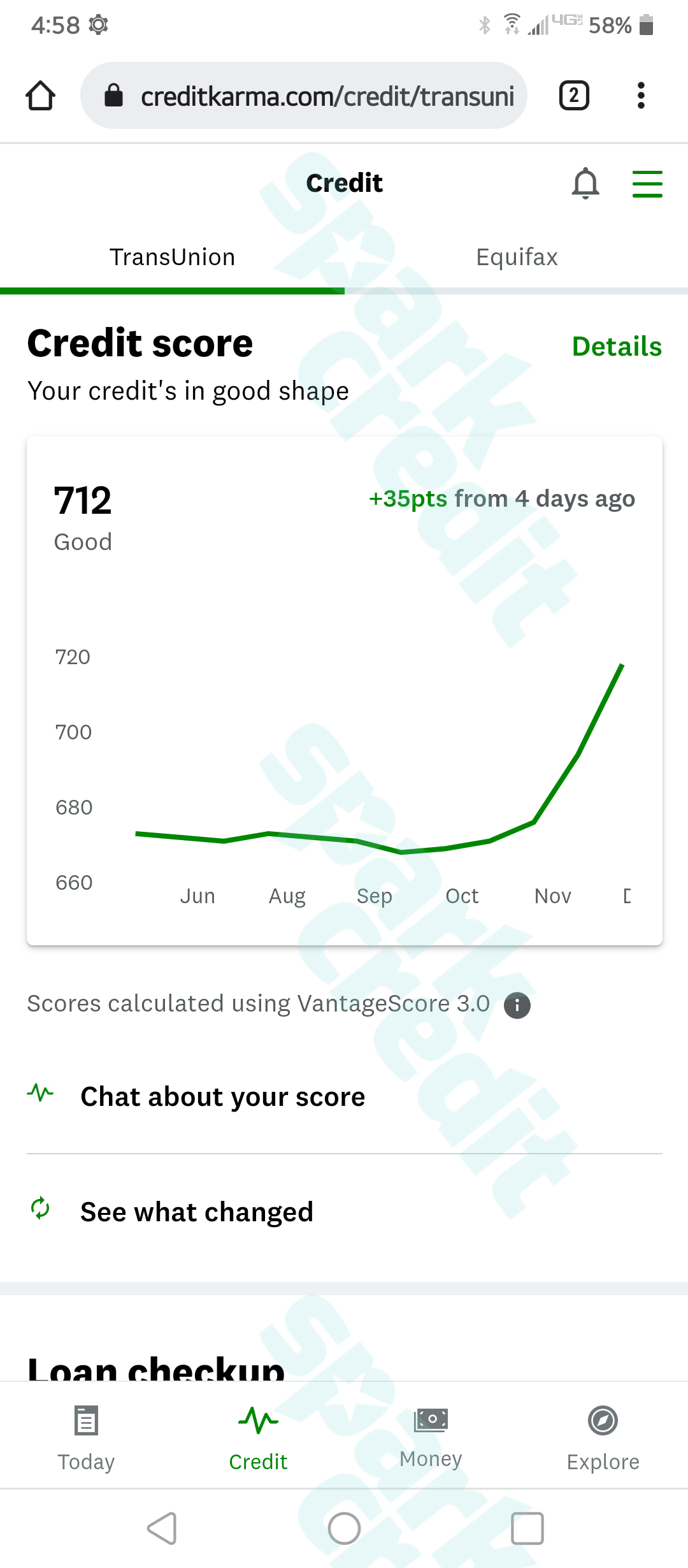

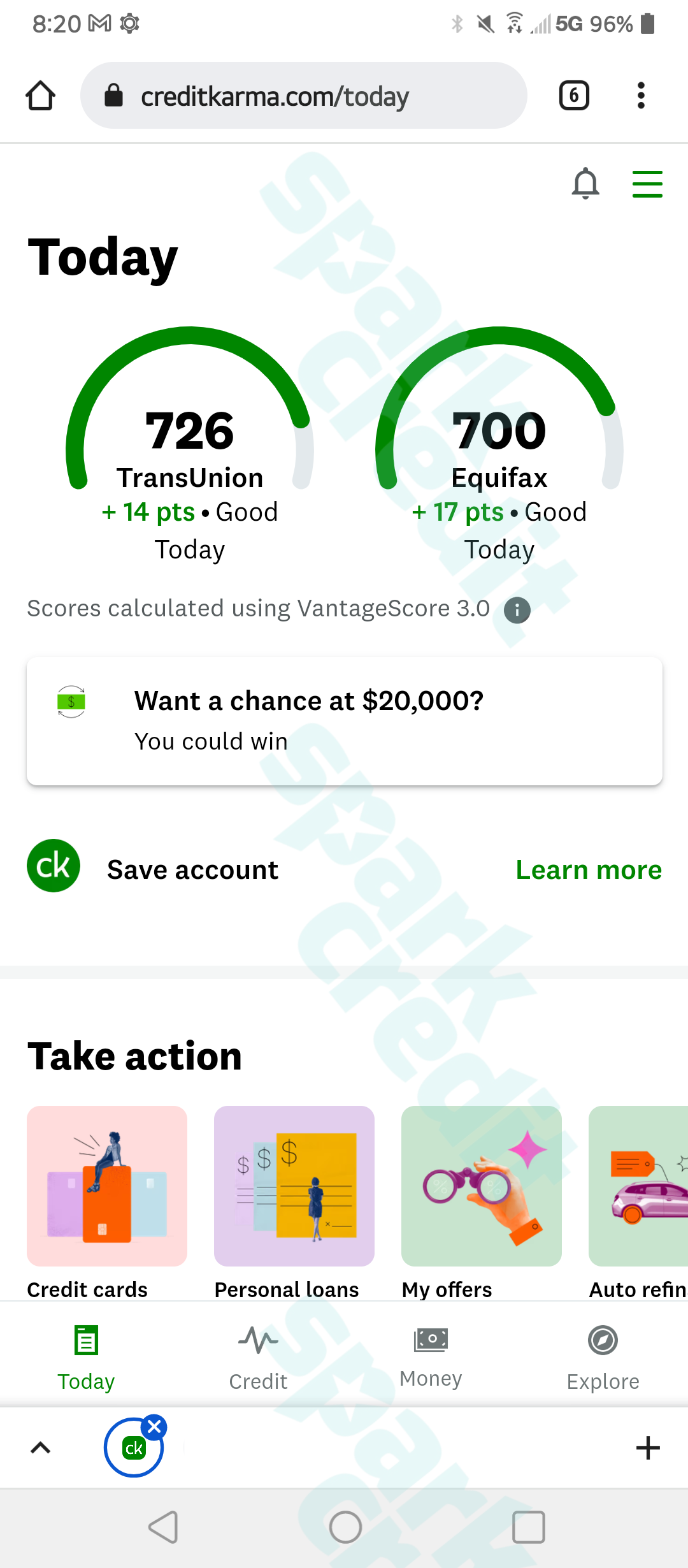

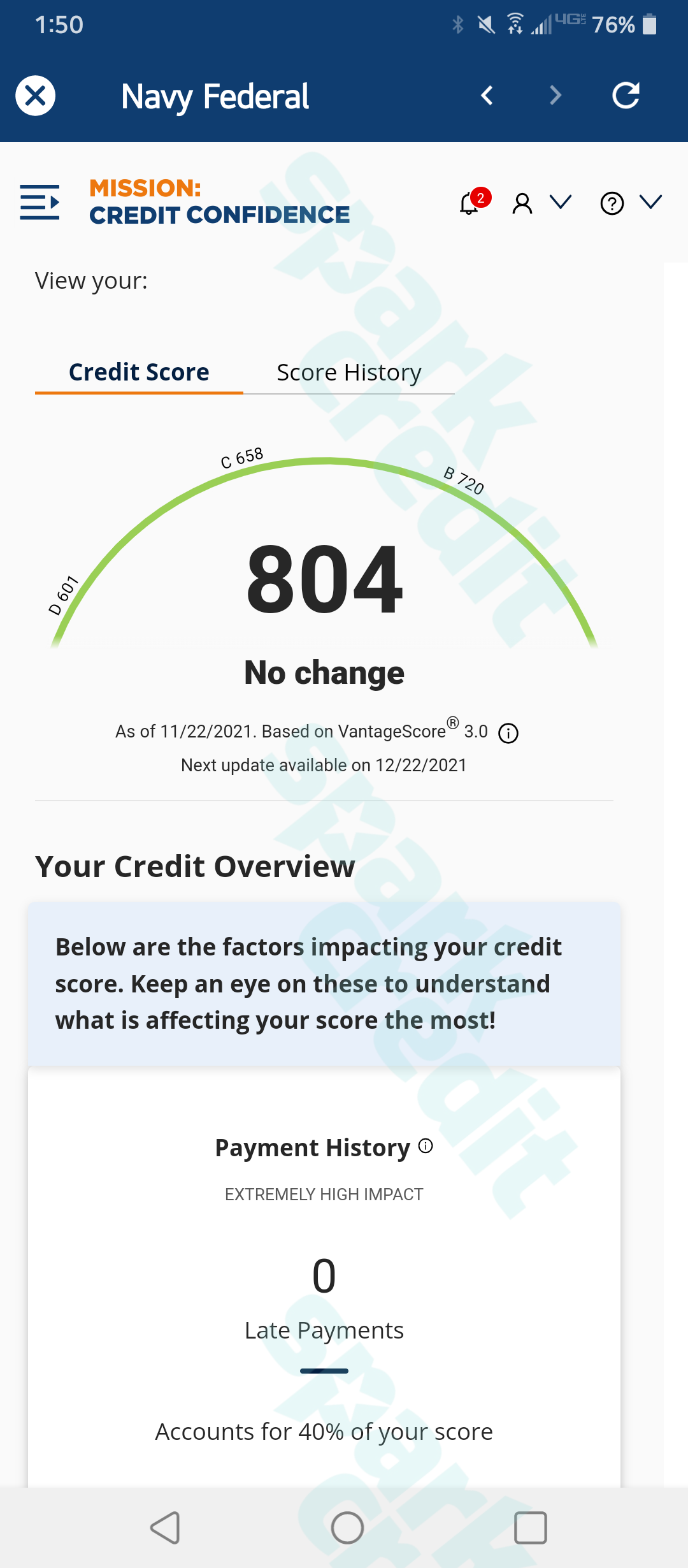

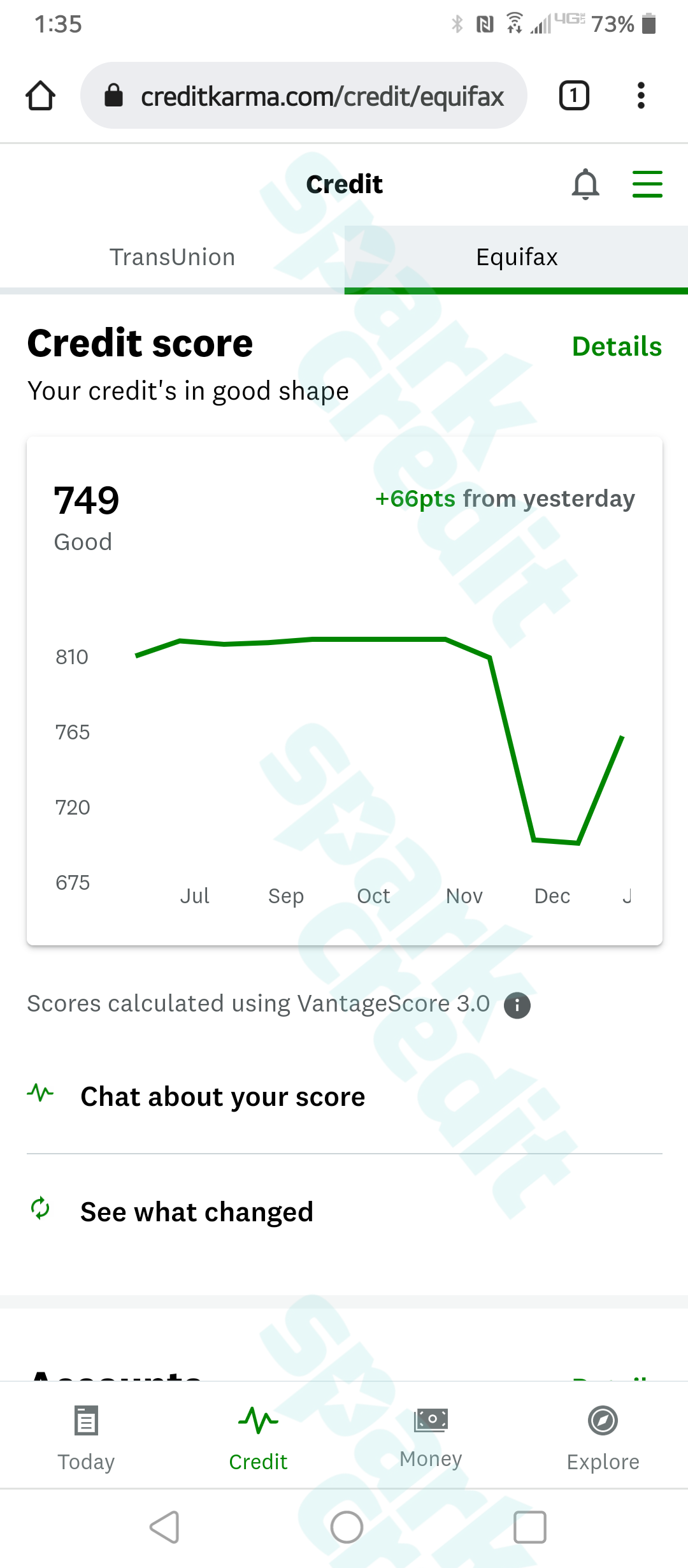

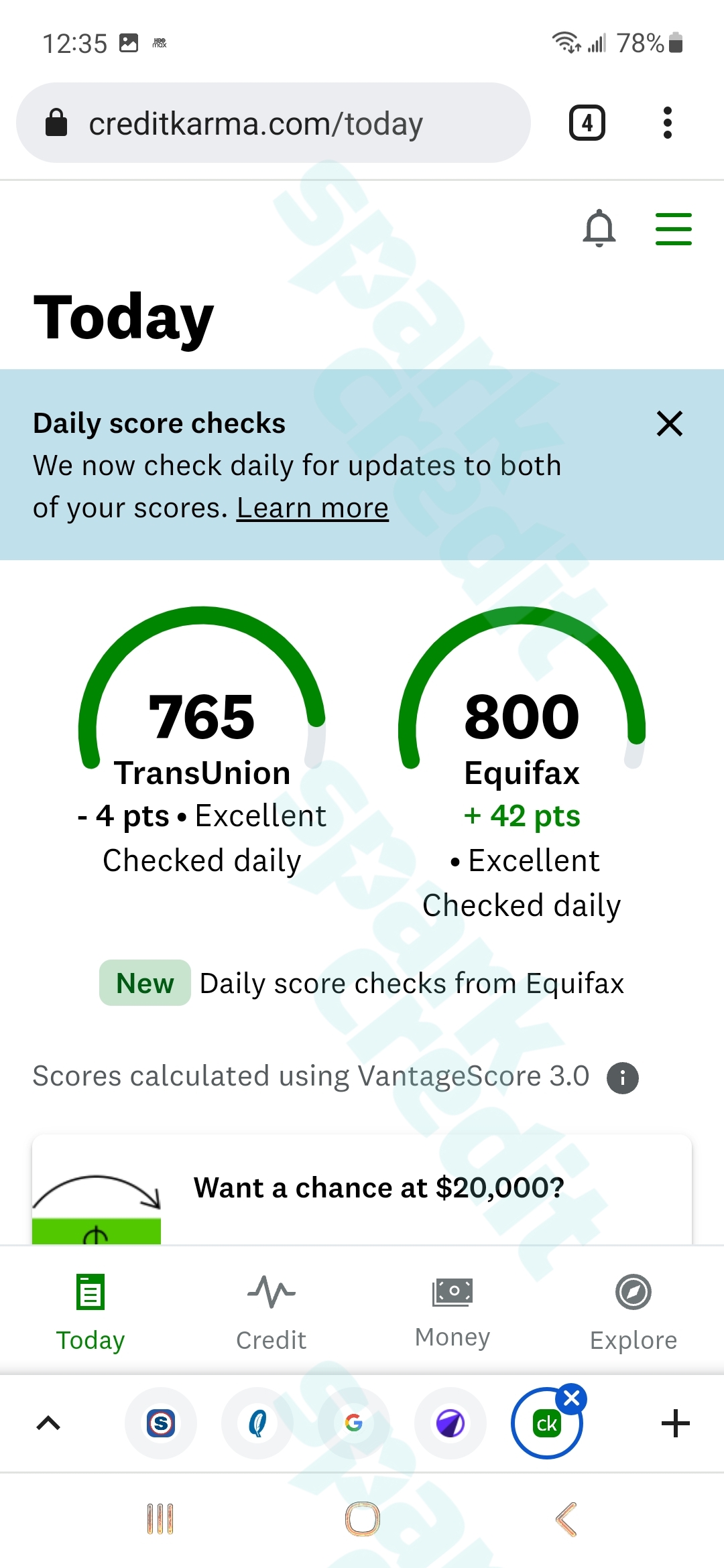

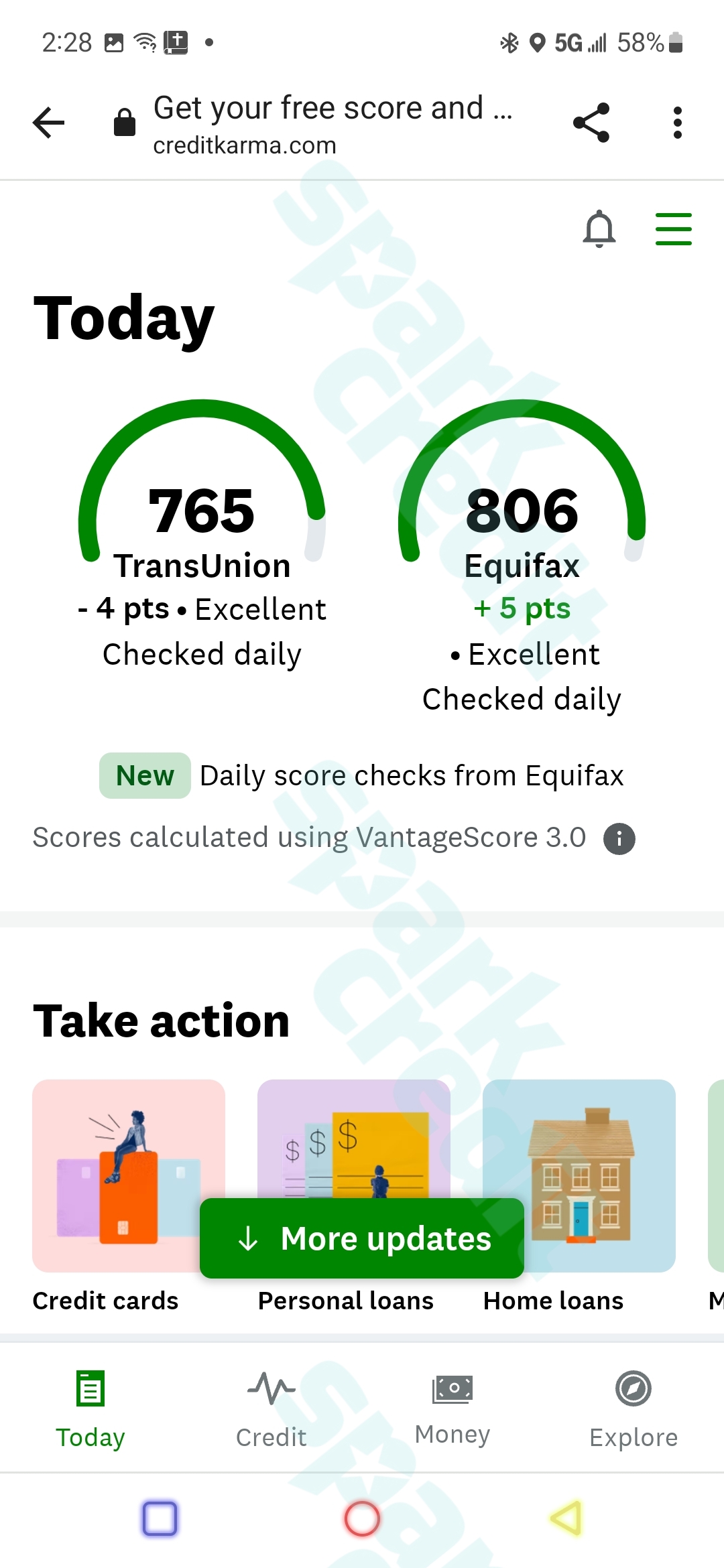

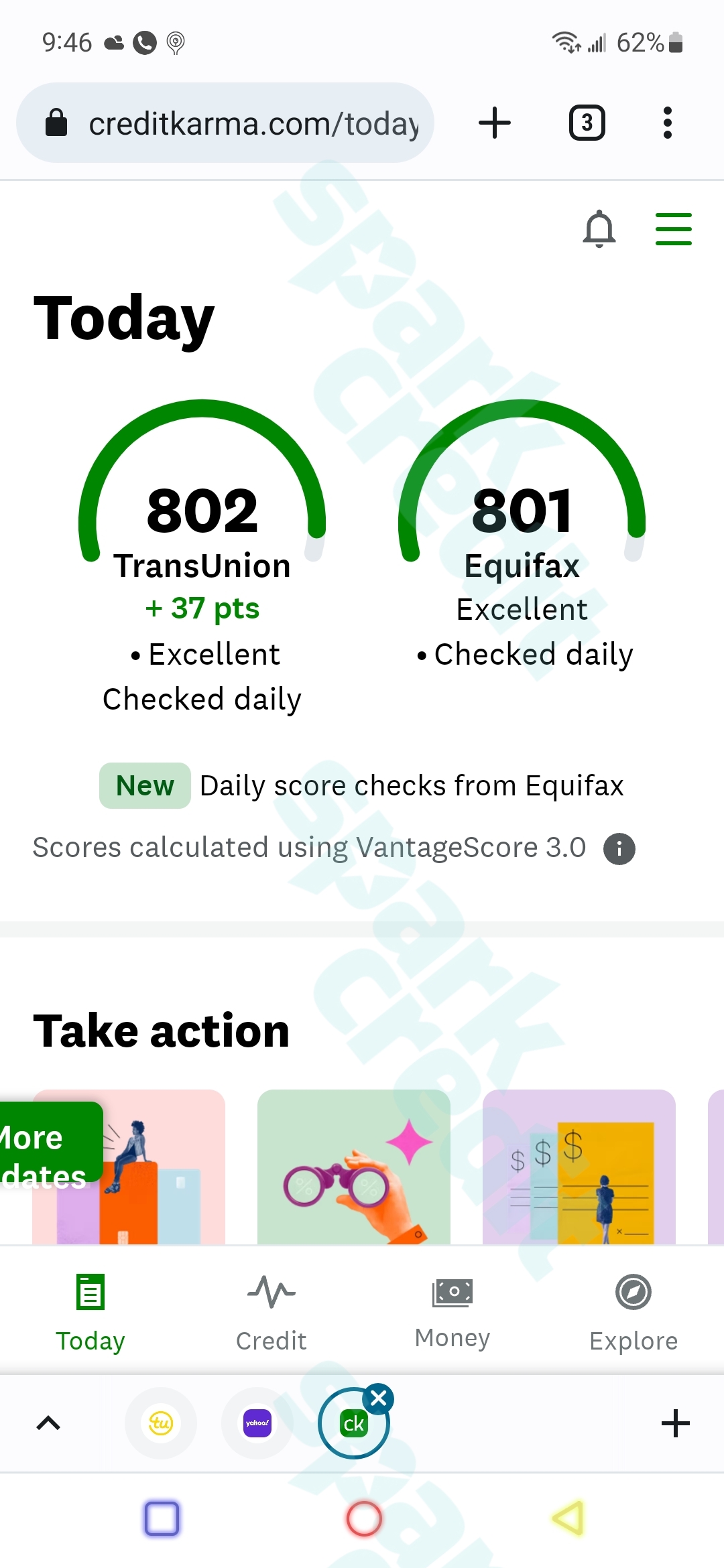

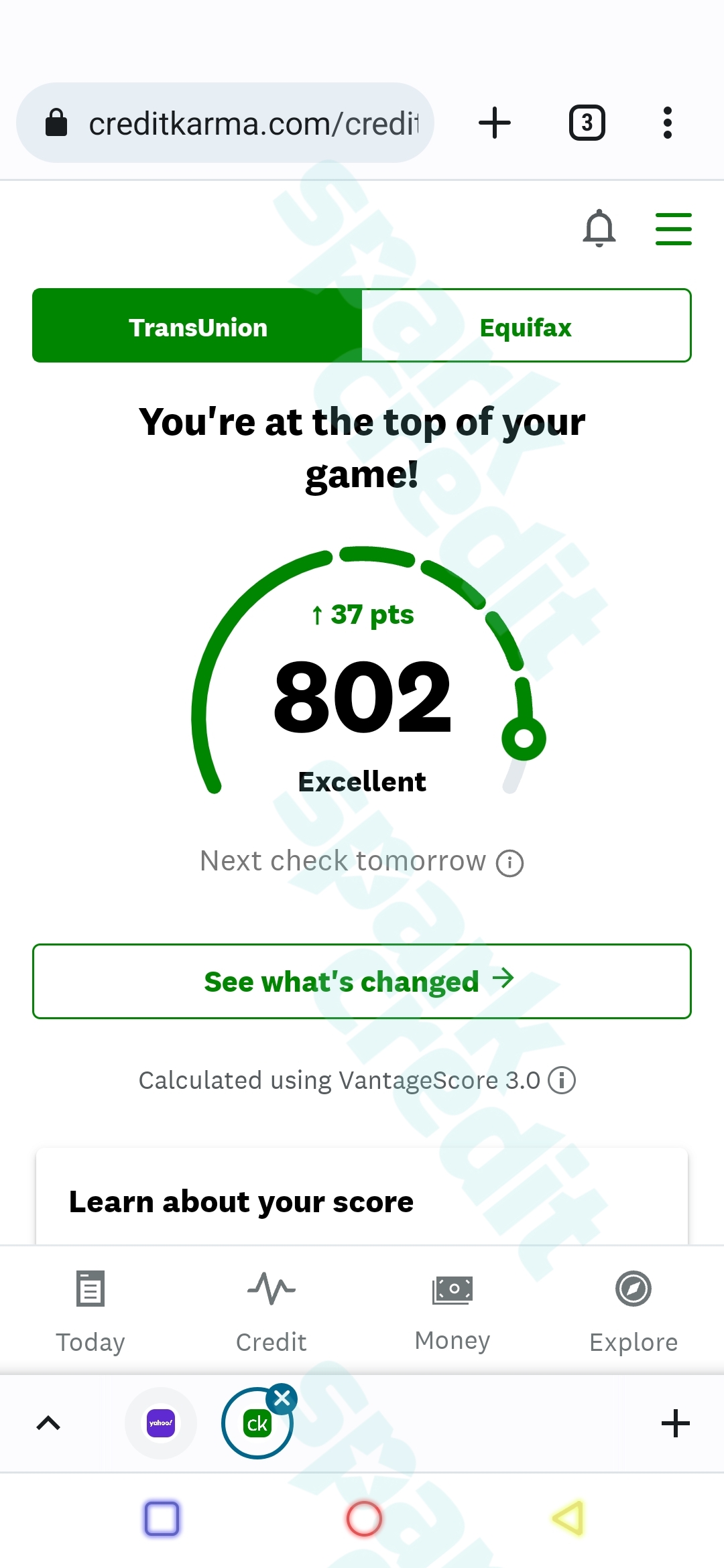

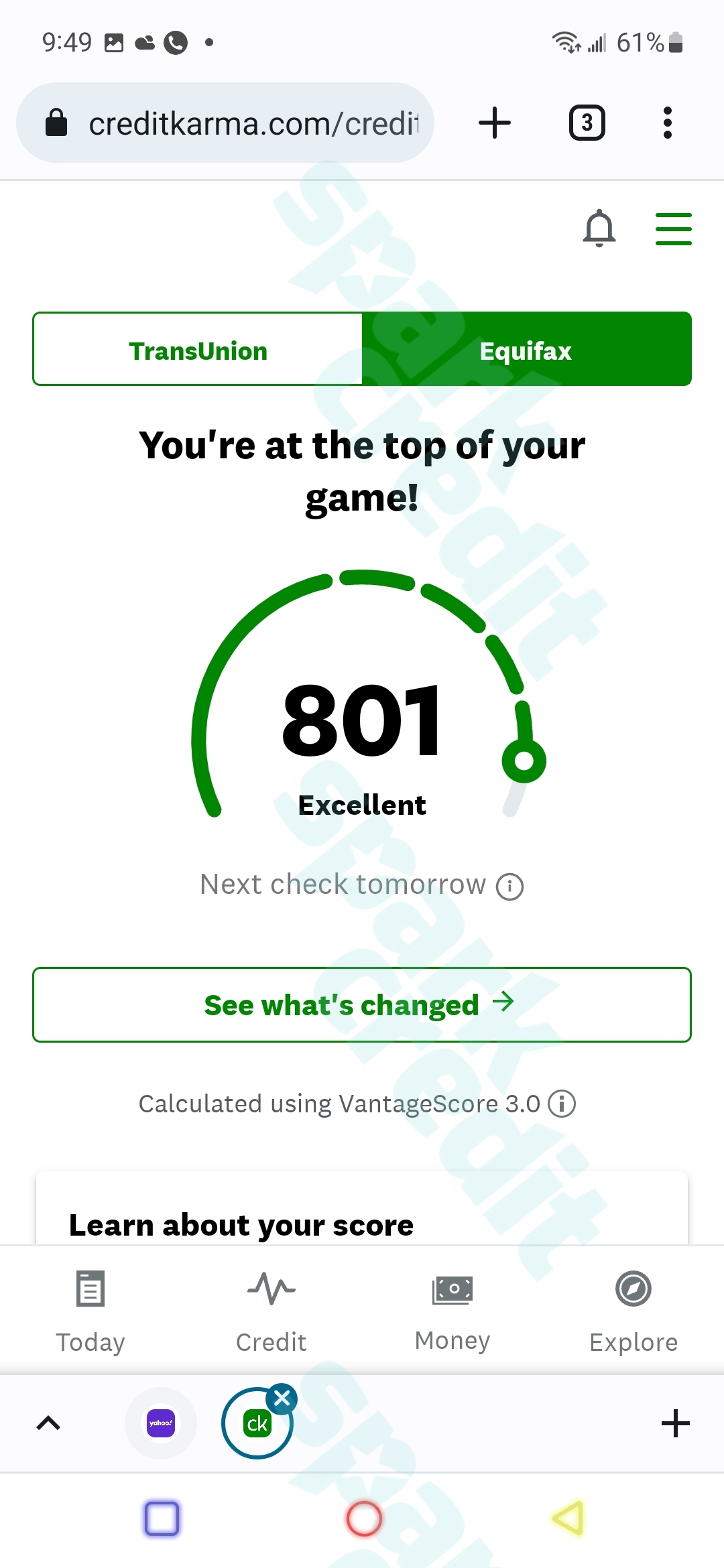

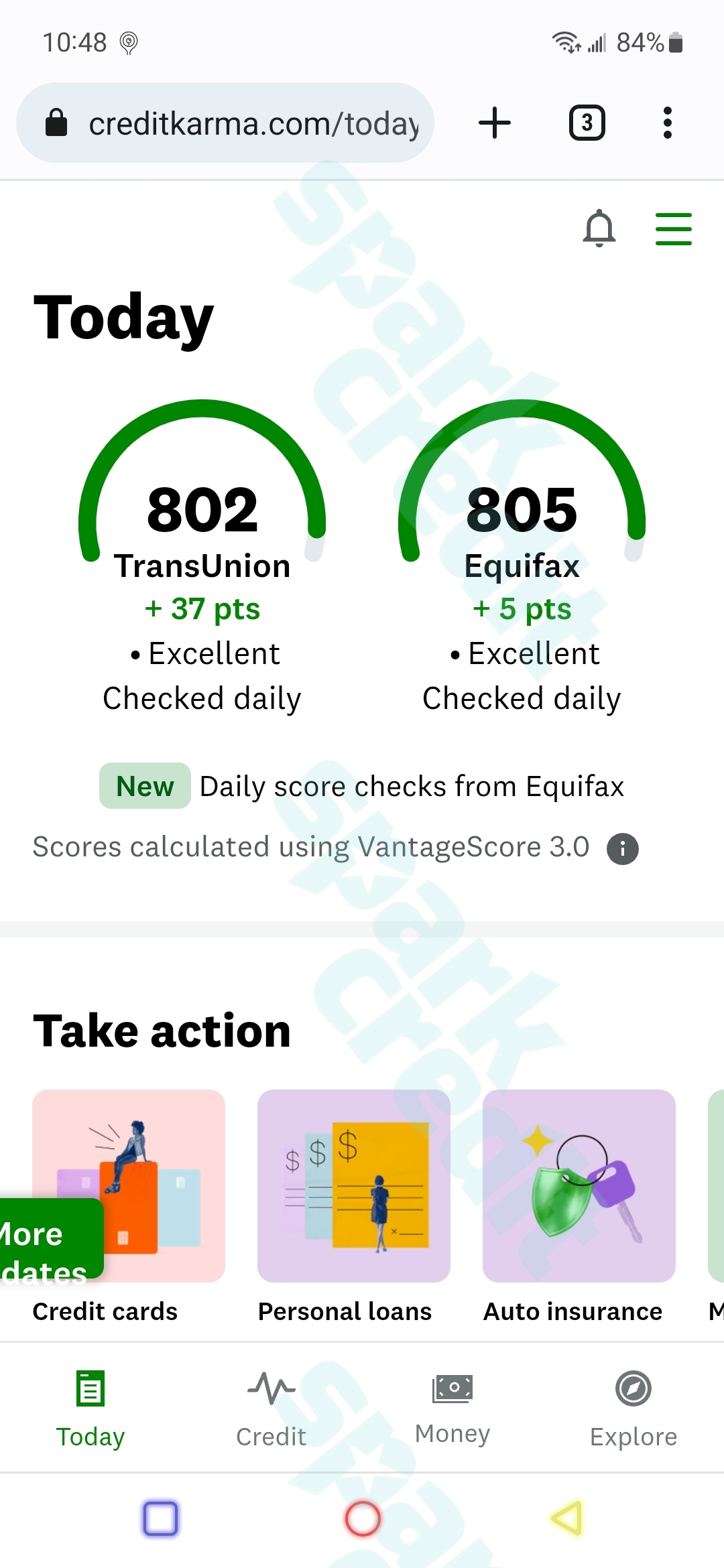

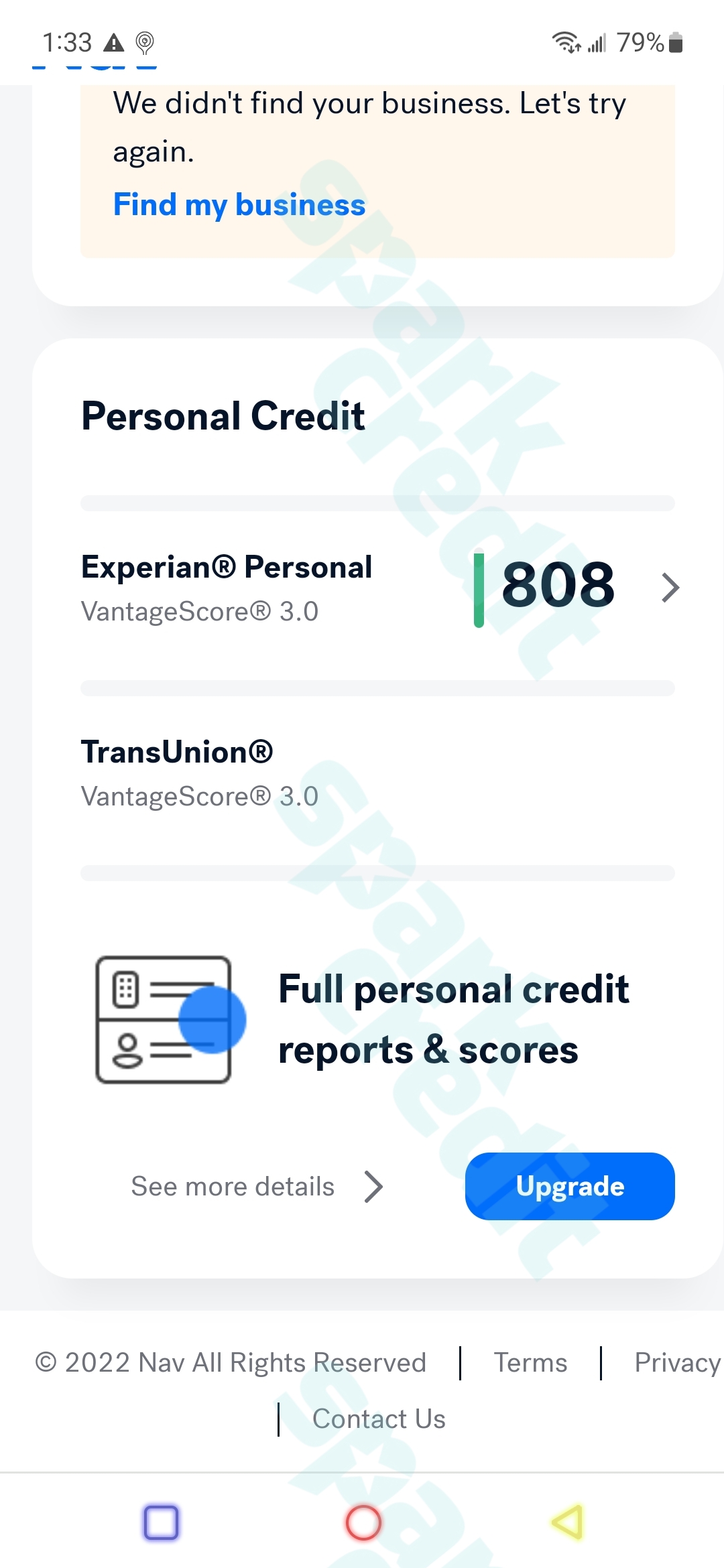

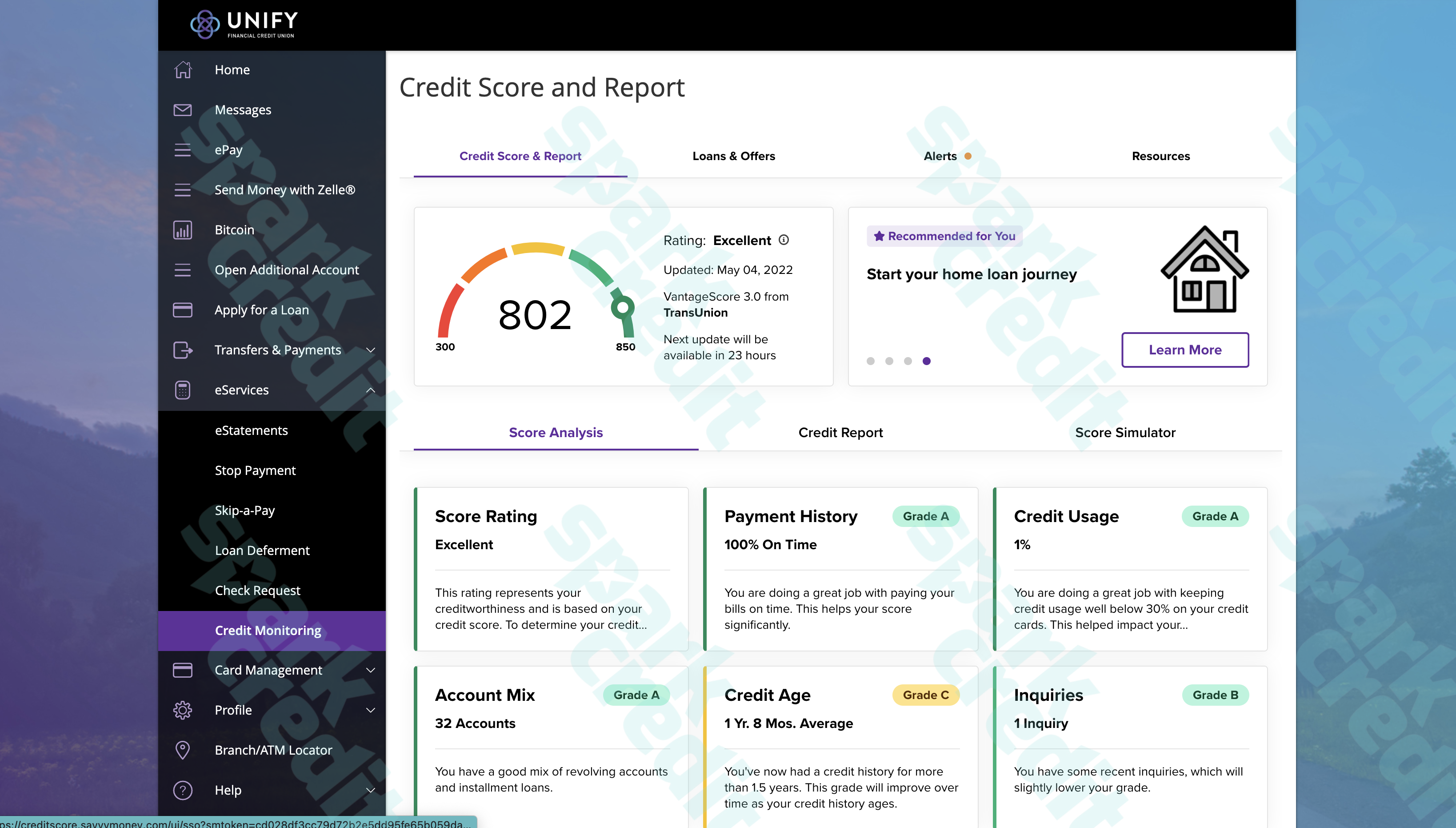

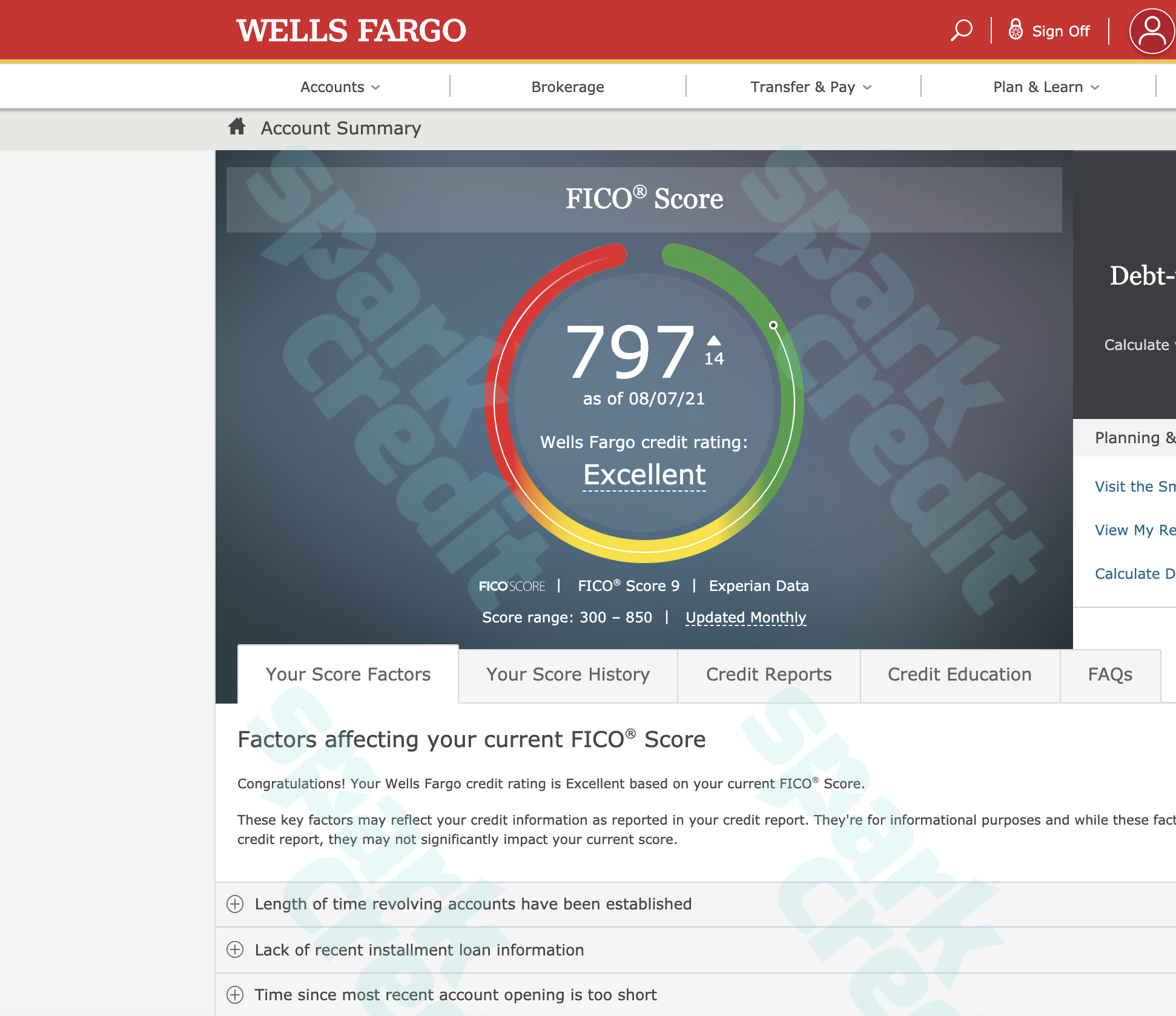

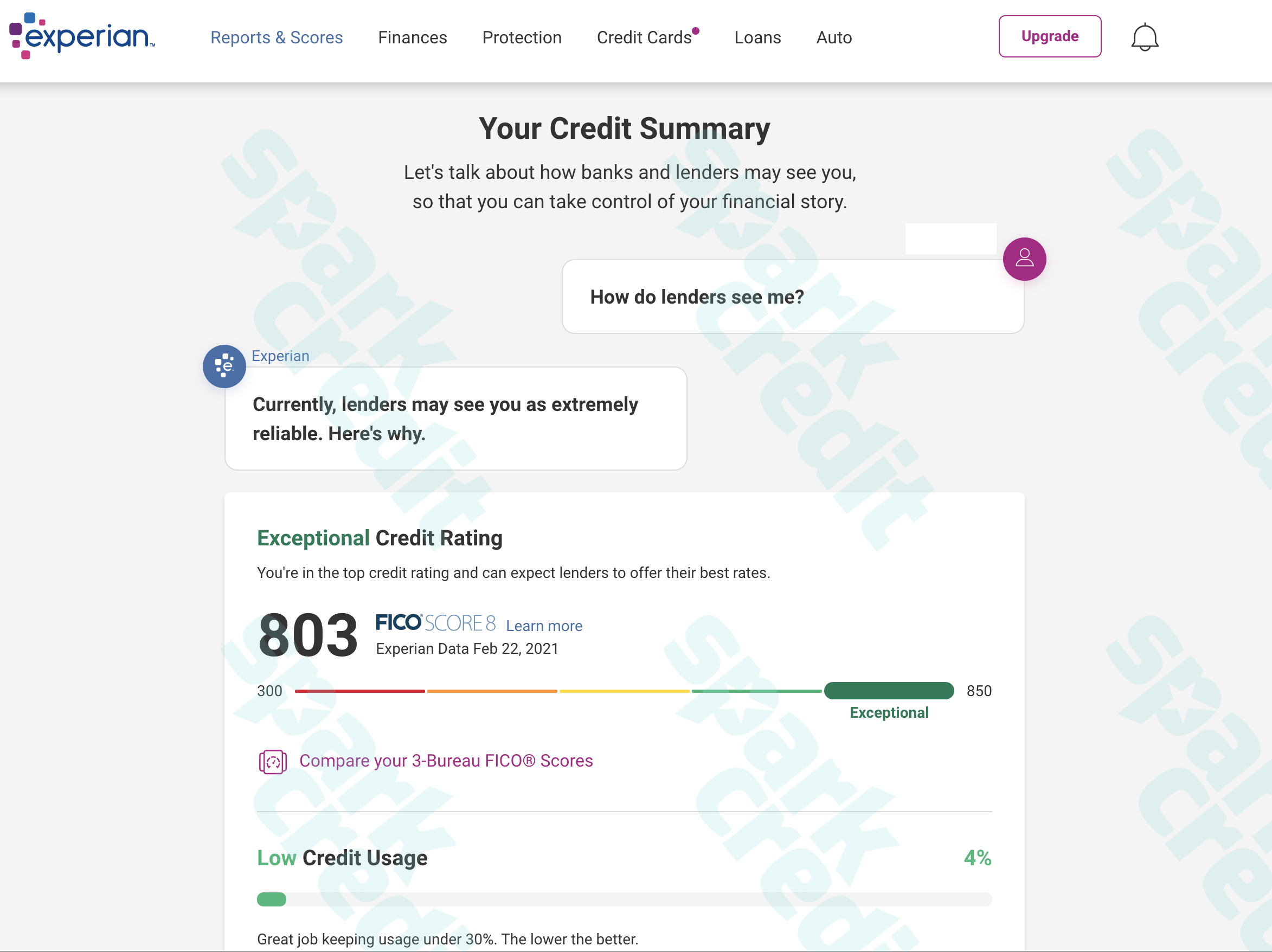

Credit Score

Credit wellness helps to strengthen the community

Do you want to increase your credit score?

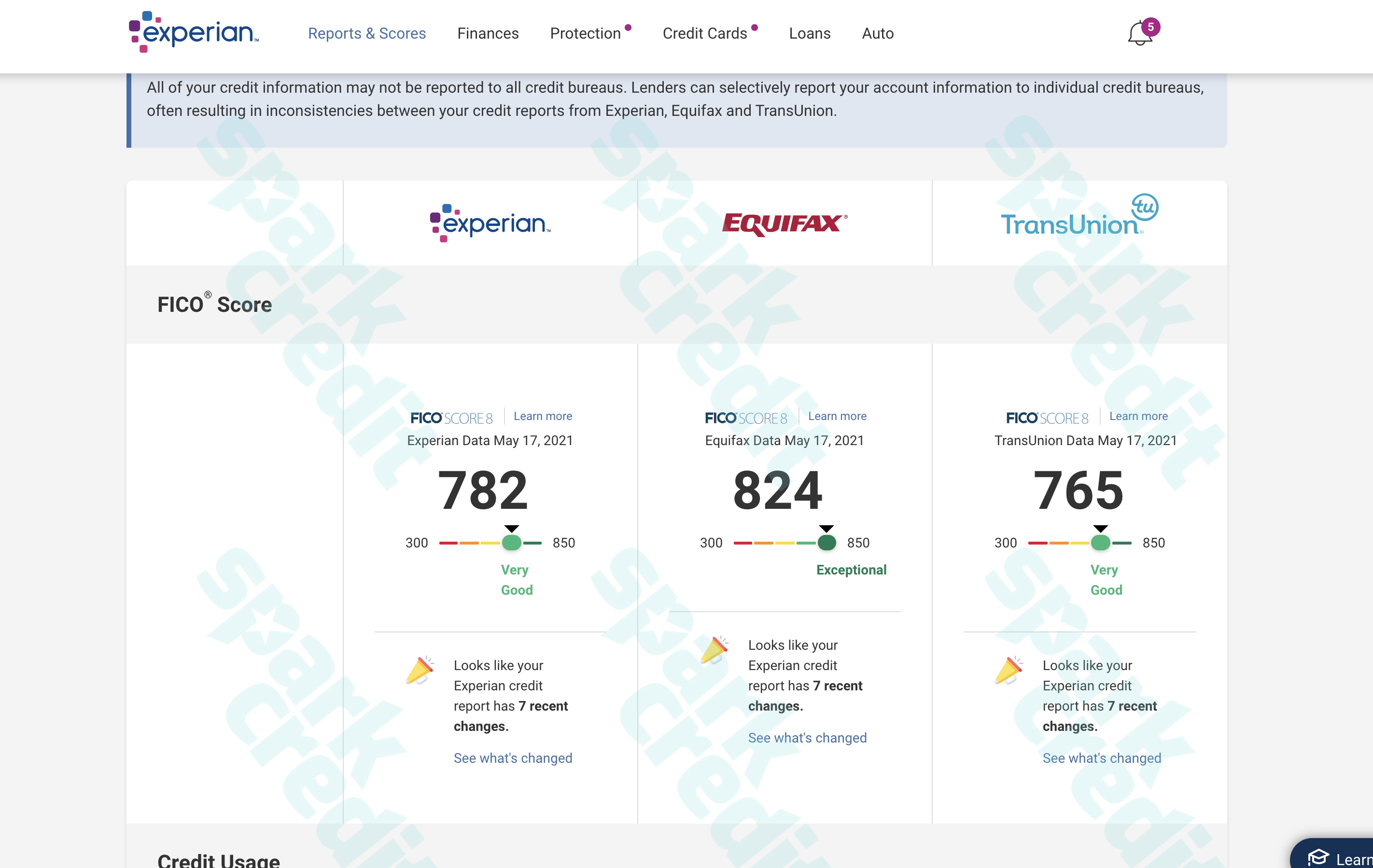

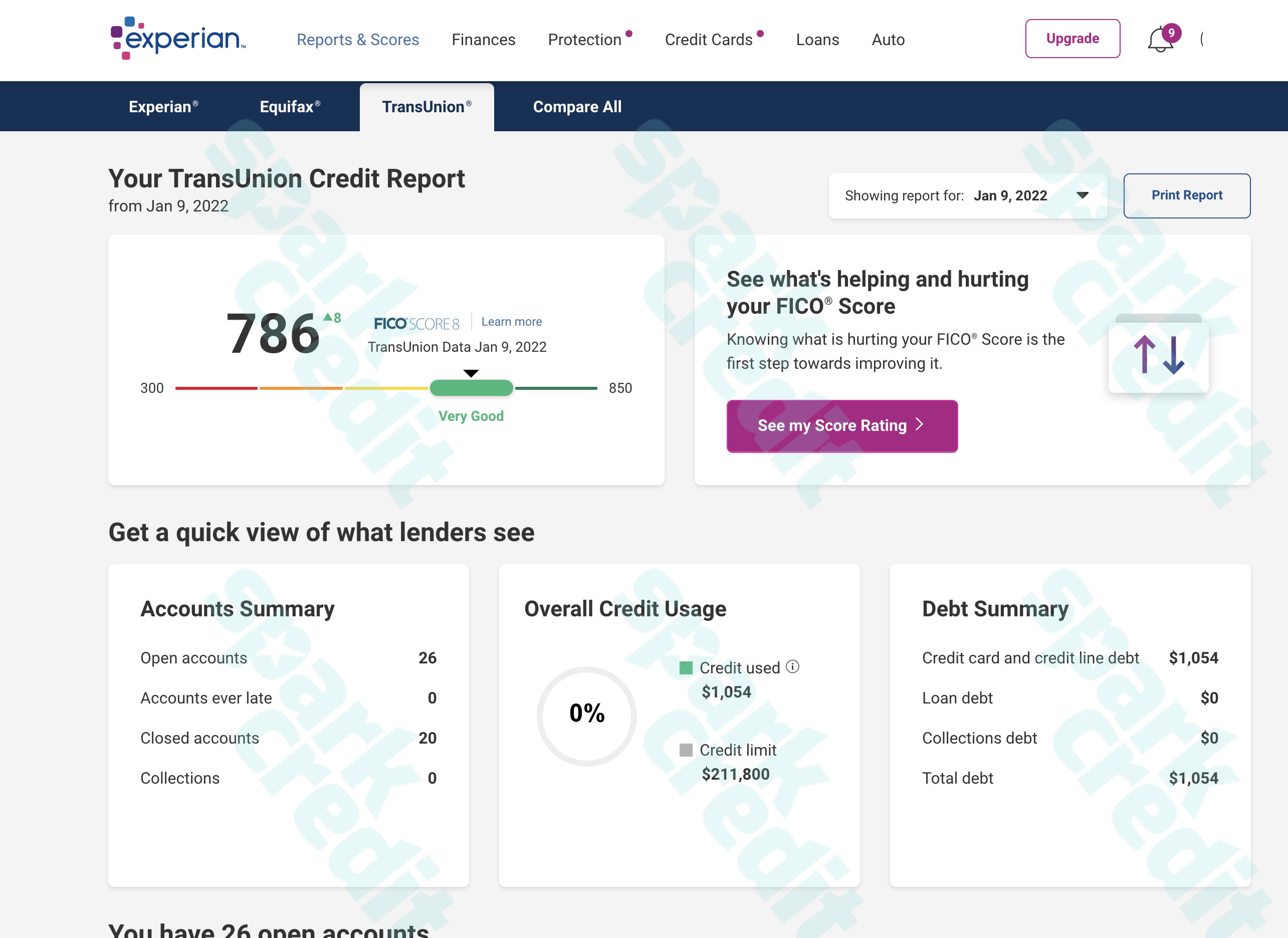

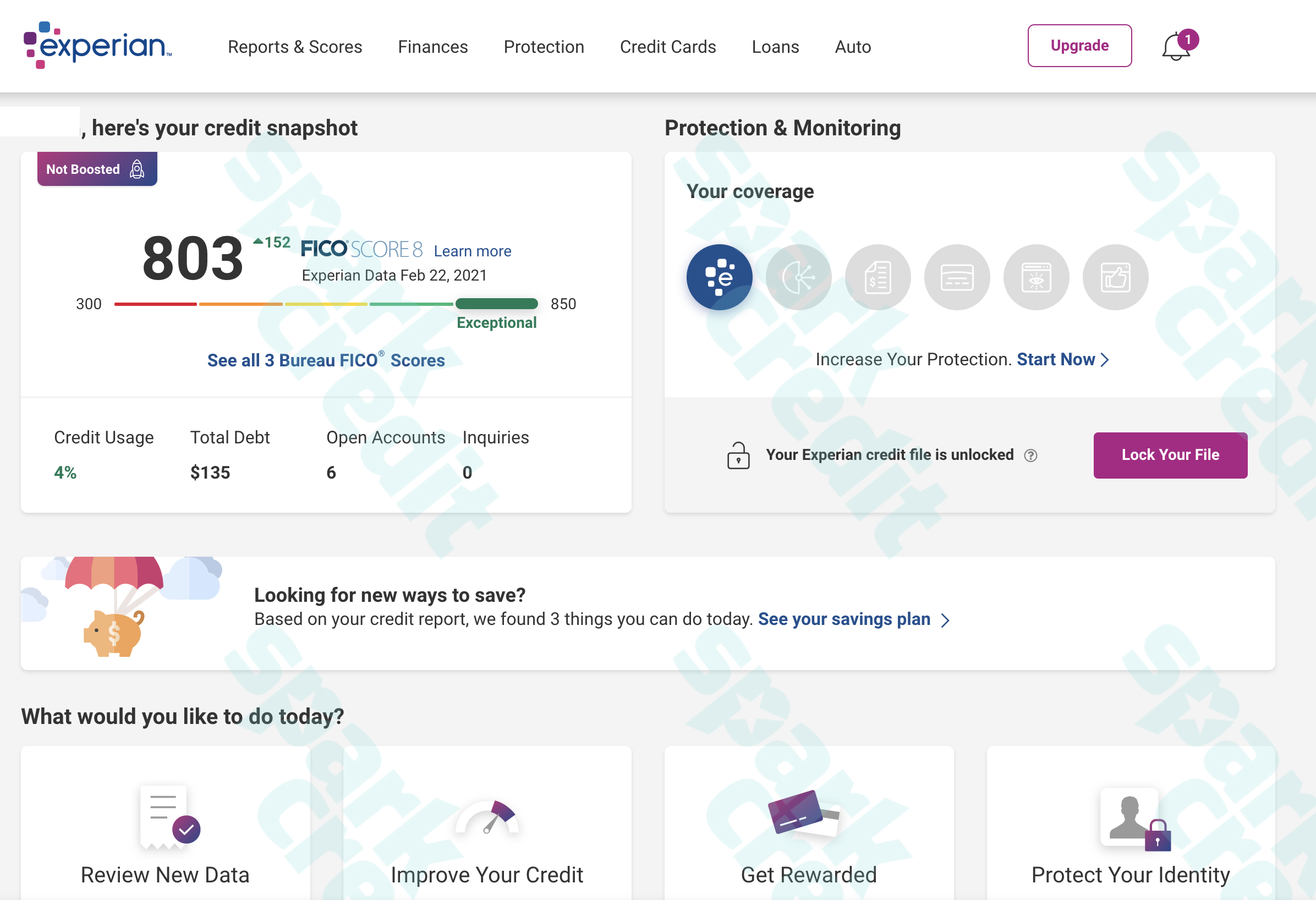

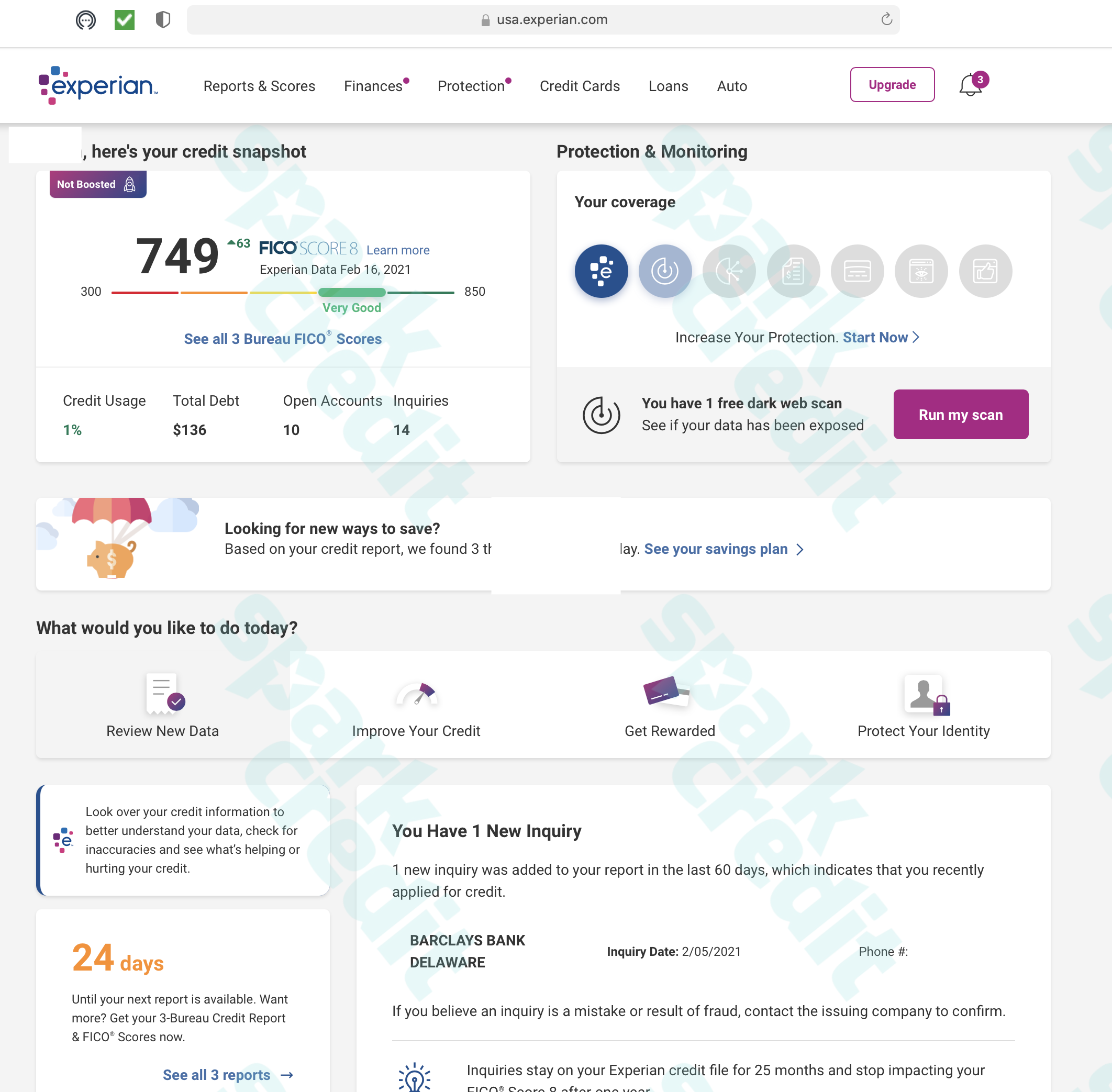

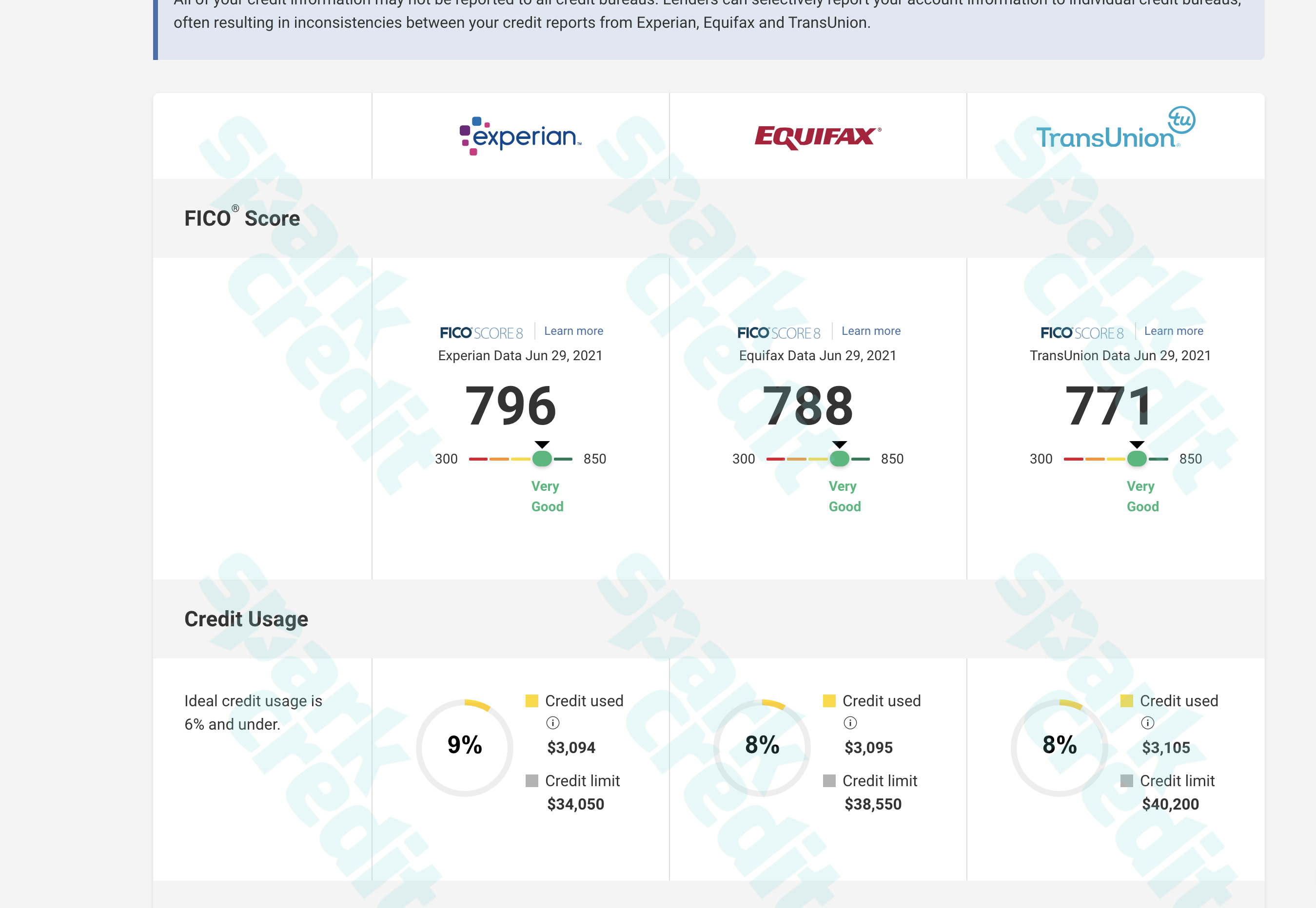

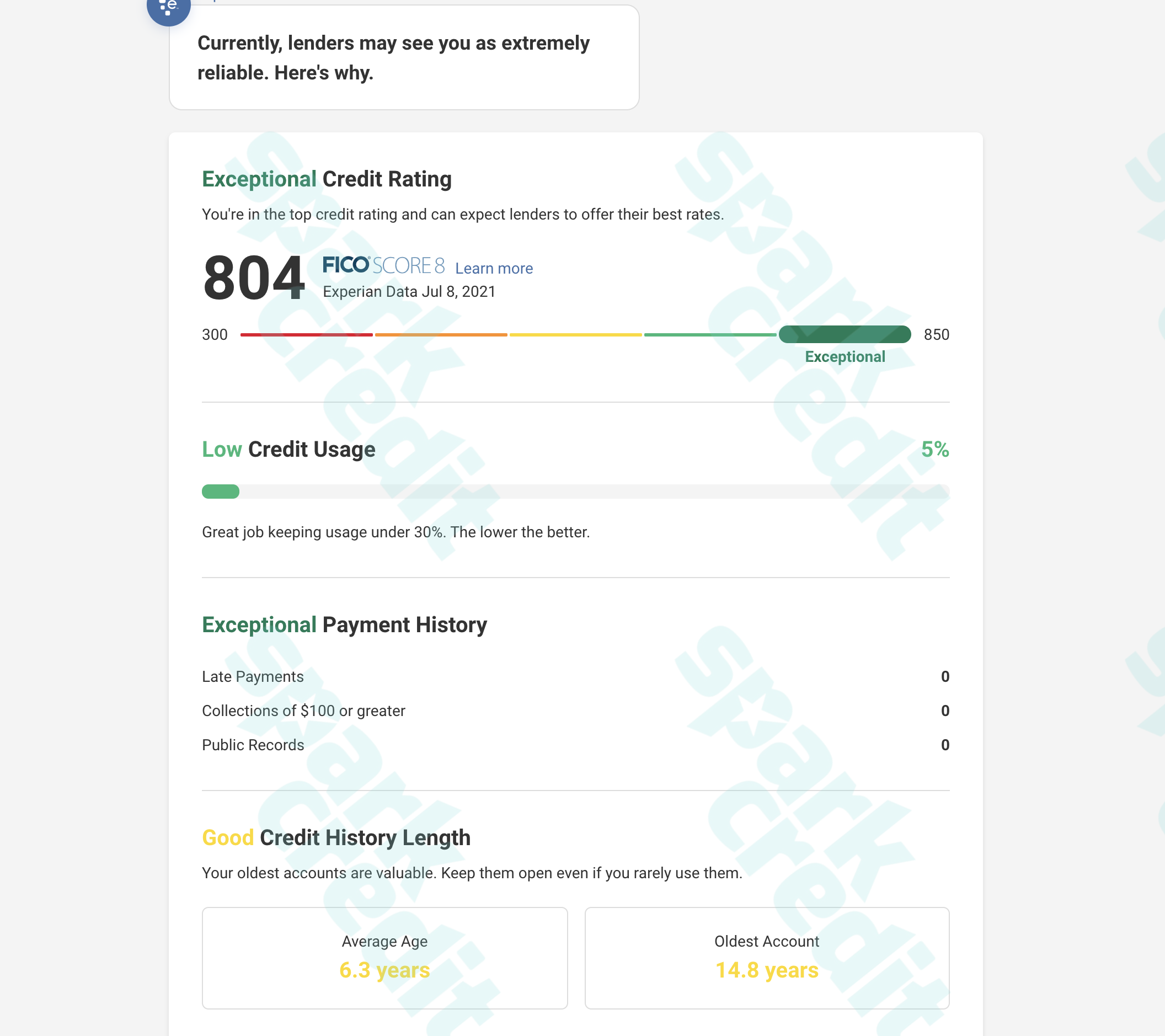

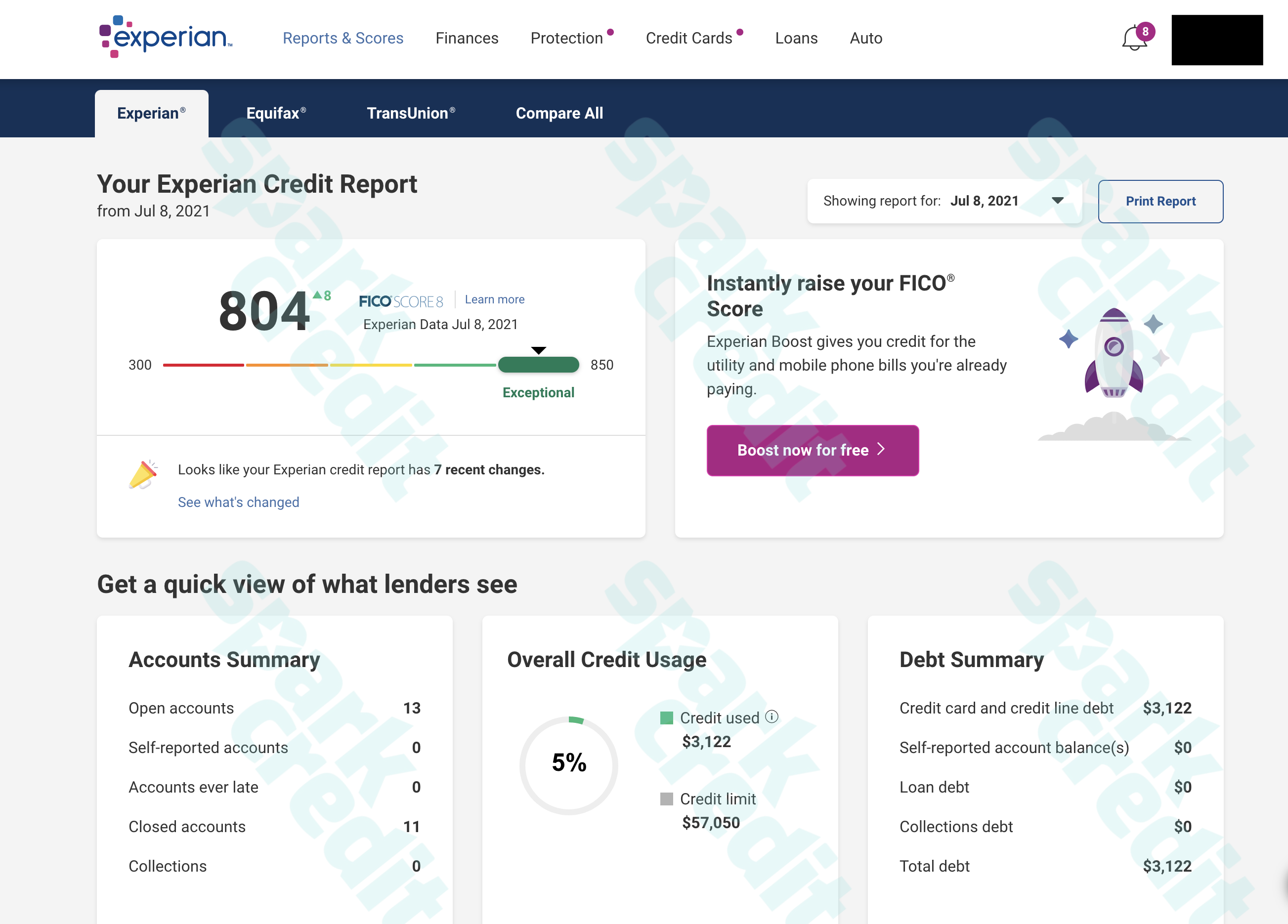

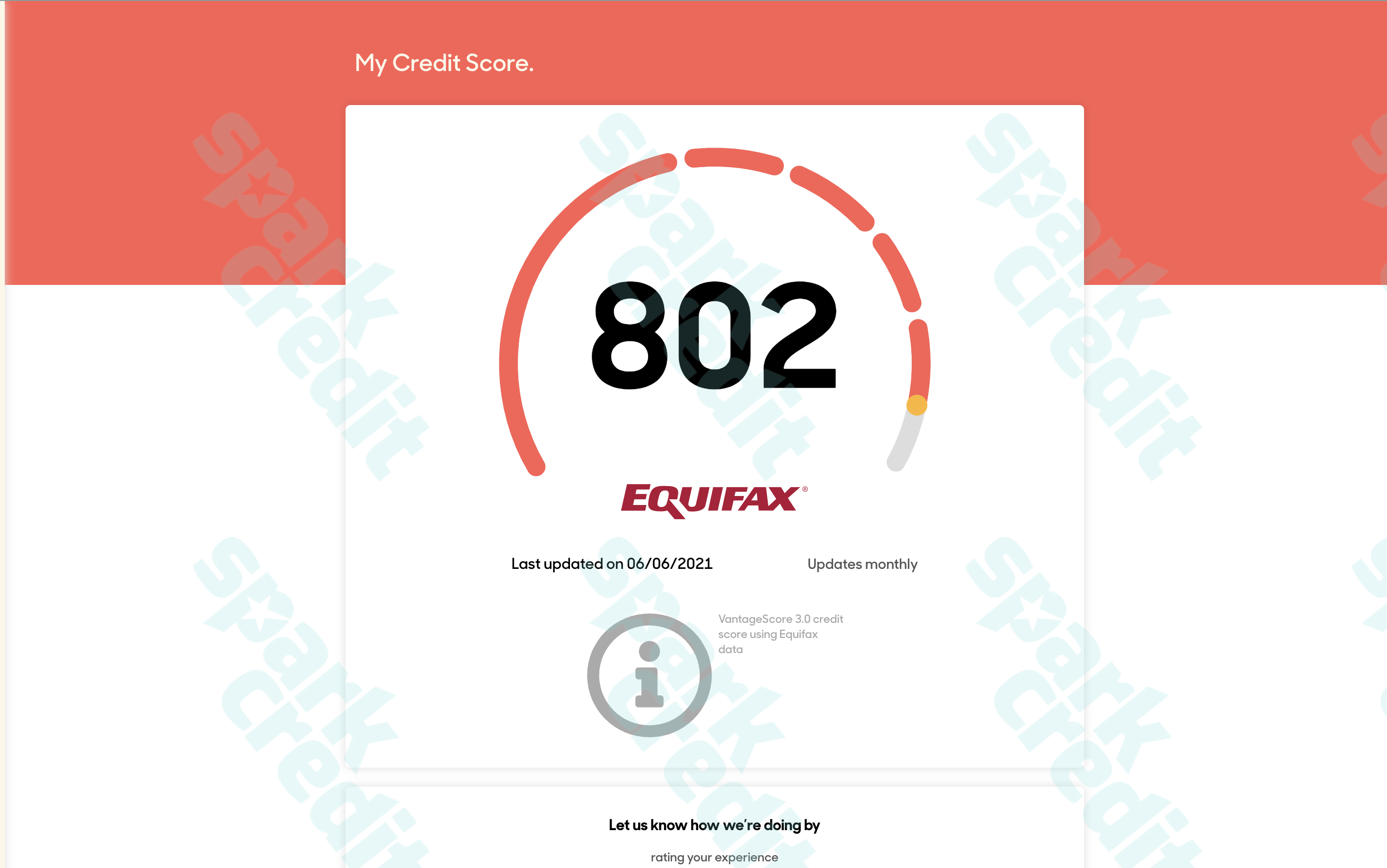

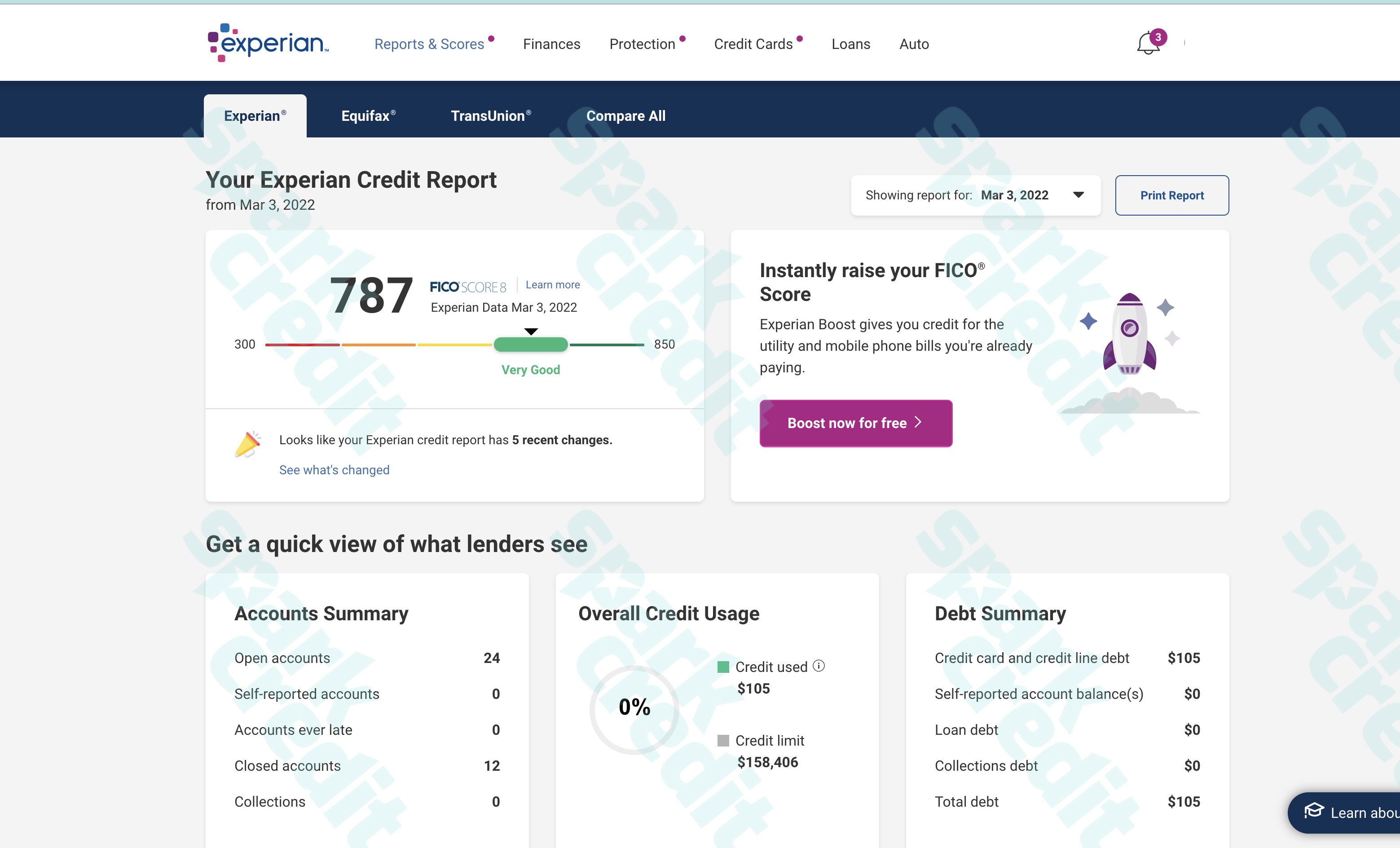

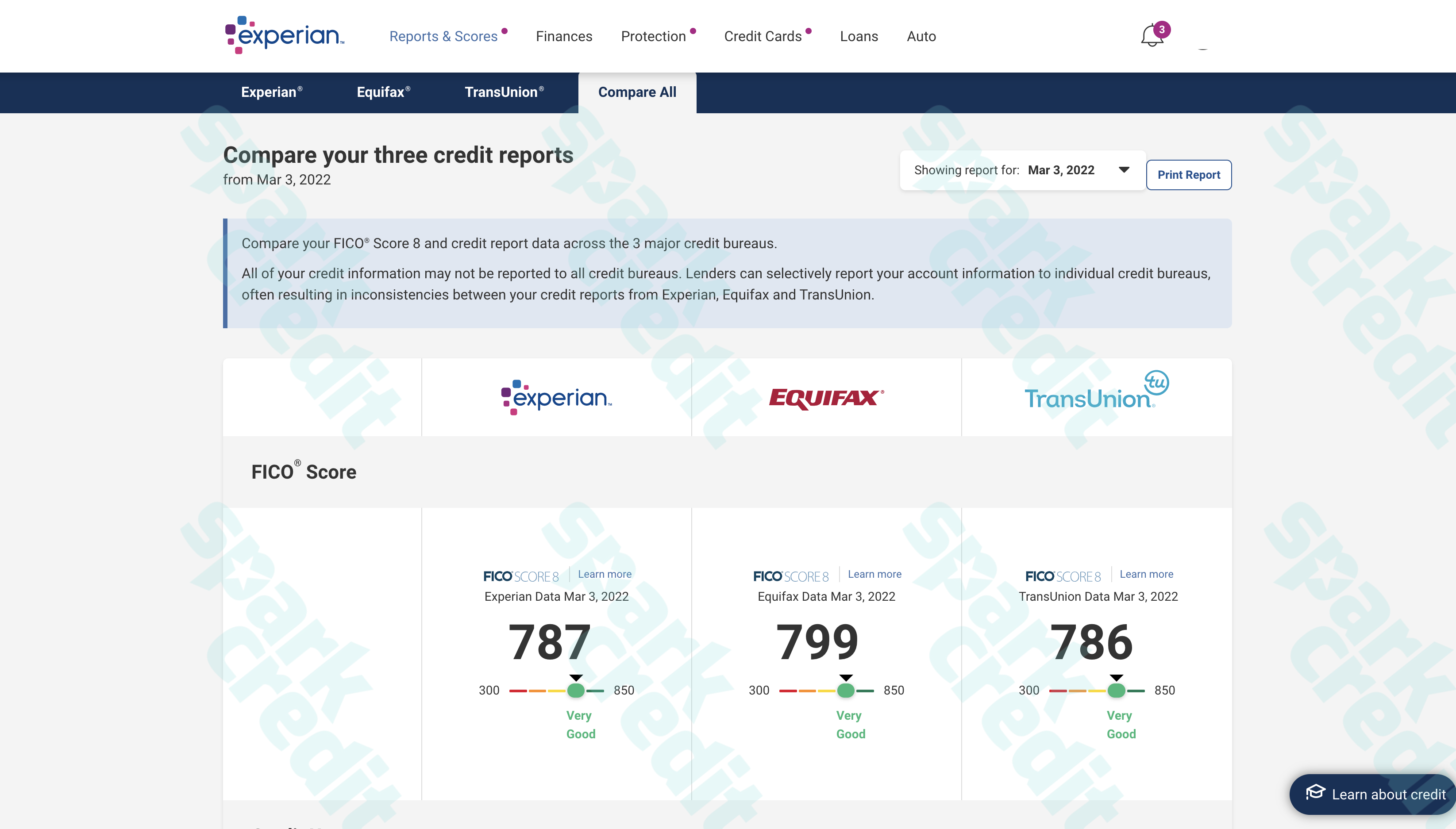

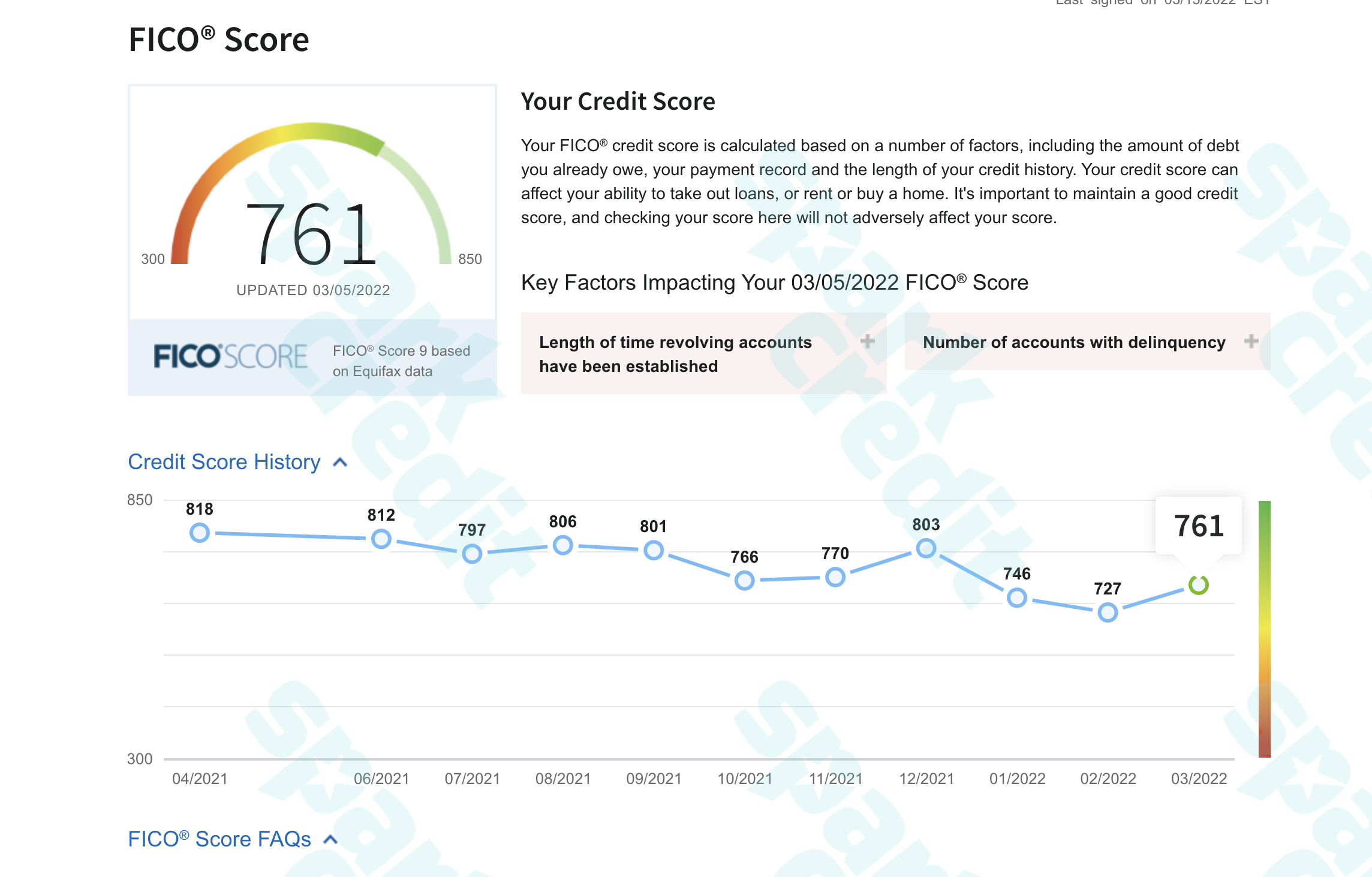

A credit score, calculated using credit reports’ details, measures an individual’s creditworthiness. Typically, a credit score falls between 300 and 850, with the lower the score and the lower the perceived risk you provide to lenders. Your credit score indicates your credit risk and helps lenders decide to grant you credit, the conditions they present, or the interest rate you pay. You may gain a high score in various ways, including securing a loan, renting an apartment, or negotiating a reduced insurance premium. Credit bureaus use credit-reporting data to determine your credit score. The following details will influence your score:

- Financial History

- Paid Balances

- History of Credit used

- Inquiries about opening new credit accounts

- Credit account types (car loans, mortgages, and credit cards)

Get Ready to build your credit score

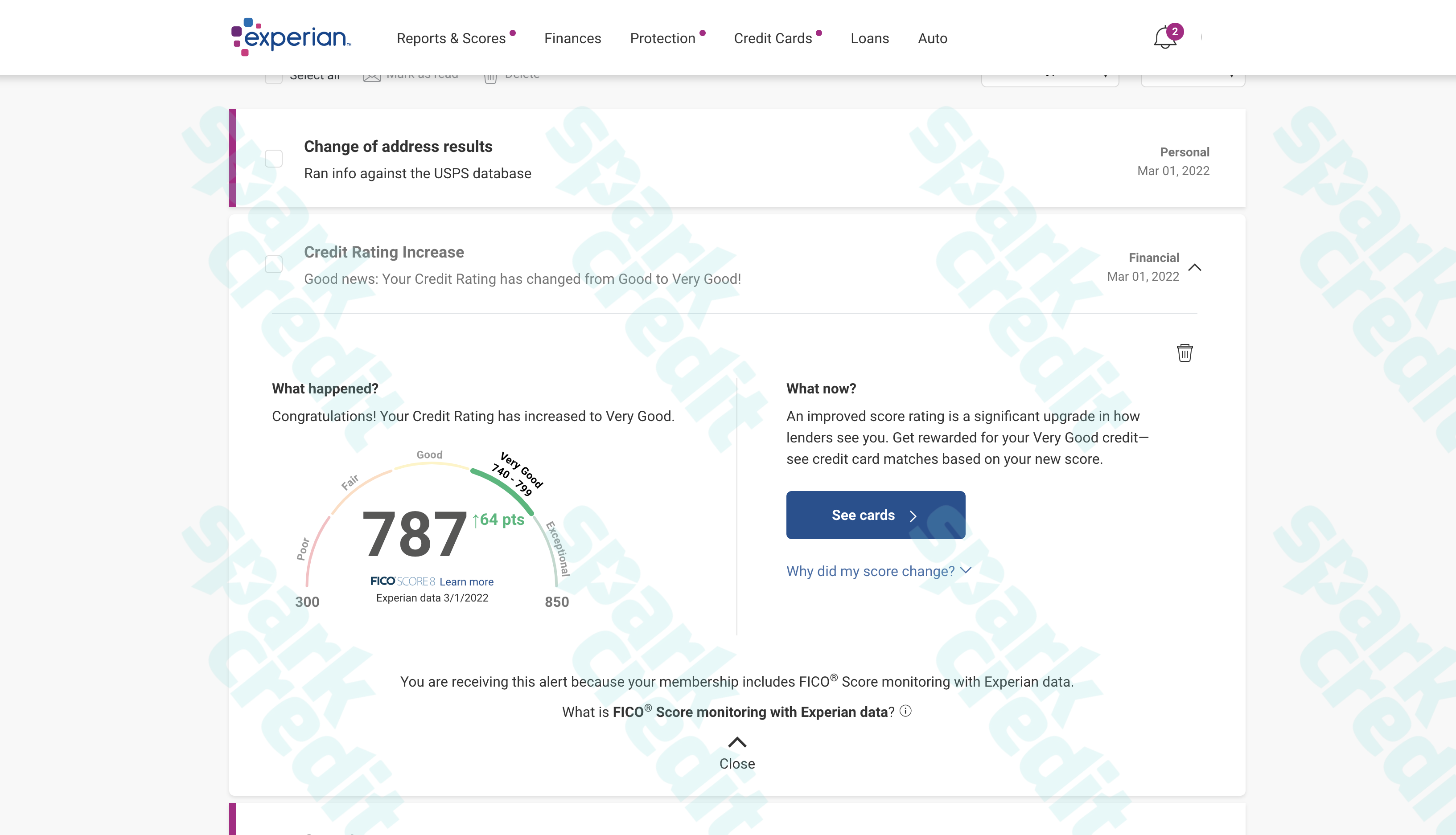

Spark Credit manages your credit repair scores that improve your credit status. Over the past decade, we’ve assisted millions of people in accessing their credit reports, boosting their scores, and realizing their financial dreams. You’re up next, and we are one click away to help you save money on loans, credit cards, and your mortgage; we’ll review your credit score, credit history, and current debt.

Your credit reports make it easier for us to notice faults and analyze the variations in scores. Analyzing and repairing errors in your credit report may significantly influence your credit score. You can maintain accuracy in your credit report with our frequent updates.

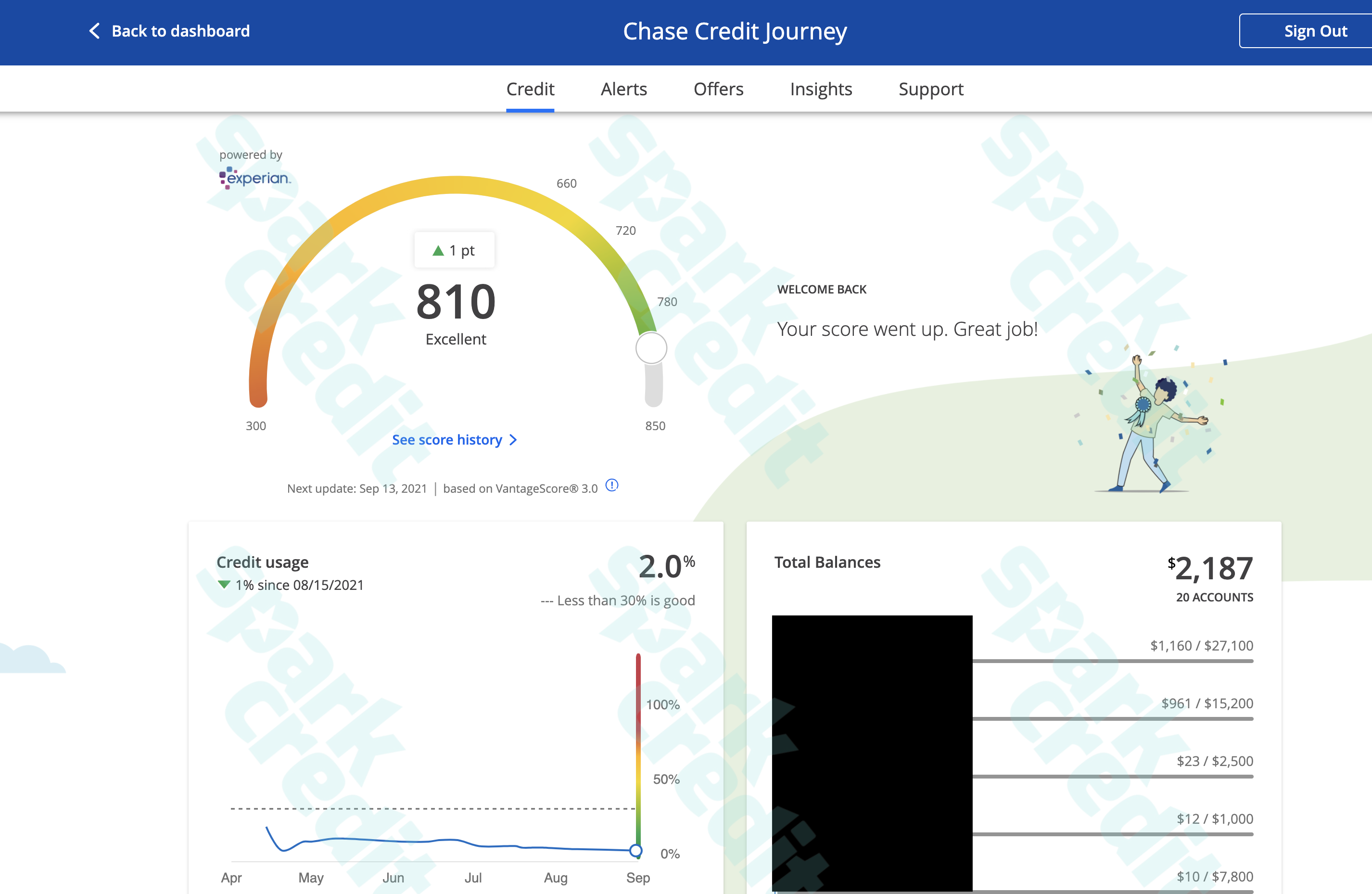

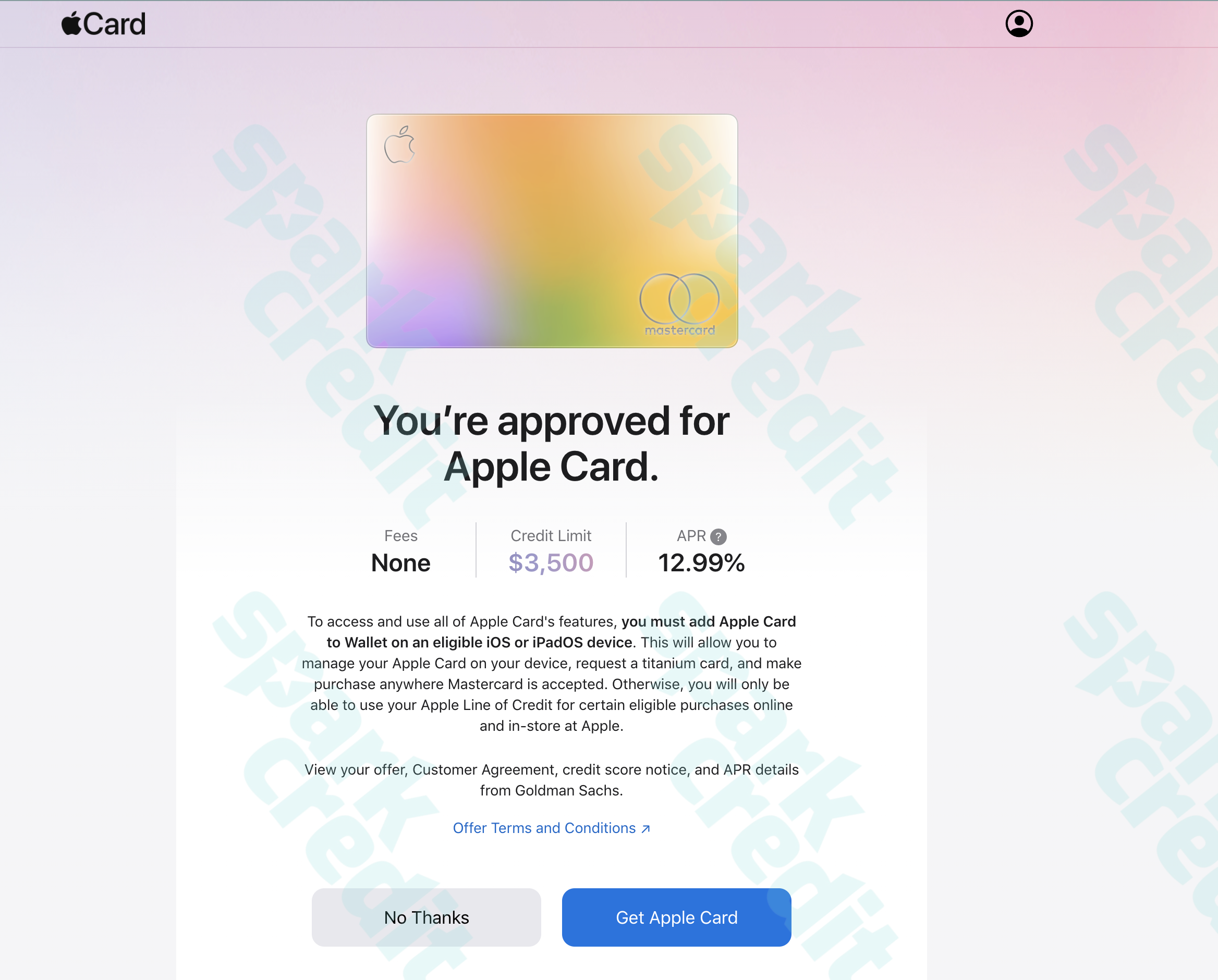

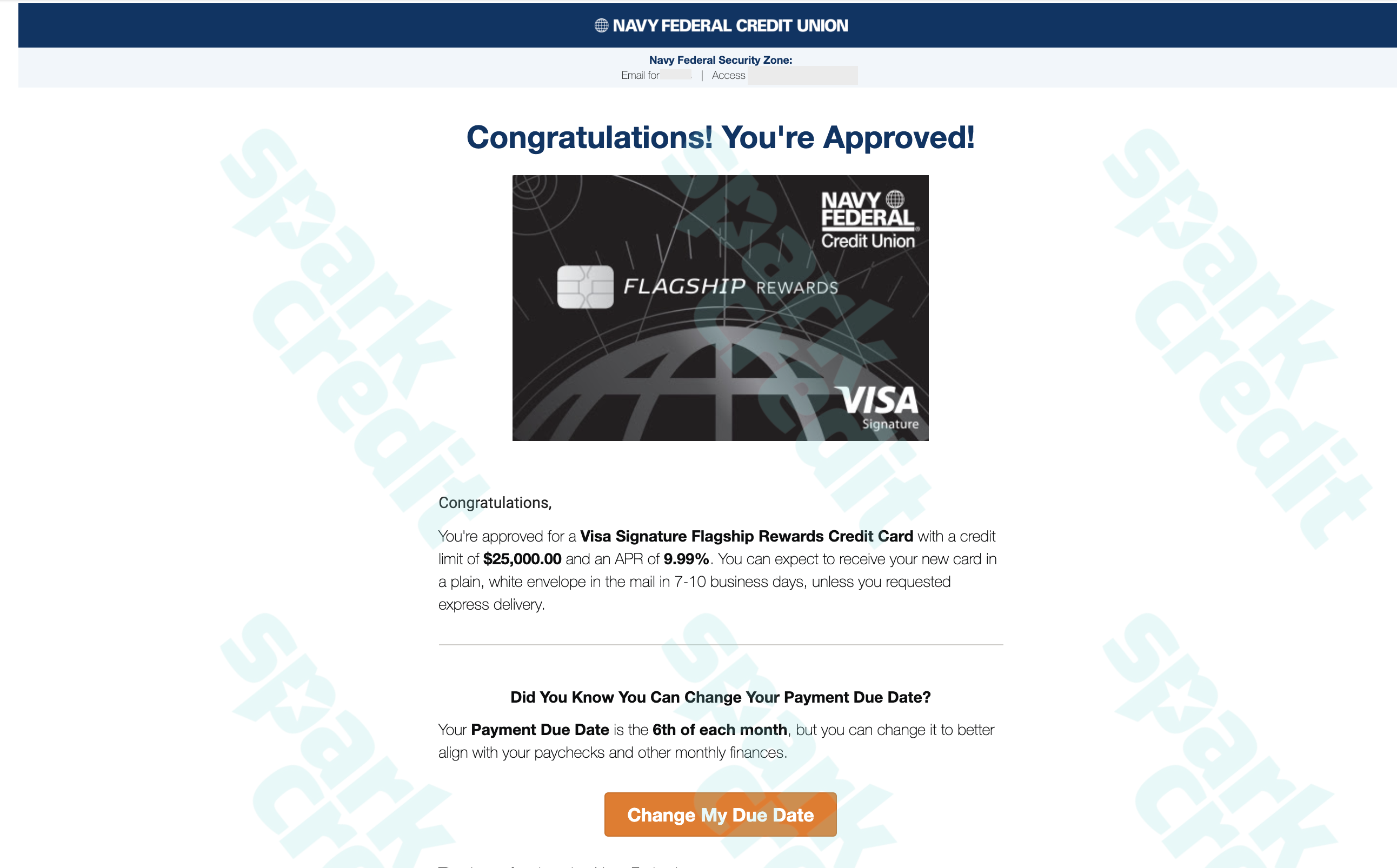

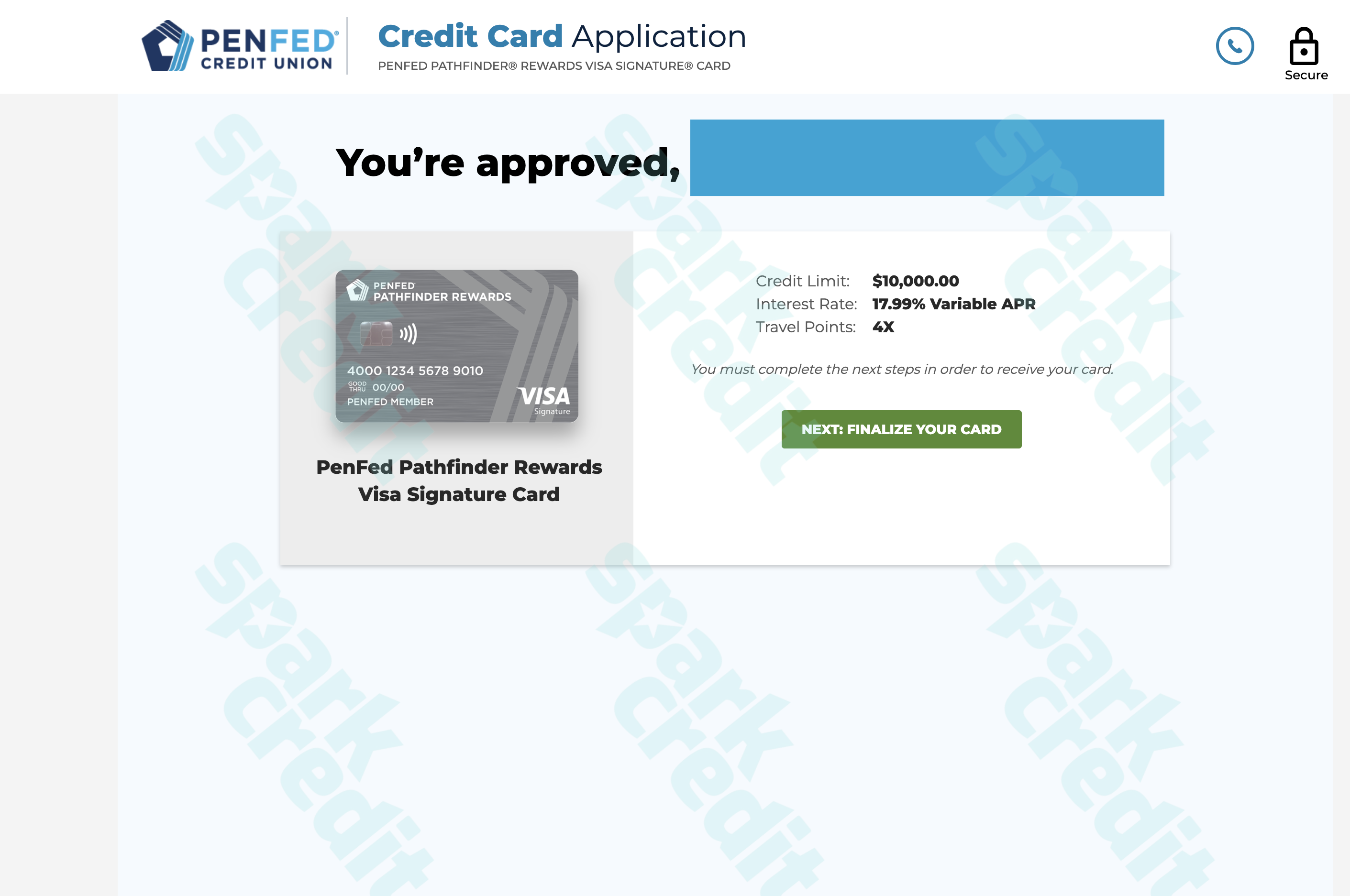

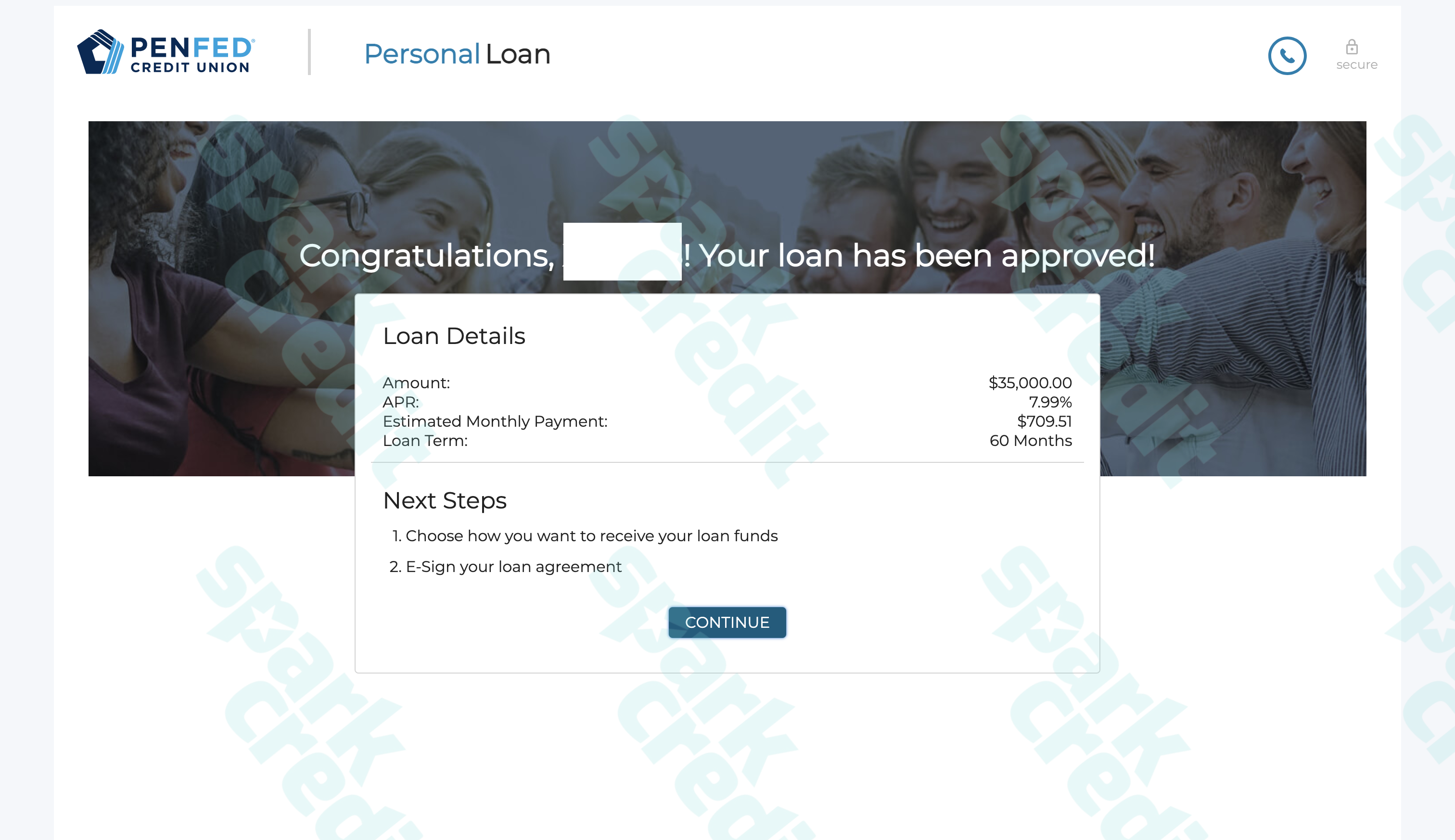

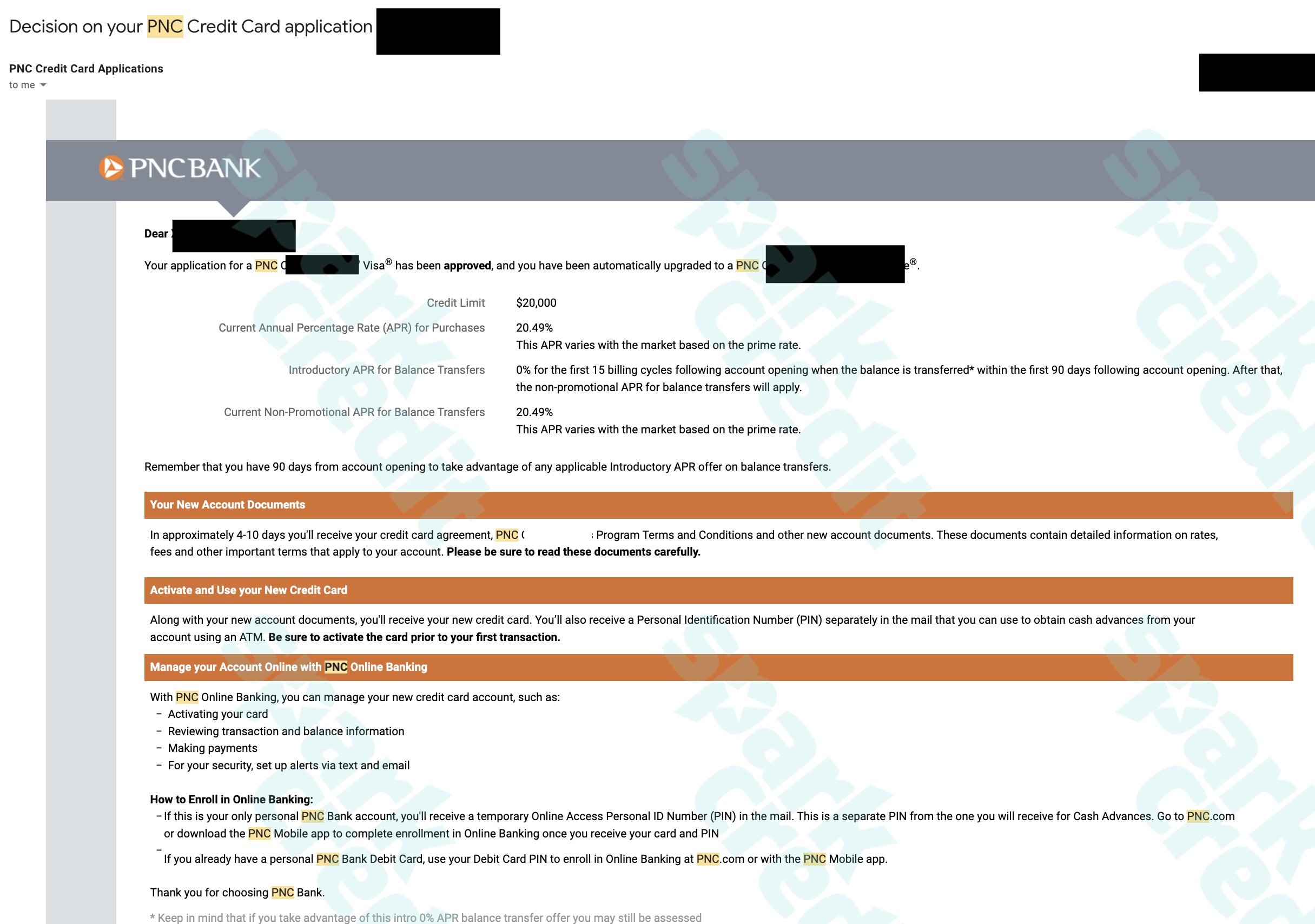

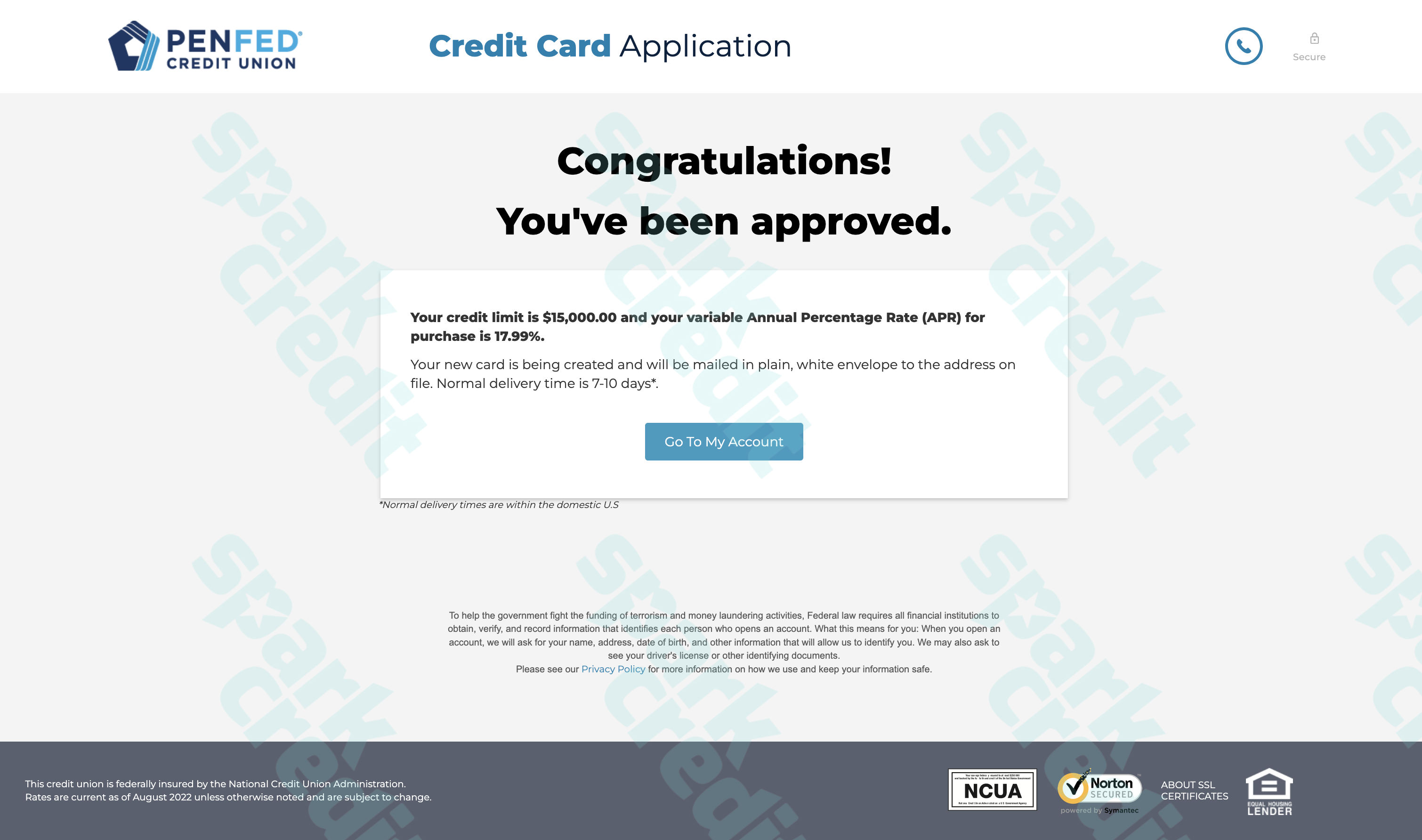

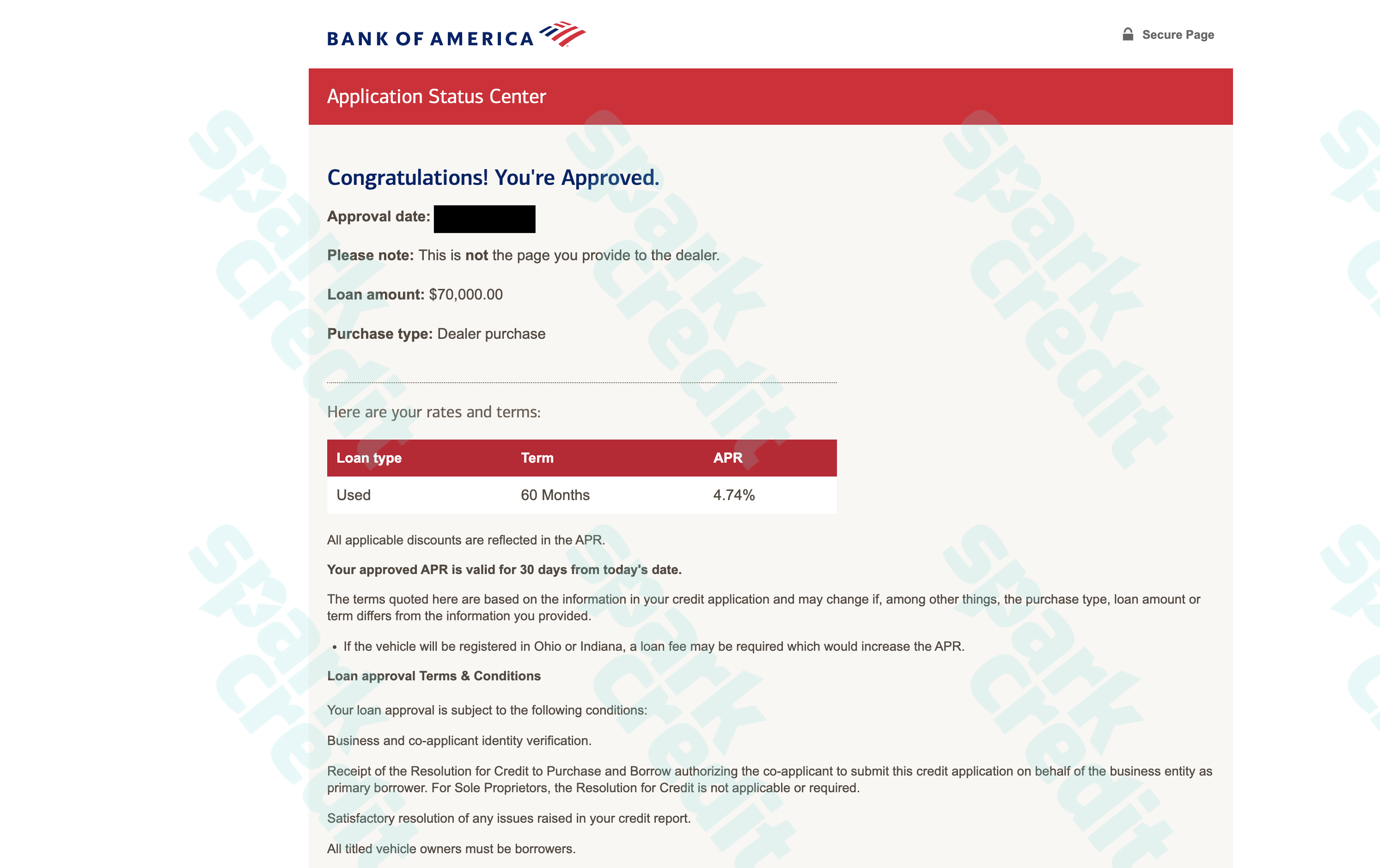

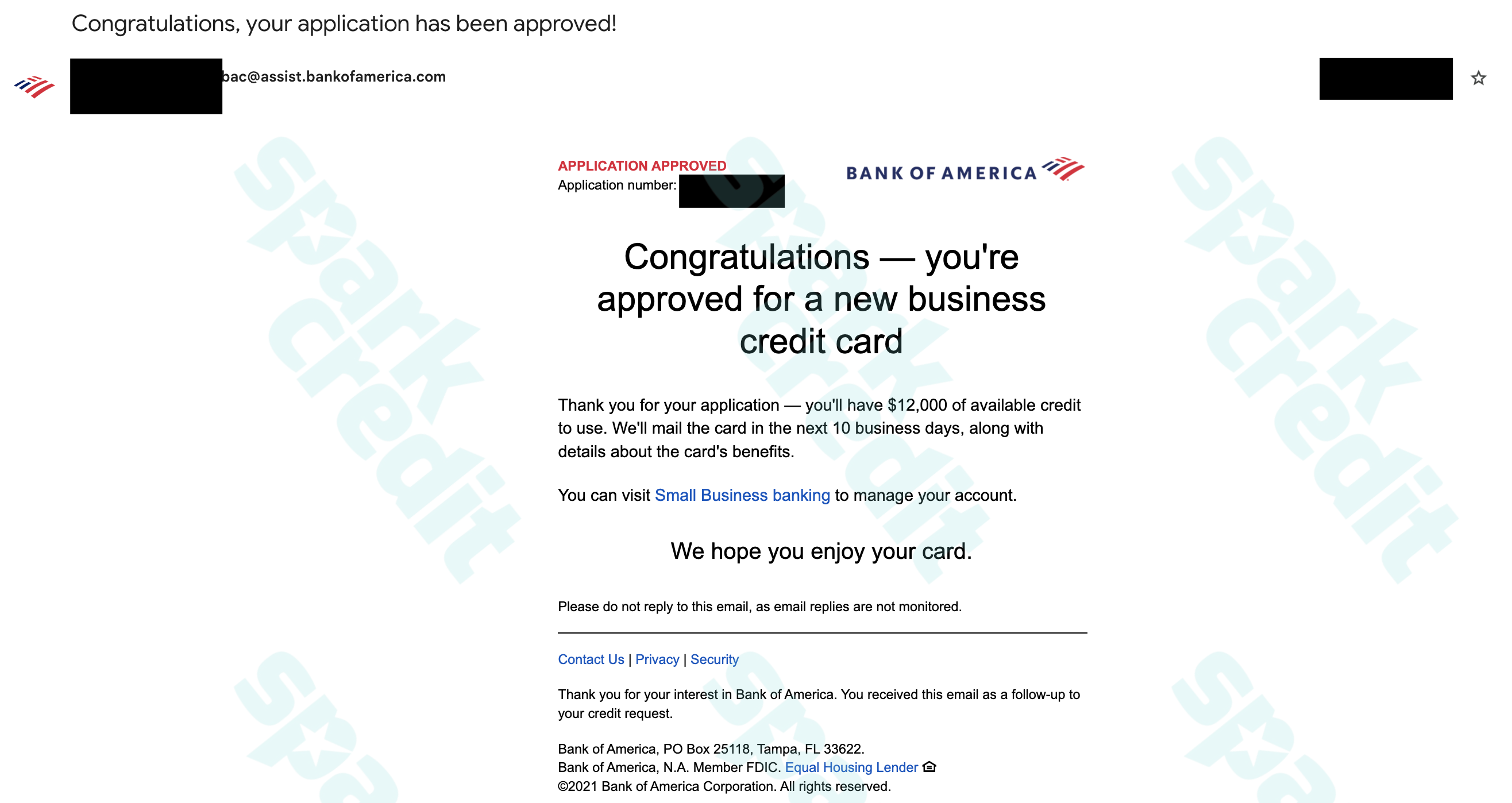

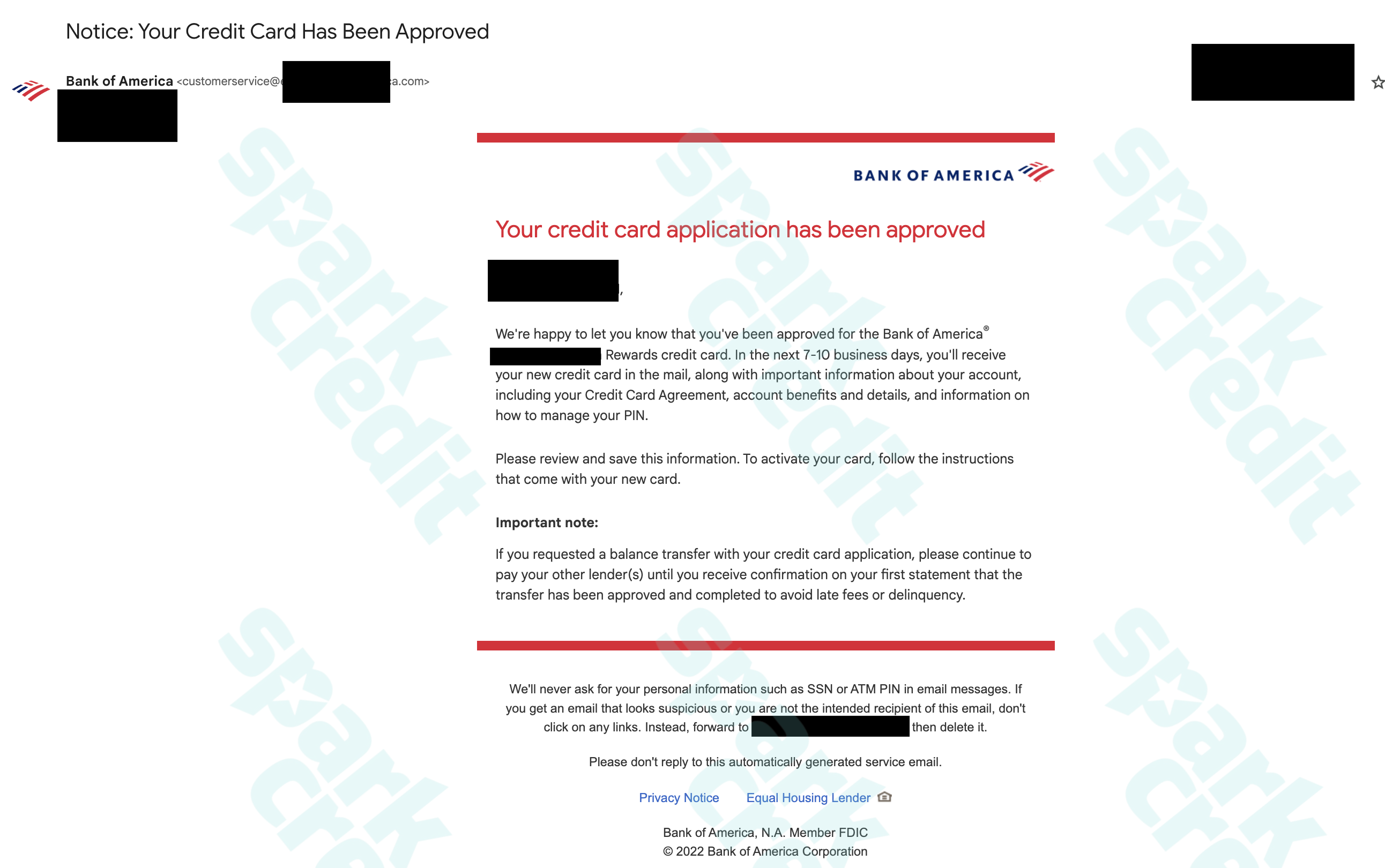

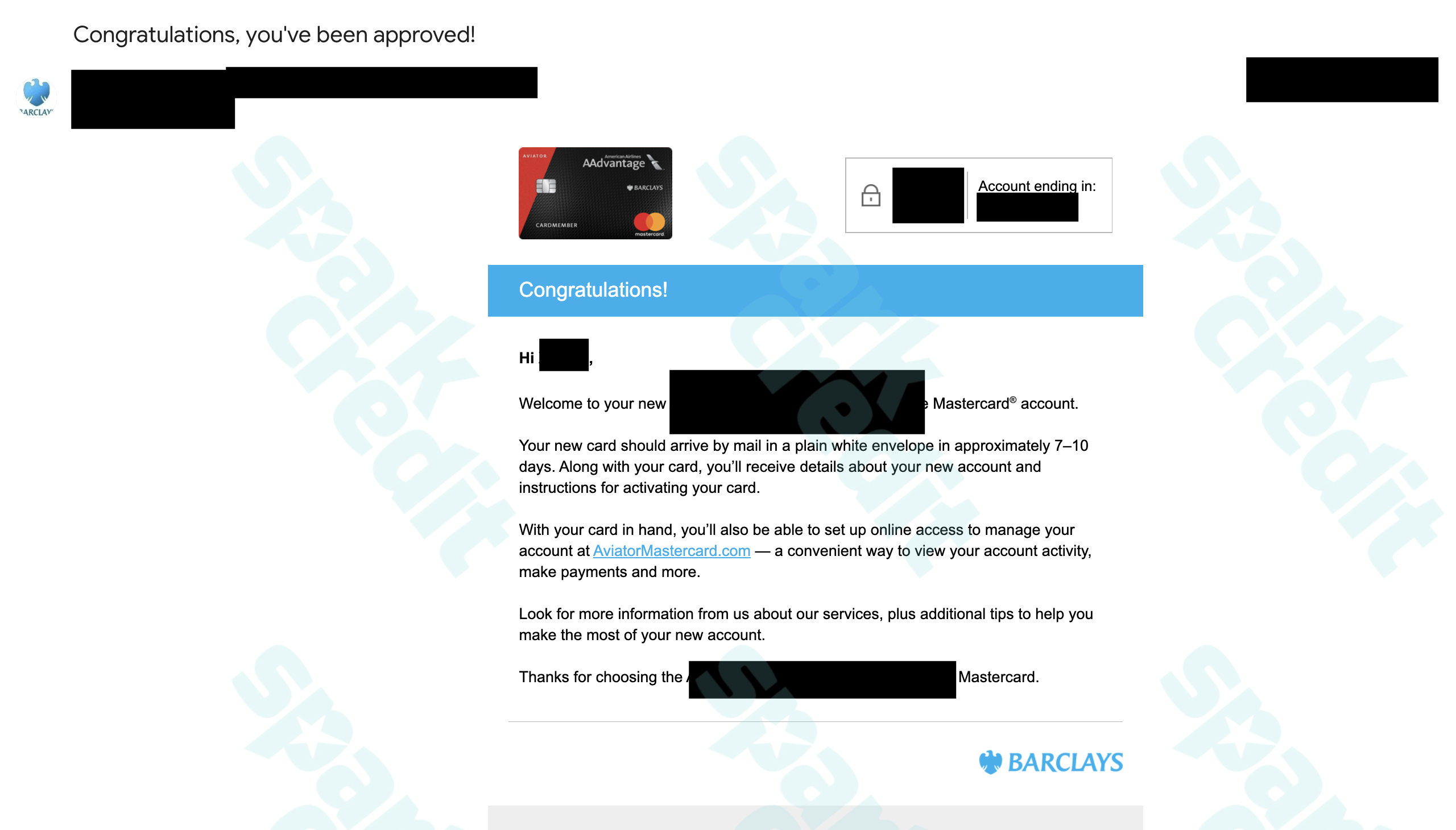

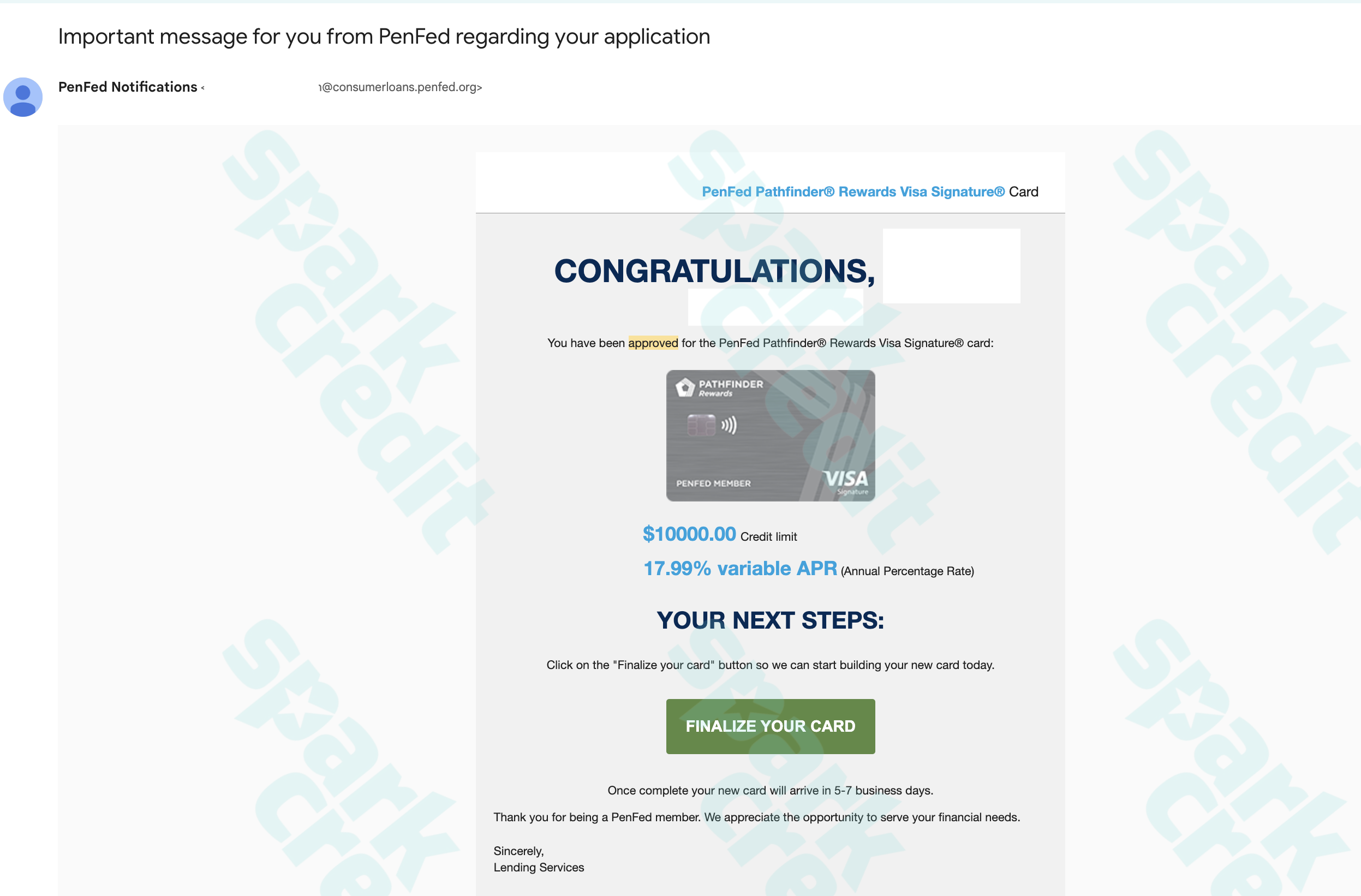

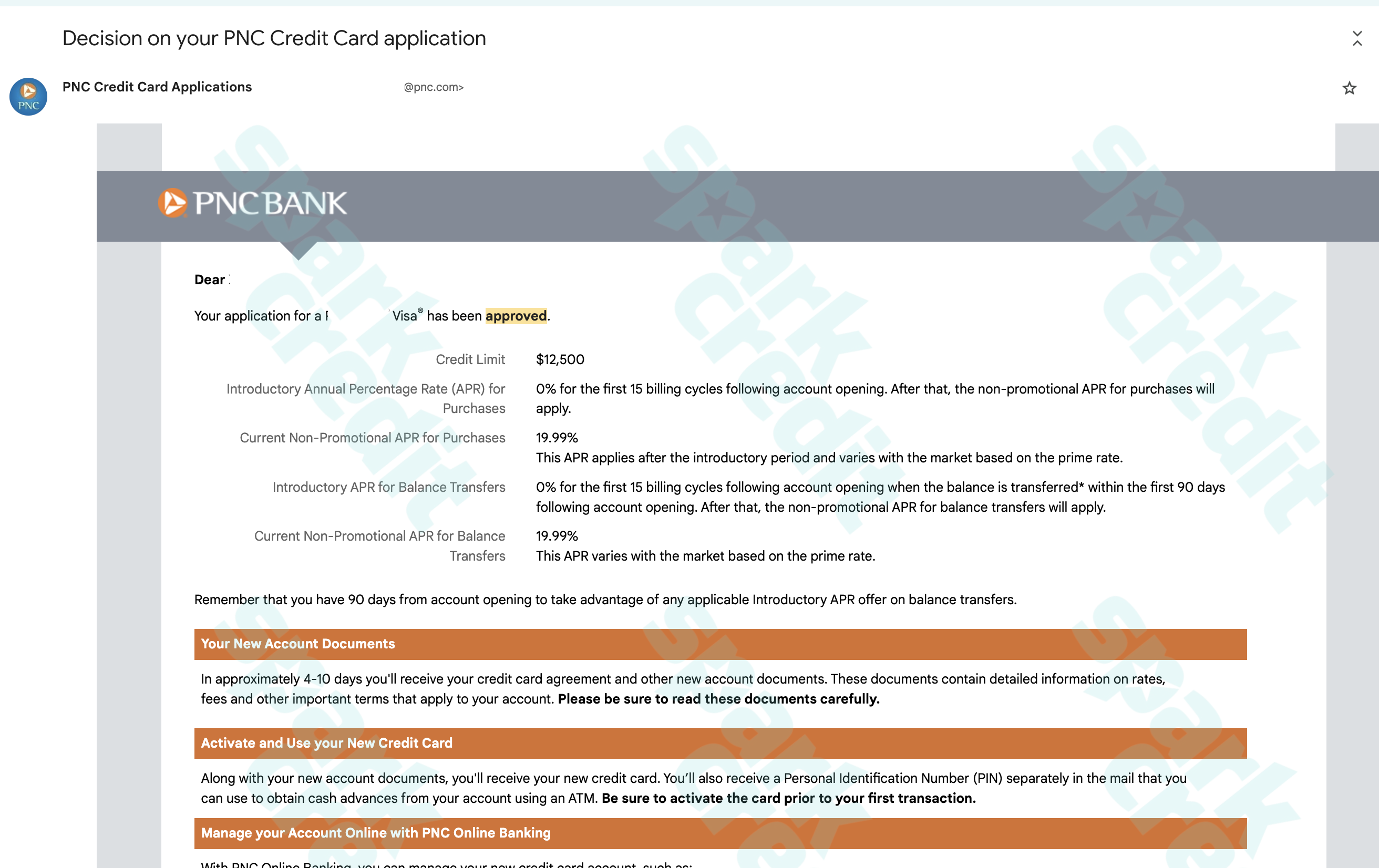

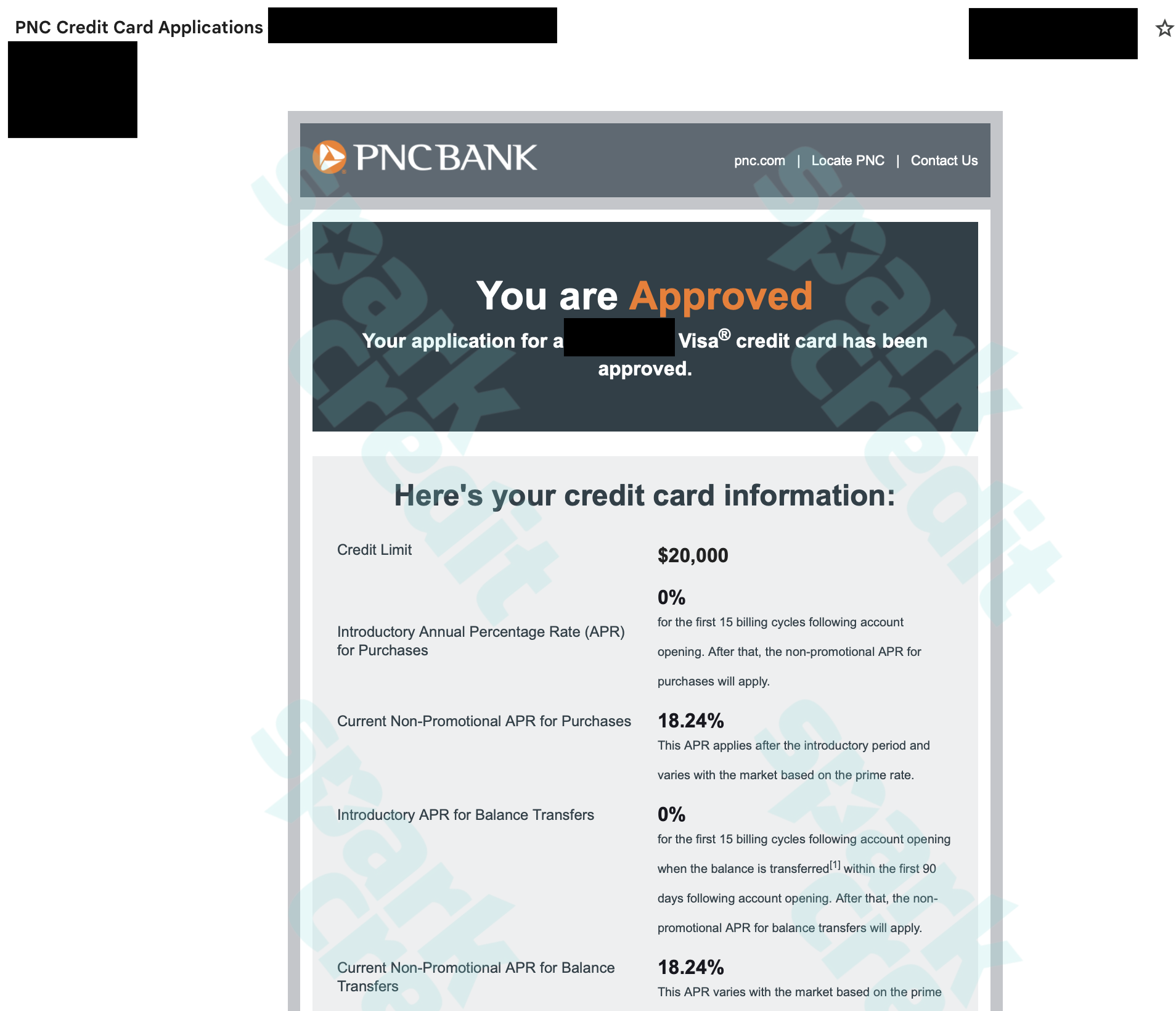

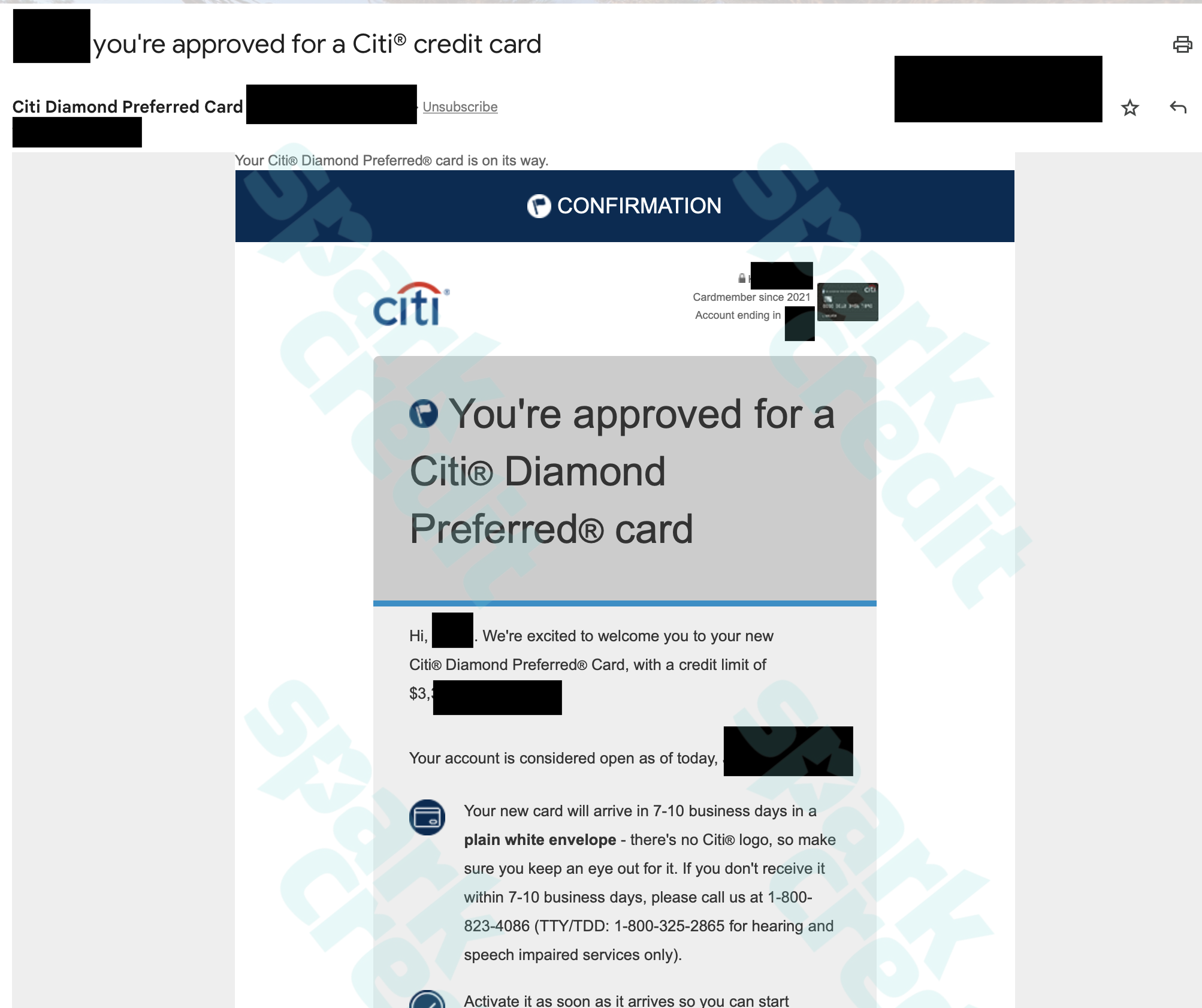

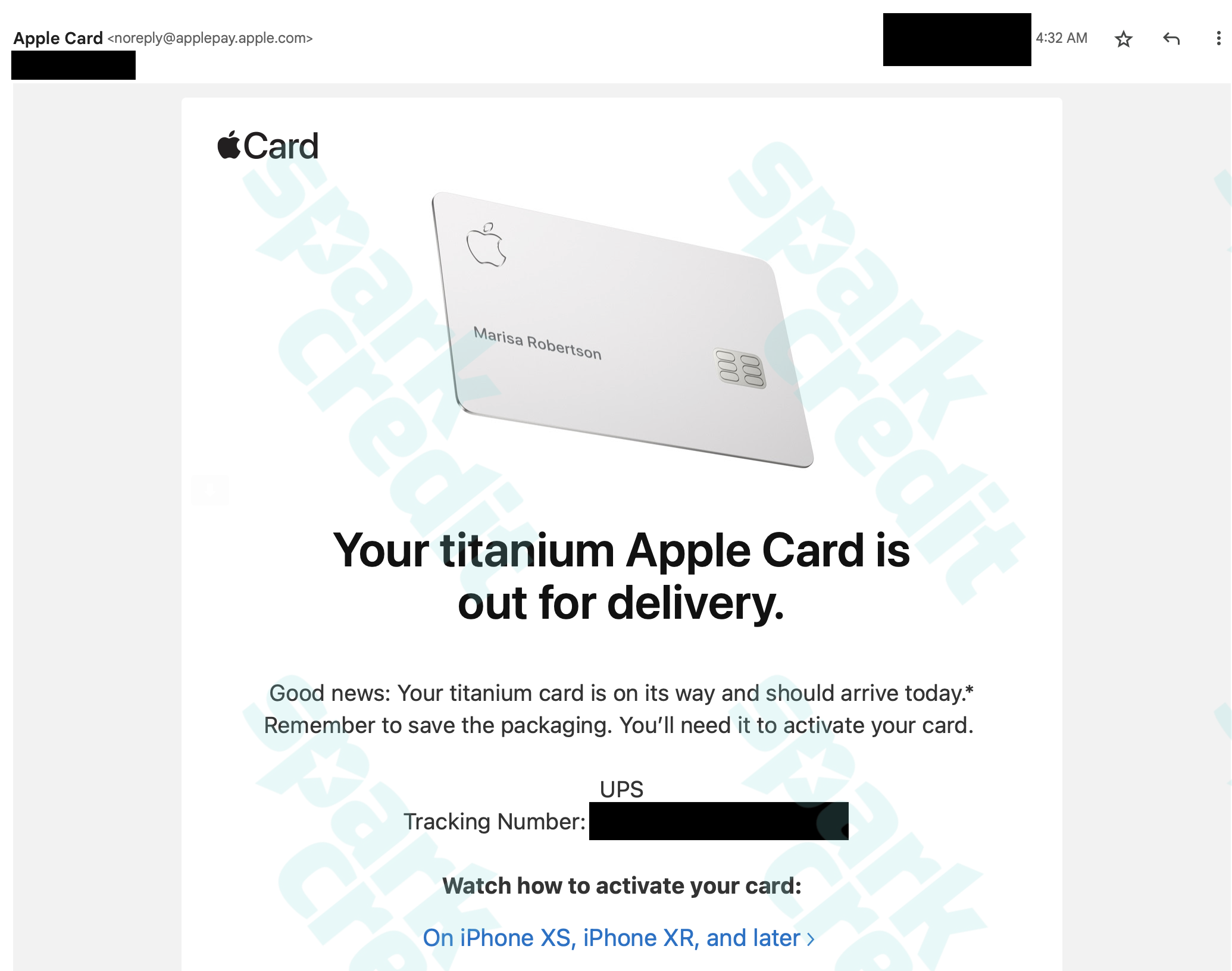

Credit Approvals

Are you in need to get credit approval?

Spark Credit can aide those with bad credit in obtaining auto financing. If you are having trouble getting accepted for a car loan or finance and need a new or used vehicle, you can receive assistance from us.

What is the process to get credit approval?

To obtain a loan, prospective borrowers are required to go through a procedure known as credit approval. A lender will evaluate a borrower’s capacity and desire to repay a loan on time, including interest and the principal amount. This evaluation will take place throughout the underwriting process. These statements will include the client’s balance sheet, income, and cash flow statement. Additionally, the lender will look at inventory turnover rates, debt structure, management performance, and market conditions. A borrower’s total outstanding debt, the quantity of the loan they seek, the period of the loan they request, and the number of times they borrow money are all additional considerations.

Spark Credit helps you to get credit approvals.

We believe everyone should have an opportunity; we give Credit Approvals to the customers, even if they have:

- No credit history

- Bad credit history

- Multiple open auto loans

- Self-employed income

- Fixed income

- Unemployment income

- Temporary income

- Multiple repossessions

By having your credit consultation with one of our Spark Credit representatives, you can know where you stand.

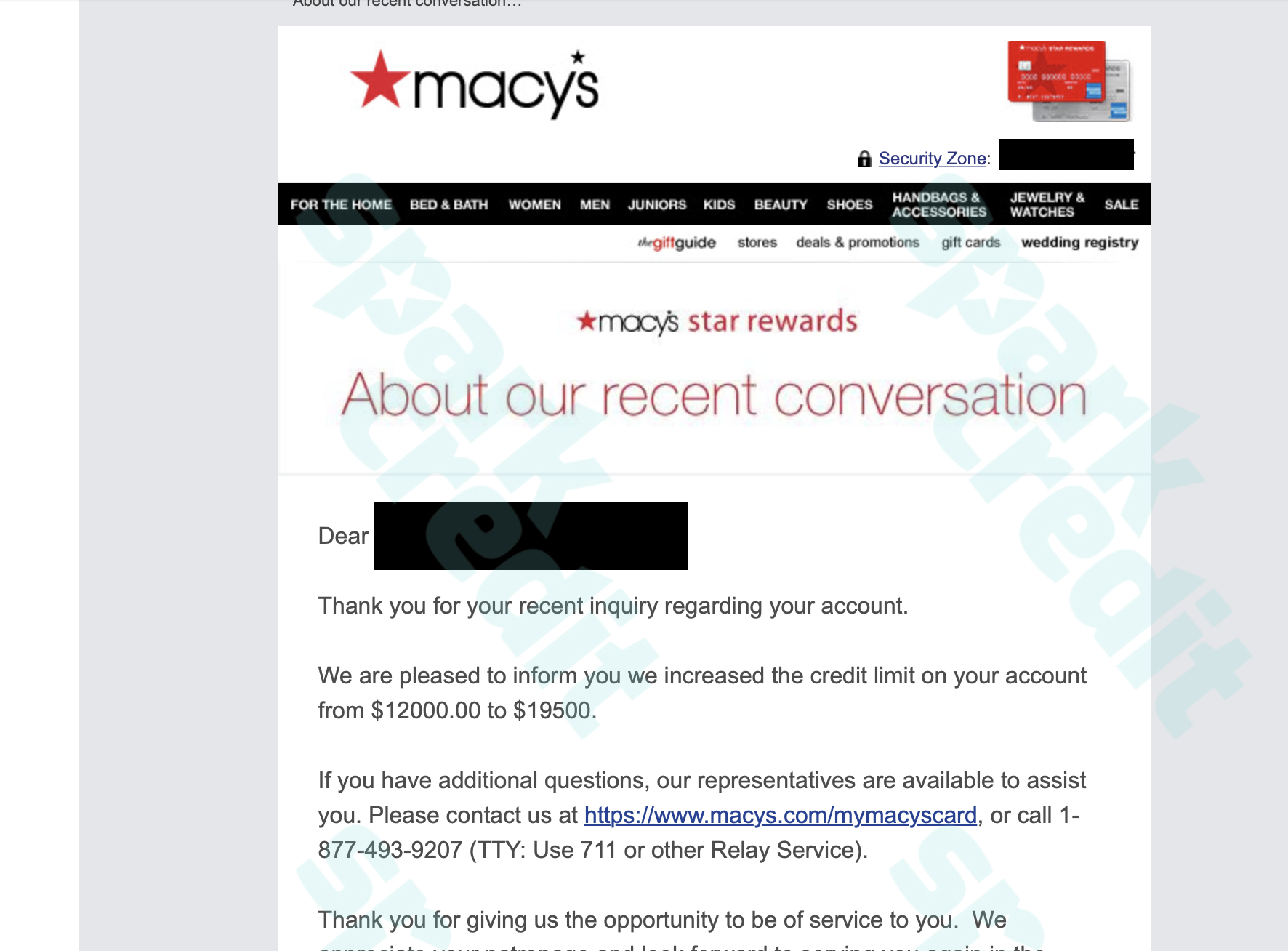

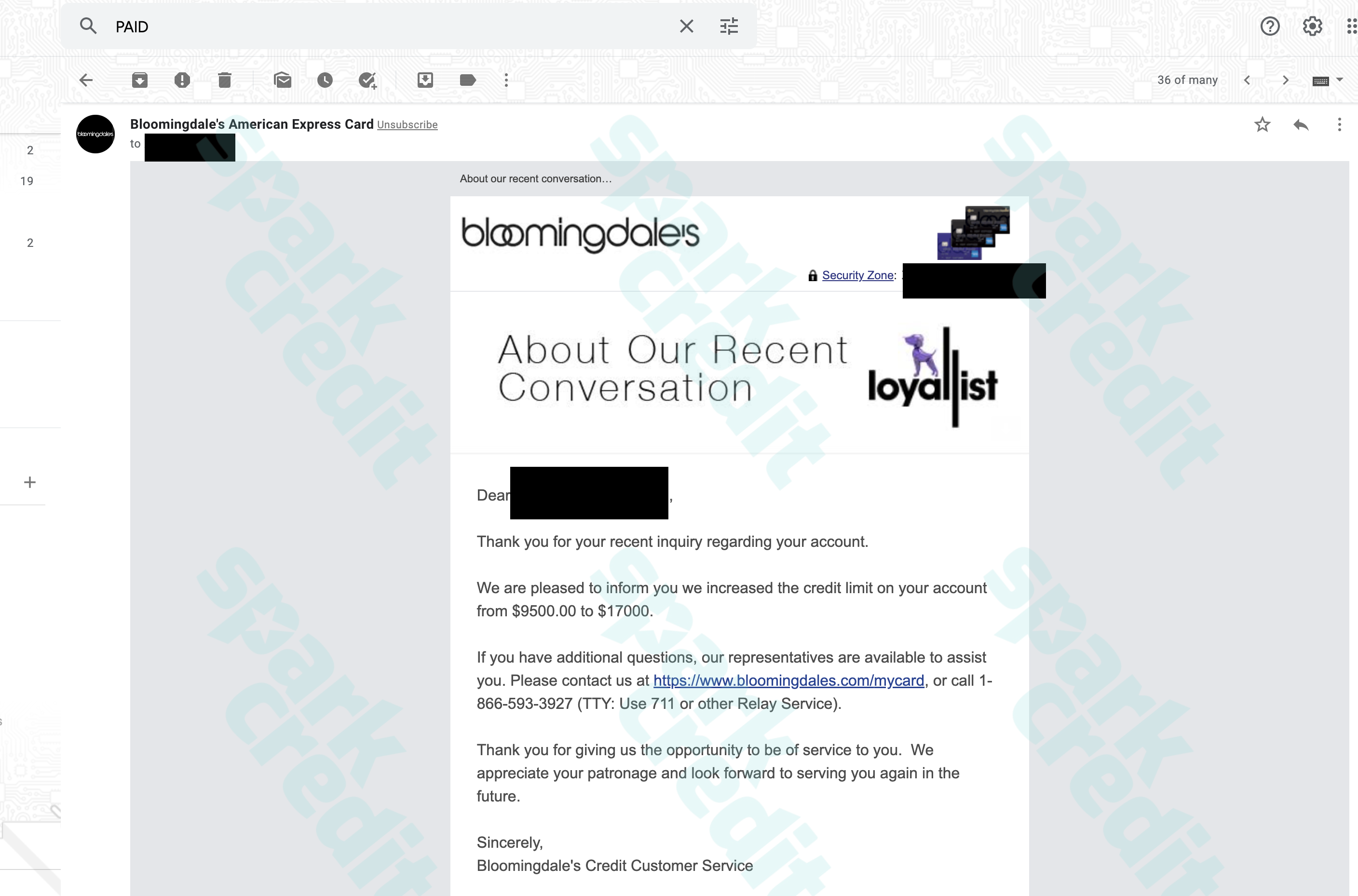

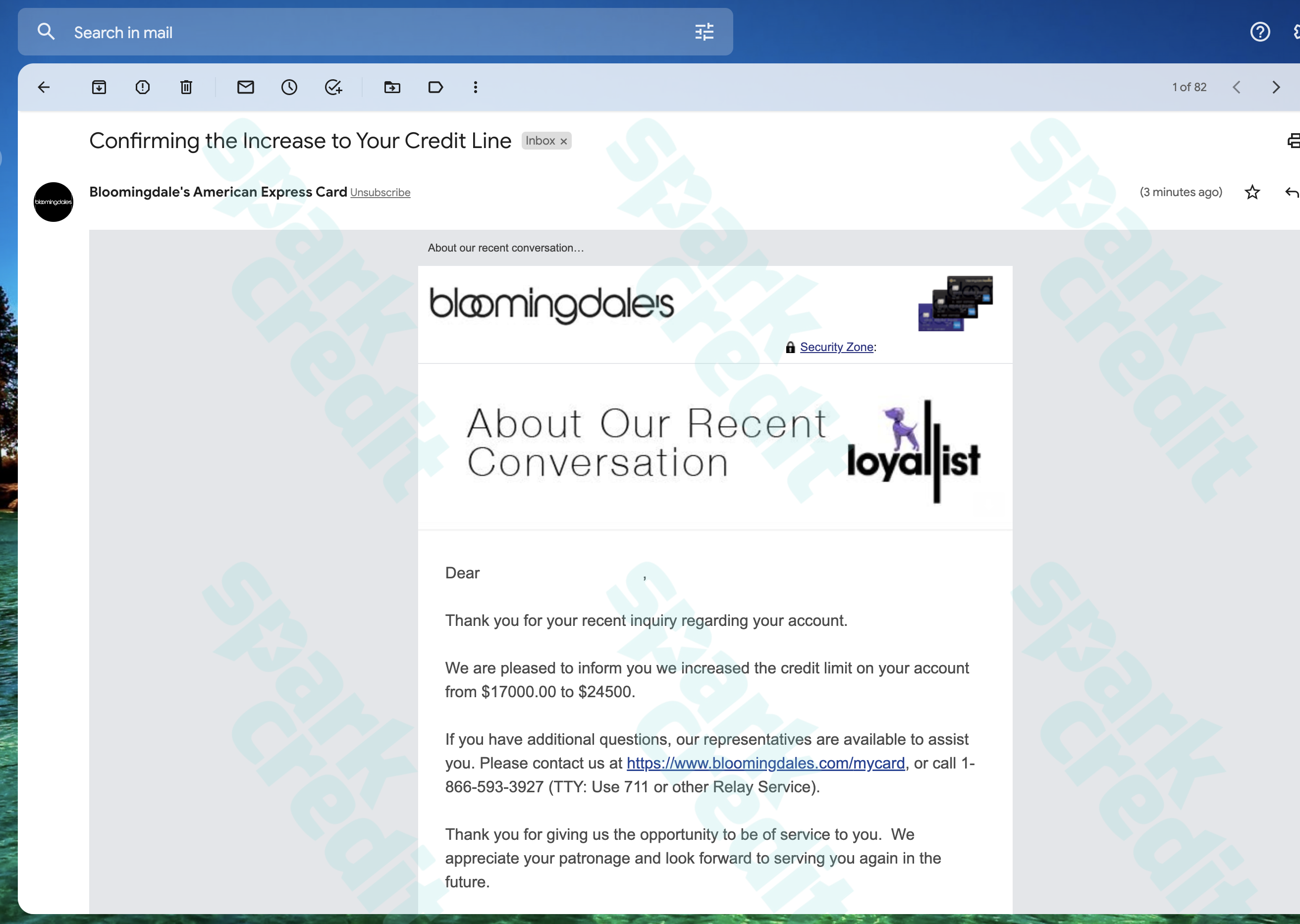

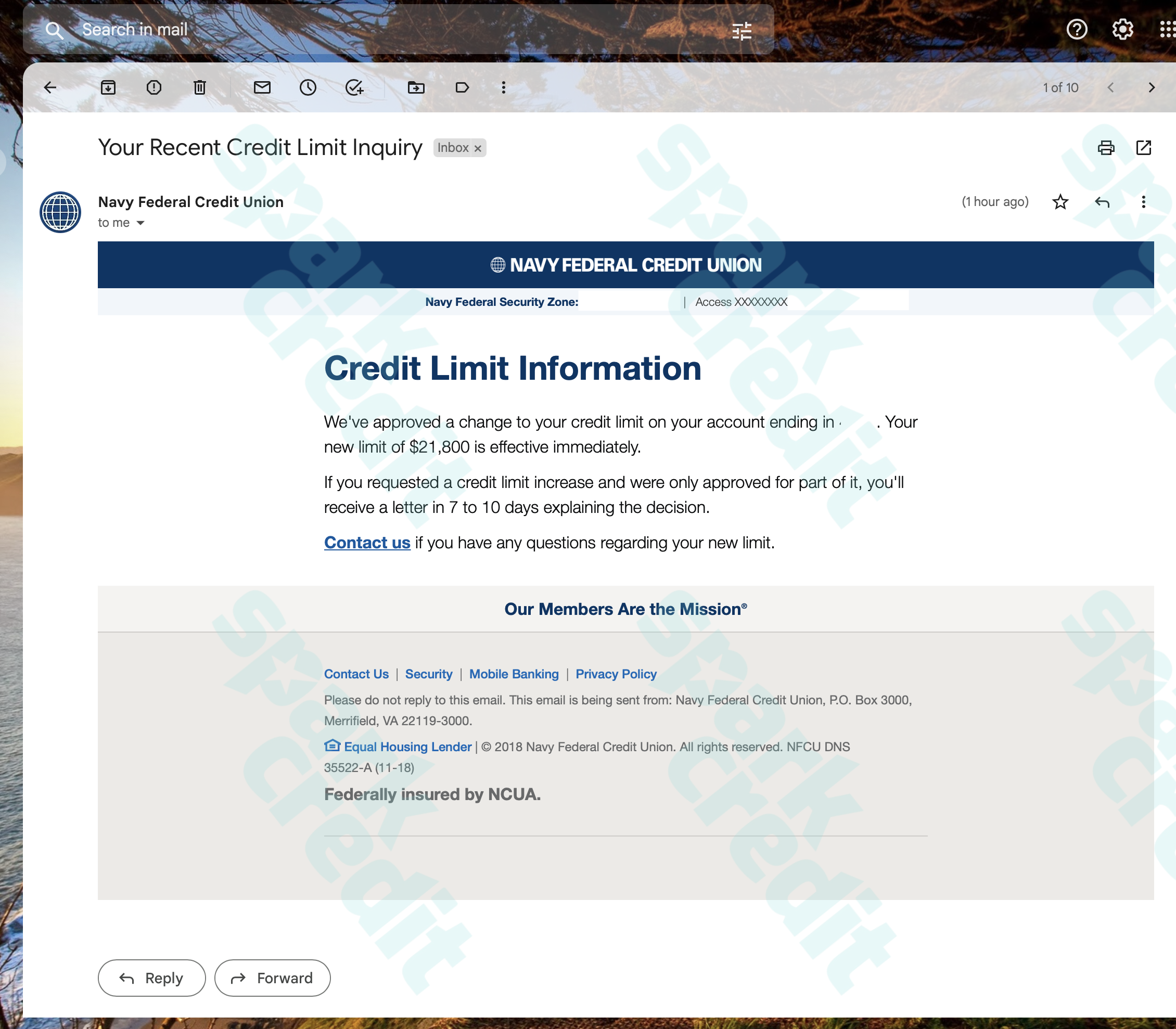

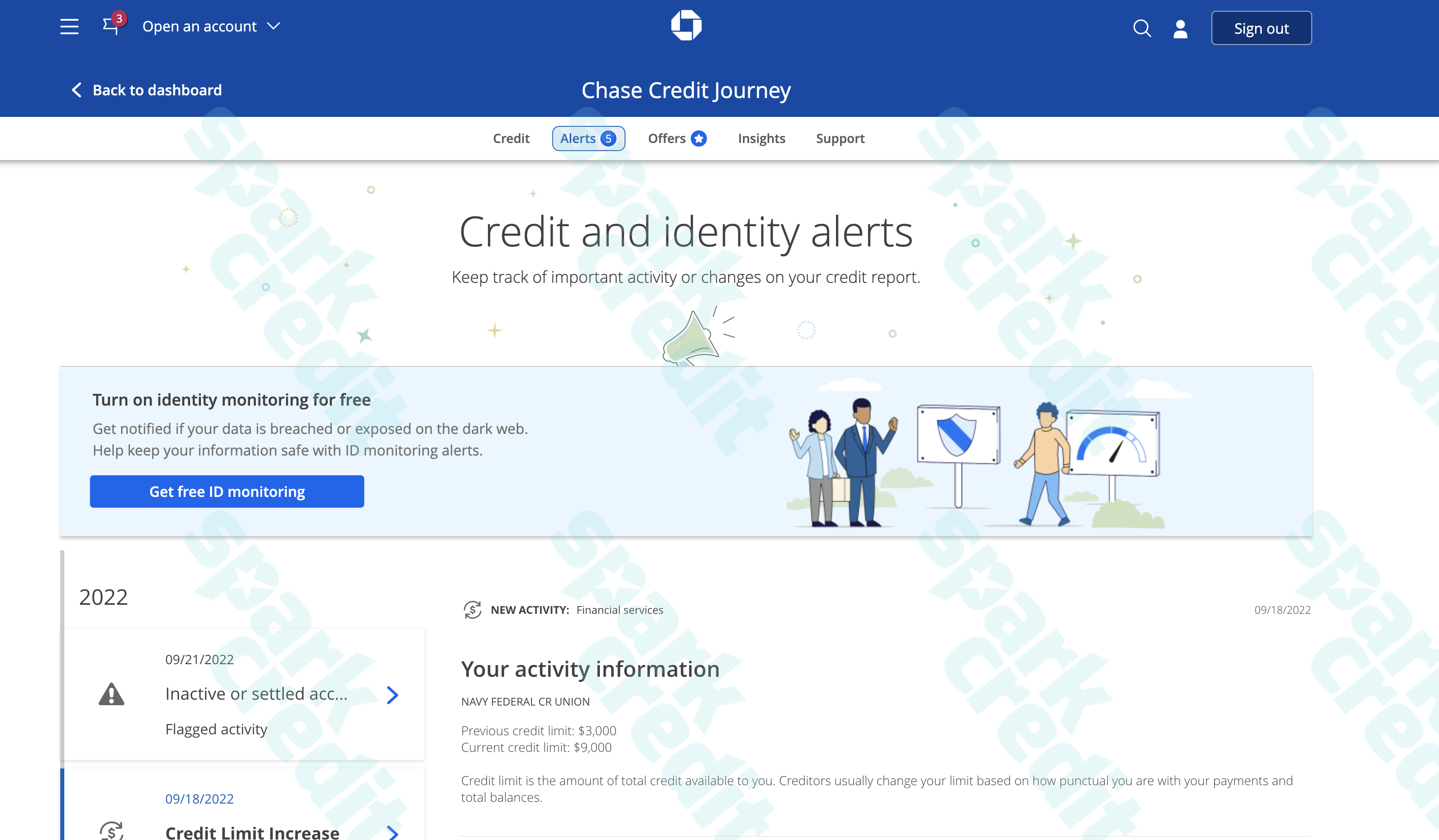

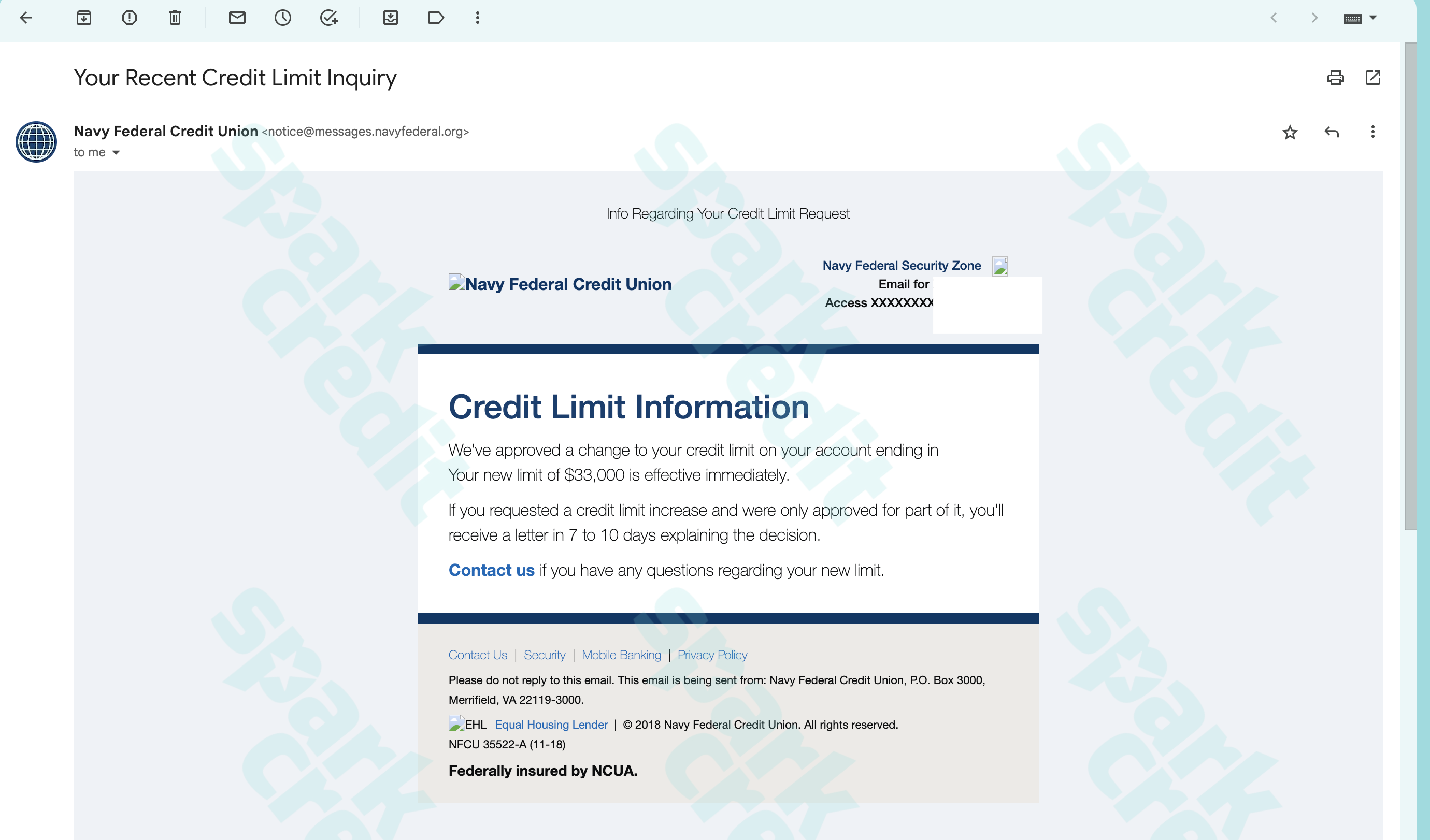

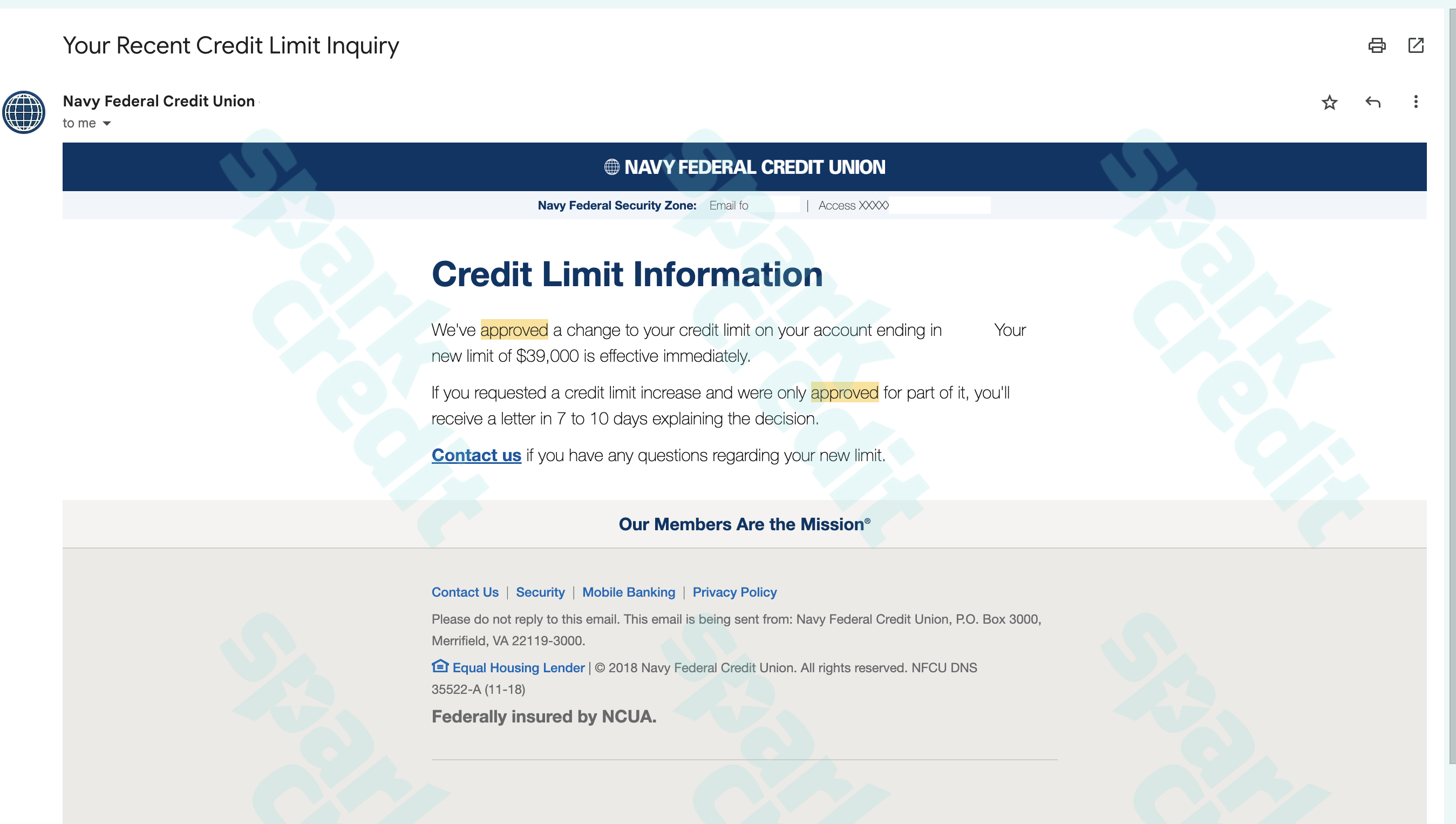

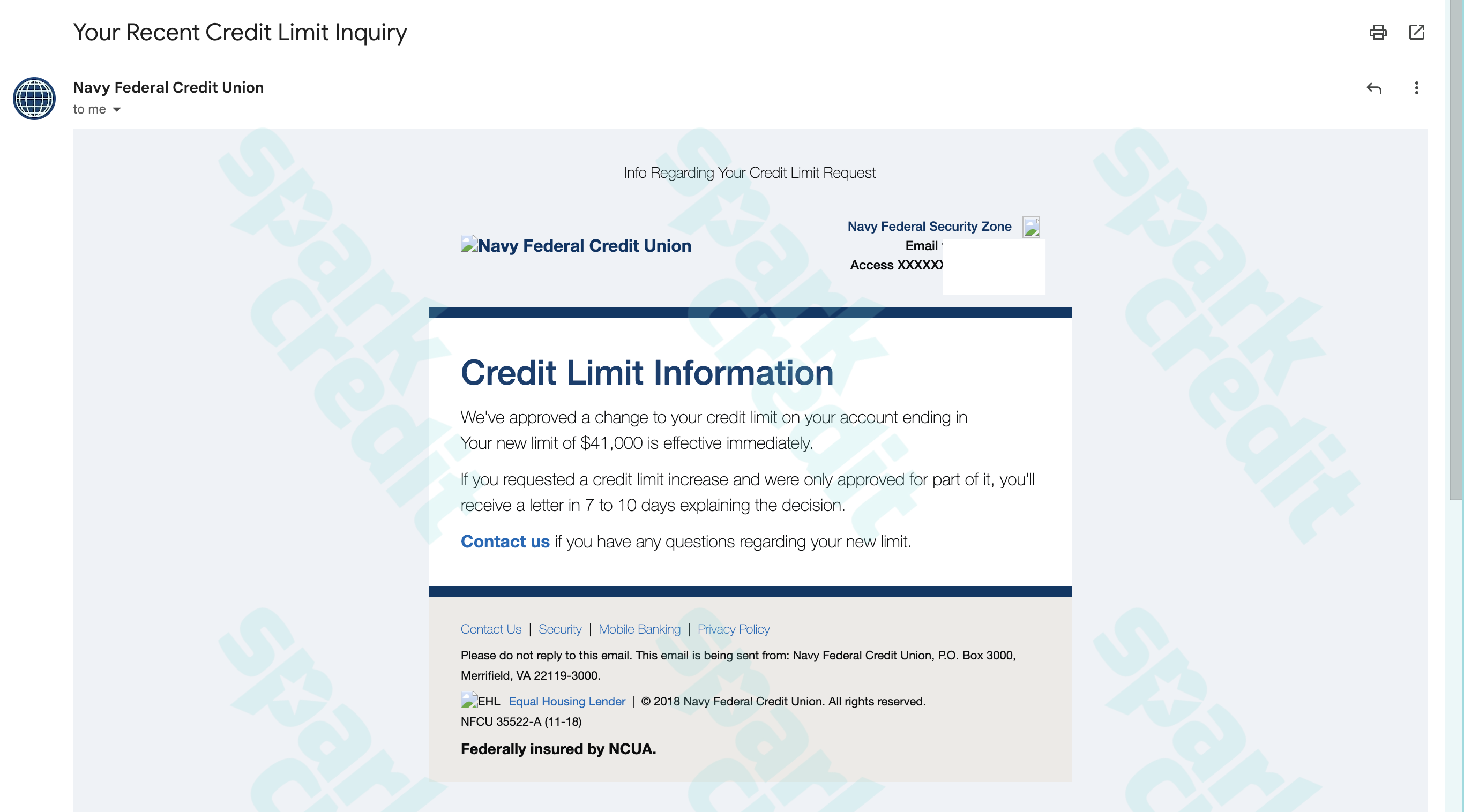

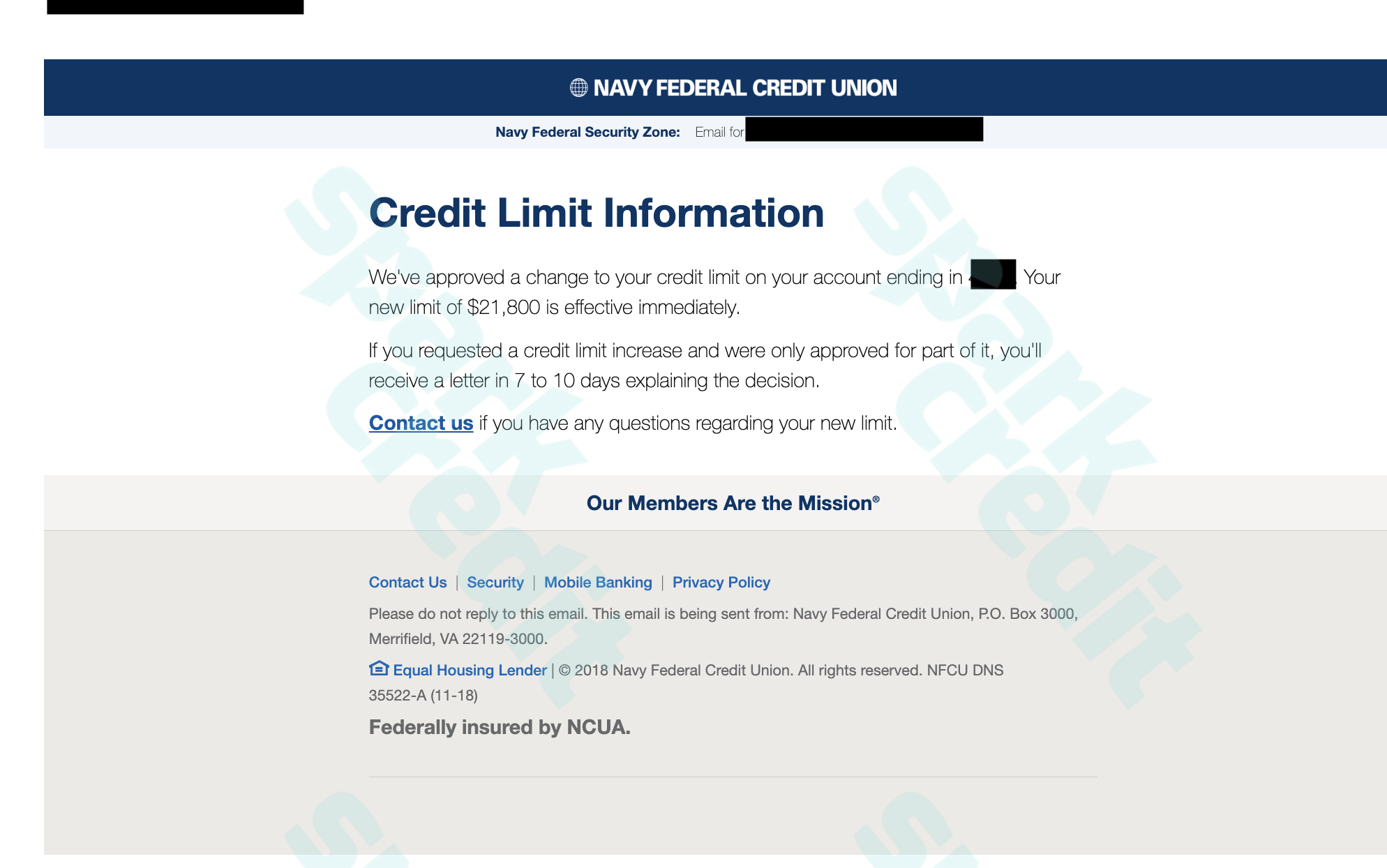

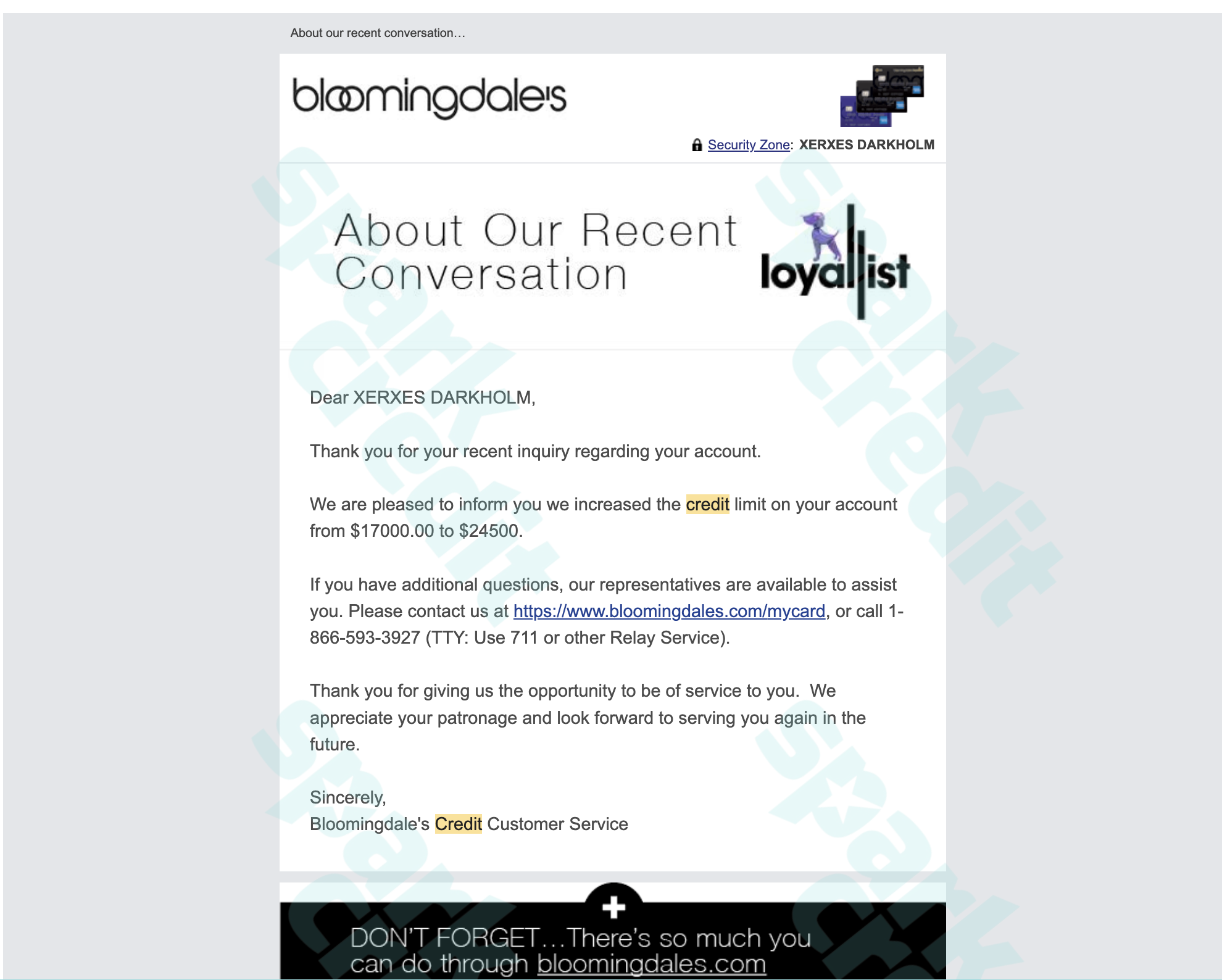

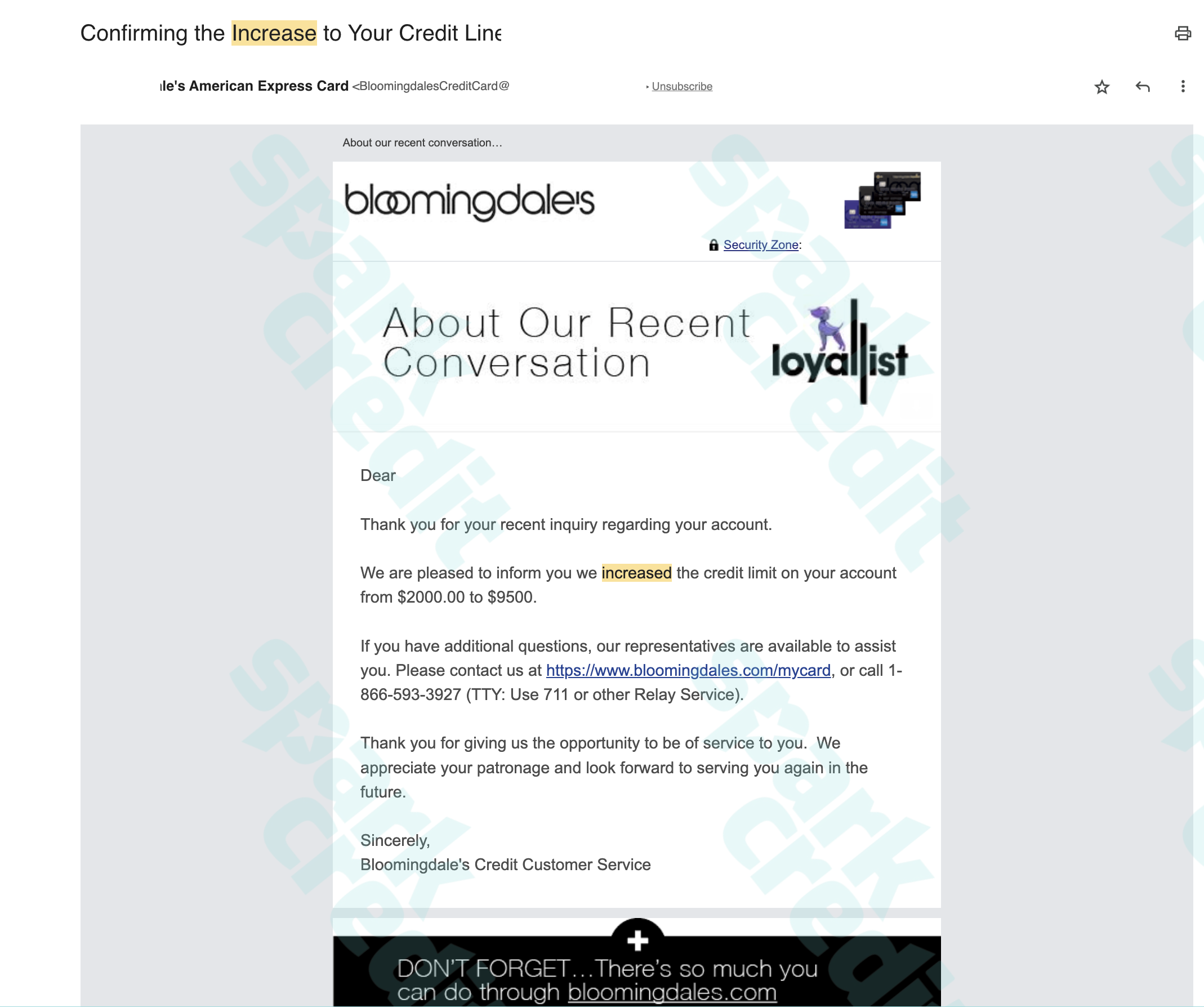

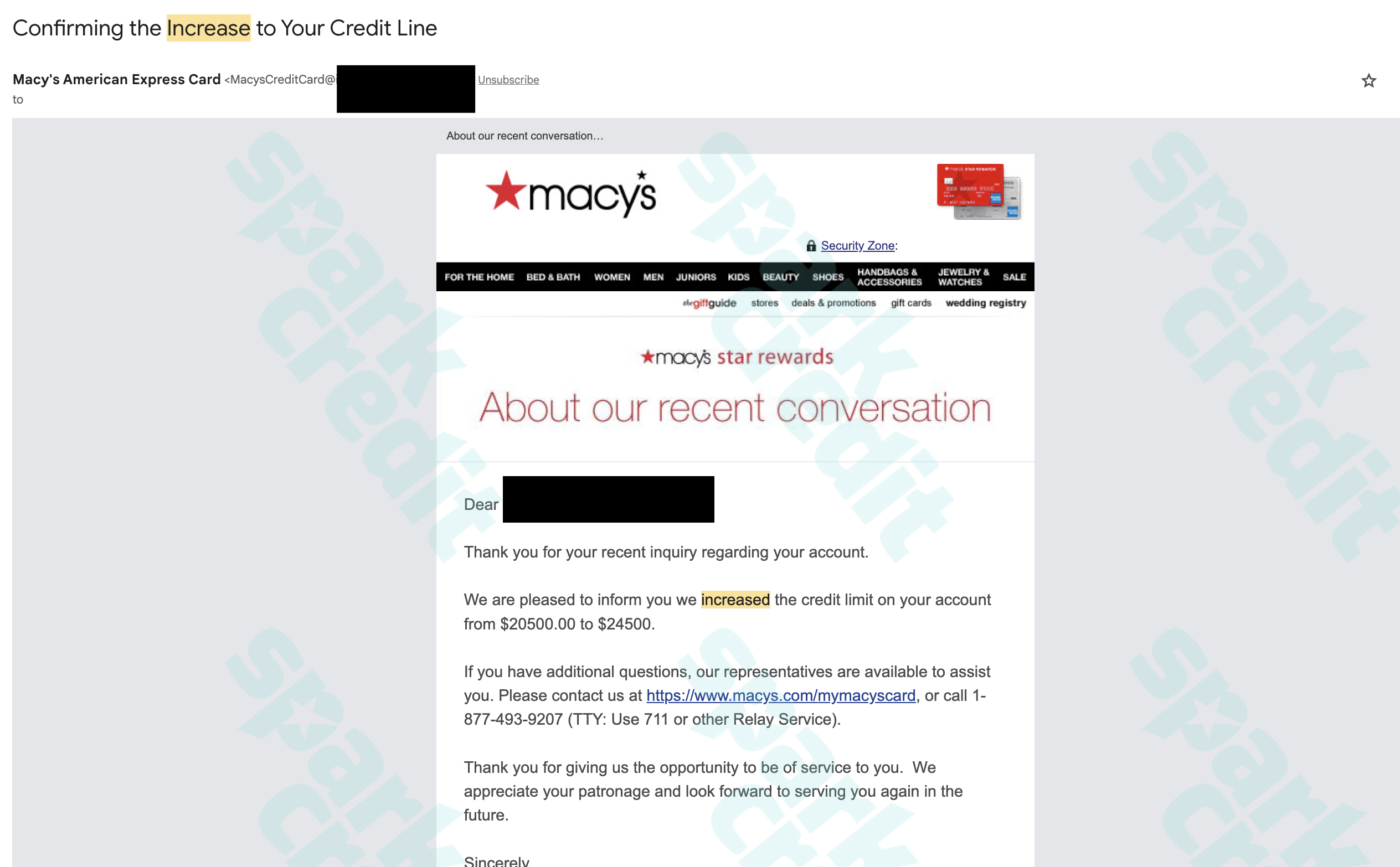

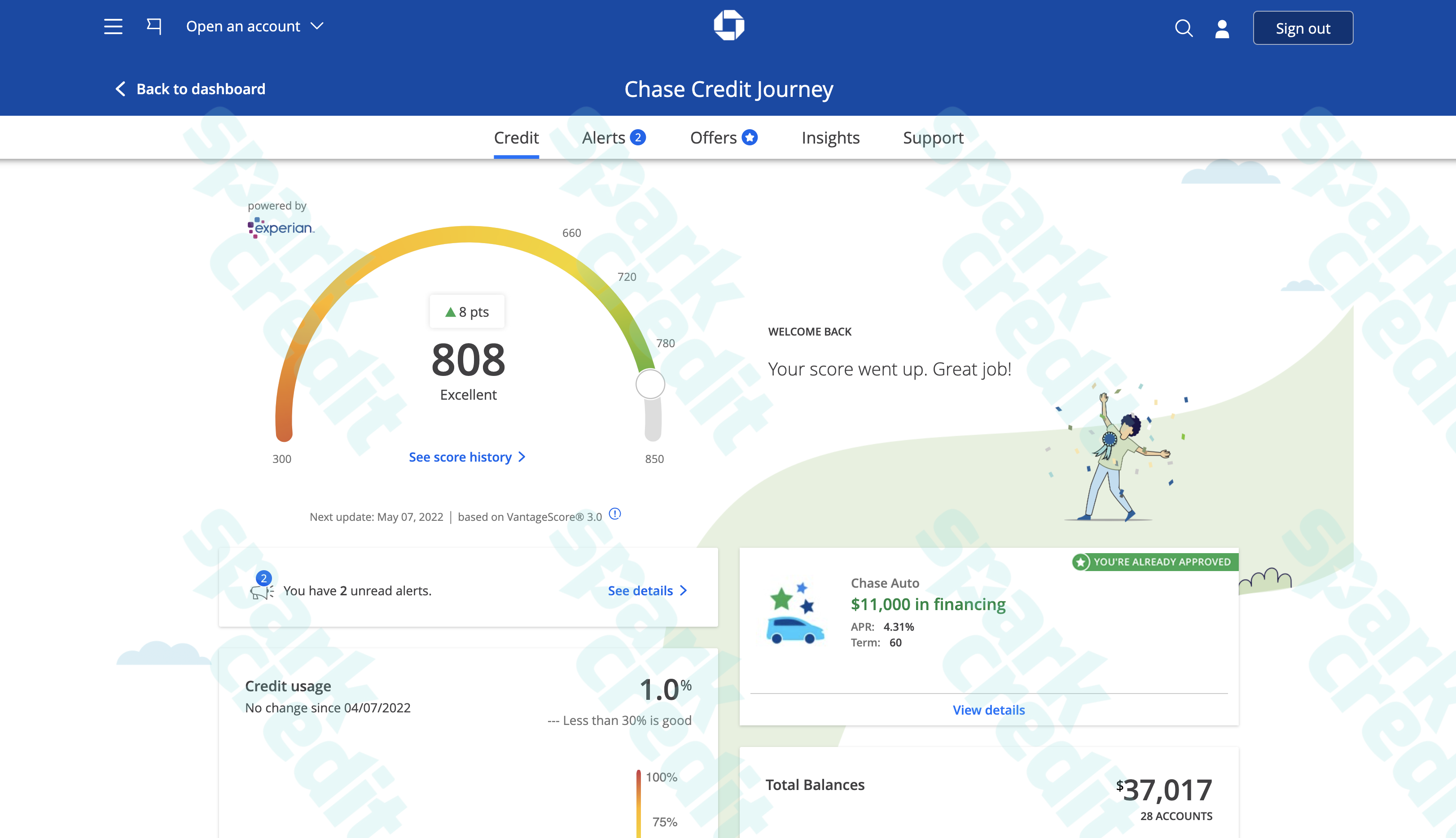

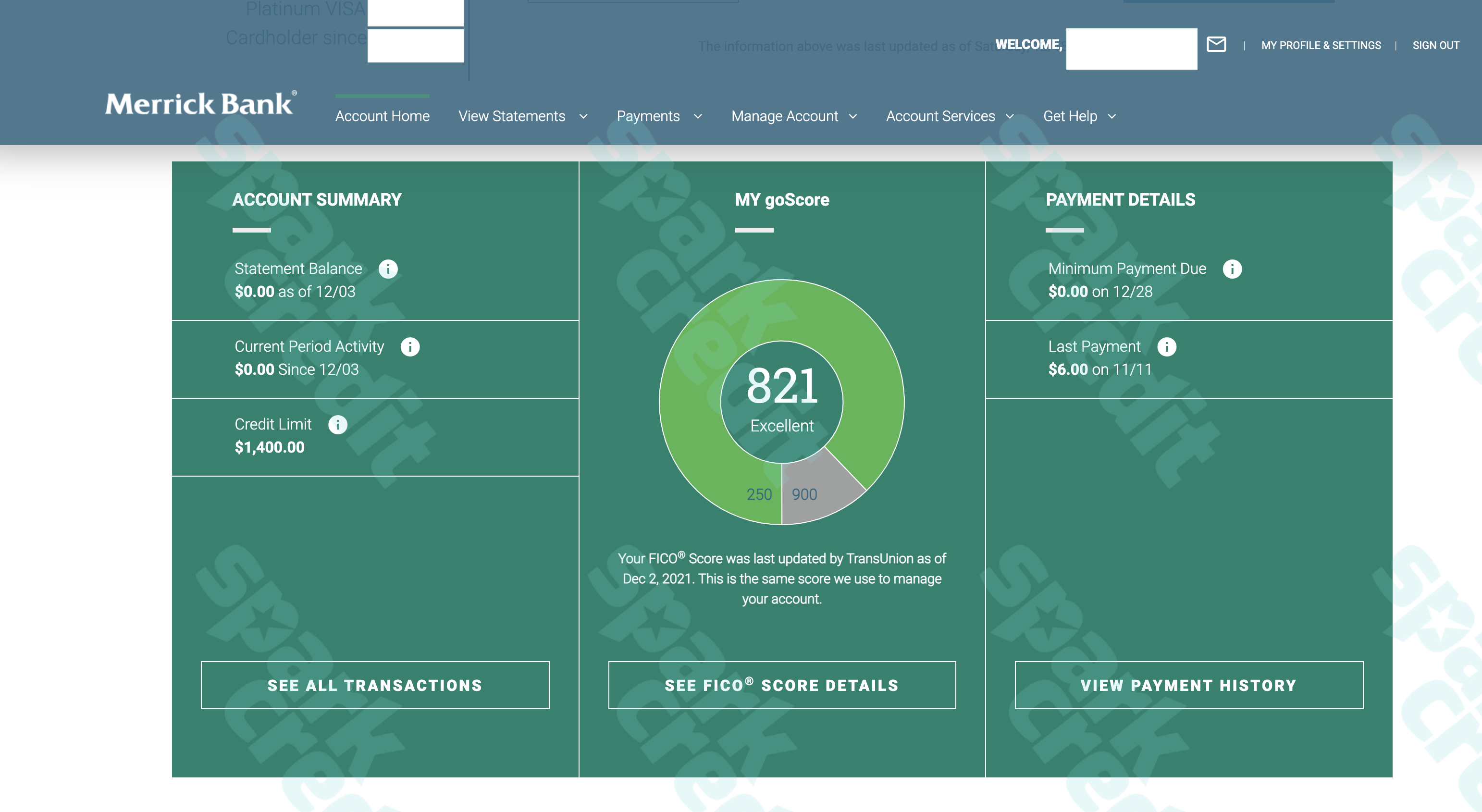

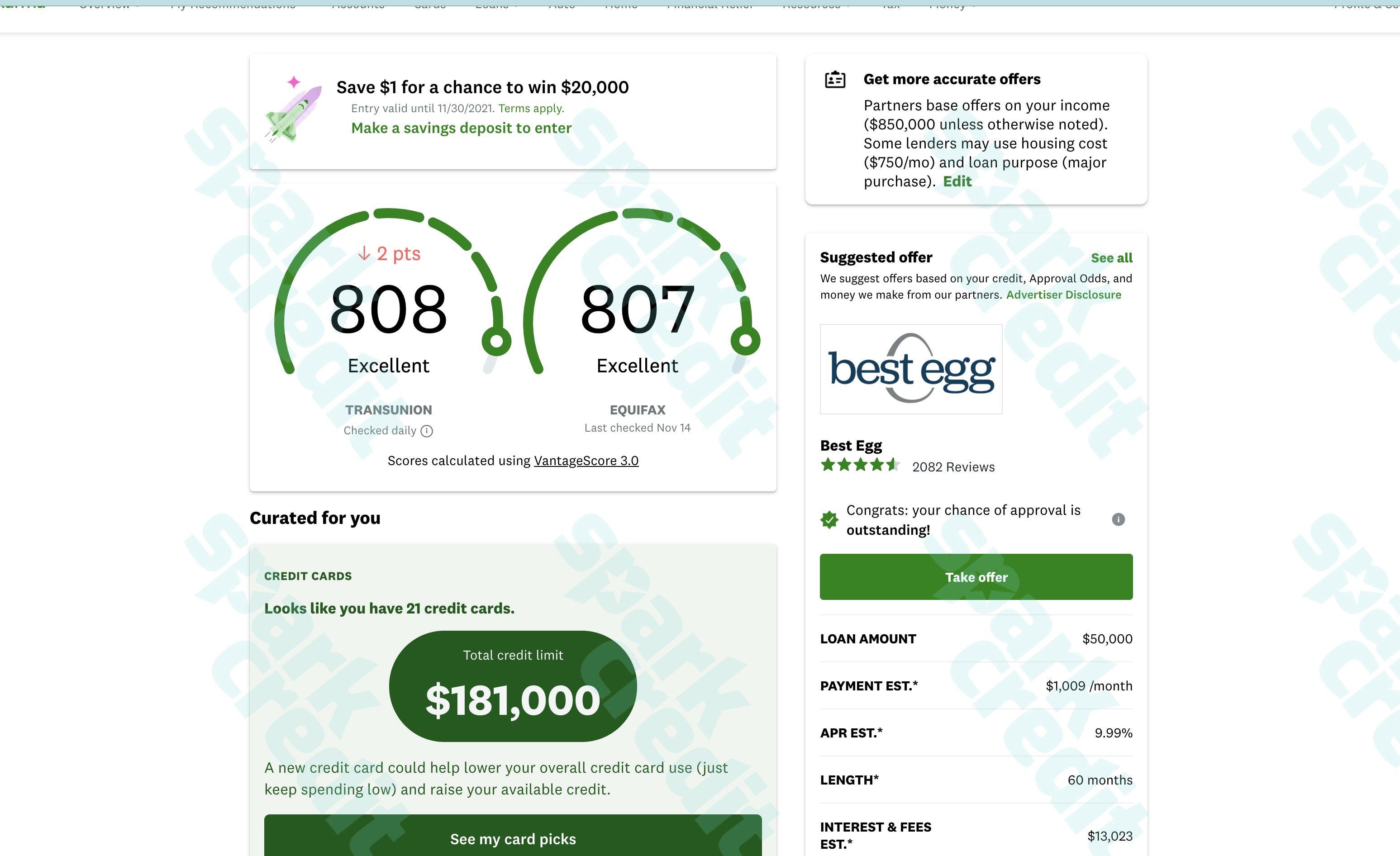

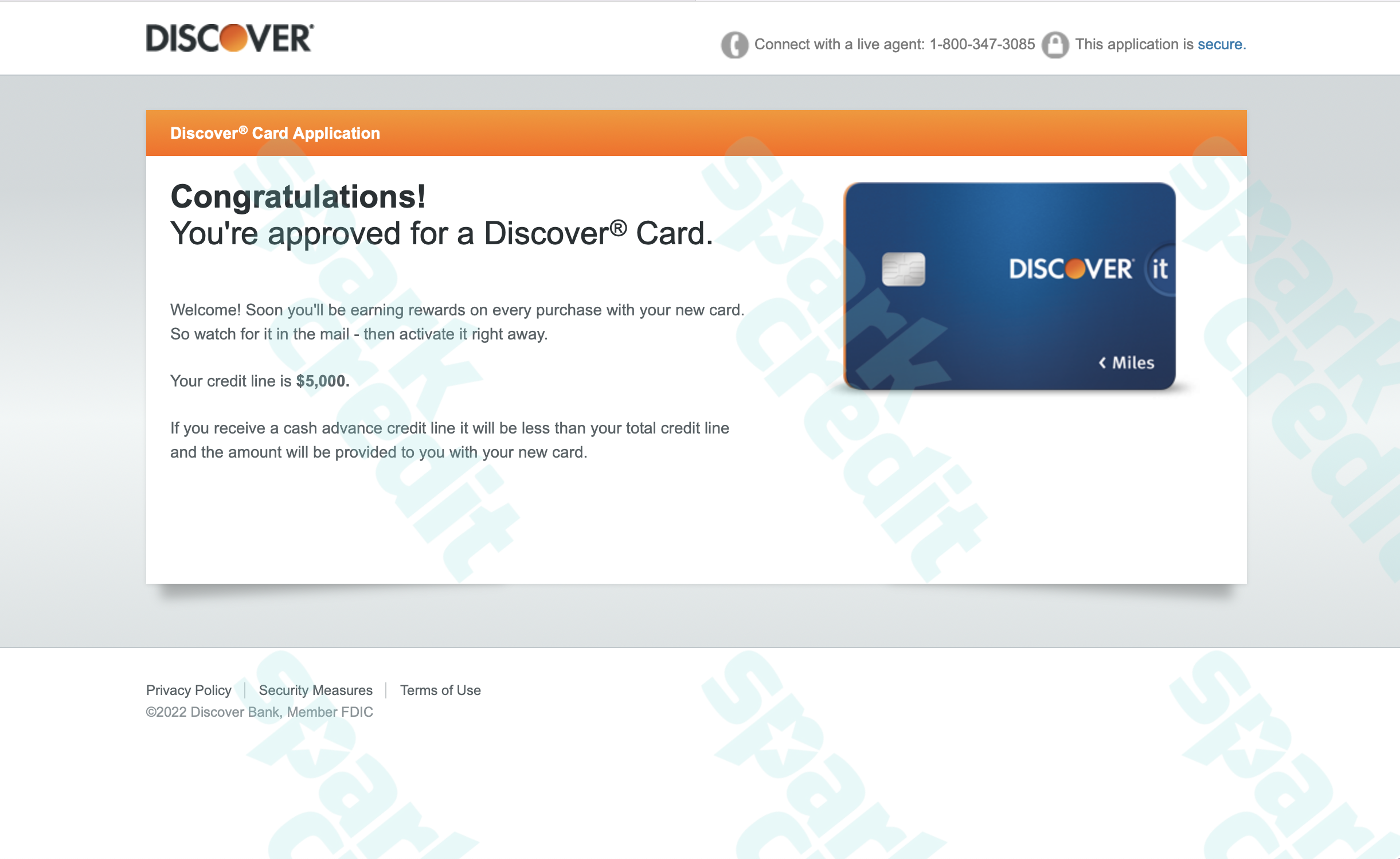

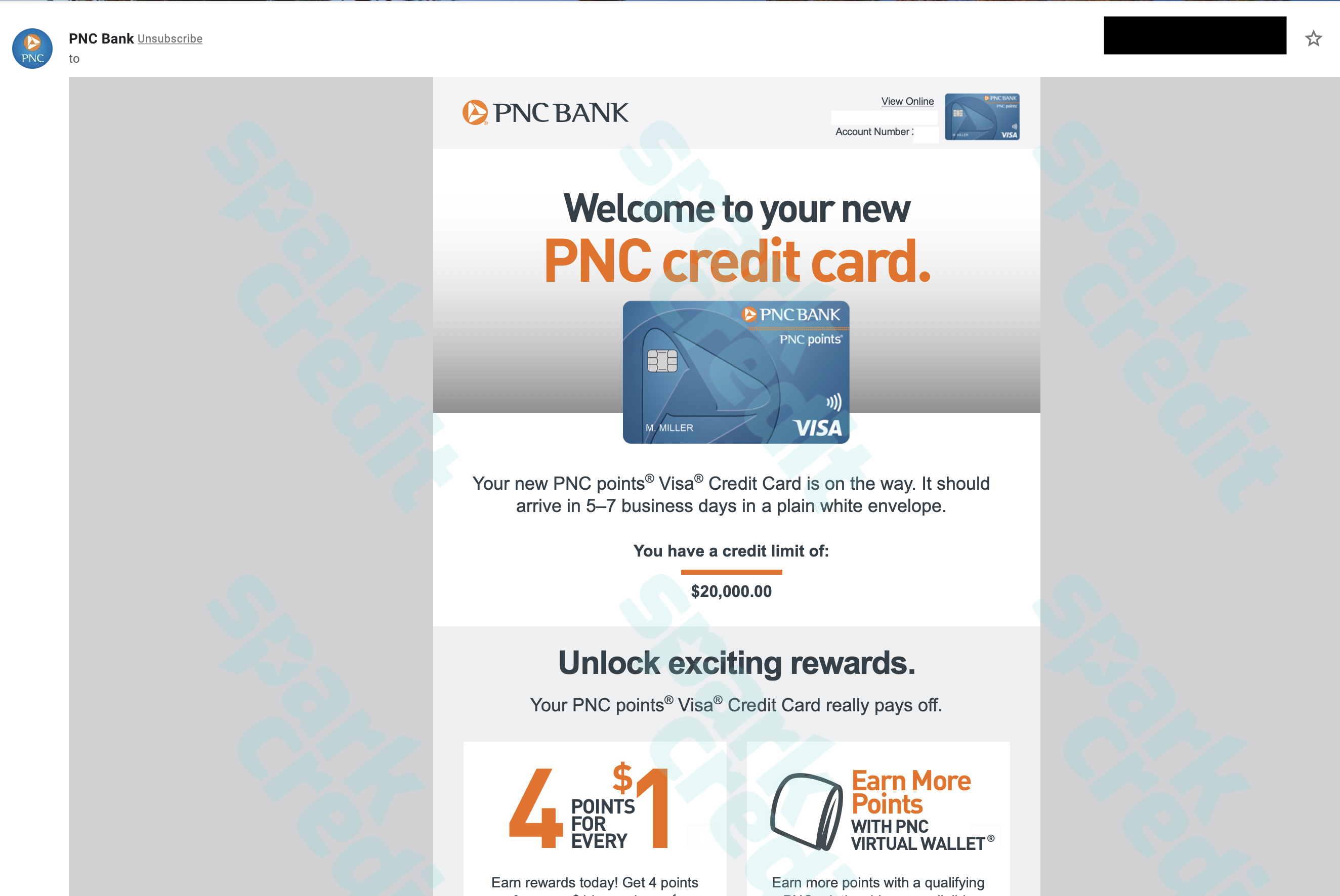

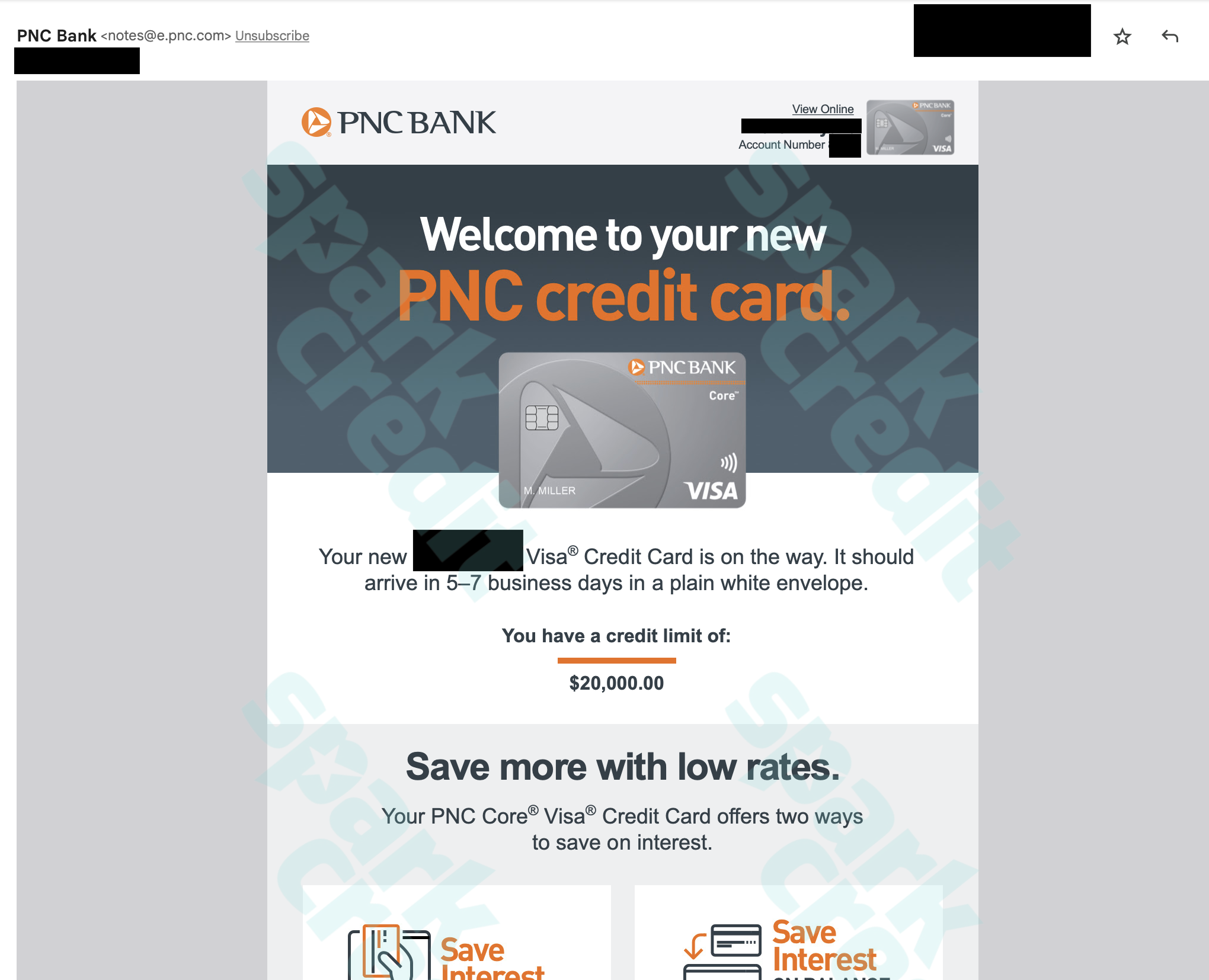

Credit Limit

We help you to increase your credit limits to improve your credit score

Spark Credit manages credit limits to expand spending power, improve your credit and assist your financial peace of mind.The credit limit refers to the maximum sum of money a client can borrow, and the credit division sets the maximum allowable credit balance for each customer.

The credit limit on a credit card is the maximum amount a customer can borrow from a financial institution. Banks, non-traditional lenders, and credit card firms use different criteria to set their respective limitations. Good credit history is usually the only need to obtain a card with a large credit limit. However, certain cards may be more willing to give you a large credit limit regardless of your credit score.

How does the credit limit affect our credit score?

An increased credit limit positively affects your credit score since it allows you to make larger purchases while still keeping your credit utilization rate low. The best part is that you can complete all of these tasks quickly and easily within your credit card account’s online interface.